Energous Seeks Approval For A Reverse Split And Increased Share Authorization

Summary

- Energous is seeking approval for a reverse split (up to 1-for-20) and a doubling of its authorized shares.

- I believe a 1-for-20 reverse split is necessary to avoid another set of compliance issues in the near-to-medium term.

- Energous may also need to do another equity raise late in 2023.

- It has been adding proof-of-concept customers but will need to prove that it can convert many of these customers into final production customers.

- Looking for more investing ideas like this one? Get them exclusively at Distressed Value Investing. Learn More »

Michael Vi

I had previously mentioned that Energous (NASDAQ:WATT) was probably going to do a reverse split to regain Nasdaq listing compliance. It is now seeking approval at its June 14th annual meeting for a reverse split (up to a 1-for-20 ratio) and to effectively double its authorized share count (not including the effect of the reverse split).

Energous is expecting 20+% year-over-year revenue growth (weighted to the second half) in 2023, but got off to a slow start with revenue down -55% in Q1 2023. Even if it does achieve its revenue growth target, it will still be burning around $5 million in cash per quarter. At its current share price, it would need to add 17% to its share count just to pay for a quarter's worth of cash burn.

Thus I am maintaining a sell rating for Energous until it can prove that it escape the cycle of heavy cash burn followed by significant dilution. It has made progress with partnerships and proof-of-concept installations, but needs to convert many of those customers to final production in order to meaningfully reduce cash burn.

Reverse Split

I noted before that Energous was likely to do a reverse split in order to maintain its Nasdaq listing. It currently needs to have a closing bid price of at least $1.00 for 10 consecutive trading days before July 19th to be able to regain listing compliance.

Energous currently intends to correct this by implementing a reverse stock split and is asking for approval for a reverse stock split that could be up to a 1-for-20 ratio. It is also asking for approval to essentially double its authorized shares (subject to the reverse split).

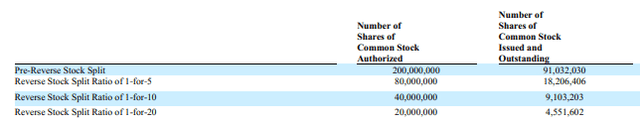

Energous currently has 200 million authorized common shares and 91 million outstanding common shares. If it goes with a 1-for-20 reverse split, it would end up with 10 million authorized shares. However, it is also looking to double its authorized shares, so if that proposal is also approved, it would end up with 20 million authorized common shares and 4.55 million outstanding common shares.

Energous' Reverse Split (energous.com)

I believe Energous is likely to go for a 1-for-20 ratio with a reverse split. Its share price is currently $0.33 per share, which would translate into $6.60 after a 1-for-20 reverse split, although companies that do reverse splits often see their shares perform poorly after the reverse split.

A 1-for-5 reverse split or a 1-for-10 reverse split would leave Energous in danger of needing to do another reverse split within a year or two if it didn't substantially improve its business performance.

Financial Position And Results

Energous provided expectations for 20+% revenue growth year-over-year in 2023, with growth weighted to the second half of the year. This would translate in revenue of at least $1.02 million in 2023. Energous would have shown modest progress if it achieved that revenue growth, although adding a couple hundred thousand in revenue doesn't make too much difference when Energous' cash burn is over $20 million per year.

Energous used $5.4 million in cash for operating activities in Q1 2023, while revenues were only $0.97 million during the quarter, so it has gotten off to a slow start in 2023.

To essentially cover its Q1 2023 cash burn, Energous raised $2.67 million (net of issuance costs) under its ATM program and another $2.68 million (net of related costs) with an underwritten offering. This added 11.9 million shares to Energous' share count, while it also issued 8.25 million warrants (exercisable by 2029) with an exercise price of $0.40.

Energous now has $26.3 million in cash on hand, enough to get it to Q2 2024 at its current rate of cash burn. I'd expect another equity raise later in 2023 though after its reverse split.

Proof-Of-Concept Customers

Energous has managed to convince a number of companies to do test runs of its technology. It reported two of these proof-of-concept customers by Q3 2022, and this increased to 10 proof-of-concept customers by Q4 2022 and 14 total proof-of-concept customers by Q1 2023.

Energous notes that the proof-of-concept phase can integrate up to 100 PowerBridges, and that if the test runs go well and the customer decides to move to the final production phase, it could involve potentially thousands of PowerBridges.

The most common application at this point involves IoT RF tags for asset tracking, including helping with inventory counts and replenishment requirements, as well as providing data about which items are tried on (for a clothing store deployment).

It is uncertain how much revenue could be generated from a proof-of-concept customer moving forward with a larger deployment. However, Energous previously sold evaluation kits (including a PowerBridge transmitter) for $599, which is probably a discounted rate to encourage the evaluation of its products. So perhaps a deployment involving 1000 PowerBridges might generate $1 million in revenue. Energous would thus need a fair number of customers moving forward with larger deployments in order to meaningfully reduce its cash burn.

Conclusion

Energous is looking to gain approval for a reverse split and increased share authorization at its June shareholders meeting. This reverse split is likely to be 1-for-20 when implemented, so that Energous can regain listing compliance and maintain that for a while.

Energous expects a bit of revenue growth this year, but its cash burn rate still appears to be around $5 million per quarter. It has enough cash on hand to last until Q2 2024 currently, but is likely to do another raise by late 2023.

Energous has been working on signing up proof-of-concept customers, but will need to convert many of those customers into final production customers to start making a dent in its rate of cash burn. Due to its likely future of further dilution, I am keeping my sell rating on Energous for now.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

This article was written by

Elephant Analytics has also achieved a top 50 score on the Bloomberg Aptitude Test measuring financial aptitude (out of nearly 200,000 test takers). He has also achieved a score (153) in the 99.98th percentile on the WAIS-III IQ test and has led multiple teams that have won awards during business and strategy competitions involving numerical analysis. In one such competition, he captained his team to become North American champions, finishing ahead of top Ivy League MBA teams, and represented North America in the Paris finals.

Elephant Analytics co-founded a company that was selected as one of 20 companies to participate in an start-up incubator program that spawned several companies with $100+ million valuations (Lyft, Life360, Wildfire). He also co-founded a mobile gaming company and designed the in-game economic models for two mobile apps (Absolute Bingo and Bingo Abradoodle) with over 30 million in combined installs.

Legal Disclaimer: Elephant Analytics' reports, premium research service and other writings are personal opinions only and should not be considered as investment advice. Only registered investment advisors can provide personalized investment advice. While Elephant Analytics attempts to provide reports that include accurate facts, investors should do their own diligence and fact checking prior to making their own decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.