Rithm Capital: This Huge 12% Mortgage Yield Is Sustainable

Summary

- Rithm Capital covered its dividend with distributable earnings in 1Q-23 and the pay-out ratio remained well below 80%.

- The mortgage trust is hedged against a variety of interest rate environments and grows its business.

- RITM is undervalued relative to less diversified mortgage trusts.

- I have made RITM my third-largest portfolio position.

marchmeena29

Rithm Capital Corporation (NYSE:RITM) maintained excellent dividend coverage in the first quarter with a pay-out ratio of just 71% and I don’t think that the trust’s 29% discount to book value is appropriate when taking into account that Rithm Capital is diversifying its portfolio and covering its dividend with distributable earnings.

I have high confidence that Rithm Capital can sustain its dividend pay-out given its consistent dividend excess coverage and the evolution of the company promises to add a new revenue stream to the portfolio. Rithm Capital's ability to hedge against several conceivable interest rate scenarios, primarily through its investment in Mortgage Servicing Rights, is a valuable asset to me.

With the company expanding and investment opportunities potentially emerging in the commercial real estate market in the future, I believe RITM is a deal at a 29% discount to book value.

Rithm Capital Adds New Revenue Streams, Improving The Trust’s Diversification

Rithm Capital is continuously evolving, and the trust has added various supplementary segments such as Servicing, Business Lending, Single Family Rentals, and other asset management services to its core mortgage investment business over time. Rithm Capital is becoming less reliant on the U.S. mortgage market as a result, and its profitability profile is becoming more resilient.

For example, the mortgage real estate investment trust has outlined a strategy for managing private capital, and Rithm Capital has established a case for expanding into a new territory, Europe. Rithm Capital purchased a 50% share in GreenBarn Investment Group, a commercial real estate equity and debt investment firm, in 2022.

The Evolution Of Rithm (Rithm Capital Corp)

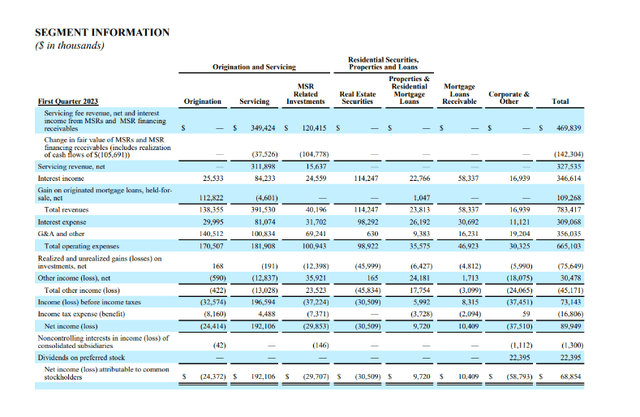

However, the mortgage servicing sector will most likely continue to be the trust's primary revenue contributor in the future. In 1Q-23, mortgage origination and servicing (including the MSR investment business) accounted for 73% of total income. New divisions, such as the private capital management business, are expected to fuel future revenue and profit growth for the trust.

Segment Information (Rithm Capital Corp)

Excellent Dividend Coverage For A 12% Yielding Mortgage Trust

Rithm Capital proved once again in the first quarter why it deserves a portfolio over-weighting, in my view, and the mortgage real estate investment trust is now my third-largest portfolio holding after Hercules Capital Inc. (HTGC) and Oaktree Specialty Lending Corporation (OCSL).

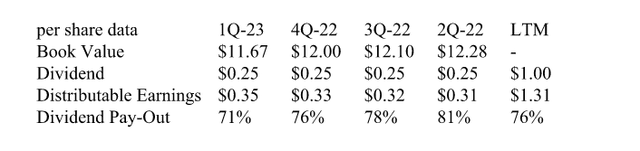

Rithm Capital earned $0.35 per share in distributable earnings, up 13% YoY, while paying out a stable $0.25 per share dividend. The dividend pay-out ratio fell from 76% in the fourth quarter to 71% in the first quarter and the mortgage trust has also impressive pay-out metrics on a comparative basis:

Annaly Capital Management, Inc. (NLY), for instance, paid out 99% of its earnings available for distribution just before the mortgage trust slashed its dividend pay-out by 26%. Annaly Capital’s 1Q-23 pay-out ratio was 80%. Thus, Rithm Capital offers passive income investors a much more stable and more consistent pay-out ratio than other high-yield options in the mortgage trust market.

Dividend (Author Created Table Using Trust Information )

Rithm Capital Unfairly Trades At A Large Discount To BV

I find it odd that Rithm Capital is selling at a higher discount to book value than agency-focused and less-diversified mortgage real estate investment trusts such as Annaly Capital or AGNC Investment Corporation (AGNC).

Rithm Capital has seen a book value decline of about 7% in the last year with Mortgage Servicing Rights being a particularly valuable asset during this time (MSRs increase in value in a rising-rate environment). Mortgage trust Annaly Capital, for instance, reported a much steeper 23% decline and AGNC Investment saw a 27% decline in its book value.

Despite a much smaller book value decline, Rithm Capital sells at a much larger discount to book value and, in my view, this valuation discrepancy makes no sense: Rithm Capital offers passive income investors a much more diversified investment portfolio with, in my opinion, a much safer dividend.

Rithm Capital: Risks And Opportunities

Rithm Capital’s dividend, based on the consistency of its pay-out ratio, is not at risk, in my view. The trust is hedged against a variety of interest environments which I view as a core asset as well.

I see opportunistic investment opportunities for the mortgage trust in the commercial real estate market which has seen a decline in originations in the last year as the central bank hiked interest rates. If more real estate loans default moving forward, there might be an opportunity for Rithm Capital to acquire distressed debt at favorable prices.

As far as risks go, Rithm Capital is heavily invested in Mortgage Servicing Rights and a decrease in interest rates should be expected to lead to lower MSR values.

My Conclusion

Rithm Capital is now my third-largest, ultra-high yield portfolio holding (with a 12% dividend yield) after Hercules Capital and Oaktree Specialty Lending.

I think the valuation discrepancy that exists, in particular in relation to less-diversified mortgage trusts like Annaly Capital or AGNC Investment, is not justified and given that Rithm Capital is hedged against a variety of interest rate environments, I would expect RITM to trade at no, or only a small, discount to book value.

I find the pay-out ratio of 71% very convincing and due to Rithm Capital’s solid excess dividend coverage and push into other business segments, I think RITM is one of the best ultra-high yield stocks that passive income investors can buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RITM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.