Weis Markets: 3 Reasons Not To Buy Into This Down Move

Summary

- Weis recently reported its fiscal Q1-2023 numbers where net profit fell by almost 18%.

- Higher costs is putting pressure on the financials and the market does not know when this trend will end.

- We look at Weis' valuation, technicals, and margins to ascertain Weis' investment case at this juncture.

CreativaImages

Intro

Weis Markets, Inc. (NYSE:WMK) recently announced its fiscal first-quarter earnings for 2023 but the reported numbers did nothing to stop the slide in the share price. Although revenues rose to $1.145 billion for the quarter, bottom-line GAAP profit ($25.8 million) was down more than 17% compared to the same period 12 months prior.

Weis Markets is known for being a solid consumer defensive play that really has seen some impressive gains since bottoming out back in early 2020. We actually wrote about this stock back in August of last year (shares were trading at approximately $82 a share) when we concluded that the stock's balance sheet trends were pointing to rising prices in this play. This very well happened which actually resulted in shares of Weis almost reaching $95 a share by late October of last year. Since then though, the company has lost over 30% of its market cap which is something much larger than a slight 'correction' in anyone's language. In fact, something 'fundamental' seems to have changed within the company which is why investors need to be careful with respect to formulating a long position in this play in the current environment.

Gross Margin Headwind

Not only is Weis' trailing 12-month gross margin of 25.29% lower than the company's 5-year average (27.3%) but the first quarter gross margin print this year (24.96%) pointed to more deterioration in this key profitability metric. Furthermore, operating costs also rose in the quarter which means Weis' gross margin as well as its operating margin continue to put significant pressure on the retailer's GAAP earnings. The majority of these 'pressures' are inflationary in nature and this is worrying for the following reason.

Retailers with above-average margins have more resources when competing in an environment where costs are rising. Weis' trailing net profit margin currently comes in at 2.53% whereas the sector in general currently reports net profit margins of 3.16%. Although this difference in the two numbers may not seem like a lot, one should ponder the following. If gross margins in this sector continued to lose ground and lost 3% on average over the next 12 to 24 months for example, Weis Markets (assuming that loss of margin was reflected throughout the income statement), would start to report negative earnings whereas the 'sector' on average would be able to maintain its profitability. Suffice it to say, when a retailer is starting behind the eight ball with respect to its gross margins, inflationary periods always bring an elevated risk of competition taking market share over time.

Technical Trend

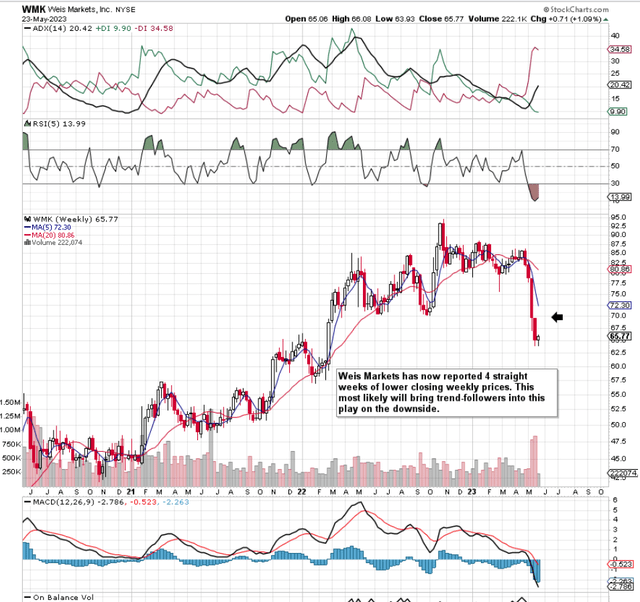

Secondly, if we pull up an intermediate chart of Weis Markets below, we see that shares of the retailer have now reported 4 consecutive weeks of lower closing prices. This denotes a steep new trend in progress (demonstrated by the sharp rise in the ADX trend-following indicator). Being chartists, we believe when a company's technicals have turned bearish, this means the stock's near-term fundamentals have also turned bearish. Furthermore, it is more probable that a defined trend in motion continues rather than reversing. Therefore, patience is required until we see the severity of this latest down move in due course.

Weis Markets Intermediate Chart (Stockcharts.com)

Valuation

Given the 30%+ drop in the share price over the past seven months and the significant carnage this month alone, one may believe that Weis' valuation has become much more attractive compared to what we have seen historically in this stock. However, when we run through the numbers by comparing Weis' trailing 12-month earnings, sales, assets, and cash flow with its 5-year counterparts, Weis actually looks fairly valued at present and definitely not under-valued.

| Valuation Multiple | Trailing 12-Month | 5-Year Average |

| Price To Earnings (GAAP) | 14.81 | 15.48 |

| Price To Sales | 0.37 | 0.38 |

| Price To Book | 1.34 | 1.32 |

| Price To Cash-Flow | 9.24 | 7.47 |

Conclusion

Therefore to sum up, although Weis Markets reported top-line growth in its recent first quarter, margins continue to be squeezed by higher costs of goods sold as well as elevated operating costs. Although some investors may see the latest down move as an exaggeration, the company's valuation, declining gross margin, and worrying technicals demonstrate that the safest decision to remain out for now. We look forward to continued coverage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.