L.S. Starrett Company: Cheap But Declining Order Rate Is A Concern

Summary

- Order rate has been declining over the last few quarters, which should impact top-line growth in the coming quarters.

- Volume deleverage should impact margins.

- Despite cheap valuations, I have a neutral rating on the stock.

gilaxia/E+ via Getty Images

About the company

L.S. Starrett Company (NYSE:SCX) stands as a leading provider of an extensive range of measuring and cutting tools. With a commitment to precision and quality, the company offers a diverse portfolio that includes precision tools, gauge blocks, optical, vision, and laser measuring equipment, saw blades, and precision ground flat stock. SCX caters to a wide customer base, serving both domestic and international markets. The company's products find their way into the hands of various industries, with notable consumers including metalworking, aerospace, medical, oil and gas, government agencies, automotive manufacturers, and skilled tradesmen such as builders, carpenters, plumbers, and electricians. These sectors rely on SCX's tools to ensure accuracy and reliability in their operations, enabling them to achieve optimal results. SCX operates through two distinct segments: North America and International. The North American market contributes to 60% of the company's total revenue, meanwhile, the International segment accounts for the remaining 40% of the company's revenue.

Recent quarter financial overview

SCX recently reported its third quarter FY23 financial results, which were better than the prior year's same quarter. The company experienced a 2% year-over-year increase in revenue, reaching an impressive $61.7 million. This growth was primarily driven by a 7% rise in price realization, offsetting a 1.2% decline due to currency translation and a 3.8% decrease in volume. In the North America region, revenue climbed by 2.1% year over year, totaling $37 million. This increase can be attributed to the sustained high demand for precision granite products and a stable market for SCX's portfolio of precision measuring tools and saw blades, which are sold through industrial distribution channels. Internationally, revenue saw 1.8% year-over-year growth, amounting to $24.6 million. This expansion was fueled by a 1.9% increase in pricing realization and a 2.7% uptick in volume, offset to some extent by a 2.8% unfavorable impact from currency translation.

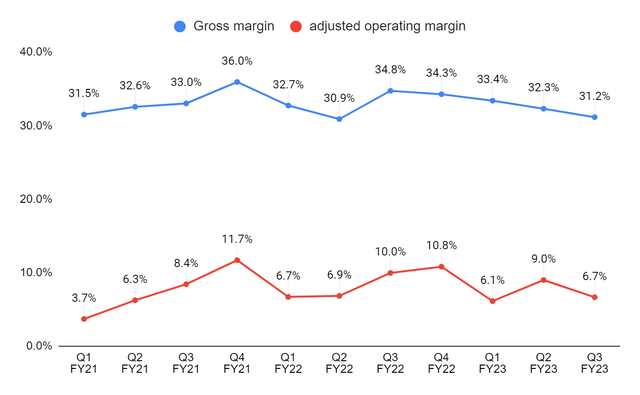

Although SCX's gross margin experienced a 360 basis point decline year over year, settling at 31.2%, this was primarily due to lower factory utilization resulting from decreased production. The company strategically shifted its focus to working capital reduction and cash generation, considering the overall improvement in supply chain conditions compared to the previous year. The adjusted operating margin also declined by 330 basis points year over year, reaching 6.7%. This decrease was mainly attributable to the lower gross margin. However, it was partially offset by a 30 basis point improvement in selling, general, and administrative (SG&A) expenses as a percentage of sales. SCX achieved a net income of $7.5 million for the quarter, equivalent to $0.99 per diluted share. In comparison, during the third quarter of the prior year, net income stood at $4.3 million, or $0.57 per diluted share.

Not an optimistic view on topline and bottom line

SCX has experienced a shift in its revenue dynamics over the past few quarters, with price realization becoming the primary driver of growth while volumes faced a decline. This trend is evident in the 2.4% Y/Y decrease in volumes during Q2 FY23 and a further 3.8% Y/Y decline in Q3 FY23. Despite having higher backlog levels in 2022, the company witnessed a softening in order intake throughout 2023, leading to a 13.8% decrease in total backlog during Q3 FY23 compared to the same quarter the previous year. The nine-month period ending in March 2023 saw a notable decline of 9.6% in order intake compared to the corresponding period in 2022. Both the North America and International segments experienced a decrease in order intake, with North America observing a 6.8% decline and International witnessing a significant 13.4% decrease. The International market, particularly in Europe, has been adversely affected by recession pressures and the ongoing conflict in Ukraine, resulting in reduced order intake. Although North American order intake has been supported by a consistent demand for precision granite products and stable intake through industrial distribution channels for the company's precision measuring tools and saw blades, it has still been negatively impacted by challenging year-over-year comparisons.

Considering these factors, I believe that SCX's revenue growth should face challenges in the upcoming quarters. The company should be compelled to lower prices to remain competitive as its competitors begin reducing their prices. Additionally, the persisting unfavorable conditions in Ukraine are likely to further impact the International segment's order intake. As a result, the overall outlook for SCX's top-line growth appears pessimistic to me, with potential hurdles and uncertainties ahead.

SCX's gross margin and adjusted operating margin chart (Created by DzD Analysis by taking data from SCX)

SCX has demonstrated a commitment to enhancing productivity within its facilities, leading to improved margins in recent quarters. This focus on efficiency has allowed the company to navigate challenges and maintain profitability. Furthermore, SCX implemented price increases in response to inflationary pressures, successfully mitigating some of the cost impacts. However, despite these efforts, the combination of lower volumes, persistent inflationary pressures, and lower production has counteracted the positive effects on margins. The decline in volumes has presented a challenge, affecting profitability.

Looking ahead, I believe that as inflationary pressures begin to moderate, margins should improve. Nevertheless, the ongoing issue of lower volumes should continue to impact margins in the upcoming quarters, along with lower production.

Valuation

Based on my estimates for SCX's 2023 EPS of $2.11, the company is currently trading at a price-to-earnings multiple of 5.17. This valuation is slightly below the 5.3 multiple observed in 2022. Furthermore, when considering the EV/EBITDA multiple, the figures for 2023 and 2022 would be 3.6x and 3.8x, respectively. To provide context for the company's pricing, I conducted a comparison with three similar firms. Utilizing the EV/EBITDA approach, the range for these three companies fell between 13.10x and 16.6x. However, when employing the P/E approach, the range for these businesses extended from -8.03 to 85.89. Remarkably, in both scenarios, L.S. Starrett emerged as the most attractively priced option among the group.

price-to-earnings | EV/EBITDA | |

L.S. Starrett Company | 5.17x | 3.6x |

Stanley Black & Decker (SWK) | 85.89x | 16.62x |

Graham Corporation (GHM) | 60.26x | 16.66x |

NN (NNBR) | -8.03x | 13.10 |

Conclusion

In conclusion, based on the analysis of SCX's financial metrics and valuation multiples, the stock appears to be trading at an attractive level compared to both its historical performance and similar companies in the market. The lower P/E multiple and EV/EBITDA multiple indicate a potentially undervalued position for the company. While SCX has shown improvements in productivity and revenue, I believe the next few quarters should be turbulent for the company in terms of revenue growth and profitability given the lower order intake across North America and internationally. I believe there are other good growth opportunities in the market and hence have a Hold rating on the stock.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.