TLTW: Is The 19% Yield Too Good To Be True?

Summary

- Covered call strategies often underperform in the long term because they are too aggressive at earning yield and sacrificing capital appreciation.

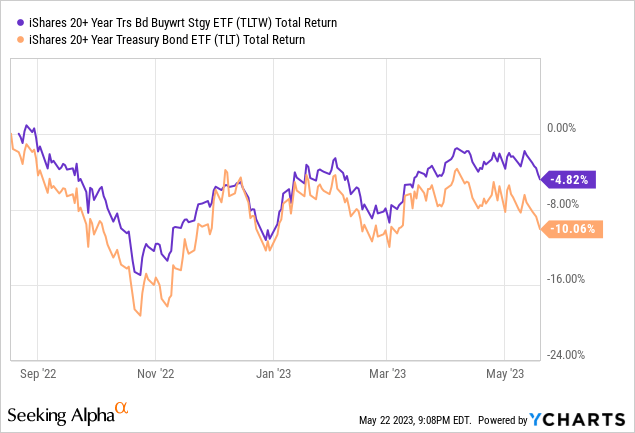

- TLTW has a total return that is higher than TLT but over a period of relatively flat price performance.

- We prefer self-managed covered call strategies to better adapt to changing market conditions.

cagkansayin

Bond bulls have a unique option available to invest in long duration bonds. In fact, it involves options. The iShares 20+ Year Treasury Bond Buywrite Strategy ETF (BATS:TLTW) is a fund that invests in long duration Treasuries through the iShares 20+ Year Treasury Bond ETF (TLT) and sells one-month covered call options on its holdings. The result is a 19.45% option-adjusted yield.

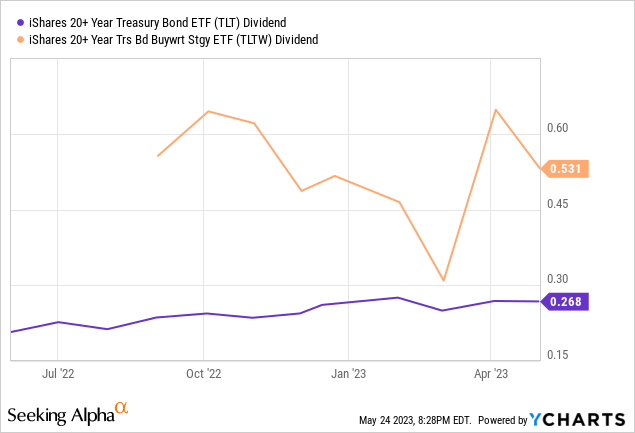

Compared to TLT, TLTW has been issuing dividends 2-3x higher but with much greater volatility. This is due to a number of factors including the price performance of the underlying holdings.

Since its inception, TLTW has outperformed TLT in total return. Since September 2022, the fund has lost 4.82% compared to the losses sustained by TLT of 10.06%. This is very interesting.

While we are strong supporters of using options to generate income, we're generally not in favor of these BuyWrite funds. This is because their strategies usually don't adapt to changing market conditions. In the long run, these strategies tend to underperform the underlying asset with less volatility and greater income. That greater income is often a trap for novice investors. Studies show that the reason BuyWrite strategies don't outperform in the long term is because they retain all the downside of an investment and sell the upside for limited value. For assets that are expected to rise over time, this results in net asset value decay as the most volatile moves to the upside are not realized. For these reasons, we've chosen to self-manage our own covered call option strategy and avoid funds like TLTW.

Net Asset Value Decay

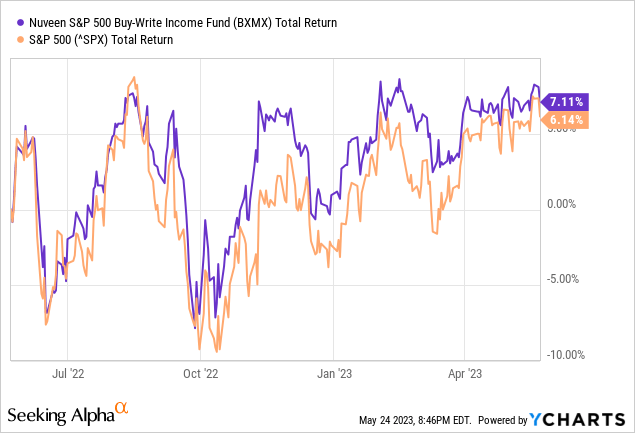

For covered call strategies to work effectively, they have to be planned with great attention to detail. Naturally, covered call strategies with a Delta higher than 0.20 or an expiration date greater than 1 month tend to result in under-performance when the covered equity is rising. Below is an example of the Nuveen S&P 500 Buy-Write Income Fund (BXMX) compared to the S&P 500 over the past year. Performance during this time has been virtually equal.

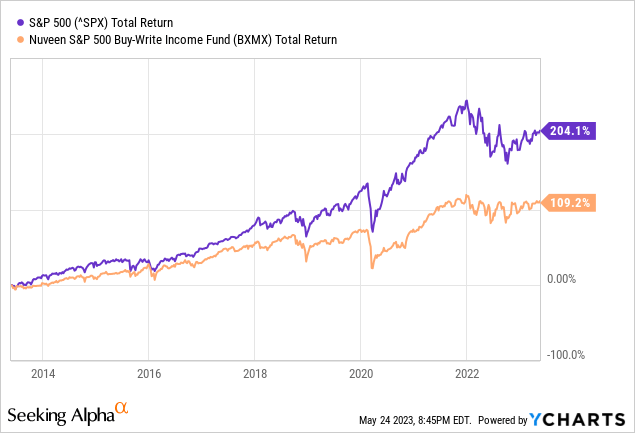

But in the long term, such as 10 years, the divergence becomes evident. The strategy of selling options is limiting upside potential. The covered call strategy works best when price of the underlying asset is flat or in decline. Obviously, we're not trying to invest in assets that are in decline. The strategy can produce healthy returns under a flat performance scenario but assets are never flat for long. We expect that the chart of TLTW and TLT will look similar over the long run, with TLT outperforming.

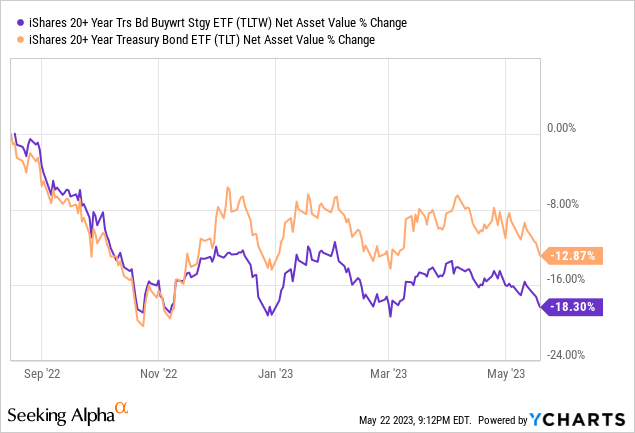

We can already see the effect of the BuyWrite strategy on net asset value. TLTW has lost 18.3% NAV since inception while TLT has only lost 12.8%. Essentially, TLTW is cannibalizing NAV to pay out hefty distributions. It's not a sustainable model, even if it rewards investors with total return.

A Better Way

TLTW has an expense ratio of 0.35% and its bond portfolio characteristics closely match that of TLT with an effective duration of 17 years compared to 17.17 and a yield to maturity of 4.07% compared to 4.06%. The difference between the funds will come from options income and capital appreciation. Since we're bullish on bonds, we're planning for higher TLT prices.

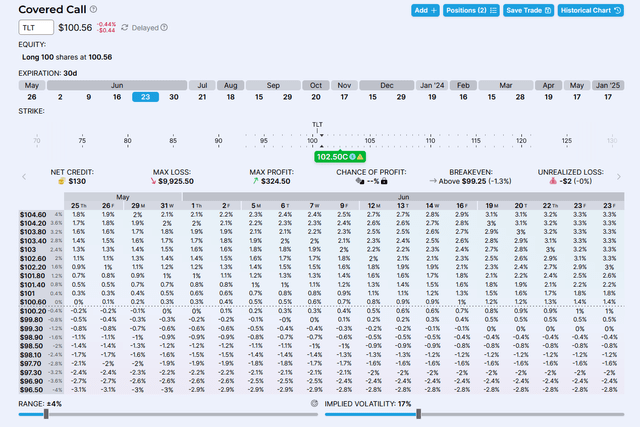

TLTW tracks the Cboe TLT 2% OTM BuyWrite Index by selling calls with a strike price at 102% of market price that expire in 30 days. Below is a screenshot from Optionstrat.com for the closest fitting option sold today. Expiring in 30 days, the $102.50 strike call offers premium of $130 per contract, annualized at $1,581. This is equal to 1.3% of the collateral which is annualized at 15.5%. But the Delta is 39.6. This implies a 39.6% probability that the option will expire in the money. In our opinion, that is far too high.

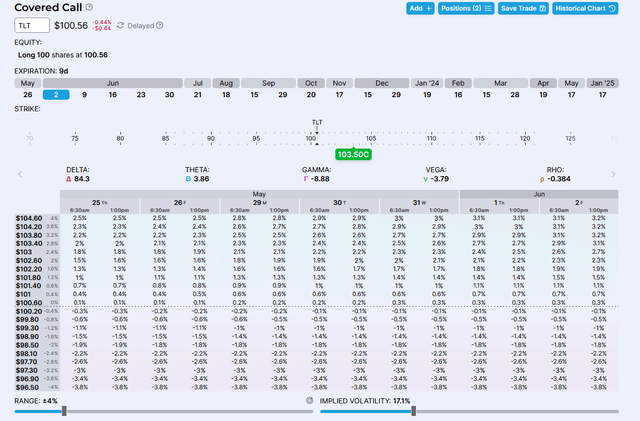

In comparison, we can create our own covered call strategy with a shorter expiration date and lower Delta. We prefer shorter expiration dates within 1-2 weeks because the Theta decay of the time-value of the option is greatest as expiration approaches. We can look at the June 2, 2023 call (9 days to expiration) at the $103.50 strike, below. The premium earned is $22 per contract, annualized at $892. The Delta is 0.157. Our expense ratio, due to brokerage contract fees, is annualized at 0.27%. Notice that if our option expires in the money, we earn $1 per share more in capital appreciation than the option above.

While the options income from this strategy is much lower than the TLTW strategy, it reduces the capital appreciation losses. This is accomplished through three ways:

- Choosing calls with lower Delta (lower probability of being in the money at expiration.

- Choosing higher strike prices to earn more appreciation if the option is called.

- Choosing shorter dated calls to reduce the chances that TLT price will move dramatically higher than our strike price before being called. Often, if in-the-money at expiration we can repurchase shares for slightly higher or wait a few days for volatility to bring price back to the strike price.

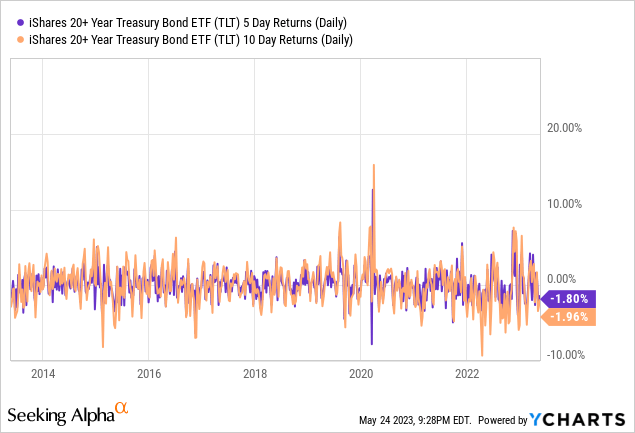

But to optimize our outcome further, we utilize option rolling strategies. Rolling a covered call option means buying back the contract and selling another contract that expires later and may have the same (rolling out) or a higher strike price (rolling up and out). We prefer to roll covered calls when share price has nearly reached or reached our strike price. This minimizes the amount of capital appreciation loss. By continuously rolling options we are hoping that volatility will eventually move the share price below our strike price by an expiration date. The strategy is not perfect, but what you can see from the chart below of 1-week and 2-week price returns for TLT, weeks that rise are quickly followed by weeks that fall and the majority of weekly returns stay within a +5% and -5% range.

Summary

In summary, the TLTW fund is not an efficient strategy, in our opinion, because it risks too much capital appreciation for the yield. Below is a table that compares the TLTW strategy to a self-managed strategy using options on TLT. When bonds are in an bullish uptrend, we expect that total return from the self-managed strategy will outperform, although more volatility is expected. Premiums on options contracts are subject to change with market conditions and cannot be accurately predicted using current data. But from our research we've found that these keys consistently produce superior results.

| TLTW strategy | TLT Self-Managed | |

| Expense Ratio | 0.35% | <0.3%+time |

| Delta | ~40 | <20 |

| Estimated Annualized Option Income | 15.7% | 8.9% |

| Capital appreciation potential | Very Limited | Somewhat limited |

| Options rolling | None | At discretion |

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not an investment advisor, is not registered as a financial advisor, and is not suggesting any investment recommendations. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgment at the time of writing and is subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.