CRAK: Lower Supply And Demand For Crude Aren't Great For Spreads

Summary

- CRAK is too tough to call, there are plenty of good reasons to see declines in the sector, and multiples are pricing in lots of problems.

- Crude prices get to stay higher because of exogenous supply cuts, but that's not happening in refining besides market-driven run-cuts while markets get used to Ukraine.

- Without refineries being the bottleneck, we have an issue for refiners, and the narrowing product deficits in the product reserves are a clear sign.

- There are other more supported companies out there with late-stage cycle multiples.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

imaginima

The VanEck Oil Refiners ETF (NYSEARCA:CRAK) is a relatively high maintenance cost ETF at 0.61% expense ratios capturing the major refinery exposures in the US. While the higher-than-average expense ratios are not helpful to CRAK's case, it ultimately comes down to the fact that the data shows the coming quarters are going to become difficult for refineries, with product inventories coming up, but crude staying pretty normal. Refineries aren't the bottleneck anymore, so CRAK's in an ambiguous situation.

CRAK Breakdown

CRAK value-exposed to major crack-exposed refineries, some outside the US like Reliance, the massive Indian refinery that has been benefiting from surging imports of cheap Russian oil. That's what most of the companies in CRAK do, take crude and make distilled products, lately a lot of diesel.

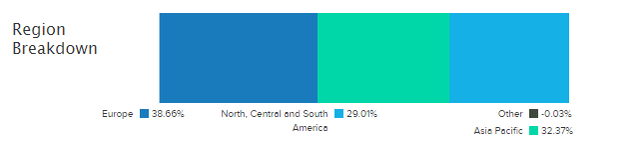

Regional Breakdown (ETFDB.com)

The present environment has shown continued growth in profits for refiners. The key element has been that refining capacity has fallen more than oil, at least in the Western bloc, as a consequence of sanctions against Russia. With sustained demand for consumer goods (although weakness is beginning to show) things like diesel have been putting utilisation to very high levels at refineries.

But markets recognise that for various reasons this is coming to an end. An initial market is that crude inventories are at pretty reasonable levels relative to long-term averages while distillates have been at pretty low levels, hence the current high crack spreads and profits for refiners. But while crude is more normalised, there is quite a forceful recovery of inventories for distillates as they revert to the mean. It has been consistent with distinctly lower levels of manufacturing and freight being reported around these products, as well as the cooling off of the goods boom, with container freight down 10%. Distillate inventories are still below the historical averages, but that is changing quickly and is affecting crack spreads. Distillate prices can come down but OPEC will likely keep that from happening to oil despite concomitant demand declines.

The PE is around 4.27x, reflecting a very late-stage cycle appraisal.

Bottom Line

Refineries tend to be very cyclical since the output prices tend to be more sensitive to the economic environment than the input, and the demand for the refinery process simply falls in times of economic hardship. Germany has shown a quarter of decline due to inflation impacting consumer spending, which means that we're definitely approaching the definition of a technical recession at this point, even though everyone already knew that the world economies were under pressure. We can already observe the compression in crack spreads. Money can be made investing in the down cycle of a cyclical, but it's probable that the economic pressures are just getting started. Moreover, the 0.61% expense ratio isn't too attractive. Best to avoid CRAK for now.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.