Snowflake Stock: Final Sale

Summary

- Snowflake Inc. reported FY24 Q1 earnings yesterday, and it turned out that the correlation with Amazon.com, Inc. AWS revenues could be stronger than many investors hoped for.

- This could pressure top line growth in the short run, which led to a strong selloff after the release.

- However, there are signs that Snowflake is already profiting from the proliferation of AI, while further interesting product announcements are expected at Snowflake Summit 2023 at the end of June.

- I believe this should help reaccelerate Snowflake Inc. top line growth already this year, which makes me provide the following takeaway for long-term investors: Final Sale in the upcoming weeks.

Lidia Efimova/iStock via Getty Images

Introduction and investment thesis

Snowflake Inc. (NYSE:SNOW) reported slightly better than expected results for its FY24 first quarter yesterday but provided a weaker than expected guidance for the upcoming quarter and reduced its revenue target for FY24 for the second time in a row. The main reason behind this has been the company’s large exposure to AWS customers that proved to be a stronger drag on revenues than in the case of some other SaaS companies, e.g., Datadog (DDOG), during the quarter. Obviously, this has been a minor shock for investors, leading the SNOW share price to plummet after the announcement.

However, the current growth slowdown should be transitory in nature, while longer term trends are quite promising. AI use cases began to rapidly expand on Snowflake’s Data Cloud, which could turn the tide in the upcoming quarters in my opinion. On the Q1 earnings call, management hinted on interesting product announcements to come, which will be revealed on Summit 2023 in Las Vegas at the end of June accompanied by the company’s Investor Day on the 27th.

I believe this could be an important catalyst for SNOW shares, which will be also realized by market participants after the initial disappointment following Q1 results. This makes me rate the shares as a Buy after the post-earnings selloff even if current valuation seems exaggerated in the light of 32% YOY expected revenue growth rate for FY24 Q2. I believe it’s worth to look a little bit further than our nose in this case, especially when someone can handle somewhat greater levels of risk.

Strong Q1, fearful Q2

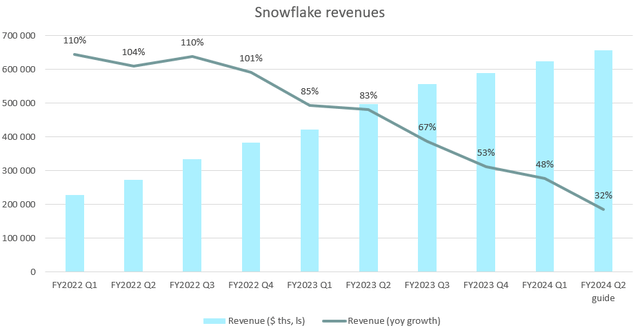

Snowflake reported revenues of $623.6 million for the FY24 Q1 quarter surpassing the average analyst estimate by 2.5%, which has been approximately in line with the magnitude of previous beats. Despite the large scale (annualized revenue run rate of ~$2.5 billion), SNOW revenues grew 48% YOY after 53% a quarter before, which couldn’t be regarded as a serious slowdown.

Meanwhile, non-GAAP operating margin reached 5% for the quarter, significantly better than the company’s estimate of 0%. This has been driven by the small revenue outperformance and cost savings in S&M spending. Free cash flow ("FCF") margin has been a whopping 46% in the quarter, but it has been strongly affected by the timing of cash collections, so investors shouldn’t project this out into the future. Based on management’s most recent guidance, 26% is more realistic for FY24 close to the 25% in FY23. These numbers show that the Q1 quarter has been a strong start to FY24. However, the accompanying guidance for Q2 and the whole financial year has spoiled this otherwise good overall picture.

Management guided for product revenues of $620-625 million for the Q2 quarter, which assuming constant services and other revenue translates into a YOY growth of 32% for total revenue:

Created by author based on company filings

This would mean a further significant slowdown from Q1 levels, just when things began to look a little bit better. Based on management’s comments on the Q1 earnings call, February and March were strong during the Q1 quarter, however in April consumption on Snowflake’s platform slowed considerably, experiencing almost zero growth from week to week. This slowdown has been mostly driven by conscious cost control efforts from customers, which usually took place in the form of decreasing the amounts of data stored on Snowflake’s platform, thereby reducing storage and compute costs.

Although the month of May has seemed somewhat better, management decided to stay conservative and include this renewed slowdown into Q2 and FY24 guidance. This has led to a second FY24 revenue guidance cut in a row (currently $2.6 billion product revenue representing 34% YOY growth), which obviously has a negative effect on investor confidence.

Although the disappointing guidance of Amazon.com, Inc. (AMZN) at the end of April calling for a further slowdown in AWS growth foreshadowed this slowdown to some extent, but some positive earnings surprises from other, also AWS-dependent SaaS companies (e.g., Datadog) provided hope for some optimism. Now, it turned out that Snowflake is not a positive exception, resulting in a reassessment of investor expectations. The takeaway from this is that when Amazon reports Q2 earnings at the end of July Snowflake investors should pay close attention as the same trend could apply with a good chance.

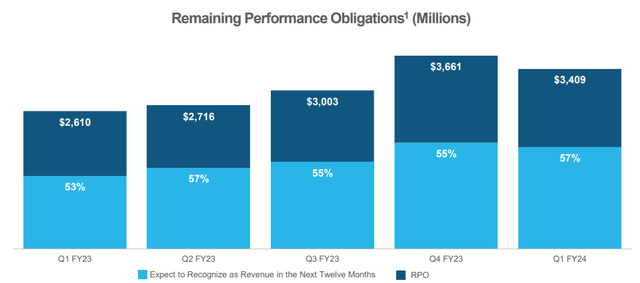

Another element that could’ve prompted fear among investors has been the development of remaining performance obligations (RPO). After a strong runup at the end of FY23 RPO decreased 7% qoq, although seasonally it used to stay flat during this period of the year:

Snowflake FY24 Q1 earnings presentation

YOY this has been an increase of 31%, a non-negligible slowdown from 38% just one quarter ago. Based on management comments, this has been mostly the result of customers becoming more cautious with multi-year contracts and commitments. If we look at the current portion of RPO (expected to be recognized within one year) YOY growth has been 40%, which should provide a better estimate into which direction revenue growth could head in the future.

There is real hope

Based on the dynamics presented above, SNOW investors can have real concerns regarding future growth prospects, which is completely normal due to repeated disappointments lately. However, I urge everyone not to make foregone conclusions and extrapolate these dynamics for the entire financial year.

On the one hand, if we look at global PMIs, the world macroeconomic outlook doesn’t seem to materially worsen recently, while inflation is continuing its way downwards. This could lead possibly to the re-evaluation of CFOs recent strongly risk-off stance leading to loosening belts on overall cloud spending. On the other hand, I believe Snowflake will be a strong beneficiary from recent trends in AI, which based on the Q2 guidance of Nvidia’s management could be already on the corner. Based on Snowflake’s Q1 earnings call, there have been some encouraging signs that AI-related revenues could soon take off.

First, more than 1,500 customers leveraged the platform for machine learning, data science and AI related workloads during the quarter, representing a YOY increase of 91%. In addition, Snowflake called out a customer in the financial industry who utilizes the company’s platform for model training, after they switched from another solution due to memory constraints.

Second, Snowflake continued its acquisition spree in the AI and machine learning space after acquiring Streamlit and Applica in 2022. With the release of Q1 earnings, the company announced the acquisition of Neeva, a search company that specializes in generative AI based search. This could further strengthen Snowflake’s position in the space.

Besides AI, another important growth driver in the upcoming quarters/years could be Snowpark, the company’s intuitive library for more efficient application development, where data from Snowflake’s platform is processed. In the Q1 quarter 30% of customers used Snowpark on at least a weekly basis up 10%-point from just one quarter ago. In addition, consumption on Snowpark increased 70% QOQ showing it is gaining strong traction at a fast pace.

I believe the trends mentioned above show that there is a good chance that the recent series of disappointing quarterly results could soon come to an end. If business conditions continue to improve in June like they did in May the Investor Day on the 27th of June could bring several positive surprises in my opinion. This could lead to a turnaround in the share price already before a possibly comforting Q2 earnings print. Based on the Q1 earnings call, the company is preparing with interesting new product announcements, which may also turn out to be a turning point. Based on this, I rate the company as a Buy at this point, even amid somewhat heightened execution risks. As a long-term investor, I don’t like to predict where to catch falling knives but rather keep focusing on fundamentals what I believe really matters.

Finally, a quick thought on valuation. Currently, shares trade at 17.5x FY24 sales, which considering management’s FY24 product revenue guidance of $2.6 billion representing 34% YOY growth seems a bit absurd. SaaS companies at these growth rates currently rather trade at 10x forward sales. However, I believe there is ample room for revenue growth re-acceleration at the company, especially in the light of current developments in AI. This should compress the valuation multiple over time. On the top of that, the total addressable market is also enormous, and that could make the strong growth for longer scenario more realistic. So, I believe the current hefty price tag for SNOW stock shouldn’t be a reason that prevents investors from investing in the shares, however, only those who can endure significantly higher volatility should do so.

Conclusion

Snowflake Inc. is a very promising company with short-term fundamental headwinds resulting from risk-off sentiment in enterprise IT spending. I believe that, with the rise of AI and the normalization of business conditions, Snowflake Inc. headwinds could soon turn into tailwinds, paving the way for a rebound in the share price. The Snowflake Inc. Investor Day one month from now, at the end of June could be a potential catalyst for this process, so I believe it’s already worth buying the shares after the post-earnings selloff. Although it's important to add Snowflake Inc. stock involves higher than usual risks in the short run.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.