Navios Maritime Holdings: Sell On Lack Of Catalysts And Tangible Value

Summary

- Company reports profitable first quarter results due to improved contributions from Navios South American Logistics ("Navios Logistics") and Navios Maritime Partners ("Navios Partners").

- That said, it's hard to assign any meaningful value to Navios Logistics as the company remains heavily indebted and faces a $500 million senior debt maturity on July 1, 2025.

- Parent Navios Maritime Holdings is looking even worse with debt and preferred stock obligations exceeding assets by more than $100 million.

- Effectively, both the common and preferred shares now represent options on major improvements at Navios Logistics, substantial price appreciation of Navios Partners' publicly-traded common units, and particularly a buyout at favorable terms by controlling shareholder, CEO, and Chairwoman Angeliki Frangou going forward.

- As I consider none of the above-listed scenarios as likely in the near- to medium-term, investors should avoid both the common and preferred shares or even consider selling existing positions.

JR Slompo/iStock via Getty Images

Note:

I have covered Navios Maritime Holdings (NYSE:NM, NYSE:NM.PG, NYSE:NM.PH) previously, so investors should view this as an update to my earlier articles on the company.

Following the sale of its dry bulk carrier fleet to former subsidiary Navios Maritime Partners (NMM) or "Navios Partners" as part of a massive bailout package last year, Navios Maritime Holdings or "Navios Holdings" has been left with two major assets:

- A 10.3% equity stake in Navios Partners that is accounted for under the equity method with a current value of approximately $69 million.

- A 63.8% equity stake in consolidated entity Navios South American Logistics or "Navios Logistics".

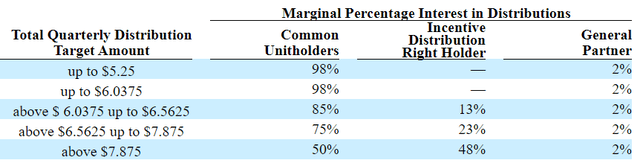

The company also holds some incentive distribution rights ("IDRs") related to Navios Partners which remain far out of the money:

Navios Maritime Partners Annual Report

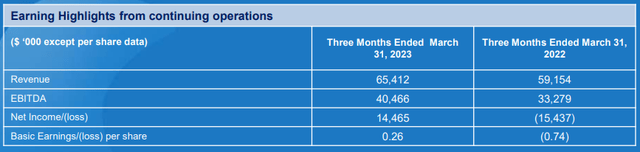

On Wednesday, Navios Holdings reported profitable Q1/2023 results which benefited from sequential top- and bottom line improvements at Navios Logistics and the contribution from Navios Partners:

While Navios Logistics contributed $26.6 million in Adjusted EBITDA in Q1, the company has more than $550 million in debt principal outstanding with $500 million in 10.75% Senior Secured Notes scheduled to mature on July 1, 2025.

Assuming Navios Logistics to achieve $110 million in Adjusted EBITDA this year and assigning an Adjusted EBITDA multiple of 5x to the business, this would be barely sufficient to cover the company's debt obligations.

In addition, Navios Logistics might experience difficulties refinancing the notes should the current interest environment persist into 2025.

Given these issues, I am having a hard time assigning any meaningful value to Navios Holdings' 63.8% stake in Navios Logistics at this point.

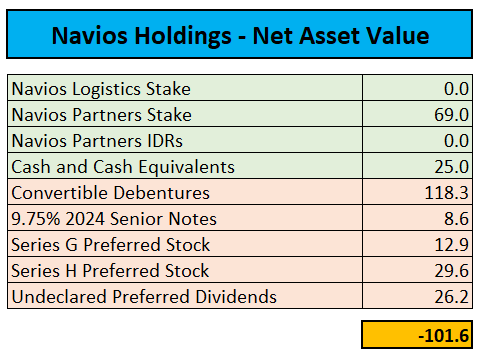

Unfortunately, there appears to be no common equity value in Navios Holdings either, even when considering the company's stake in Navios Partners and approximately $25 million in cash on its balance sheet as the company's debt and preferred stock obligations exceed assets by more than $100 million:

Annual Report on Form 20-F / First Quarter 2023 Report

Please note that the terms of last year's bailout agreement have resulted in Navios Shipmanagement Holdings Corporation or "Navios Management", a private entity controlled by the company's CEO and Chairwoman Angeliki Frangou, having accumulated almost $120 million in convertible debentures which are convertible into common stock at a conversion price of $3.93 per common share.

At the date of company's annual report on form 20-F filed with the SEC in late March, Ms. Frangou beneficially owned approximately 64.1% of Navios Holdings including shares issuable upon conversion of the above-discussed debentures.

As the maximum number of common shares issuable under the debenture is limited to 35.5 million, Ms. Frangou's stake in Navios Holdings won't exceed 67.3% without her taking further action.

Apparently, Navios Holdings' common equity holders will have to hope for:

- The Navios Logistics business to improve quite meaningfully

- Major price appreciation for the company's stake in Navios Partners

- Angeliki Frangou taking Navios Holdings private at a substantial premium

As I do not expect any of the required catalysts to come to fruition in the near- to medium-term, investors should consider selling their shares and moving on.

That said, there has been some major price appreciation in the company's Series G and Series H Preferred Stock in recent months despite the dividend having been suspended since 2015 already with both issues now trading substantially above last year's tender offer prices.

Apparently, some investors are speculating on Ms. Frangou making a near-term move for Navios Holdings but as discussed above already, I consider this a highly unlikely scenario as there's not much to gain for her at this point, particularly given the fact that she is in full control of the company anyway.

Bottom Line:

While last year's bailout deal has saved Navios Maritime Holdings from a near-term bankruptcy filing, it's difficult to assign any tangible value to the company's common shares at this point.

Effectively, both the common and preferred shares now represent options on major improvements at Navios South American Logistics, substantial price appreciation of Navios Maritime Partners' publicly-traded common units and particularly a buyout at favorable terms by Angeliki Frangou going forward.

As I consider none of the above-listed scenarios as likely in the near- to medium term, investors should avoid both the common and preferred shares or even consider selling existing positions.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.