VOE: Simple Mid-Cap Value Fund, Cheap Valuation

Summary

- A reader asked for my thoughts on the Vanguard Mid-Cap Value Index Fund.

- VOE is a mid-cap value fund, providing investors with diversified exposure to cheaply valued mid-cap equities.

- An overview of the fund follows.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Khanchit Khirisutchalual

Author's note: This article was released to CEF/ETF Income Laboratory members on May 7th, but numbers have been updated.

The Vanguard Mid-Cap Value ETF (NYSEARCA:VOE) is a simple, cheap, effective, U.S. mid-cap value index ETF. The fund provides investors with diversified exposure to cheap mid-cap equities, and could outperform as valuations continue to normalize. With a 2.3% dividend yield, the fund is not an effective income vehicle.

Although VOE is a reasonable investment opportunity, I think that the ProShares S&P MidCap 400 Dividend Aristocrats ETF (REGL) offers a similar, but somewhat stronger, investment thesis, with a stronger performance and dividend growth track-record. VOE is a reasonable fund, but REGL seems like the better choice.

VOE - Overview and Benefits

VOE is an equity index ETF investing in U.S. mid-cap value stocks. It tracks the CRSP US Mid Cap Value Index, an index of these same securities. Said index first selects mid-cap stocks, defined as those whose market-caps account for the middle 70% - 85% of total U.S. market-cap. Bottom 15% is small, top 70% is large, those in the middle are mid-caps. The following graph summarizes the situation, check the breakpoints in the left.

CRSP

From applicable mid-cap equities, the index then selects the cheapest, based on the following valuation metrics.

CRSP

The metrics above are all standard, effective valuation metrics.. As with most other indexes, applicable securities must meet a basic set of criteria to be included in the portfolio. There are also a set of buffers and other assorted rules meant to reduce portfolio turnover.

In my opinion, VOE's underlying index is reasonable, effective, and does not suffer from any significant issues or negatives. Said index should result in a portfolio of cheap value stocks, as is the case.

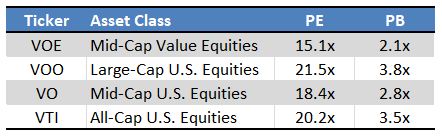

Fund Filings - Chart by Author

As can be seen above, VOE's valuation is quite a bit lower than those of broader U.S. equity indexes. The fund's valuation is also a bit lower than its own historical average, as per J.P. Morgan data on mid-cap value stocks.

JPMorgan Guide to the Markets

VOE's cheap valuation could lead to significant capital gains and outperformance moving forward, contingent on valuations normalizing. This could happen for several reasons or catalysts, including improved investor sentiment and assorted economic events. Valuations have started to normalize since at least 2022, in large part due to rising interest rates. VOE has outperformed mid-cap equity indexes since then, as expected.

On the other hand, the fund has matched broader equity indexes since then, and underperformed relative to most other large value funds. VOE's subpar performance relative to peers was due to mid-cap underperformance, in large part caused by recent regional banking failures.

Notwithstanding the above, VOE remains a cheaply valued fund, and its cheap valuation could lead to further outperformance moving forward.

VOE's underlying index is quite broad, which results in a reasonably well-diversified fund. VOE invests in 190 different companies, from all relevant industry segments. Diversification is quite good, about average for an equity index fund, although lower than that of the largest, most diversified index funds.

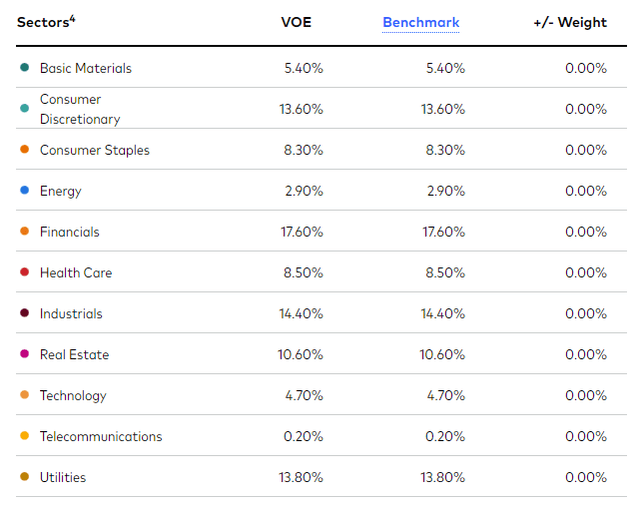

VOE

VOE's industry exposures are quite balanced, although with a tilt towards cheaply valued old-economy industries, including financials, industrials, and real estate. Importantly, the fund is not significantly overweight financials, so regional banking woes are not a significant concern for the fund, at least not much more than average. VOE is significantly underweight tech, an expensive, high-growth industry. Sector drifts for VOE versus the S&P 500 are as follows.

Etfrc.com

VOE's industry exposures generally lead to outperformance when old-economy industries outperform, and when tech underperforms, as was the case in 2022.

Data by YCharts

On the flipside, fund industry exposures generally lead to underperformance when old-economy industries underperform, and when tech outperforms, as was the case in 2020.

VOE's cheap valuation could lead to strong capital gains and market-beating returns moving forward, and is an important benefit for the fund and its shareholders. It is also an incredibly common one, with lots of diversified U.S. equity funds sporting cheap valuations too. These include the Vanguard Value ETF (VTV), the Avantis U.S. Large Cap Value ETF (AVLV), and REGL. There are many differences between these funds and VOE, but all are cheap, and their benefits and overall investment thesis are quite similar. Nothing wrong with VOE, but its benefits are quite common, and this is an important fact for investors to consider.

VOE - Performance Analysis

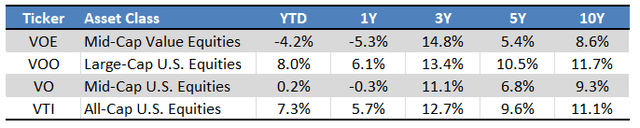

VOE's performance track-record is below-average, with the fund generally underperforming most relevant U.S. equity indexes. The fund's performance only looks good at the 3Y mark, but that puts us right in the middle of the pandemic, an incredibly volatile time.

Seeking Alpha - Chart by Author

Although VOE's performance track-record is not terrible, it is somewhat weak, and compares unfavorably to some of its peers. Most simply large-cap value ETFs have outperformed VOE, including VTV. Some of the stronger actively-managed value ETFs too, including AVUV. REGL, a mid-cap dividend growth index ETF, and close peer to VOE, has outperformed as well.

VOE's underperformance was due to mid-cap underperformance, and recent regional banking woes.

In my opinion, regional banking woes were something of an idiosyncratic shock, and so investors should not put too much importance on VOE's recent underperformance. Nevertheless, the fact remains that the fund has underperformed, which is a negative.

REGL Comparison

VOE is somewhat similar to REGL, so I thought to do a quick comparison between these.

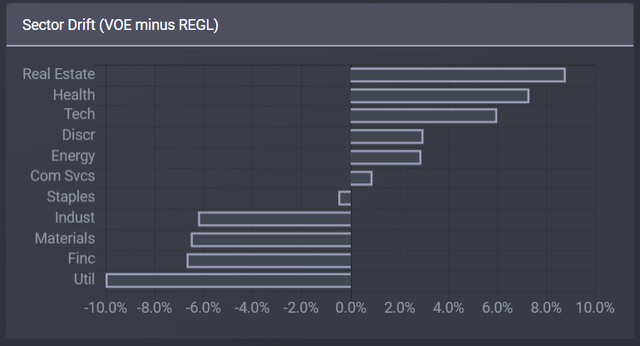

VOE invests in mid-cap U.S. value equities, while REGL invests in mid-cap U.S. equities with at least 15 years of dividend growth.

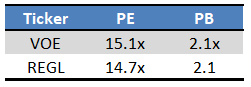

Both funds have almost identical valuations, as VOE targets cheap stocks, while REGL targets older companies with long dividend growth track-records which are, invariably, cheap stocks.

Fund Filings - Chart by Author

REGL seems a bit more focused on real, tangible industries over VOE, but not consistently so.

Etfrc.com

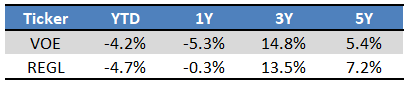

REGL's performance track-record is stronger, with the fund moderately outperforming since inception, and for some other relevant time periods too.

Seeking Alpha - Chart by Author

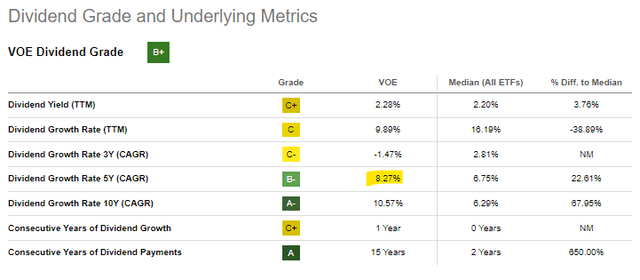

Dividend yields are functionally identical.

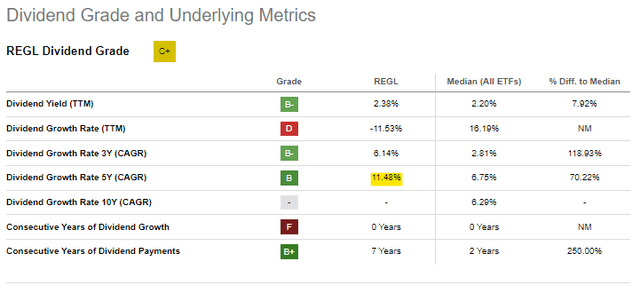

Dividend growth rates are not, with REGL's dividends generally growing at a faster pace. Growth for REGL.

Seeking Alpha

Growth for VOE.

Seeking Alpha

VOE has effectively zero advantages to REGL, so I see no reason to pick VOE over REGL.

Besides REGL, there are other value ETFs out there with broadly similar characteristics and benefits to VOE. I've covered probably a dozen of these so far, and I do not believe that VOE offers investors any significant advantages to these. It is a reasonable fund, but not particularly stronger than its peers.

Conclusion

VOE is a simple, cheap, effective, U.S. mid-cap value index ETF. Although there is nothing inherently wrong with the fund itself, REGL offers an incredibly similar, but stronger, value proposition and investment thesis. VOE is a reasonable fund, but REGL seems like the better choice.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.