9.4%-Yielding Omega Healthcare: A Bargain With Upside Potential

Summary

- Omega Healthcare looks set to benefit from the recovery of its operators and long-term growth drivers in its industry.

- It pays a high yield and the dividend coverage should improve in the remainder of the year.

- Investors could see potentially strong total returns at the current discounted price.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

It’s easy to write off an investment as being too risky based on yield and near-term price action alone. However, it’s not that simple in reality, as today’s beaten down stocks could be tomorrow’s winners, especially if they are a dominant player in their respective industries.

Such may be the case with Omega Healthcare Investors (NYSE:OHI), which has surely seen its ups and downs over the past 3 years. I last covered OHI here back in March, and while the price has barely budged with a 0.9% increase, the stock has given a 3.4% total return thanks to the power of dividends.

In this article, I discuss OHI’s recent business developments and why now may be a great time to lock in this 9%+ yield.

Why OHI?

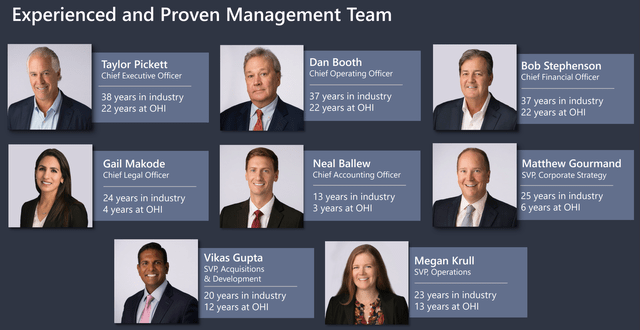

Omega Healthcare Investors has been around for 31 years, and is the largest owner of skilled nursing facilities in the U.S., with international exposure in the UK. At present, OHI holds 902 mostly skilled nursing facility properties across the US and UK, covering 66 operators and over 89,000 bends. As shown below, OHI is led by an experienced management team, of whom the top 3 executives have been with the company for 22 years.

OHI recently produced results that were more or less in line with expectations, generating AFFO per share of $0.66 and FAD per share of $0.60. Notably, the $0.67 quarterly dividend was not covered by FAD and the dividend payout ratio was 112%, which is unsustainable for the long-term. However, management expects for the payout ratio to rapidly improve, as one of its top tenants, Agemo, resumed paying quarterly rent and interest of $6.5 million in April.

In another sign of an industry in recovery, the Healthcare Homes operator began paying full contractual rent this month after a four-month rent deferral. Also encouraging, all other assets with troubled operators have been fully transitioned to new ones, and this should provide momentum for FAD growth in the remainder of the year.

Importantly, it appears that the SNF industry is better able to stand on its own legs. This is reflected by core EBITDAR to rent coverage, excluding funds from the CARES Act, improved to 1.09x at the end of 2022 compared to 0.83x at the end of Q3 2022. For reference, operator rent coverage is always reported one quarter in arrears. Plus, OHI is opportunistically consolidating the SNF industry, as it closed $276 million worth of transactions so far this year.

Meanwhile, OHI maintains a strong BBB- rated balance sheet with $1.4 billion in undrawn capacity on its revolving credit facility, and carries a low weighted-average interest rate of 4.2% of its debt. Moreover, 98% of OHI’s debt is fixed rate, thereby mitigating the near-term impact of higher interest rates. It’s also safely levered with a net debt to EBITDA ratio of 5.9x and has a respectable fixed charge coverage ratio of 3.6x.

Looking ahead, stabilization of the SNF industry in the near term bodes well for OHI’s long-term prospects. SNFs remain the lowest cost-of-care setting in the healthcare industry compared to Inpatient Rehabilitation Facilities and Long-term Acute Care Hospitals, with an average cost per day of $462, sitting well under half of that of IRF and LTACH.

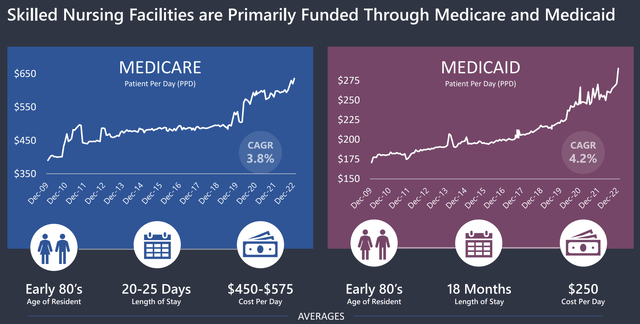

Increasing demand for the properties due to an aging population combined with the 86% of states having a moratorium or CON (certificate of need) restrictions should also drive occupancy higher to above 80% over the next few years, above the 77% occupancy rate at present. Plus, as shown below, Medicare and Medicaid patient per day payments have meaningfully picked up over the past year, as shown below.

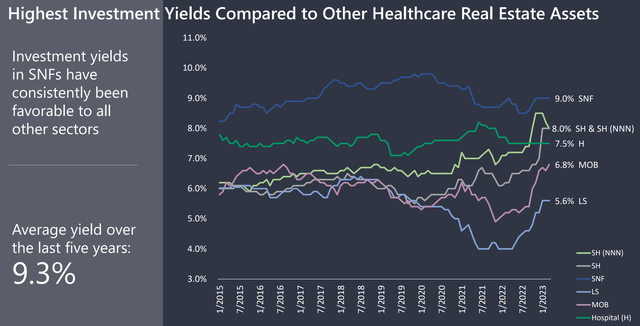

Admittedly, the SNF segment is higher risk than other healthcare assets due to lower rent coverage ratios. However, that’s the nature of the beast, as operators are not supposed to live richly off government payments, and the industry is adequately compensated for that risk. As shown below SNFs enjoy the highest yields on investment compared to other asset classes.

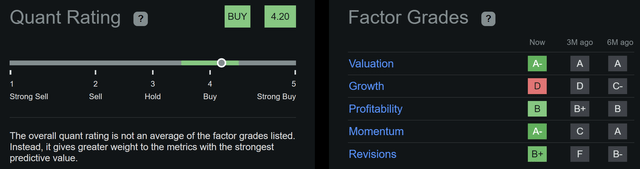

Lastly, OHI remains in value territory at the current price of $28.48 with a forward P/FFO of 10.4, sitting comfortably below its normal P/FFO of 12.3. Analysts expect FFO/share to grow by 4.6% next year and have a conservative price target of $29.91, implying a potential 14% total return over the next 12 months. Plus, as shown below, SA’s Quant gives a Buy rating with a score of 4.2, with A and B grades for valuation, profitability, momentum, and analyst earnings revisions.

Investor Takeaway

Omega Healthcare is well-positioned to benefit from the recovery of its operators, long-term growth drivers, and limited supply in its industry. While the dividend currently isn't covered, the coverage should improve in the remainder of the year. Meanwhile, OHI carries a strong balance sheet and is growing by consolidating the fragmented industry. Lastly, income investors are well-compensated with a 9.4% yield while participating in the continued turnaround.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OHI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.