AudioCodes: Hit By Softer Demand, But With Voice AI Prospects

Summary

- After sliding more than 60%, one starts to wonder whether AudioCodes is not an opportunistic buy.

- Other reasons could be that it pays dividends and has announced cost-cutting measures.

- However, it faces a demand problem implying that the top line could continue to suffer throughout 2023.

- As a result, the stock could also fall further signifying that it is not time to buy.

- Still, with ChatGPT being popularized throughout the world, the company should be on your watchlist because of Voice AI opportunities.

Urupong

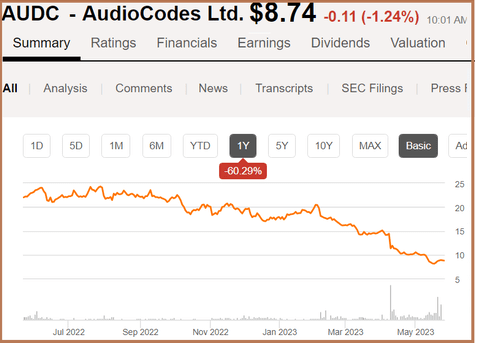

For those wondering why AudioCodes' (NASDAQ:AUDC) shares are down by more than 60% during the last year, the answer lies in its financial results for the first quarter of 2023 (Q1) which have deteriorated compared to last year. In addition, guidance for 2023 has been revised downward.

AUDC's Price Action (seekingalpha.com)

Now, this is a dividend-paying stock, and after such a drop, the question is whether it has become an opportunistic buy. My objective with this thesis is to provide an answer, through an assessment of competitive positioning and product demand. I will also provide insights into its Voice AI business line as everyone is talking about ChatGPT's intelligent algorithms.

I start with the financial results.

The Financials and Impacted Business Lines

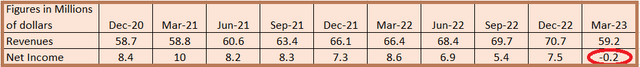

Revenues of $59.2 million for Q1 represented a decrease of 10.8% over the same period last year, but worst, the Israel-headquartered company suffered from a net loss of $0.2 million compared to income of $8.6 million previously. This loss as encircled in red below also marks a break from a streak of profits during the last nine quarters.

Quarterly Income Statement (seekingalpha.com)

Despite the loss, the company continued to generate cash from operations of $3.2 million resulting in total cash and equivalents of $121.5 million at the end of March 2023. It also managed to keep shareholders happy by declaring a cash dividend of $0.18 per share representing an aggregate amount of around $5.7 million.

Now, for a loss-making company to sustain dividend payments, and also committed to share buybacks, especially during uncertain market conditions, it becomes important to assess whether it is actioning cost-cutting measures. This is indeed the case with a planned reduction in the total number of employees by 6% in the first phase of a restructuring which should result in savings of $8 million annually.

Therefore, the company faces challenges but is taking actions to reduce costs, but restoring profitability will also depend on whether it is able to increase sales. For this purpose, I provide an overview of the business before diving into the different product lines.

This is a company that has developed expertise in voice technology, namely in Unified Communications as a Service (UCaaS) one of whose applications is the conversion of traditional analog PABX systems into digital VoIP solutions. One associated product is the IP phone where people can make phone calls on the Internet. This business line suffered as product distributors held to their existing inventories since customers themselves continued to delay purchase decisions both in Europe and North America.

The same applies to two other business lines, namely the CPE (customer premises equipment) which constitutes about 10% to 15% of the company's revenues annually, and to the more strategic UCaaS where which also experienced softness. The executives again attributed the softness to customers being cautious as to how they spend, not competitive challenges.

Hence, it is important to look at the competition.

The Competition

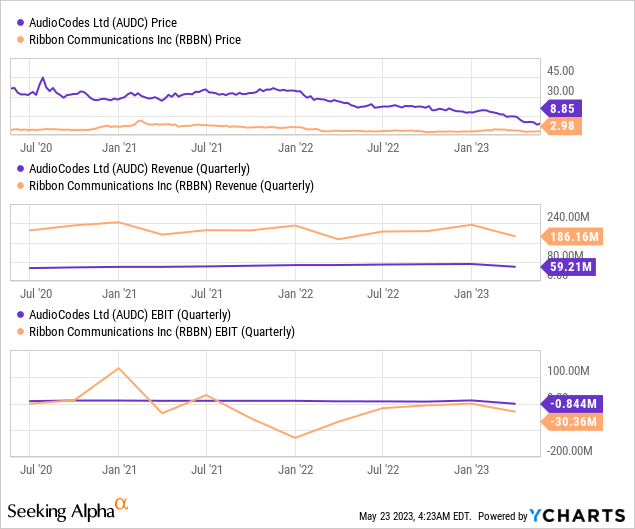

For this purpose, given its wide range of product offerings, AudioCodes has to compete with a range of companies including Neat, VoxImplant, Ribbon (NASDAQ:RBBN), and others. Hence, a comparison with U.S based Ribbon shows that the company has also suffered from a decrease in quarterly revenues in its latest reported quarter as shown in the orange chart below. Now, given both companies' toplines have been adversely impacted tends to give credence to the CEO's affirmation that the softness witnessed is the result of lower demand rather than competitive pressure.

Still, as shown by the price action in the blue chart above, AudioCodes shares have suffered from more downside, which, as touched upon earlier, could again be to the operating loss of $0.844 million, after several quarters of delivering profits.

To put things into context, with high inflation in the U.S. and throughout the world compared to last year together and the elevated interest rates making corporate borrowing more expensive, it is the value strategy that has prevailed when it comes to smaller caps. Hence, there is little tolerance for companies that are not able to sustain profitability, and, worst, the stock's downside could continue till August when second-quarter (Q2) results are announced. The reason is the $8 million of cost savings I talked about earlier will only start to show up in Q3's income statement as per the management.

Softness in Demand Confirmed

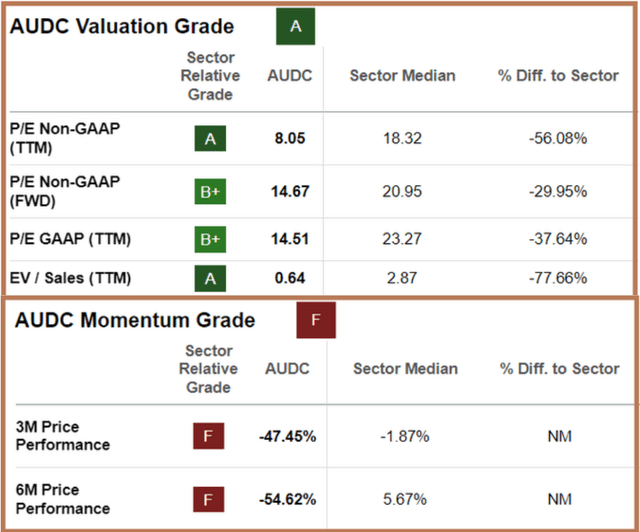

Therefore, despite its lower valuation grade of A and its non-GAAP trailing price to earnings being lower than the sector by more than 50%, AudioCodes is not a buy.

AUDC Valuation and Momentum Grades (www.seekingalpha.com)

In this case, some may be tempted to invest as just like other risk assets, the stock is benefiting from occasional support mostly due to positive developments around the extension of the debt ceiling and the possibility of a Fed pause in June. However, I remind investors that these are temporary market moves.

Trying to chart the longer-term price action, the stock scores a momentum of F as shown above, and slid by nearly 55% during the last six months while the sector median gained 5.6%. The start of the downside dates back to September/October when coincidentally Zoom (ZM) announced more than 1300 job cuts due to the waning demand for its video-conferencing tools. These had gained traction as the pandemic forced people to work from their homes, but things are changing rapidly as work-from-homers are actively being encouraged to return back to the office. Since AudioCodes has good business with Zoom it should suffer too as a result of less derived demand since both companies' products are complementary.

Now, in addition to Zoom, the Israeli company supports others like Microsoft (NASDAQ:MSFT) Teams and Cisco's (NASDAQ: CSCO) Webex. In this respect, while the software giant has not raised the alarm about an erosion of demand on its Team product which, by the way, is offered bundled with Office 365, it has seen some deceleration in the number of users added in 2023 compared to the acceleration enjoyed in 2021 and 2022 as per data from Business of Apps.

Consequently, with pandemic-led demand behind us, it is unlikely for the Israeli company to witness the same level of quarterly sales as in 2021 and 2022. In these conditions, the cost-cutting measures are indeed positive, but may not be sufficient to restore profitability in a sustained manner in case demand continues to decelerate.

Shifting to a positive tone, as an innovator, AudioCodes has a product that companies may find appealing to improve CX or customer experience.

Concluding with Opportunities in Voice AI

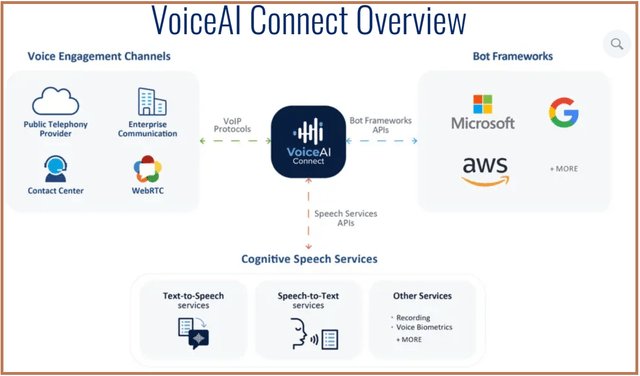

In this respect, there have been recent developments in ChatGPT-style natural languages, whereby Generative AI algorithms understand commonly used words as they are typed in. Extrapolating further, the next step should be conversational AI, for example by adding a telephony channel to a text-based chatbot as part of a strategy to improve customer satisfaction. These are the sort of use cases that form part of AudioCodes' Voice AI business line, where the company is investing considerably. Thus, the business grew by 5% year-over-year with stronger numbers expected over time.

I envisage further growth in this business line as booking numbers have been strong, the company faces no strong competitor in this field and the Voice AI product can even be connected to cognitive services like ChatGPT-type solutions.

Voice AI Connection (www.audiocodes.com)

Thus, it may be a good idea to put the company on your watchlist in case there is a sudden uptake of Voice AI. Here, considering that ChatGPT has already reached the 100 million user mark in just three months while Microsoft Teams took more than three years to reach this figure and was helped by Covid, AudioCodes' sales could receive a boost if just a fraction of ChatGPT customers chooses to attach its devices.

In conclusion, by going through the competition and demand for its products, this thesis has shown that AudioCodes faces headwinds, which could continue to impact unfavorably both revenues, profitability, and the stock price in the quarters ahead. My pessimism is further reinforced by its two main markets, the North American region and EMEA which represented around 46% and 31% of its revenues in Q1 facing risks of economic slowdown.

Thus, the stock could fall further, possibly to the $7.5 support level last reached in 2018, but, watch out for its Voice AI business line.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.