Snowflake: Dead Money Walking For Now

Summary

- Snowflake stunned investors with disappointing guidance as the near-term headwinds from reduced enterprise spending hampered its performance.

- A broad-based optimization drive across the hyperscalers affected its growth. However, its heavier exposure to Amazon Web Services worsened the challenges.

- SNOW has recovered remarkably from its early 2023 lows. However, it's far from being undervalued, with increased execution risks.

- We're currently running a sale for our private investing group, Ultimate Growth Investing, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Sundry Photography

Snowflake Inc. (NYSE:SNOW) disappointed investors yesterday (May 24) as it reduced its revenue outlook and lowered its profitability projections, given uncertain macroeconomic uncertainties.

As such, SNOW is down more than 12% in post-market at writing, as investors assessed the time taken for such uncertainties to abate. Management was reticent in providing more clarity over the expected growth inflection, even though the company remains confident in its long-term game plan.

Hence, Snowflake didn't adjust its long-term outlook of $10B in product revenue by FY29 with a "better margin profile." However, given SNOW's expensive valuation, the challenge for holders is how to navigate the near-term challenges in its sales cycle if the optimization trends continue.

Management pointed out to investors that Snowflake is more exposed to the growth drivers underpinning Amazon Web Services or AWS (AMZN). CEO Frank Slootman articulated that "Amazon is such a large percentage of [Snowflake's] overall deployments that they are a good proxy. So there's definitely a ripple effect because [Snowflake's] in the stack."

Keen investors should recall that AWS reported a significant slowdown recently, as "AWS notched only a 16% YoY rise in its topline for FQ1, hampered by ongoing optimization and macro challenges."

However, Snowflake's cloud-agnostic model suggests that it should be exposed to multi-cloud deployments, helping mitigate the revenue growth slowdown. Despite that, a general downturn in the hyperscaler space was noted in Q1, affecting Snowflake's revenue growth, given its usage-based consumption model.

Moreover, while Microsoft (MSFT) notched robust growth last quarter, Slootman reminded investors that its "Microsoft [exposure] is smaller, so they're not as predictive of [Snowflake's] experience as AWS would be."

With that in mind, I expect the overstated consensus estimates to be revised downward, given SNOW's remarkable recovery from its early 2023 lows. I updated investors in my previous article that SNOW's pullback should be bought, as it significantly outperformed the S&P 500 (SPX) (SPY).

Accordingly, Snowflake communicated guidance of $2.6B in product revenue for FY24 (up 34% YoY), predicated against a reduced adjusted operating margin of 5%. Although it's just 1% point lower than Wall Street estimates, the magnitude of the reduction, given its relatively weak adjusted profitability, suggests that we must be more cautious now.

Notwithstanding, Snowflake stressed that it remains well-primed to leverage AI workloads, given its ability to leverage data sharing and storage, as it "manages a vast and growing universe of public and proprietary data." Therefore, the company believes its services remain highly relevant and in demand. The company also highlighted that its "customer base for data science, machine learning, and AI workloads grew by 91% year-over-year."

However, it must first navigate near-term macro and enterprise spending challenges, although the company expects the "trend to reverse." In addition, management stressed that the falling net revenue retention rate of 151% is being hampered by older cohorts, as "newer cohorts are growing faster."

As such, the company is confident that "there is plenty of demand" driven by AI workloads. Hence, investors are urged to remain patient as the company navigates short-term macro headwinds.

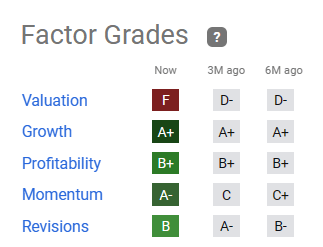

SNOW quant factor ratings (Seeking Alpha)

However, I understand why the market has little patience for a tepid outlook. SNOW's "F" valuation grade indicates that it's priced for perfection, with little margin for error or disappointment.

Given management's less optimistic near-term guidance, investors must account for increased execution risks, as the recent recovery has likely reflected significant optimism.

With the post-market pullback, SNOW is less overvalued but nowhere attractive to consider adding. Its price action is also not constructive, and thus I don't see a particularly enticing entry point, even for a speculative entry.

As such, I move to the sidelines from here.

Rating: Hold (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for Technology, Software, and the Internet.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.