My Top 10 High Dividend Yield Companies For June 2023

Summary

- High dividend yield companies can help you earn an extra income in the form of dividends, which you can then use to cover your expenses.

- In this article, I will introduce you to 10 companies that I believe are attractive picks for investors since they combine an attractive Dividend Yield with Dividend Growth.

- The Average Dividend Yield [FWD] of these selected picks is 6.56%, and they have shown an Average Dividend Growth Rate of 7.02% over the past 5 years.

Deagreez/iStock via Getty Images

Investment Thesis

Companies that provide you with a high dividend yield can help you earn a significant amount of extra money via dividends without the necessity to sell some of your stocks in an attempt to achieve capital gains. You can use this extra income via dividend payments to reinvest or, alternatively, to help you cover your monthly expenses.

In today's article, I will present you with 10 companies that I currently consider to be attractive since they pay an attractive Dividend Yield (the Average Dividend Yield [FWD] is 6.56%), have recently shown significant Dividend Growth (the Average Dividend Growth Rate [CAGR] over the past 5 years is 7.02%), and have an attractive Valuation (the Average P/E [FWD] Ratio of these selected picks is 10.22). Moreover, I believe that each of the selected picks offer strong competitive advantages as well as disposing of a relatively strong financial health which can help you increase the probability of making successful long-term investments.

Below, I will describe the selection process in more detail. Since I have already described this process in a previous article, if you are already familiar with it you can skip the following section written in italics.

First Step of the Selection Process: Analysis of the Financial Ratios

In order to identify companies with a relatively high Dividend Yield [FWD], I use a filter process to make a pre-selection. From this pre-selection, I will later choose my top 10 high Dividend Yield companies of the month. To be part of this pre-selection of high Dividend Yield stocks, the companies should fulfil the following requirements:

- Market Capitalization > $10B.

- Dividend Yield [FWD] > 2.5%.

- Payout Ratio < 100% [changed from 80%].

- P/E [FWD] Ratio < 30.

- EBIT Margin [TTM] > 5% or Net Income Margin [TTM] > 5%.

In the following, I would like to specify why I have chosen the metrics mentioned above in order to select my top 10 high Dividend Yield stocks of the month.

A Market Capitalization of more than $10B contributes to the fact that the risks attached to your investments are lower, since companies with a higher Market Capitalization tend to have a lower volatility than companies with a low Market Capitalization.

A Payout Ratio of less than 100% [changed from 80%] contributes to the fact that the risk of a Dividend cut in the near future tends to be lower. A Payout Ratio of more than 100%, for example, would imply that the company pays a higher Dividend per Share than it has generated Earnings per Share. This would be a strong indicator that the Dividend could be cut soon and that the share price could drop significantly as a result. This would imply a strong risk factor for investors. Therefore, this filter contributes to lowering the risk level.

A P/E [FWD] Ratio of less than 30 implies that the price you pay for the company is not extraordinarily high, thus filtering out those that have stock prices in which high growth expectations are priced in. High growth expectations imply strong risks for investors, since the stock price could drop significantly. Again, the filtering process helps us to reduce the risk so that we are more likely to make an excellent investment decision.

An EBIT Margin [TTM] or Net Income Margin [TTM] of more than 5% are indicators of a company's Financial Strength.

Second Step of the Selection Process: Analysis of the Competitive Advantages

In a second step, the companies' competitive advantages (for example: brand image, innovation, technology, economies of scale, etc.) are analyzed in order to make an even narrower selection. I consider it to be particularly important for companies to have strong competitive advantages in order to stand out against the competition in the long term. Companies without strong competitive advantages have a higher probability of going bankrupt one day, thus representing a strong risk for investors to lose their invested money.

Third Step of the Selection Process: The Valuation of the Companies

In the third step of the selection process, I will dive deeper into the Valuation of the companies.

In order to conduct the Valuation process, I use different methods and criteria, for example, the companies' current Valuation as according to my DCF Model, the expected compound annual rate of return as according to my DCF Model and/or a deeper analysis of the companies' P/E [FWD] Ratio. These metrics should serve as an additional filter to only select companies that currently have an attractive Valuation, which helps you to identify companies that are at least fairly valued.

The Fourth and Final Step of the Selection Process: Diversification over Industries and Countries

In the fourth and final step of the selection process, I have established the following rules for choosing my top picks: in order to help you diversify your investment portfolio, a maximum of two companies should be from the same industry. In addition to that, there should be at least one pick that is from a company that is based outside of the United States, serving as an additional geographical diversification.

New Companies Compared to the Previous Month of May

- Allianz (OTCPK:ALIZF, OTCPK:ALIZY).

- BB Seguridade Participações (OTCPK:BBSEY).

- Kinder Morgan (NYSE:KMI).

- The Bank of Nova Scotia (NYSE:BNS).

- United Parcel Service (NYSE:UPS).

My Top 10 High Dividend Yield Stocks to Invest in for June 2023

- Allianz.

- Altria (NYSE:MO).

- AT&T (NYSE:T).

- BB Seguridade Participações.

- Johnson & Johnson (NYSE:JNJ).

- Kinder Morgan.

- The Bank of Nova Scotia.

- United Parcel Service.

- U.S. Bancorp (NYSE:USB).

- Verizon Communications Inc. (NYSE:VZ).

Overview of the Selected Companies

Company Name | Sector | Industry | Country | Dividend Yield [TTM] | Dividend Yield [FWD] | Div Growth 5Y | P/E FWD Ratio |

Allianz | Financials | Multi-line Insurance | Germany | 5.45% | 5.45% | 5.72% | 8.76 |

Altria Group | Consumer Staples | Tobacco | United States | 8.21% | 8.30% | 7.18% | 8.98 |

AT&T | Communication Services | Integrated Telecommunication Services | United States | 6.81% | 6.81% | -5.78% | 6.72 |

BB Seguridade Participações S.A. | Financials | Multi-line Insurance | Brazil | 9.19% | 11.60% | 13.89% | 8.61 |

Johnson & Johnson | Health Care | Pharmaceuticals | United States | 2.84% | 3.00% | 6.11% | 14.9 |

Kinder Morgan | Energy | Oil and Gas Storage and Transportation | United States | 6.75% | 6.84% | 14.16% | 15.05 |

The Bank of Nova Scotia | Financials | Diversified Banks | Canada | 6.24% | 6.22% | 4.380% | 8.94 |

U.S. Bancorp | Financials | Diversified Banks | United States | 6.31% | 6.38% | 10.00% | 6.6 |

United Parcel Service | Industrials | Air Freight and Logistics | United States | 3.67% | 3.79% | 12.53% | 15.88 |

Verizon Communications | Communication Services | Integrated Telecommunication Services | United States | 7.21% | 7.24% | 2.04% | 7.7 |

Average | 6.27% | 6.56% | 7.02% | 10.22 |

Source: The Author

Allianz

Allianz belongs to the largest positions of my personal investment portfolio. The main reason for this is that I believe the company is an excellent fit in terms of risk and reward. I consider the risks that come attached to an Allianz investment as being relatively low, while I consider the reward in the form of its expected compound annual rate of return to be relatively high.

Another reason why I'm invested in Allianz and for which I have made the company part of this list, is the attractive Dividend it pays its shareholders: the current Dividend Yield [FWD] for Allianz stands at 5.45%, which lies 32.55% above the Sector Median of 4.11% and 3.43% above its Average Dividend Yield [FWD] over the past 5 years (5.27%).

The company's Dividend Growth Rate [CAGR] over the past 10 years is 7.80%, which clearly demonstrates that Allianz could help you earn an extra income via dividend payments while being able to increase this amount on an annual basis.

Furthermore, I would like to highlight that the company has shown 42 consecutive years of dividend payments, which confirms it as being a reliable dividend payer for shareholders.

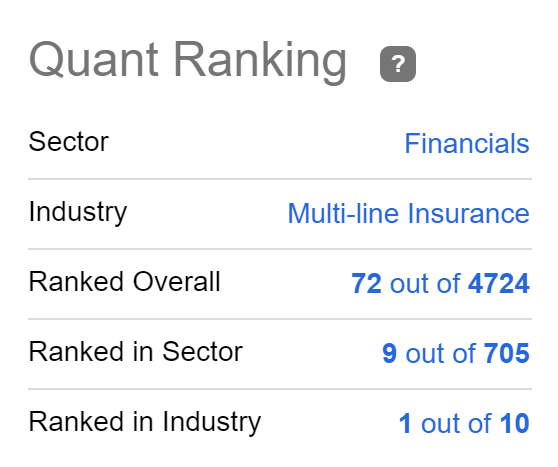

The Seeking Alpha Quant Ranking further confirms that the company is an excellent choice for investors: Allianz is ranked 1st out of 10 within the Multi-line Insurance Industry, 9th out of 705 within the Financials Sector and 72nd out of 4724 within the Overall Ranking.

Source: Seeking Alpha

Altria

Altria has shown a negative performance within the past 12-month period: the company's Total Return has been -11.54%.

At its current stock price of $45.17, Altria has a P/E [FWD] Ratio of 9.19, which lies 28.86% below its Average over the past 5 years and 55.36% below the Sector Median (20.58), confirming that the company is undervalued at this moment in time.

This is also confirmed when considering the company's Price / Sales [FWD] Ratio of 3.87, which lies 10.29% below its Average from over the past 5 years.

Altria's P/E [FWD] Ratio of 9.19 lies significantly below the one of competitor Philip Morris International (NYSE:PM) (P/E [FWD] Ratio of 15.16), thus confirming my investment thesis that it's currently undervalued. However, it should also be mentioned that the company's P/E [FWD] Ratio lies slightly above the one of British American Tobacco (NYSE:BTI) (OTCPK:BTAFF) (which has a P/E [FWD] Ratio of 8.70).

Altria currently offers investors a Dividend Yield [FWD] of 8.30%. The company's Dividend Yield is significantly above the one of Philip Morris International (Dividend Yield [FWD] of 5.45%), but slightly below British American Tobacco's (8.45%).

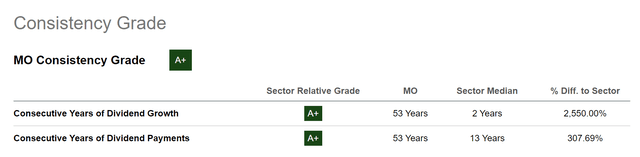

The Seeking Alpha Consistency Grade confirms that Altria is an attractive fit for dividend income and dividend growth investors: the company has not only shown 53 consecutive years of Dividend Payments, but also 53 consecutive years of Dividend Growth.

AT&T

AT&T's stock price has declined significantly within the past 12-month period (the company has shown a Total Return of -21% within this period of time), making its Valuation even more attractive than before.

At AT&T's current stock price of $16.34, it has a P/E [FWD] Ratio of 7.04, which lies 38.94% below its Average over the past 5 years and 63.82% below the Sector Median. These numbers demonstrate that AT&T is undervalued.

The same is confirmed when looking at the company's Dividend Yield [FWD] of 6.81%, which stands 102.03% above the Sector Median of 3.37% and 2.99% above its Average Dividend Yield [FWD] over the past 5 years.

Below you can find the Consensus Dividend Estimates for AT&T: the Consensus Rate and Consensus Yield are $1.11 and 6.83% respectively for 2023, $1.12 and 6.86% for 2024, and $1.13 and 6.90% for 2025. This strengthens my belief that dividend income investors should be able to benefit from steadily increasing dividend payments within the next years.

BB Seguridade Participações

BB Seguridade Participações is a Brazilian-based Multi-line Insurance company that was founded in 2012. The company currently has a Market Capitalization of $12.35B.

BB Seguridade Participações pays a Dividend Yield [FWD] of 11.60%. Moreover, it has shown a Dividend Growth Rate [CAGR] of 13.89% over the past 5 years. However, the company's Payout Ratio of 87.39% is relatively high, which is why I don't consider its Dividend to be absolutely safe.

Due to the elevated risk factors that come attached to an investment in this company (such as a possible dividend cut as well as the currency risk), I suggest to only underweight this company in your investment portfolio if you decide to include it: I would limit the proportion of this company to a maximum of 1.5% of your overall investment portfolio in order to reduce portfolio risk.

In terms of Valuation, I believe that the company is an attractive fit for investors, since its P/E [FWD] Ratio stands at 8.24, which is 5.34% below the Sector Median of 8.70.

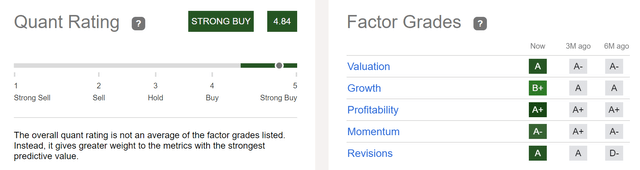

Both the Seeking Alpha Quant Rating and the Seeking Alpha Factor Grades confirm my investment thesis that the company is an attractive pick for investors. BB Seguridade Participações is rated with a strong buy according to the Seeking Alpha Quant Rating. The Seeking Alpha Factor Grades give the company an A+ rating for Profitability, an A for Valuation and Revisions and an A- for Momentum.

Johnson & Johnson

Within the past 12-month period, the stock price of Johnson & Johnson has declined by 9.53%. This has contributed to the company currently paying a Dividend Yield [FWD] of 3.00%. In my opinion, this makes Johnson & Johnson a very attractive fit for investors.

With a Payout Ratio of only 44.44%, I consider the company's Dividend to be absolutely safe. In addition to that, Johnson & Johnson has shown a Dividend Growth Rate [CAGR] of 6.28% over the past 10 years and 6.02% over the past 5 years. This indicates that the company will not only provide your portfolio with an attractive and reliable dividend, but that it also has the potential to increase this dividend year over year.

At this moment in time, the company has a Free Cash Flow Yield [TTM] of 3.89%, which makes me believe that it's a perfect fit when considering risk and reward.

In terms of Valuation, I believe that Johnson & Johnson is undervalued, since its P/E Non-GAAP [FWD] Ratio is 14.92, which lies 23.05% below the Sector Median (19.39). Furthermore, it is 11.22% below its Average over the past 5 years, once again, confirming my investment thesis that the company is undervalued.

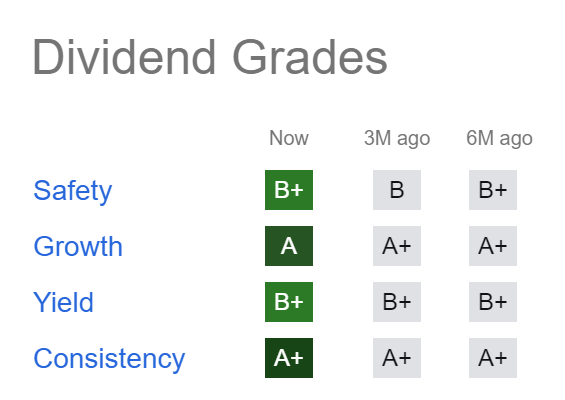

The fact that Johnson & Johnson is a reliable dividend payer is confirmed when looking at the Seeking Alpha Dividend Grades: Johnson & Johnson receives an A+ for Dividend Consistency, an A for Dividend Growth, and a B+ for both Dividend Safety and Dividend Yield.

Source: Seeking Alpha

When compared to competitors such as Merck & Co (NYSE:MRK), Pfizer (NYSE:PFE) or Novartis (NYSE:NVS, OTCPK:NVSEF), it can be highlighted that Johnson & Johnson has shown 60 consecutive years of dividend growth, while Merck & Co and Pfizer have shown 12 and Novartis 4. This confirms that Johnson & Johnson is the most adequate pick in terms of Dividend Consistency.

Kinder Morgan

Kinder Morgan is an energy infrastructure company that operates through the following segments:

- Natural Gas Pipelines.

- Products Pipelines.

- Terminals.

- CO2.

The company was founded back in 1936 and has a current Market Capitalization of $37.02B.

I consider its Valuation to currently be attractive as its P/E [FWD] Ratio of 14.67 lies 74.51% below the company's Average from over the past 5 years (which is 57.55).

Kinder Morgan's Price / Sales [FWD] Ratio of 1.99 is 26.23% below its Average from over the past 5 years (2.70), once again suggesting that the company is undervalued.

At the current stock price of $16.52, Kinder Morgan pays shareholders a Dividend Yield [FWD] of 6.84%. In addition to that, it can be highlighted that the company has shown an attractive Dividend Growth Rate [CAGR] of 14.16% over the past 5 years.

However, it should be mentioned that Kinder Morgan's Payout Ratio stands at 98.67%, which indicates the existence of a possible dividend cut in the near future. For this reason, I suggest underweighting this company in your investment portfolio.

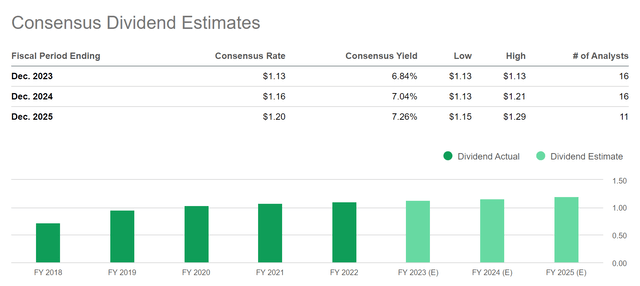

Below you can find the Consensus Dividend Estimates for Kinder Morgan: the Consensus Yield stands at 6.84% for 2023, 7.04% in 2024 and 7.26% in 2025.

The Bank of Nova Scotia

The Bank of Nova Scotia was founded in 1832, and it operates in the following segments:

- Canadian Banking.

- International Banking.

- Global Wealth Management.

- Global Banking and Market.

At the time of writing, I consider the bank's Valuation to be attractive. This is since its P/E [FWD] Ratio of 9.20 lies below its Average from over the past 5 years (10.16). Moreover, it can be highlighted that the bank's Price / Book [FWD] Ratio of 1.11 is 16.13% below its Average over the past 5 years (1.32). I interpret both metrics as being strong evidence that the Canadian bank is undervalued at this moment in time.

At its current price level of $49.26, the bank pays shareholders a Dividend Yield [FWD] of 6.22%. Meanwhile its 5 Year Dividend Growth Rate [CAGR] stands at 4.38%. These numbers serve as indicators that the bank is an excellent choice for investors that seek to combine dividend income with dividend growth.

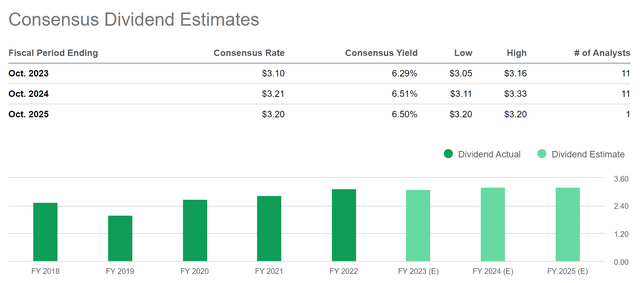

The graphic below illustrates Consensus Dividend Estimates for The Bank of Nova Scotia: Consensus Dividend Estimates are 6.29% for 2023 and 6.51% for 2024, thus suggesting the company is as an excellent fit for dividend income investors aiming to increase their additional income in the form of dividends from year to year.

United Parcel Service

At the company's current price level of $171.34, United Parcel Service pays shareholders a Dividend Yield [FWD] of 3.79%, while its Payout Ratio lies at 51.07%.

I consider the company to be particularly attractive for investors since it has shown significant Dividend Growth within recent years: United Parcel Service's Dividend Growth Rate [CAGR] over the past 10 years stands at 10.19% and its 3 Year Dividend Growth Rate [CAGR] is even higher at 16.81%.

The company's Dividend Yield [FWD] of 3.79% currently lies above the one of competitor FedEx (NYSE:FDX), which provides investors with a Dividend Yield [FWD] of 2.20%.

These metrics have contributed significantly to me selecting United Parcel Service in my list of high dividend yield companies to invest in.

Moreover, I believe that United Parcel Service's Valuation is attractive at this moment of writing: its P/E [FWD] Ratio stands at 15.94, which lies 14.55% below the Sector Median of 18.65 and gives me belief that the company is currently undervalued.

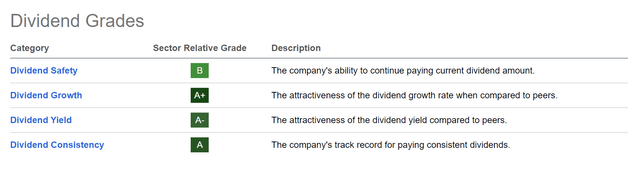

Below you can find the Seeking Alpha Dividend Grades, which underline the company's attractive Dividend: United Parcel Service receives an A+ rating in terms of Dividend Growth, an A for Dividend Consistency and an A- for Dividend Yield. For Dividend Safety, the company gets a B rating.

U.S. Bancorp

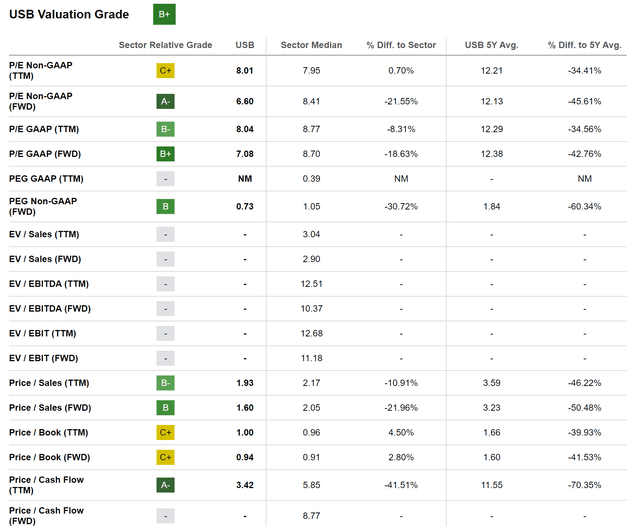

When considering the past 12-month period, the stock price of U.S. Bancorp has been down 39.63%. Due to its decreasing stock price, it currently has a P/E [FWD] Ratio of only 7.08. Its current P/E [FWD] Ratio stands 42.76% below its Average over the past 5 years and 18.63% below the Sector Median. All of this points towards the fact that the company is undervalued.

Below you can find the Seeking Alpha Valuation Grades for U.S. Bancorp, which underline my investment thesis that the U.S. bank is currently undervalued.

Moreover, I would like to highlight that the bank's current Dividend Yield [FWD] stands at 6.38%. For this reason, I believe the company could help you to increase the Weighted Average Dividend Yield of your investment portfolio while, providing it with Dividend Growth.

My thesis, that the bank is on track in terms of Growth can be shown by the fact that its Revenue Growth Rate [FWD] of 8.74% is above the one of competitors such as Bank of America (NYSE:BAC) (Revenue Growth Rate [FWD] of 2.20%), JPMorgan (NYSE:JPM) (5.70%), or Citigroup (NYSE:C) (3.04%).

Verizon Communications

Since the beginning of 2023, the stock price of Verizon has declined by 10.04%. Considering the past 12-month period, Verizon's stock price decline has been even higher: it has shown a negative Total Return of -26.46% within this time period.

Today, Verizon has a P/E [FWD] Ratio of 7.84. Since the company's P/E [FWD] Ratio of 7.84 stands 29.70% below its Average from over the past 5 years and 59.73% below the Sector Median, I believe that it's undervalued. For these reasons, I consider the company to be particularly attractive for dividend income investors.

At Verizon's current stock price of $36.13, it pays shareholders a Dividend Yield [FWD] of 7.24%

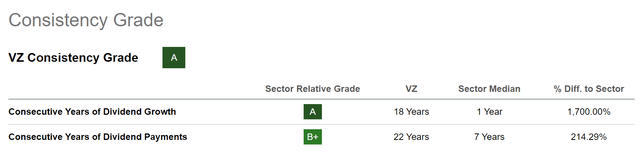

In addition to the above, I would like to highlight that Verizon has shown 22 years of dividend payments and 18 years of dividend growth, indicating that including the company in an investment portfolio would not only be attractive for dividend income investors but also for those seeking dividend growth.

Conclusion

I consider the inclusion of high dividend yield companies to be important for any investment portfolio. Doing so can help you earn an additional extra income via dividends from today onwards, while at the same time helping you to become more independent from price fluctuations of the stock market.

The 10 companies which I have selected and presented in today's article, have an Average Dividend Yield [FWD] of 6.56%. In addition to that, they have shown an Average Dividend Growth Rate [CAGR] of 7.02% over the past 5 years.

These metrics raise my confidence that the selected companies will not only provide you with an attractive dividend income for today, but that they can also increase this amount from year to year.

Moreover, I would like to highlight that I consider the Valuation of these picks to be attractive: the reason for this is their Average P/E [FWD] Ratio of 10.22. I consider each of the selected companies to be at least fairly valued at this moment in time.

Author's Note: I would love to hear your opinion on my selection of high dividend yield companies to buy in June 2023. Do you already own or plan to acquire any of the picks? Which are currently your favorite high dividend yield companies?

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, JPM, ALIZF, MO, T, VZ, PM, BTI, JNJ, PFE, MRK, USB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.