Snowflake Earnings: The Importance Of Customer Adoption

Summary

- Snowflake put out a mixed report. There are some positive and negative aspects.

- Snowflake's value proposition lies in its architecture that separates compute and storage, allowing customers to scale resources independently.

- Snowflake's prospects are not aligned with investors' expectations.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

Povareshka/iStock via Getty Images

Investment Thesis

Snowflake's (NYSE:SNOW) guidance didn't live up to investors' expectations. As I had stated previously, its customer adoption growth rates are the key to this investment thesis.

Investors are more than willing to pay up for a fast-growing company, with a compelling narrative, particularly if the fundamentals are moving in the right direction.

But when an expensive stock has the fundamentals moving in the wrong direction, this can leave the stock too exposed to a share price correction.

Snowflake's Near-Term Prospects

Snowflake data platform provides data warehousing and data sharing solutions. Snowflake allows customers to store and analyze large amounts of structured and semi-structured data.

In simple terms, structured data is data that is in neat regular inputs, such as a spreadsheet, while semi-structured is more open and always on. Think of semi-structured data as a web page that may contain tags and links.

Its value proposition lies in its architecture, which separates compute and storage. This allows customers to scale their computing resources independently from their data storage requirements.

In my prior article, titled Snowflake: Not at One With Customers, I said,

I have consistently argued that consumption-based revenue streams cause more problems than they solve. Here's the rationale, you want customers to use more of your products. Not to be left with a bill when they find themselves engaging with your platform.

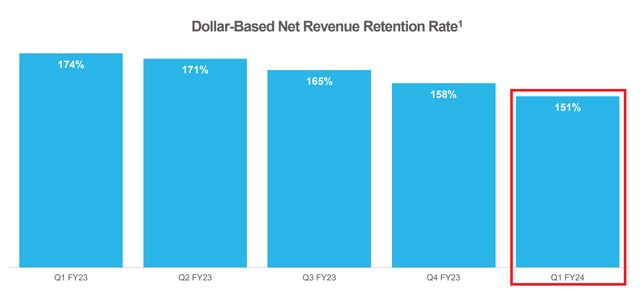

Snowflake prides itself on its extremely high net retention rates, but I believe that the trend above speaks for itself. Customers are pushing back against their high bills.

With this context in mind, I now highlight the following updated trend.

Above we see that customers are unwilling to be left with too high a bill for simply using Snowflake's platform. Indeed, that is the key problem with Snowflake's business model.

The consumption business model is not congruent with customers' plans.

Allow me to put forward an example. Let's say, for example, that Netflix (NFLX) charged you per video watched, do you think that Netflix would be as valuable? You should set up your business to maximize consumption.

In fact, there was a pay-per-video offering by another entertainment company with a blue logo. And that didn't end well for that company.

Along these lines, consider the following perspective:

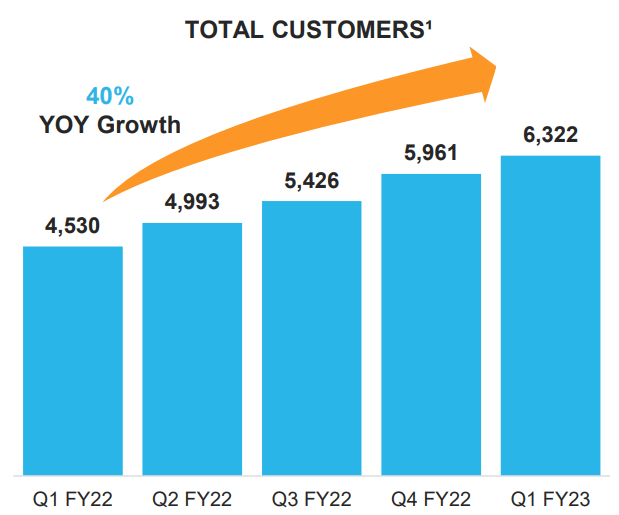

SNOW fiscal Q1 2023

As of fiscal Q1 2023, Snowflake's customer growth was 40% y/y. And now?

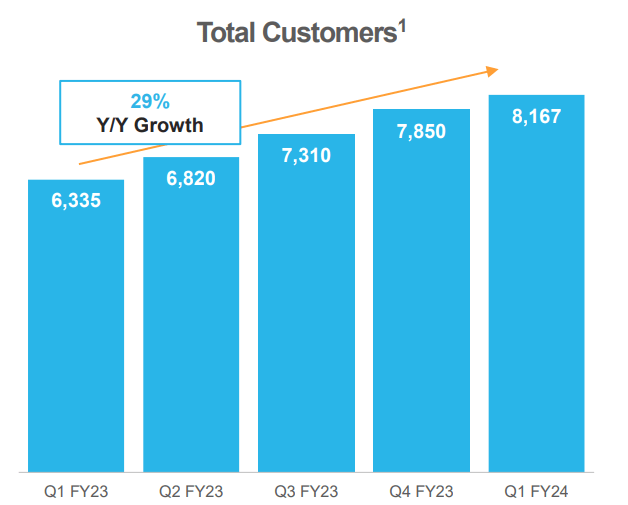

SNOW fiscal Q1 2023

The trend here is evident. Nobody is disputing data demand isn't rapidly increasing. Furthermore, nobody argues that there is not massive demand for large language models and data. The only point of contention is whether Snowflake is going to retain enough market share in this space?

Revenue Growth Rates Slow Down, Macro Continues to Weigh

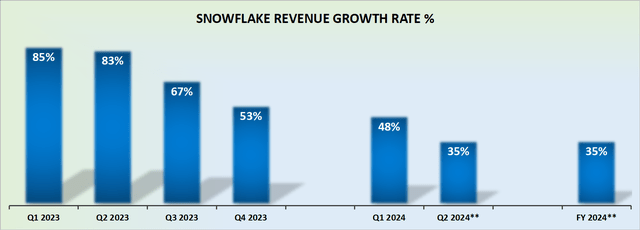

Snowflake's guidance points to around sub-40% growth rates for fiscal Q2 2024. This implies that on a y/y basis, Snowflake's run rate has been cut in half.

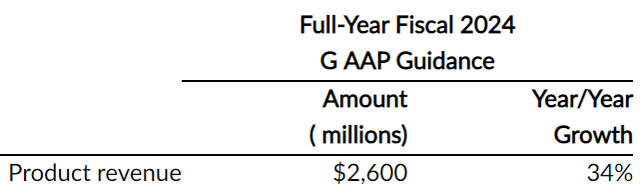

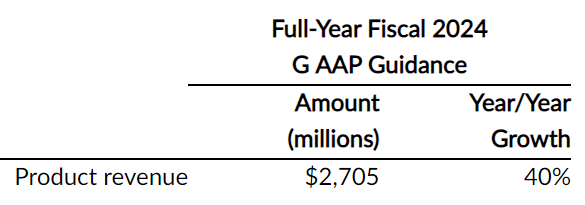

Looking out to full-year fiscal 2024, consider Snowflake's guidance that it offered together with its fiscal Q4 2023 results:

SNOW Q4 2023

At the time of the prior quarter, Snowflake was guiding for its product revenues to be up 40% y/y. And investors were hoping to be positively surprised.

Instead, consider now what's Snowflake's newly updated product revenue guidance.

Snowflake now guides for 34% y/y product revenue guidance.

Profitability Profile in Focus

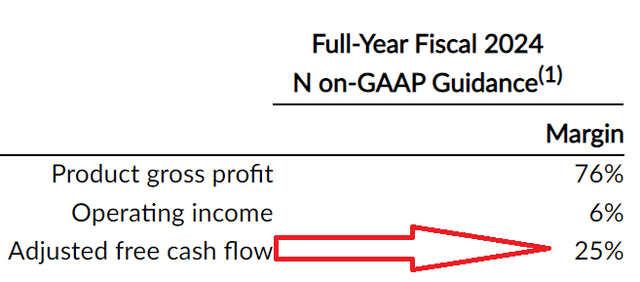

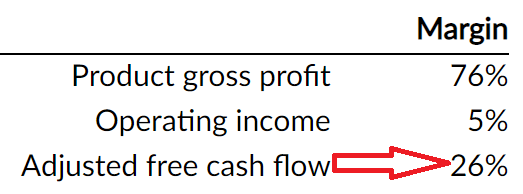

That being said, one area where Snowflake is making positive strides is in its profitability profile.

What we see here is that Snowflake's guidance last quarter pointed to 25% adjusted free cash flow margins. And this figure has now increased to 26% free cash flow margins.

SNOW fiscal Q1 2024

The Bottom Line

Snowflake's guidance fell short of investor expectations, and the growth rates of its customer adoption are crucial to the investment thesis. However, the company's expensive stock combined with negative fundamental trends could leave it vulnerable to further share price correction.

Despite positive strides in profitability, Snowflake's revenue growth rates have slowed down, and its consumption-based business model faces challenges as customers push back against high bills.

I continue to recommend that investors avoid this stock.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.