Federal Signal Corporation: Great Performance Does Not Translate To A Great Opportunity

Summary

- Federal Signal Corporation has seen impressive financial performance and increased guidance recently.

- These improvements do not, however, mean that the company makes for a compelling prospect right now.

- Even with improved financial performance and a strong backlog, shares look more or less fairly valued right now.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Stephen Barnes

I don't think anybody will disagree with me when I say that these are difficult and uncertain times. But one company that is cleaning up well in this environment is Federal Signal Corporation (NYSE:FSS). The phrase 'cleaning up' serves as a bit of word play because the company focuses largely on the production and sale of products like sewer cleaners, industrial vacuum loaders, hydro excavation trucks, street sweepers, and more. Recently, financial performance achieved by management has been very impressive. Not only has the company done well so far, the firm has also increased its guidance because of strong demand for its offerings. This is fantastic to see, but it doesn't necessarily mean that shares of the company make sense to buy into. Although the company has outperformed the broader market in recent months, shares do look to be more or less fairly valued at this moment. So because of this, I would argue that the business makes for a solid 'hold' candidate as opposed to something more bullish.

Cleaning up your portfolio

This is not my first time discussing whether or not now might be the moment for investors to buy shares of Federal Signal. Back in January of this year, for instance, I wrote an article that took a rather neutral stance on the enterprise. In that article, I talked about how the company had a fairly solid operating history, even in spite of some volatility that it had to deal with. I expressed my view that, in the long run, the business would likely do well for itself and its shareholders. But because of how shares were priced, I felt as though upside was limited to something more or less in line with what the broader market would experience. This led me to rate the business a 'hold' instead of something more bullish. Since then, shares have outperformed the market, but only slightly, climbing by 5.8%. By comparison, the S&P 500 is up 3.7%.

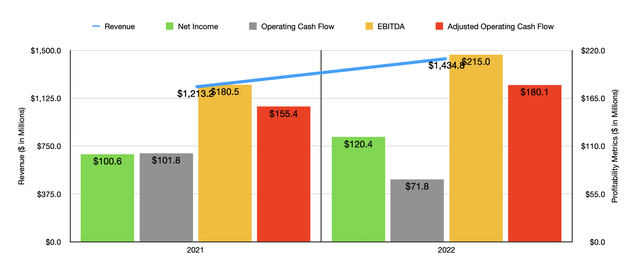

Even though shares of the company looked fairly valued at the time, I would argue that this upside was probably warranted. For starters, the company ended the 2022 fiscal year on a high note. Overall revenue came in at $1.43 billion. That's up significantly from the $1.21 billion generated in 2021. This increase, according to management, totaling about 18%, was driven by multiple factors. But the primary driver of the upside was strong demand. In fact, results would have been more impressive had it not been for foreign currency fluctuations. In all, these impacted sales negatively by roughly $12 million.

On the bottom line, the picture for the company also improved year over year. Net income, for instance, shot up from $100.6 million to $120.4 million. Operating cash flow managed to drop from $101.8 million to $71.8 million. But if we adjust for changes in working capital, we would have gotten an increase from $155.4 million to $180.1 million. Meanwhile, EBITDA for the company expanded from $180.5 million to $215 million.

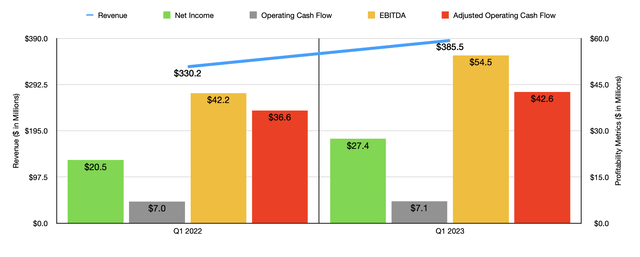

The 2022 fiscal year was not a one-time thing. Strength for the company has continued into the 2023 fiscal year as well. Revenue of $385.5 million generated in the first quarter of the year came in significantly above the $330.2 million reported the same time one year earlier. This allowed profitability to increase as well. Net income, for instance, grew from $20.5 million to $27.4 million. Operating cash flow inched up from $7 million to $7.1 million. As you can see in the chart above, the other profitability metrics for the company also improved, with adjusted operating cash flow growing from $36.6 million to $42.6 million, while EBITDA managed to climb from $42.2 million to $54.5 million.

Given just how strong the company performed during the first quarter, management was able to confidently raise guidance for the 2023 fiscal year as a whole. They now think that revenue should come in at between $1.62 billion and $1.72 billion. The lower end of this range is now $40 million above what it was with prior guidance. Meanwhile, earnings per share should now come in at between $2.21 and $2.43. That compares favorably to the prior expected range of between $2.15 and $2.40. At the midpoint, this would imply net income for shareholders of $142.2 million. Unfortunately, management did not provide any guidance when it came to other profitability metrics. But if we assume that they will increase at the same rate that earnings should, then we should anticipate adjusted operating cash flow of $212.7 million and EBITDA of roughly $253.9 million.

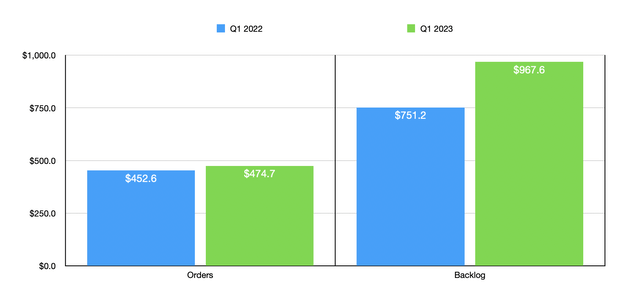

For those worried about current economic conditions, I understand. Having said that, management is not flying blind when it comes to this guidance. The company actually has seen a significant increase in its backlog in recent quarters. Strong orders of $474.7 million in the first quarter of 2023, up from the $452.6 million reported one year earlier, helped to lift backlog at the end of the most recent quarter to $967.6 million. This represents an increase of 28.8% over the $751.2 million reported one year earlier. It's also a nice increase over the $879.2 million that the company reported in backlog at the end of 2022. These backlog figures should be seen as leading indicators that help to fuel future financial results. Sort of see the metrics increase so much should be considered bullish.

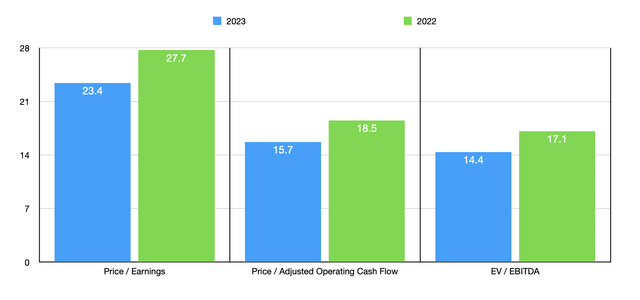

Taking the numbers that I calculated for 2023, we can easily value the company. The end result, using not only 2023 estimates, but also 2022 numbers, can be seen in the chart above. And as part of my analysis, I also compared the company to five similar firms. This can be seen in the table below. On a price to earnings basis, four of the five companies were cheaper than Federal Signal. When it comes to the price to operating cash flow approach, three of them were cheaper. However, using the EV to EBITDA approach, we end up with Federal Signal as the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Federal Signal Corporation | 23.4 | 15.7 | 14.4 |

| Terex (TEX) | 9.1 | 10.3 | 7.1 |

| Trinity Industries (TRN) | 27.7 | 27.3 | 12.1 |

| Allison Transmission Holdings (ALSN) | 8.0 | 6.6 | 6.9 |

| Alamo Group (ALG) | 18.3 | 30.3 | 11.1 |

| Manitowoc (MTW) | 19.1 | 6.2 | 6.2 |

Takeaway

From a purely fundamental perspective, Federal Signal is doing really well for itself. It's fantastic to see strong results and management confidently increased guidance for the year. Strong backlog, driven by robust orders, indicate that the near-term outlook from a revenue and profit perspective is likely very positive. But this doesn't necessarily mean that investors should be clamoring to pick up stock in the firm. Relative to similar firms, shares are a bit pricey. And I would argue that, on an absolute basis, the stock looks more or less fairly valued at this time. So because of this, I have no problem keeping the company rated a 'hold' for now.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.