PENN Entertainment: Blitzed By Mr. Market Despite Mostly Solid Performance

Summary

- Our bull case on PENN Entertainment, Inc. guided an upside to $50. The stock has tanked since. Here's our best theory why.

- PENN Entertainment is among the most solid U.S. regional casino operators with strong management, a good balance sheet, and sunny post-covid prospects.

- A single act of a tone-deaf host on Barstool should not be enough to tank a stock $5 overnight.

- I do much more than just articles at The House Edge: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

gradyreese/iStock via Getty Images

The stock market's traditional price discovery value has been battered to death by irrational players at institutions as well as among retail players. It has become an ugly fact of life in today's investing scenario. We thought we'd had our fill of insanity over the Robinhood Markets, Inc. (HOOD) GameStop Corp. (GME) nuttiness, but we didn't. Case after case since then has proven beyond comprehension of rational players that a knee-jerk mentality has broken a hole in the dike of patience and common sense and has flooded the landscape of investor minds.

The shares of PENN Entertainment, Inc. (NASDAQ:PENN) come to mind

It's not merely the scared retail rabbits among us with zero patience. It also inhibits the precincts of hedge funds where one would assume more educated minds preside over buy, sell or hold decisions. The colossal mispricing of PENN Entertainment, Inc. stock, including my own expectations, bears examination.

Regardless of many positive numbers in Penn's recent 1Q23 earnings release, the stock, which began to erode late last year, has tanked another 10%. I have been a strong fan of PENN stock, as I have pointed out over many SA articles. In fact, in my last call on March 20, I put a price target ("PT") of $50 on the stock. The Penn price at writing is $29. My take, evidently way wrong.

WSW

Above: Forward flat scenario logical in a way but does not square with the upside the sector will see assuming there is no deep recession ahead.

It was based on my inside-the-industry view. Having been part of top management in the industry for decades, having known many of the key people who run Penn, and having an outlook about recovery of the U.S. regional casino space, I saw real value ignored by Mr. Market. That evoked even more enthusiasm in my mind for the stock. I even considered raising my guidance above $50 before I settled for that PT.

So, the question that settled into my mind was what headwinds did I not see, that others did? Perhaps I should have recalculated the valuation based on facts I had bypassed. I made a case that literally was a loser from day one. Apologies.

Readers may consider my overall batting average despite this three-strike, big-time whiff. I'm not here with a wheelbarrow of excuses. A bad call is part of the game. But, here's my batting average according to Tip Ranks:

Success rate: 60.69%

Average return: 22.90%.

Global rank among financial bloggers/analysts: 424 out of 24,866.

Unlike some baseball commenters, I'm not trying to use the "injury list" as an excuse for a whiff on Penn. Tip Ranks ratings aren't universally seen as a gold standard. Yet they are, in general, providers of pretty good weightings over time. Your call as to whether you deem them relative or not. The point is, a whiff is a whiff, period.

I'm not running and hiding from what clearly was a strikeout on Penn. I own it, not everyone does. So, let's move ahead and examine what I may have missed, or equally so, what Mr. Market is still missing, in the valuation of PENN shares at the current screaming buy price.

Looming recession? Sure, add to that the scary prospect that begins to look like the dug-in positions on the debt deal between the House and the clueless denizens of the Oval Office are nearing the cliff's edge. Also, bake in the perception that the early post-covid pent up regional casino demand may have shot its load and revenue gains are cooling down. Penn is the biggest player in the space without a big-time Vegas presence.

Penn's 43 properties are sprinkled in what is the best geographical footprint in its category - minus Las Vegas. Its 1Q23 results, if anything, should have looked positive both to holders and potential investors. Revenue was up 7%y/y to $1.67b. Adjusted EBITDA $483m a 23.5% y/y decline largely due to a rebalanced revenue feed, as increases from Northeast segment were offset by declines in the Southern properties.

The net revenue gain shift was a function of higher tax rates in Northeastern properties vs. flatter performance in lower gaming tax areas of the South. That, plus a litigation settlement, were the principal culprits in lower-than-consensus performance. Overall analyst's reaction to the 1Q23 performance had a bit of a bearish tone, which clearly might have triggered some selloff sentiment that has yet to recover.

Then there are the funny joker, but dead serious, impacts of incidents that send lightning bolts of fear in corporate board rooms, fears that have little or no impact in the grand scheme of what may cause massive customer departures.

Penn had one such incident early this month. A host of its Barstool Sports division thought rapping of lyrics that contained clearly objectionable words was funny. The reaction was instant and he was fired. But Barstool's PR team statement was a logical, take us for what we are, warts and all. Penn Founder Dave Portnoy, of course, did not approve the miscue, but held that Barstool's business was what it was - its audience gets it.

The brouhaha clearly contributed to much negative sentiment that continued to hit the stock and still does. And that is indisputable truth that a scared rabbit mentality knee-jerks corporations these days - unrelated to its real world results. The rapping incident revealed a case of bad judgment, without question. But for it to contribute to be a big-time bearish outlook on the shares exceeds to the edge of insanity.

Penn knew when it paid $501m for Barstool that its head guy in Dave Portnoy was both a media genius without parallel in his field, as well as a periodic loose cannon. He has 20 months to go on his contract, and there is some feeling around the business that he could decide to take a hike and spend his time cutting those wonderful coupons on his cash-out $100m.

The day the rapper fiasco came public, Penn shares traded at $30.35. The aftermath took PENN stock down $5.15 within 24 hours. That reveals how vulnerable market valuations can be in a world of knee-jerkism. Nobody approves of bad taste - let's stipulate that. It was an expression of tone-deafness by the Barstool host. But what is far more disturbing to serious holders of Penn shares is the biting of nails and tremors of corporate PR department that can shake loose a $5 hit to a stock on what amounts to a single few words of bad taste.

Here's a bet: Guess how many Penn casino patrons and sports bettors expressed their distaste at the remark and cancelled their loyalty cards? Out of 22,000, my guess nobody. My guess, too, that almost no one cared one way or another how Penn reacted to the tone-deaf rapper. By the way, Penn reported that during 1Q23, the company added 350,000 new loyalty members. My guess is that process will continue to grow because Penn's revenue growth has two engines.

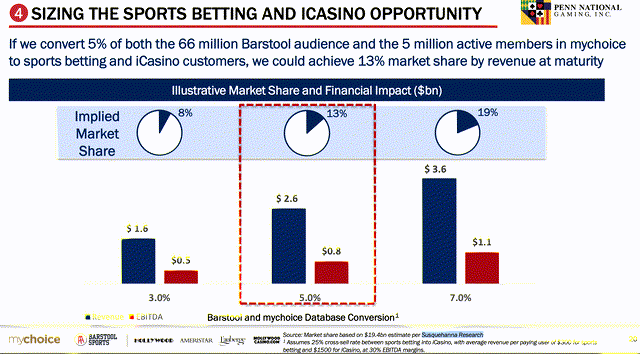

First, the post-covid return of valued, older demos in the slot business. Second, in the rapidly growing contribution of millennials to the database through the Barstool Sports portal. The slick loose cannon style of Barstool Sports is part of its DNA. It is part of why its sports betting business has reached near $275m for the quarter, showing a small loss in comparison to other third tier peers. Barstool Sports is positioned to go profitable in our view by 3Q23.

In my opinion, 1Q23 results were not so draconian as to evoke the degree of bearish outlook on PENN shares, certainly not enough to disappoint analysts to the degree that it may have.

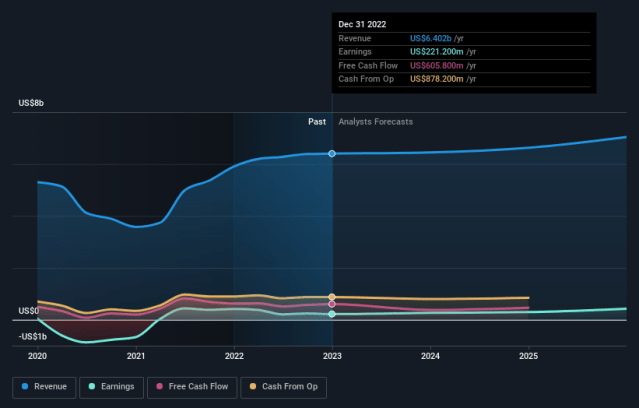

However, management is guiding revenues for the year at $6.81b with a neutral EBITDAR, guiding at $1.875b to $2b. Penn has repurchased 50m shares at an average price of $30.36.

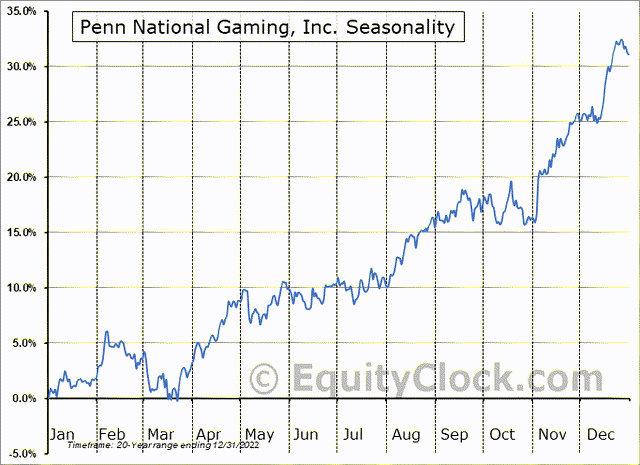

Above: Historically, revenue levels are just beginning to move into peak season in most of Penn's geographic footprint areas.

The hedgies may have played a role as a meaty buy-hold-sell strategy over a short term. It is part of the DNA of many.

The composition of holders of Penn shares indicate that 8 institutions hold 52% of the outstanding, among them lots of hedge funds. So, what we have seen here could have gathered bearish steam from hedgies who looked at the stock seeing value but beginning to run for the exits all at once when their estimates of earnings growth - like mine-- proved wrong.

Of Penn's institutional holders, 11% are hedge funds. And intermediate round trip strategies are common. The shares have had a long-time margin of safety in my view because its balance sheet has been a plus.

Short interest today sits at 15,197,460 average shares, the highest it has been in about one year. I believe this is a reflection of strategy more than pure disappointment in 1Q23 earnings results. The shares had traded at a high of $37 attained last August. Short interest then was 8,600,000 shares. So, short positions on the stock have since doubled at the same time as overall operating results have shown strong post-covid recovery. And add to that a growing rosier picture in digital both with Barstool Sports as well as Penn's acquisition of Ontario-based sports betting site theScore.com.

We have looked at discounted cash flow ("DCF") value according to several formulae we consult in the process of arriving at our own to sensitivity test our estimates going forward.

DCF value: $48.88 per share, indicating PENN is undervalued by 76%.

Alpha Spread indicates an intrinsic value of $59.85, just above our March call PT of $50.

Our own formula concludes the value at the same $50 we guided back March, which falls in between the two noted above by other sites.

Conclusion

I think what we see and I apparently did not see, or at least consider, was the possibility that PENN Entertainment, Inc. shares represented what hedge funders considered a pretty safe hedged short position in the stock of Penn, with a good margin of safety. Retail investors who you would think have seen the bull case for the stock based on real-world fundamentals would have moved into the stock - not on my say-so - but based on 8 facts about the company:

- The biggest, most solid national gaming operator in the space without a Vegas footprint per se.

- A casino operator with a smart strategy using sports betting to grow its casino data base among younger demos.

- The clear return in large numbers of foundational older demo slot players across its entire 43 property portfolio.

- A solid balance sheet.

- Nearing profitability as a third-tier sports betting operator.

- An innovative touch-free service policy on the property.

- A savvy management that has proven it can generate a strong operating margin over time. Cash on hand: $1.31b Long-term debt: $11.66b. (This is clearly a factor in some of the bearish outlook, but it does not suggest anything close to a problem, long-term.)

- Current ratio: 1.38 falls within a comfortable zone to earn what we believe is a good margin of safety for the stock going forward to the balance of this year and next.

I'm sure there are PENN factors that can be cited to offset these eight positives as there are in all stocks. I'm not just being stubborn by not dropping my guidance because I believe in PENN Entertainment, Inc. and its future. So what I see is the same set of macro headwind threats facing the entire market if a debt deal fails, or more specifically, if we get a big-time recession, as some believe.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

MY INVESTMENT STRATEGY: Due to the necessities of my casino consulting business which encompasses many top gaming companies, I have placed my own gaming portfolio into a blind trust over ten years ago. At that time I instructed my money manager(who is a former industry colleague herself as well as a corporate lawyer and money manager) to follow my gaming investment strategy along these lines.

1. I am a value investor first. Knowing the industry in depth I am able to plumb opportunities and problems others cannot see. Mostly I like to identify price ranges over given periods where I believe the market is asleep and I can buy in at the lowest possible risk. 2. I am a strong believer in management quality. Knowing so many top people in the industry allows me to evaluate which ones I believe have the "right stuff" to move a stock and which are populated by corporate drones. 3. I have instructed my manager never to trade on sugar high spikes in earnings or news per se but use the "string theory" I have developed which in brief, follows a skein of news and earnings releases over set periods of time for each stock and then move in or out. 4. I have instructed her to keep the portfolio diverse with holdings in four basic areas: Casino stocks in Las Vegas, Macau and the regionals, gaming tech stocks with real moats not just cute apps.

I am pleased to announce that as of September 1, 2022 I am expanding my coverage to include entertainment stocks, a sector undergoing a massive revolution on many fronts. This has sprung loose many investment ideas in the space I expect to share with members. The coverage is added at no extra cost.

I have been involved in the entertainment sector as well for decades involved in overseeing show and events in my properties as well as independent productions. I currently sit on the board of privately held Atlas Media Corporation, one of America;s premium non-fiction producers of tv and film programming.

Overall I have done immensely well and share my views with SA readers and more specifically with strong recommendations and gaming stock strategy analysis based on my network of industry contacts for subscribers to my SA Premium Site: THE HOUSE EDGE.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.