Alibaba: Beijing Goes All In

Summary

- Thanks to the upcoming spin-offs of its businesses, Alibaba Group Holding Limited’s shares could rally in the short term.

- Despite this, there are reasons to believe that they remain uninvestable for long-term investors who were planning to hold the company’s shares in their portfolios for the next few years.

- This is because the structural inefficiencies of the Chinese economy along with the further Sino-American confrontation are likely to put additional pressure on Alibaba’s stock once the spinoffs are completed.

- Looking for a helping hand in the market? Members of BlackSquare Capital get exclusive ideas and guidance to navigate any climate. Learn More »

Kevin Frayer/Getty Images News

In recent months, Beijing has been actively implementing measures to revive the Chinese economy after the momentum from the reopening faded away. At the same time, it has also been retaliating against American restrictions that led to the rise of geopolitical risks which resulted in a record capital outflow from the mainland. All of this has had a direct impact on Alibaba Group Holding Limited (NYSE:BABA) and its shares, which have failed to pick up momentum after the company reported decent fiscal Q4 earnings results and gave more clarity on how the upcoming spinoffs of its divisions have the potential to unlock value in the following quarters.

Therefore, as investors are wondering what to do next, this article will highlight Alibaba's latest developments, explain why its shares could rally in the short-term but remain uninvestable in my view over the long term, and outline how the company has become another casualty of the greater Sino-American confrontation.

Alibaba's Quest To Unlock Value Has Begun

Last week Alibaba reported earnings results for the fourth fiscal quarter that ended in March. During the quarter, the company managed to generate $30.32 billion in revenue, which is above the street consensus by $410 million. Its non-GAAP EPADS of $1.56 was also above the estimates by $0.21. Despite those results, Alibaba's stock failed to gain momentum and has been depreciating in the last few days.

This is likely because of the fact that its core commerce business, which accounts for 65% of total sales, failed to grow as its revenues in Q4 were down 3% Y/Y, while the revenues from its promising cloud business which accounts for 9% of total sales were down 2% Y/Y as well. On top of that, due to Beijing's crackdown against Ant Group in the past, Alibaba's profits from its stake in the financial firm have been constantly declining and were down over 50% Y/Y in Q4.

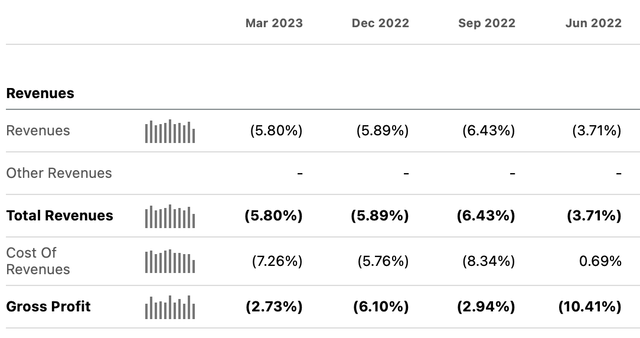

What's worse is that if we take into account the currency fluctuations and Beijing's policy of devaluating the yuan to stimulate the growth of its export-oriented economy, then we'll see that Alibaba's total revenues in Q4 were actually down Y/Y in dollar terms. If in Q4'22 Alibaba generated $32.19 billion in revenues, then in Q4'23 its total revenues of $30.32 billion were down over 5% Y/Y in dollar terms. The same is true for all the other recent quarters, during which Alibaba's revenues and gross profits were up Y/Y in RMB thanks to the improvement of the overall Chinese economy but were down Y/Y in USD.

Alibaba's Revenues and Profits (Seeking Alpha)

Due to the currency devaluation and Beijing's constant interference in Alibaba's affairs, it became nearly impossible for the Chinese tech giant to generate meaningful returns for its shareholders in recent years. So, its stock has been significantly underperforming against the S&P 500 Index (SP500) since 2021.

Alibaba's Stock Performance Against S&P 500 (Seeking Alpha)

To fix this issue and unlock the value of its business in this new environment full of domestic and foreign risks, Alibaba's management along with its founder Jack Ma recently made peace with Beijing and finally gave us more clarity on how the company will spin off its various divisions during the recent earnings call.

We now know for a fact that Alibaba will hold full control of its current domestic commerce business which accounts for the majority of the company's sales, while its Cainiao logistics business will go through the IPO process in the next 12 to 18 months and is expected to raise up to $2 billion on the Hong Kong stock exchange. At the same time, Alibaba's retail grocery arm Freshippo will also execute its own IPO on the Hong Kong stock exchange in the next 6 to 12 months. In addition to that, Alibaba will also fully spin off its cloud business which is expected to become a standalone public company in the next 12 months and will likely eye a listing on the Hong Kong stock exchanges as well due to regulatory and geopolitical reasons.

All of those moves without a doubt are aimed at immediately unlocking the value of various parts of Alibaba's business, since it's unlikely that the company would be able to outperform its Western peers in the current era of heightened geopolitical risks.

As such, it would be safe to assume that Alibaba's shares have a decent upside at the current levels in the short term, since the positive effects from the spinoff would likely outweigh the geopolitical risk premium and the company's mixed performance in recent quarters.

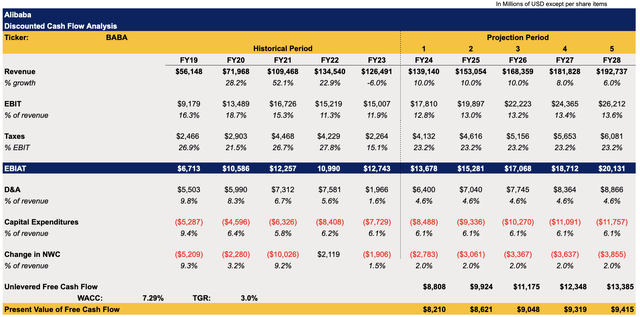

My latest discounted cash flow ("DCF") model on Alibaba, which was published after the announcement of the company's fiscal Q3 earnings results in February, already showed that the business's fair value is $124.10 per share, significantly above the current market price. To figure out whether the upside remains the same, I've decided to update my model and include the FY23 numbers that were reported last week. At the same time, the growth assumptions remained mostly unchanged for other periods as there's a possibility that Alibaba would be able to improve its Y/Y performance in the following months due to the fact that its business won't be negatively affected by the lockdowns, as was the case last year.

Alibaba's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

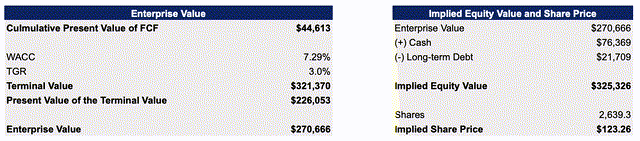

The updated model shows that Alibaba's fair value is $123.26 per share, which is close to the previous calculations and represents an upside of ~50% from the current market price.

Alibaba's DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

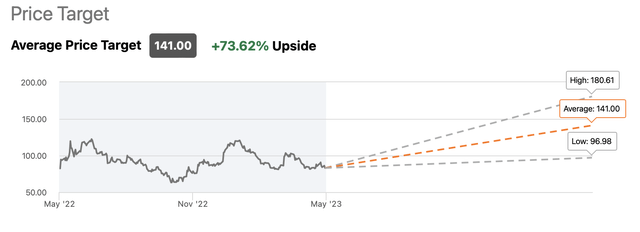

Considering this, it's safe to assume that Alibaba is greatly undervalued at the current levels since the street also believes that its shares have more room for growth. However, as I've indicated in my latest articles on the company, Alibaba has been undervalued for years, and that didn't stop its shares from further depreciating and reaching new lows due to Beijing's constant interference in its affairs.

While the upcoming spinoff has all the chances to change the situation and help Alibaba's shares to appreciate in the short term, especially since it appears that Beijing also supports the company's latest moves to unlock value, there are still concerns about the company's ability to outperform and exceed expectations in the long run.

Alibaba's Consensus Price Target (Seeking Alpha)

The Bigger Picture

It's impossible to analyze Alibaba and decide whether to invest in it for the long term without understanding what's currently happening in China. The reality is that the reopening of the Chinese economy that happened at the beginning of this year is already losing momentum and has all the chances to slow down the recovery of Alibaba's core commerce business.

The latest data for April shows that despite all the stimulus by the government and its central bank in the past, the industrial output and retail sales growth in China have undershot expectations, while the youth jobless rate reached another record. At the same time, there's also a risk of an impending debt crisis within the country as some municipalities already struggle to repay their debt on time.

What's worse is that in addition to the weakened consumer sentiment, China is also currently experiencing a record outflow of foreign capital mostly due to the rise of geopolitical risks, which among other things have resulted in the loss of nearly all gains since the beginning of this year in Chinese equities.

Considering this, an IPO of major tech businesses that are currently part of Alibaba, JD.com, Inc. (JD), and others on the Hong Kong stock exchange is one of the ways to attract new investors and prevent a further outflow of capital. Hong Kong itself has been under the de-facto control of Beijing since 2019, and the integration of the financial markets of the administrative region with the mainland in recent years indicates that further integration of their economic and governing systems is only a matter of time.

The Wall Street Journal, which was one of the first to report the main reason behind Xi Jinping's crackdown against Alibaba in 2020, published an article shortly after the news of the upcoming spinoffs was announced on how the upcoming IPOs could give a jolt of confidence to a Hong Kong market. The upcoming IPOs could also stop a capital outflow from Hong Kong as well and help its monetary authority defend the dollar peg with the new inflows. This would prop HKMA's reserves after they were aggressively decreasing due to the constant interventions to keep the currency trading at HK$7.75 to HK$7.85 per U.S. dollar.

In the end, IPOs of businesses that are currently a part of Alibaba and its peers have an opportunity to prevent a capital outflow and give additional time for Beijing to fix the structural inefficiencies of its economy. At the same time, they would make it possible for Alibaba to immediately unlock the value of a significant portion of its business and make everyone involved happy in the short term.

Sino-American Relations Enter a New Phase of Confrontation

Even though there's an upside to Alibaba's shares in the short term, there are still reasons to believe that the company remains uninvestable for the long term. Despite the fact that Beijing has approved Alibaba's spinoffs, the fact that the company won't have even a minority stake in its cloud business in the future has made analysts question whether the state could've forced the management to fully break up its ties with the soon-to-be-formed standalone enterprise. If that's the case, then it would be safe to assume that Beijing could continue to interfere in Alibaba's affairs in the future if it decides that it would be beneficial for the state. This could once again pressure Alibaba's stock and prevent it from further appreciating after the spin-off of euphoria fades. At the same time, the loss of the promising cloud business, which is currently one of the leaders in AI development in China, would make it nearly impossible for Alibaba to benefit from the ever-growing AI market in the future.

In addition to all of that, there's no guarantee that Alibaba, which is focused solely on the commerce business in China, won't be affected by a further Sino-American confrontation as long as its shares continue to trade on American exchanges. There are already talks about the need to implement stricter outbound investment rules into China at a time when PCAOB found irregularities with audits of Chinese businesses that were performed by overseas auditors. Add to all of this the fact that Beijing has been also retaliating in recent months by raiding the offices of American consulting firms, blocking the access of products of American firms to its markets, sponsoring cyber-attacks on the U.S. critical infrastructure, and it becomes obvious that geopolitical risk premium won't go away anytime soon.

Considering that American officials believe that Beijing wants to have the capability to invade Taiwan by 2027, it's highly likely that the era of heightened geopolitical risks is upon us. As such, it's hard to see how Alibaba would be able to avoid becoming a casualty of a greater Sino-American confrontation in the long term even if it would be focused solely on expanding its commerce business.

The Bottom Line

As Sino-American relations deteriorate, Alibaba's management is doing whatever it takes to unlock value and reward its shareholders as quickly as possible to mitigate potential domestic and foreign risks due to the rising geopolitical tensions that have already intensified global economic fragmentation.

While the upcoming spinoffs of its divisions have the potential to push Alibaba's shares higher in the short term, Alibaba Group Holding Limited stock likely remains uninvestable for the long run. This is because the structural inefficiencies of the Chinese economy along with the greater risk of a further Sino-American confrontation will make it harder for investors to generate meaningful returns in the coming years. That's the main reason why I don't hold any stocks of Chinese-based companies in my portfolio anymore despite their fundamental attractiveness, and instead focus solely on finding growth opportunities closer to home.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Brave New World Awaits You

The world is in disarray and it's time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it's worth it for you!

This article was written by

It was there that I started to combine my academic knowledge with a passion for investing to build an all-weather portfolio that could overcome periods of constant economic and political uncertainty. Given the systemic shocks that have been happening to Ukraine in the last decade, I saw firsthand what’s it like to live in an environment where there’s too much unpredictability and no guarantee that your endeavors won’t fail. Despite this, I managed to show strong returns and since 2015 have been sharing some of my ideas here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.