Debt Ceiling Deal... Or No Deal

Summary

- The U.S. is once again coming up against its debt limit and the prospect of a default.

- While consensus expectation is that we’ll see a last-minute deal to avoid breaching the limit, we consider potential market outcomes - from most to least likely scenarios.

- A protracted period of debate or default could begin to damage the standing of the U.S. in global markets.

bauhaus1000

By Joshua Kutin, Head of Asset Allocation, North America; Edward Al-Hussainy, Senior Currency and Rates Analyst, Head of Emerging Market Fixed Income Research

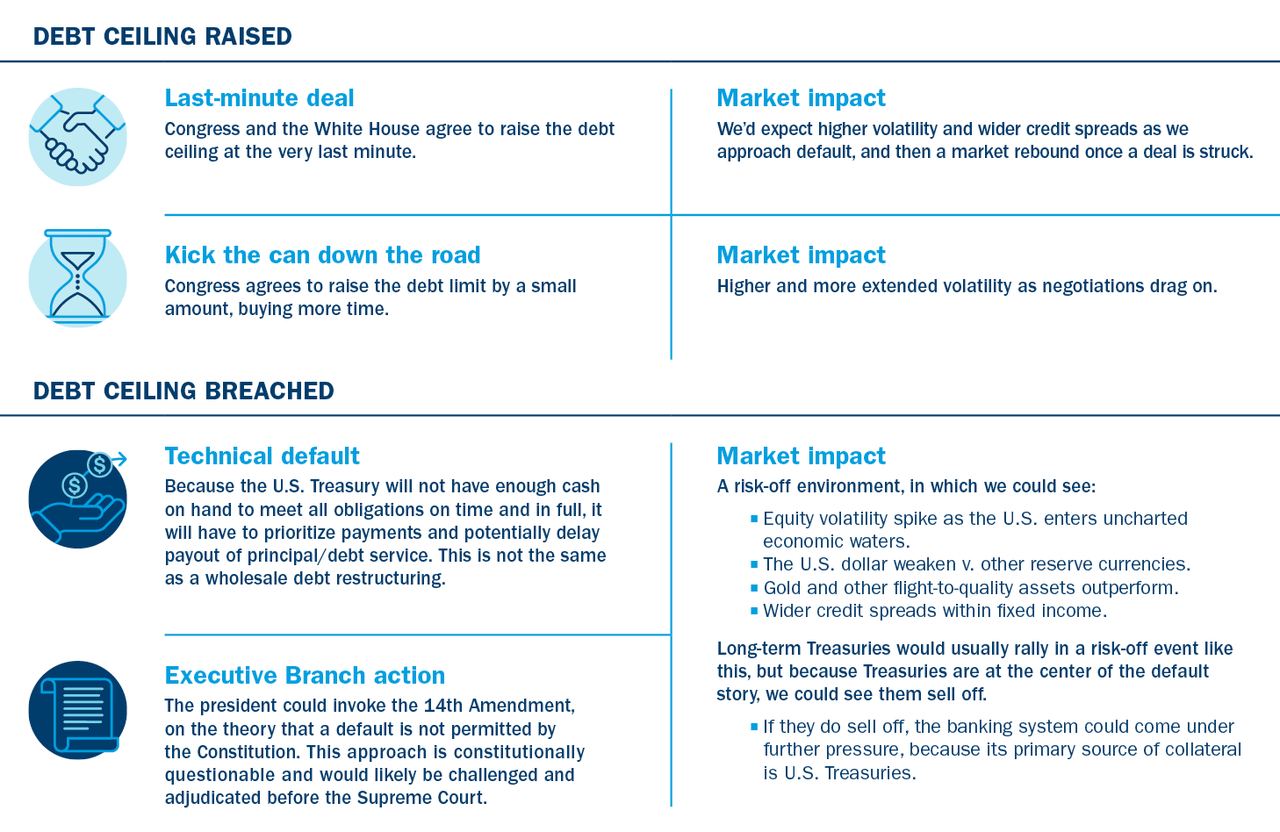

Potential market outcomes — from most to least likely scenarios.

The U.S. is once again coming up against its debt limit and the prospect of a default. While consensus expectation is that we’ll see a last-minute deal to avoid breaching the limit, we consider potential market outcomes — from most to least likely scenarios.

A protracted period of debate or default could begin to damage the standing of the U.S. in global markets, impacting the standing of the U.S. dollar as a reserve currency and the relative appeal of the U.S. versus international equity markets.

There’s also impact for the real economy. In a protracted technical default, the government will need to balance the budget, leading to a cut in spending equal to the size of the deficit (currently 5.3% of GDP*). This would result in a deep recession.

Other creative solutions have been floated, including minting a $1 trillion coin to be deposited at the Fed and then using the proceeds for payments, liquidating non-marketable securities from government pensions, and issuing premium bonds. We believe these are unlikely.

The bottom line

The base case scenario is that an agreement is reached — likely at the last minute — and we still expect higher volatility as rhetoric heats up. In 2011, the rating of U.S. debt was downgraded due to debt ceiling brinkmanship. There could be longer-term implications once again, especially if the rest of the world grows tired of our repeated debt ceiling crises.

*Congressional Budget Office

© 2016-2023 Columbia Management Investment Advisers, LLC. All rights reserved.

Use of products, materials and services available through Columbia Threadneedle Investments may be subject to approval by your home office.

With respect to mutual funds, ETFs and Tri-Continental Corporation, investors should consider the investment objectives, risks, charges and expenses of a fund carefully before investing. To learn more about this and other important information about each fund, download a free prospectus. The prospectus should be read carefully before investing. Investors should consider the investment objectives, risks, charges, and expenses of Columbia Seligman Premium Technology Growth Fund carefully before investing. To obtain the Fund's most recent periodic reports and other regulatory filings, contact your financial advisor or download reports here. These reports and other filings can also be found on the Securities and Exchange Commission's EDGAR Database. You should read these reports and other filings carefully before investing.

The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Management Investment Advisers, LLC (CMIA) associates or affiliates. Actual investments or investment decisions made by CMIA and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor's specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be appropriate for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Since economic and market conditions change frequently, there can be no assurance that the trends described here will continue or that any forecasts are accurate.

Columbia Funds and Columbia Acorn Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA. Columbia Funds are managed by Columbia Management Investment Advisers, LLC and Columbia Acorn Funds are managed by Columbia Wanger Asset Management, LLC, a subsidiary of Columbia Management Investment Advisers, LLC. ETFs are distributed by ALPS Distributors, Inc., member FINRA, an unaffiliated entity.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by