Can Medtronic maintain revenue beat run in Q4?

JHVEPhoto/iStock Editorial via Getty Images

Medtronic (NYSE:MDT) is scheduled to announce Q4 earnings results on Thursday, May 25th, before market open.

The consensus EPS Estimate is $1.55 (+2.0% Y/Y) and the consensus Revenue Estimate is $8.25B (+2.0% Y/Y).

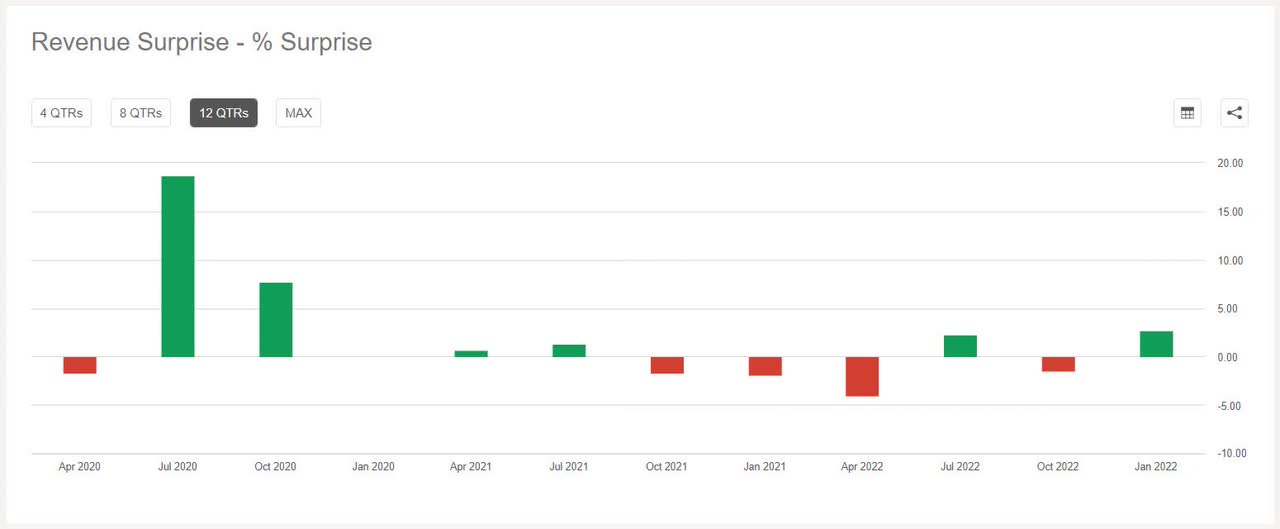

Over the last 2 years, MDT has beaten EPS estimates 88% of the time and has beaten revenue estimates 50% of the time.

Over the last 3 months, EPS estimates have seen 2 upward revisions and 7 downward. Revenue estimates have seen 19 upward revisions and 0 downward.

The medical device maker's stock was largely flat (+0.81%) on Feb. 21 after Q3 results beat estimates. The company had also tightened its full year EPS guidance.

M&A chatter:

Earlier this month, Shockwave Medical ticked higher after the cardiovascular device maker was said be seeing takeover interest from Johnson & Johnson and Medtronic, according to a report.

Medtronic, reportedly in March, itself was seeking $8B to $9B from the potential sale of two medical technology units, with interested parties being ICU Medical and GE Healthcare. The month also saw UBS assume its coverage on MDT, downgrading the stock to Sell from Buy citing risks to sales and EPS numbers for FY24 and FY25.

Approvals and Regulatory News:

In April, the U.S. FDA approved Medtronic's MiniMed 780G insulin pump system. Wells Fargo had upgraded MDT, a few days after the device approval, to overweight from underweight citing its attractive valuation, improvement in medtech markets, and pipeline.

The company's leadless pacemakers Micra AV2 and Micra VR2, which have a longer battery life, received FDA approval in May.