DoubleVerify: A Hidden Gem In The Ad-Tech Space

Summary

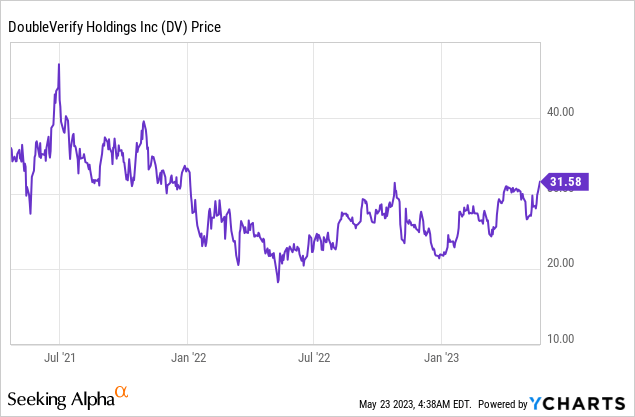

- DoubleVerify's share price has held up well despite facing rising interest rates and elevated inflation.

- The ad-tech company operates in an attractive fraud and viewability market that is much less competitive and cyclical.

- The latest earnings continue to show excellent growth despite facing a slowdown in the advertising industry.

- The current valuation looks very reasonable considering the strong top and bottom-line growth.

- I rate DV stock as a buy.

lovenimo/iStock via Getty Images

Investment Thesis

DoubleVerify (NYSE:DV) has held up relatively well since going public in 2021, with shares down less than 20% despite facing high inflation and rising interest rates. While the company is not widely-known, I believe will continue to play a critical role in the huge and fast-growing digital advertising market. The company specializes in ad fraud and viewability solutions, which are essential to all advertisers and publishers.

The company has been growing rapidly and the latest earnings once again reported outstanding growth in both the top and the bottom line. The current multiples are slightly elevated but I believe it will grow into its valuation fairly quickly considering its growth rates. Therefore I rate the company as a buy.

Attractive Market Opportunity

DoubleVerify is a New-York based digital advertising company founded in 2008. The company provides software solutions to advertisers and publishers for brand safety, fraud, viewability, and others. For instance, it helps ensure an ad is viewed by a real person under the intended context. Its current customers include notable names such as Apple (AAPL), Adobe (ADBE), and Home Depot (HD). While the company mostly operates behind the scenes, I believe it is well-positioned to benefit from the ongoing expansion of digital advertising.

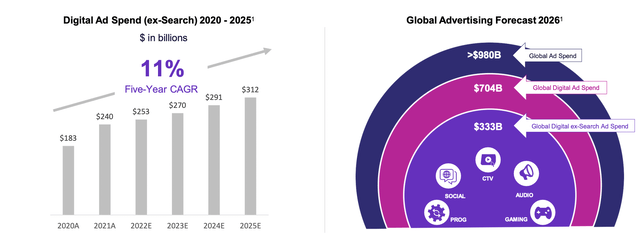

According to the company, digital ad spending (excluding search ads) is expected to increase from $252.11 billion in 2022 to $338.2 billion in 2025, representing a strong CAGR (compounded annual growth rate) of 15%. While the company's own TAM (total addressable market) is estimated to be roughly $20 billion. The growth is mostly driven by the ongoing shift from traditional media to digital media, especially into fast-growing segments such as CTV (connected tv) and social media. The company has been capturing market expansion through partnerships with Netflix (NFLX), TikTok, etc.

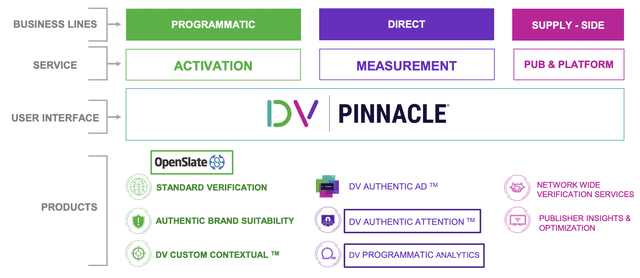

DoubleVerify plays an important role in the digital advertising ecosystem as it provides essential solutions to both advertisers and publishers. For instance, it help ensures all the ads on the publishers' platforms are brand-safe and fraud-free. On the other hand, it also helps advertisers deliver their ads to the intended target audience in the proper context.

I believe DoubleVerify can see durable growth in the long run as the fraud and viewability market is much less crowded compared to other sub-segments in the advertising space, with the major player only being Integral Ad Science (IAS). Other segments such as SSP and DSP are much more competitive with multiple players including The Trade Desk (TTD), Magnite (MGNI), and PubMatic (PUBM). The company is also much less cyclical than other ad companies, as most of its solutions are non-discretionary. For instance, most publishers and advertisers are generally reluctant to cut down on spending and expose themselves to fraud.

Strong Q1 Earnings

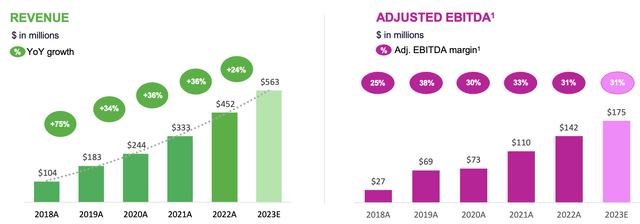

DoubleVerify announced its first-quarter earnings last week and the results are excellent in my opinion, especially when considering the current state of the advertising industry and the economy. The company reported revenue of $122.6 million, up 27% YoY (year over year) compared to $96.7 million.

Activation revenue increased 32% to $69.9 million, accounting for 57% of total revenue. The growth was mainly driven by the ABS (authentic brand suitability) segment, which grew 56% as the adoption rate continue to rise. Measurement revenue increased 22% to $41.4 million, accounting for 33.8% of total revenue. The growth was led by the strength in transactions for CTV and social, which grew 39% and 33% respectively. Supply-side revenue increased 15% to $11.3 million, accounting for 9.2% of total revenue. The growth is mostly attributed to Amazon (AMZN) and LinkedIn (MSFT).

The bottom line was also extremely strong as the company continue to gain substantial operating leverage. Thanks to strong organic traction, S&M (sales and marketing) expenses as a percentage of revenue dropped 660 basis points from 27.6% to 21%. G&A (general and administrative) expenses as a percentage of sales also dropped 390 basis points from 20.4% to 16.5%. The lowered spending resulted in the adjusted EBITDA up 45.3% YoY from $24.7 million to $35.9 million. The adjusted EBITDA margin expanded 300 basis points from 26% to 29%. The net income increased 165% YoY from $4.6 million to $12.2 million. The diluted EPS was $0.07 compared to $0.03.

The company's guidance for FY23 is also very solid. Revenue is expected to be $557 million to $569 million, representing a growth of 24% at the midpoint. Adjusted EBITDA is expected to be $171 million to $179 million, representing an adjusted EBITDA margin of 31% at the midpoint.

Valuation

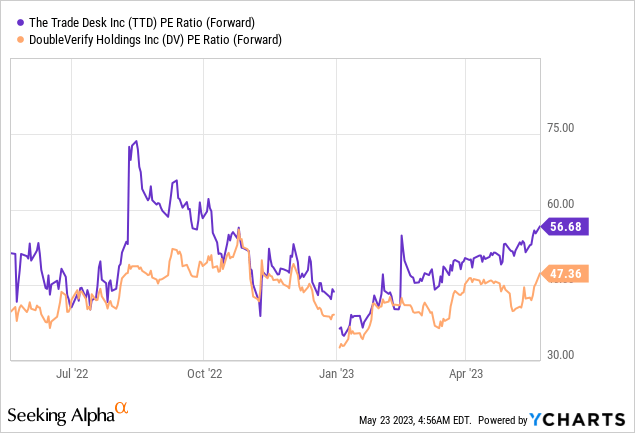

DoubleVerify is currently trading at an fwd PE ratio of 47.4x. This looks a bit elevated at first sight but it is actually very reasonable if you take its growth rate into consideration. For instance, ad-tech peers such as The Trade Desk are posting similar growth rates while trading at an fwd PE ratio of 56.7x, which represent a premium of 19.6%, as shown in the chart below. Unlike most growth stocks, the company is also already profitable with a gross profit margin of over 80% and an adjusted EBITDA margin of over 20%, which is very rare. Considering the strong growth and profitability, I believe the premium valuation is definitely warranted.

Investors Takeaway

I believe DoubleVerify is an ad-tech company that deserves more attention from investors. Many are only focused on popular names like The Trade Desk but DoubleVerify is actually growing revenue at a faster pace while trading at a cheaper valuation. Unlike most ad-tech companies that are highly exposed to the market downturn, the company's essential fraud and viewability solutions should provide solid resilience, as demonstrated in the latest earnings. It is rare to see a company that balances growth and profitability so well, not to mention the outstanding fundamentals and resiliency. I believe the company should continue to do well in the long run and I rate it as a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.