KRBN: JPMorgan Steps To The Green Plate, But Carbon Credits Remain Lackluster

Summary

- Interesting industry news this month came when banking-giant JPMorgan announced a major clean energy push.

- But with a broader lack of ESG interest lately, there are headwinds in the renewable energy world.

- As shares of KRBN consolidate, I reiterate my hold rating.

baranozdemir

Following the energy crisis in Europe that was expected to hit this past winter, global natural gas prices have remained low compared to year-ago levels. Recall Q2 2022 when oil, natural gas, and power prices were skyrocketing. That came after years of a push toward renewable energy and away from traditional fossil fuels. A hot trade while interest rates were near zero in late 2021 was the nascent carbon credit market.

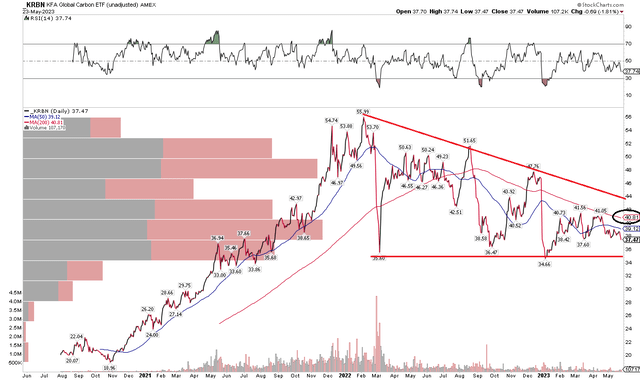

The KraneShares Global Carbon ETF (NYSEARCA:KRBN) peaked near $56 per share in early 2022. The fund has since ranged from the mid-$30s near $50 with a series of lower highs. I continue to have a hold rating as we await more bullish catalysts and better technical momentum.

But there was sanguine industry news just a few days ago. According to CNBC, JPMorgan Chase (JPM) agreed to purchase $200 million worth of carbon removal. Its investment to remove the equivalent of carbon emissions by 2030 underscores that the push to clean energy solutions and rising future costs of polluting the environment is in place despite a dearth of ESG fund launches.

Morningstar recently reported that it has been more than 7 weeks since the last ESG fund hit the street, the longest such stretch since 2019.

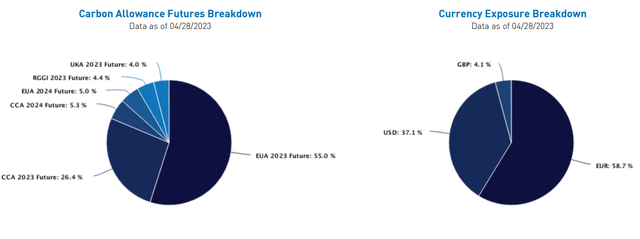

According to the issuer, KRBN is benchmarked to IHS Markit's Global Carbon Index, which offers broad coverage of cap-and-trade carbon allowances by tracking the most traded carbon credit futures contracts. The index assumes a long position in the price of carbon while supporting responsible investing. Currently, the index covers the major European and North American cap-and-trade programs: European Union Allowances (EUA), California Carbon Allowances (CCA), the Regional Greenhouse Gas Initiative (RGGI), and United Kingdom Allowances (UKA).

KRBN Portfolio Construction

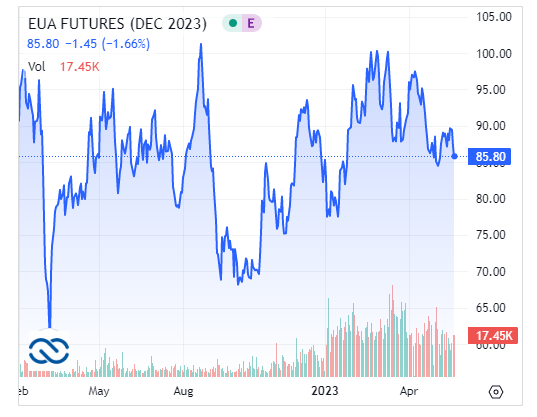

You'll see that the major component of KRBN's portfolio, EUA futures, has done very little over the last year. While there has been ample volume in the Dec 2023 contract this year, price action has been soft. Still, proponents of the fund argue that the fund can offer diversification benefits. But with a 0.78% annual expense ratio and large yield, it is not the most friendly product from a cost and tax efficiency standpoint. Assets total $612 million, while volume has been declining lately, with a typical daily volume of about 100,000 shares.

EUA Futures: Trendless Last 12 Months

TradingView

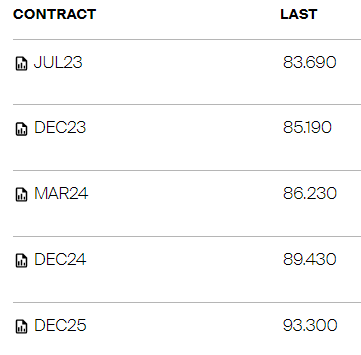

What's hurting KRBN right now internal to the ETF's structure is that its ownership of futures contracts dictates that it must sell out of expiring EUA future to roll out to later-dated terms. That creates what is known as "roll risk." In this case, a futures market in contango (whereby near-term contracts trade at a discount to later-dated contracts) is bearish, since the issuer must sell cheap contracts and buy more expensive contracts.

EUA Futures: Risky Contango Term Structure For KRBN

ICE

Seasonally, there is not much price history given the ETF's modest lifespan so far, but the summer months tend to feature an upside through June, but Q3 performance has been shaky in the past. The real sweet spot has been November-December-January, according to seasonal data from StockCharts.com.

Mixed Q2-Q3 Performance Trends

The Technical Take

KRBN continues to consolidate in a descending triangle pattern. Notice in the chart below that shares have clear support in the mid-$30s. As the ETF coils, investors must be on guard for a possible bullish breakout or bearish breakdown. Given that this consolidation comes after an uptrend many quarters ago, the implication is that the next move will be in the direction of the prior trend - which would be higher. For now, the long-term 200-day moving average is downward sloping, which is not a bullish feature from a trend perspective heading into the summer.

A drop under the $34 to $35 range would portend a large bearish break - take a look at how much volume by price is in the $35 to $50 area - once that is lost, then there are few previous buyers to support KRBN technically. Moreover, any rally would be met with selling pressure from those who got long the fund, seeking to get back to even.

KRBN: The Consolidation Continues, Eyeing Support

The Bottom Line

I reiterate my hold rating as KRBN continues to consolidate, and energy markets remain somewhat calm heading into summer.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.