2 REITs With Sustainable Long-Term Upside

Summary

- REITs have been hammered during this period of rising interest rates, which has provided opportunities for long-term investors.

- Both of these REITs pay safe and sustainable dividends.

- These REITs have strong portfolios that have the ability to perform well even if the US economy falls into a recession.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Kwarkot

Many stocks in 2022 had a rough year, as the S&P 500 fell nearly 20% and the Energy sector was really the only safe haven. The technology-led Nasdaq fell more than 30% in 2022, but things have turned around for many within the technology sector in 2023.

The Real Estate sector, more importantly the REIT sector, continues to remain under pressure in 2023. The Vanguard Real Estate Index ETF (VNQ) is down 15% over the past 12-months and down 2% in 2023.

This has provided opportunities in some high-quality REITs for those looking to take advantage of these suppressed levels.

Today, we are going to look at 2 Blue-Chip REITs that look undervalued

2 Undervalued Blue-Chip REITs

REIT #1 CubeSmart (CUBE)

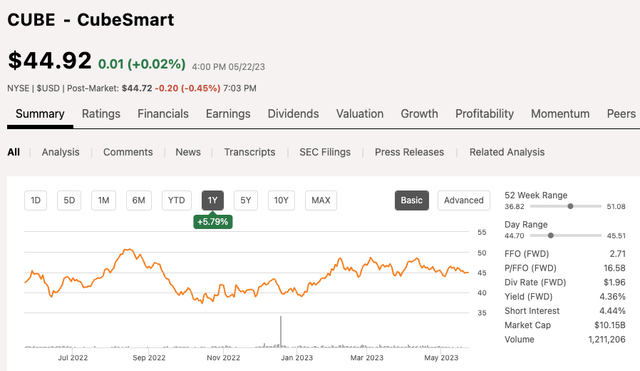

CubeSmart is one of the largest publicly-traded REITs within the self-storage sector. The REIT has a market cap of $10 billion and over the past year, shares have edged out a 6% gain.

For comparable purposes, the two largest self-storage REITs include:

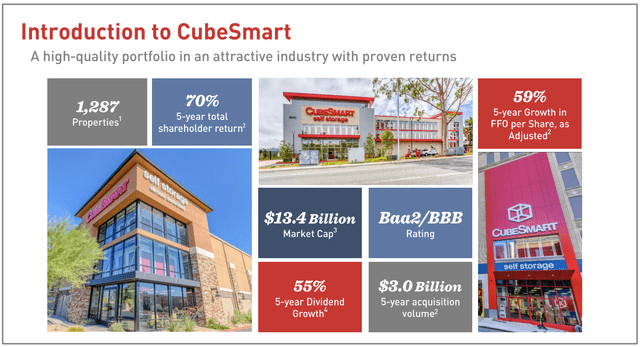

As of the company's May 2023 Investor Day, CUBE had a portfolio that consists of 1,287 properties with a 70% 5-year total shareholder return.

CUBE Investor Day Presentation

During Q1 2023, CubeSmart reported FFO of $0.65 per share, which was an increase of 12.1% year over year. Occupancy as of the end of the quarter was ~92%.

Many believe the economy is slowing and will likely fall into a recession in the back half of 2023, however, people still need a place to store things, especially if things get bad to where they need to downsize.

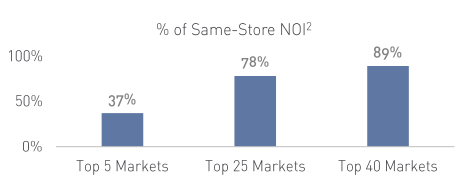

However, this has not slowed management's expansion plans for the REIT, as they continue to enter into agreements with developers to build more facilities. The company's portfolio is well diversified across the US as they have facilities within 39 states, operating in 153 markets with 89% of owned store NOI coming from the Top 40 metropolitan areas.

CUBE Investor Day Presentation

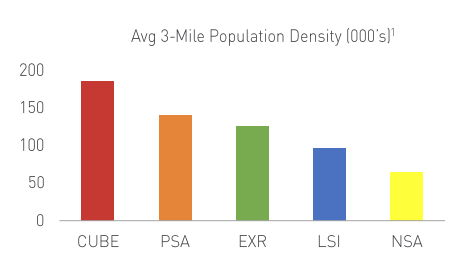

CUBE's properties are generally located in population dense areas, with an average 3-mile population density near 200K.

CUBE Investor Day Presentation

In addition to owning their properties, they also enter into deals with joint ventures as well as their third party management platform. The third party management platform is available for self-storage facility owners that want to hire an operator to run the day-to-day operations. This gives CUBE a steady stream of management fees with little to no initial capital outlays. The company added 25 stores to its third party management platform during the quarter.

During the company's Q1 earnings release, management released 2023 guidance:

- Revenue growth between 4-5.5%.

- Same-Store NOI growth between 4-6%.

- FFO between $2.64 to $2.71.

In terms of the balance sheet, the company has a solid BBB credit rating, with 98% of their debt being fixed rate debt with an avg maturity of six years.

In addition, investing in CUBE earns investors a dividend yield of 4.4%, a dividend management has grown for 13 consecutive years. Over the past five years, the dividend has grown at an average annual rate of 10%, so you get a good combination of higher yield and some nice dividend growth.

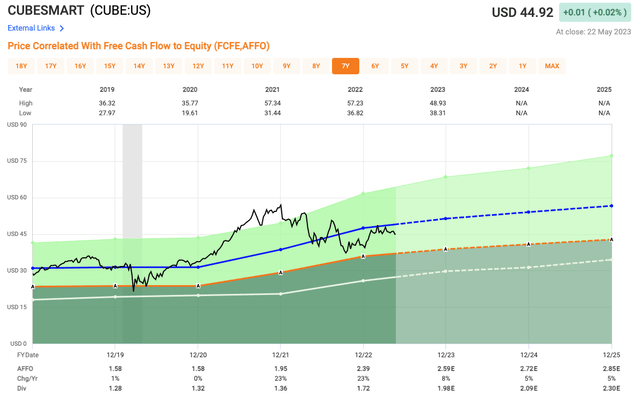

In terms of valuation, analysts are looking for a 2023 AFFO of $2.59, which equates to a 2023 AFFO multiple of 17.3x. Over the past five years, shares of CUBE have traded closer to 20x and over the past decade, closer to 21x, suggesting shares look rather undervalued in more of a recession-resistant sector.

Undervalued REIT #2: W. P. Carey (WPC)

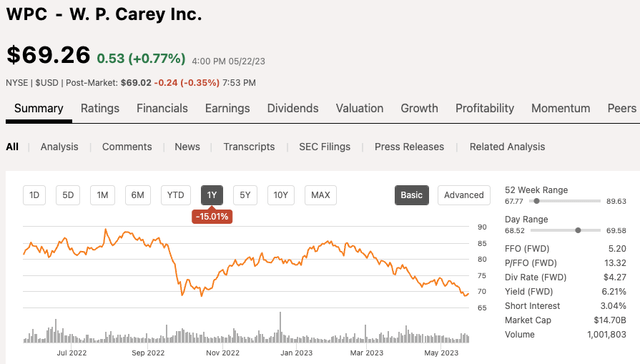

W. P. Carey is a well-diversified REIT that operates primarily within the Industrial & Warehouse sectors. WPC currently has a market cap of $14.7 billion and over the past 12 months, shares of WPC have fallen 15%. In 2023, shares of WPC are down 11%, far underperforming the broader S&P 500.

W. P. Carey Inc. is a global REIT with a diversified portfolio of commercial properties and tenants. As of the end of Q1, WPC's portfolio consisted of 1,446 properties leased out to nearly 400 tenants. The portfolio had 176.1 million square feet of leasable space and a high occupancy rate of 99.2%.

As mentioned, WPC has a global reach with nearly 40% of the annual base rent, or ABR, coming from outside the United States. The other great thing about WPC is that they have consistent cash flows coming in from their long lease terms. As of Q1, WPC had a weighted average lease term of 10.9 years.

In addition to their net lease portfolio, WPC also has a self-storage portfolio that consists of 84 properties and over 52K units with an average occupancy rate of 91.5%.

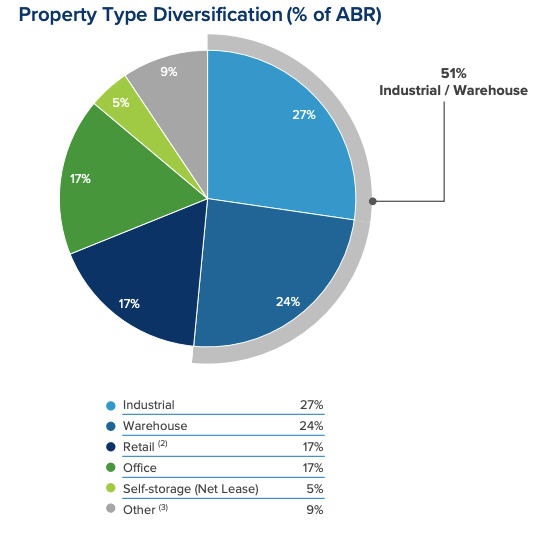

Looking here, you can see the diversification of the portfolio.

WPC Q1 Investor Presentation

As you can see, Industrial and Warehouse sectors make up 51% of the company's annual base rent. In years past, WPC had a much higher exposure to office, which has been a major concern for investors, especially in 2023. However, the REIT has transformed themselves over the past few years, and the multiple has not yet caught up, which is why the REIT looks like a bargain.

The last thing that has had me intrigued with WPC for the past 12+ months has been how nearly 60% of ALL their leases have rent escalators that are linked to CPI. Here we are sitting in a high inflation environment, meaning this will continue to be a tailwind for the business at least in the near term and provide protection in the long term.

WP Carey is on the verge of becoming a Dividend Aristocrat, as they have hiked their dividend for 24 consecutive years. WPC has an even higher dividend yield than CubeSmart with a high-yield of 6.2% currently.

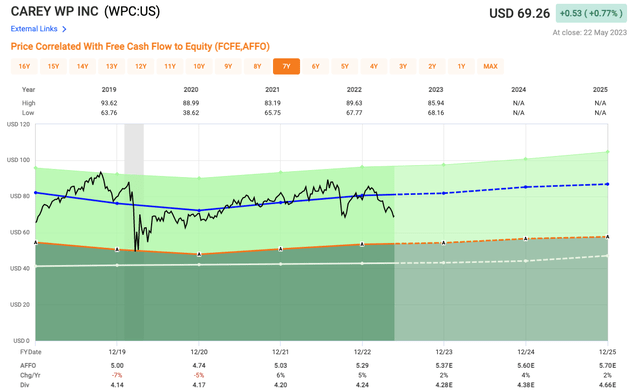

In terms of valuation, analysts are looking for a 2023 AFFO of $5.37 per share which equates to an AFFO multiple of 12.9x, which is well-below their five-year average of 15.2x. Even at 15.2x, WPC should be trading at a much higher AFFO multiple, more in line with industrial peers such as STAG Industrial (STAG) and Prologis (PLD).

Investor Takeaway

REITs continue to be under heavy pressure, but it seems more and more likely that the Federal Reserve is nearing the end of their rate hiking cycle, which would relieve some of that pressure. However, if we set rate cuts, that usually coincides with a weaker economy, so a pause would be the best bet for the REIT sector.

Nonetheless, both of these REITs operate within sectors that have staying power, regardless of the economic backdrop in the near term, and both appear to be trading at cheap valuations.

COMMENT BELOW: Which of these two REITs would you be more comfortable buying at these levels?

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CUBE, PSA, WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.