Cardinal Health: Focus On Core Strengths And Operational Efficiency Enabling Margin Expansion

Summary

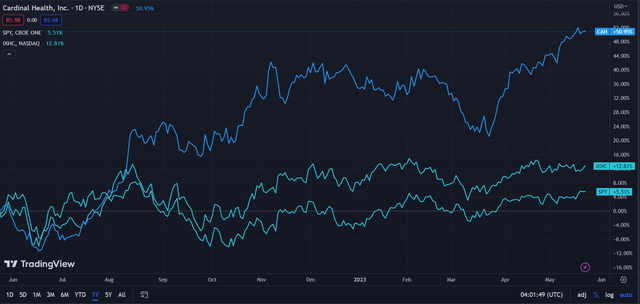

- In the past year, Cardinal Health (CAH: +50.95%) has rallied significantly, with share price action superior to both the broad market (SPY: +5.51%) and the healthcare industry (IXHC: +12.81%).

- This reflects a 34.80% in free cash flow from 2021-22 to $2.73bn and revenue growth of 11.62% in the same period.

- Beyond a recession-resilient business model, Cardinal has aimed for a leaner business model, with a focus on the dual verticals of pharmaceuticals and medical instruments.

- In doing so, Cardinal has become a more nimble organization, able to better position itself to take advantage of secular growth trends, such as an aging population, drug innovation, and homecare.

- Combined with a general undervaluation, Cardinal's broad-based corporate strategy leads me to rate the firm a 'buy'.

SweetBunFactory/iStock via Getty Images

Cardinal Health (NYSE:CAH) is a US-based multinational healthcare services company, specializing in the manufacturing and distribution of pharmaceutical and medical products.

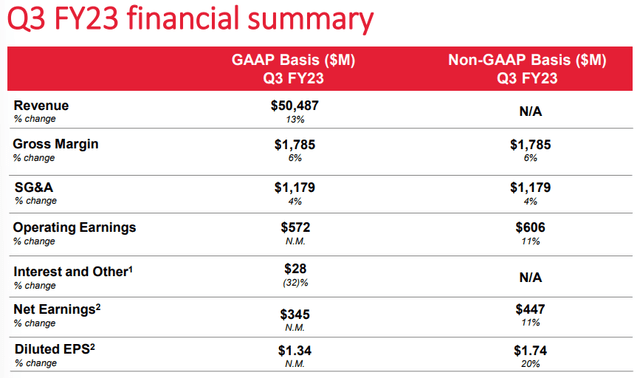

Cardinal Health Q3 FY23 Presentation

The company positions itself as an integral aspect of the US medical supply chain, emphasizing its end-to-end role from manufacturing to the distribution of its products.

Introduction

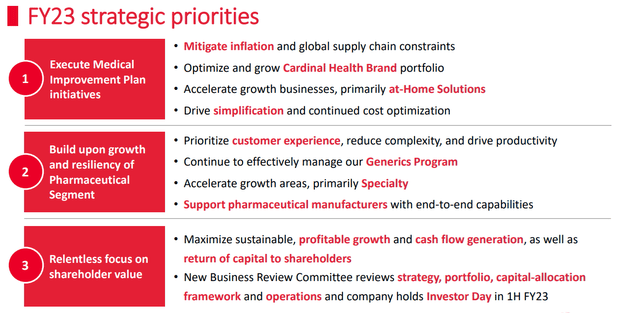

To optimize growth and fulfill the needs of all stakeholders, Cardinal Health has identified three strategic priorities; scale growth will be driven by Cardinal's 'Medical Improvement Plan' initiatives, which aim to leverage the firm's market position and healthcare megatrends; focus on the core business of pharmaceuticals, enhancing consumer experiences and supporting growth across specialty segments; and returning value to shareholders, through a capital allocation mix of organic growth, dividends, and opportunistic buybacks.

Cardinal Health Q3 FY23 Presentation

Such strategies have enabled across-the-board growth in the company's Q3'23, achieving 13% revenue growth and 6% gross margin growth YoY.

Cardinal Health Q3 FY23 Presentation

Valuation & Financials

General Overview

In the TTM period, Cardinal Health- up 50.95%- has seen significantly greater growth than the healthcare industry (IXHC)- up 12.81%- and the broad market, represented by the S&P 500 (SPY)- up 5.51% for the year.

Cardinal Health (Dark Blue) vs Industry and Market (TradingView)

Such price action validates Cardinal's lean organizational strategy, which has reduced the company's sensitivity to macro headwinds (i.e., integrated healthcare firms such as UnitedHealth (UNH) are exposed to health insurance, PBM, pharma, etc. risks) and adapt to general circumstances.

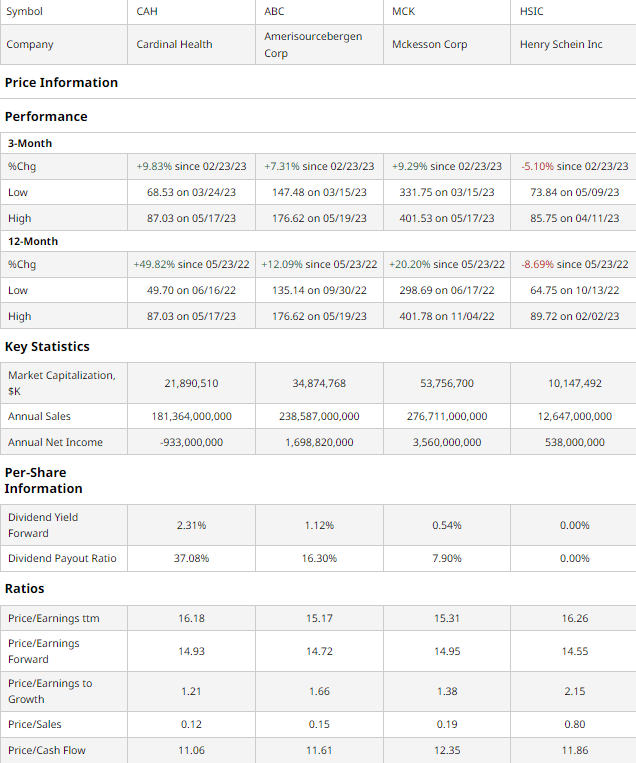

Comparable Companies

The scale advantage necessary for effective competitiveness in the pharmaceutical and medical distribution market supports a highly concentrated market, with a few large-cap and specialty mid-cap firms. Among these are AmerisourceBergen (ABC) a leader in leveraging ongoing healthcare megatrends, but much less flexible than Cardinal, McKesson (MCK), the largest pharmaceuticals distributor, and Henry Schein (HSIC) which carries a large portion of net sales in its dental products segment.

barchart.com

As illustrated above, Cardinal Health sustains the best quarterly and yearly price action, with respective price increases of 9.83% and 49.82%. This growth comes in conjunction with the best dividend among peers, further demonstrating Cardinal's commitment to capital return to shareholders.

The firm's undervaluation is further emphasized on a multiples basis; while Cardinal is near-median in trailing and forward P/E ratios, the company sustains the lowest PEG, P/S, and P/CF ratios.

On the flip side, Cardinal does maintain high debt levels owing to historic M&A activities and historic operational deficiencies. The good news, however, is that Cardinal has low levels of current net debt and has demonstrated an outsized ability to convert its EBIT to cash flow effectively. Moreover, many of the company's historic misgivings have been rectified, with Cardinal aiming for a leaner business model; for instance, in August 2021, Cardinal divested from its cardiology and endovascular device manufacturing division, selling it to Hellman & Friedman for $1bn, as the business was non-material to the overall success of the company.

Valuation

According to my discounted cash flow model, at its base case, the fair value of Cardinal is $124.32, meaning that the stock is currently undervalued by 31% at its current price of $85.37.

My model assumes a discount rate of 11%, owing to Cardinal's debt-laden cap structure and overall recessionary impacts, though the inelastic nature of pharmaceuticals and medical devices reduces any negative demand pressures. Additionally, I project sales growth of ~5% although average revenue growth in the past five years has been ~8.30%, incorporating business risk and inflationary pressures adding to the operational expenses of the firm.

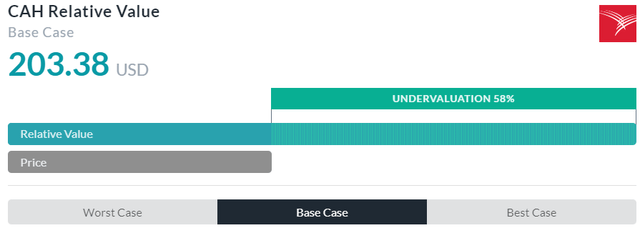

AlphaSpread's multiples-based relative valuation tool more than validates my thesis of undervaluation, calculating Cardinal's base case fair value to be $203.38, a 58% undervaluation from its current price.

However, AlphaSpread's inability to incorporate Cardinal's high debt levels causes a skew upward in valuation.

Therefore, using a weighted average with more weight given to my DCF, the fair value of Cardinal is $133.58, with the company currently undervalued by 36%.

Simplified Business Model Enables Adaptation to Secular Cash Flow Streams

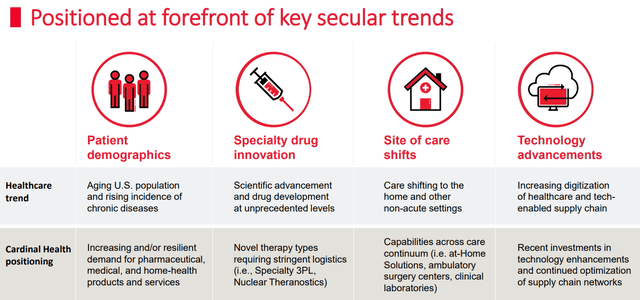

At large, the healthcare industry presents investors with an ideal proposition, being a recession-resilient industry and growth driven by healthcare megatrends. For example, the combination of an aging US population and accelerated chronic disease diagnoses support scale expansion, while innovations in specialty drugs, site-of-care shifts, and technology advancements create inherent opportunity.

Cardinal Health Q3 FY23 Presentation

As exemplified above, Cardinal's nimble organization enables them to leverage said growth trends; the firm is a leader in nuclear pharmaceuticals and radio-pharmacies, has expanded its vertical footprint to support homecare, and continues to invest in technological improvement, remaining a key aspect of the US pharmaceutical and medical supply chain.

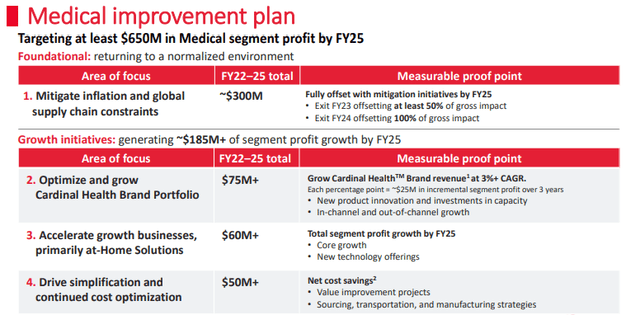

On a more specific level, Cardinal has outlined its 'Medical Improvement Plan', delineating its investments in short-term and long-term growth objectives. In the immediate term, the company plans to invest ~$300mn in inflation mitigation and supply chain resilience while, in the longer term, >$75mn, $60mn, and $50mn are being allocated towards optimizing and expanding the Cardinal Health Brand portfolio, accelerating its homecare solutions, and cost optimization respectively.

Cardinal Health Q3 FY23 Presentation

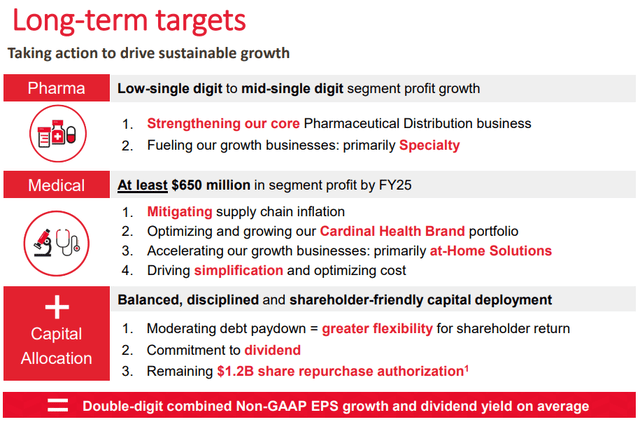

Combined with a shareholder-oriented capital deployment strategy- with a premium on debt reduction (i.e. recording a 67.11% decline in net debt from 2021-22, from $3.31bn to $1.09bn) and then dividend payouts and opportunistic share repurchases (with a $1.2bn remaining repurchase authorization)- Cardinal's pharma and medical strategies have enabled long-term double-digit EPS growth and dividend yield growth.

Cardinal Health Q3 FY23 Presentation

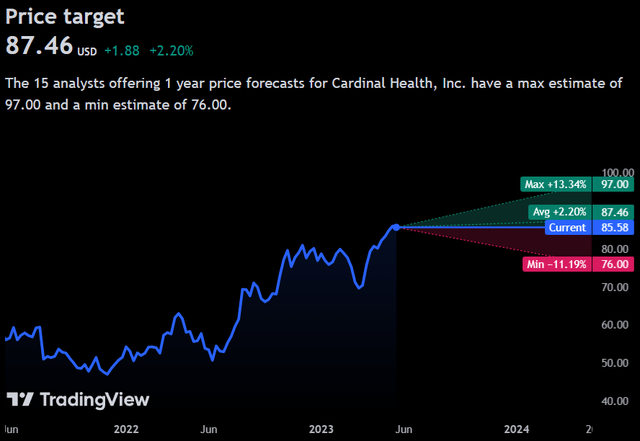

Wall Street Consensus

Analysts largely echo my positive view on the stock, projecting an average 1Y price increase of 2.23% to $97.00.

However, at the minimum estimated price action, analysts forecast a price decline of -11.19%, to a price of $76.00. I believe these projections are based on apprehensions about Cardinal's debt levels and inability to pass down inflationary costs.

Risks & Challenges

Sustained Regulatory Complexity

The healthcare industry intrinsically remains a highly regulated and bureaucratic market, with high levels of public scrutiny. Increased complexities or price restrictions can inhibit Cardinal's ability to adequately adapt to macro circumstances and dampen profitability and free cash flow generation capabilities.

Competitive Intensity May Hamper Profitability

Although Cardinal only directly competes with a handful of pharmaceuticals distributors, they face the backwards integrations of healthcare insurers and groups such as the UnitedHealth Group and CVS (CVS), thus furthering competitive intensity and continuously reinforcing downward pressure on pricing and thus profitability.

Continued Inflationary Pressure

Primarily operating as a pharmacy and medical device distributor, Cardinal additionally manufactures a range of products; as such, Cardinal has been privy to the effects of inflation, leading to material reductions in profitability; the aforementioned increase in sustained competitive intensity only reduces Cardinal's ability to adapt to higher input costs, thus increasing operational expenses and reducing margins.

Conclusion

In the short term, I expect that Cardinal will continue to revert from the financial lows of the past few years and pay down its net debt.

In the long term, I project that Cardinal's lean business model will enable adaptability and position the company to maximize long-term growth.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.