The Case Against A Dividend Growth Portfolio Strategy

Summary

- Dividend Growth investing focuses on finding companies that have a strong history of increasing dividends.

- Exclusively focusing on the expected yield on cost over time may erode long-term capital appreciation.

- Over the long term, it's probably better to look for great businesses that have sustainable competitive advantages, rather than solely focusing on dividends.

bpawesome

Prelude

Dividend growth investing is a popular strategy in which people build a portfolio focused primarily on companies with lower current yields but high dividend growth rates. The basic logic is very sound: forgo some current income for a higher yield on cost over time and ideally, one which outpaces inflation. Coupled with dividend reinvestment, this strategy abuses compounding interest in a tangible way which attracts many investors to pursue a purely dividend growth focused portfolio strategy. In this article, I'd like to explore this strategy in a bit of detail and offer commentary on why it may not be optimal for all investors and what is a better alternative.

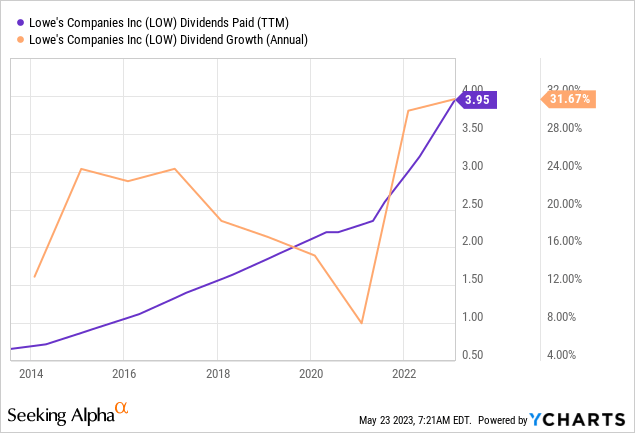

Many companies have tailored their long-term business model around a strategy of consistent dividend payments and consistent dividend increases. The market applauds dividend aristocrats and dividend kings that have long track records of consistent distributions to shareholders. For many retirees current income is of foremost importance, and for many long-term investors yield on cost is the sole focus. Businesses like Lowe's (LOW) have impressive track records of both dividend payments and growth that beats inflation:

As bulletproof as this strategy seems, it's not invincible. Investors may be sacrificing long-term capital appreciation for the guise of total returns with a high yield on cost and hefty income growth.

For example, Lowe's has an impressive share buyback and dividend policy, but its underlying business does not produce enough cash to fully cover this strategy, so they have opted to take out many long-term debt obligations to keep this policy afloat. Throughout times of cheap money and ample liquidity, this is not an issue; but today is not a time of cheap money and ample liquidity. To continue this strategy of large buybacks and solid dividend growth, Lowe's will either need to increase its payout ratio, which will sacrifice capital that can be used for reinvestment, or take out higher interest debt obligations to continue this growth strategy.

Growth and Reinvestment

Berkshire Hathaway's iconic leader Warren Buffett has been famously averse to dividend payments to shareholders. His basic logic is that there is no sense in distributing $1 of cash to shareholders if the company can retain that dollar and get more than $1 worth of market value. Using his value investing approach, he seeks to find companies trading below their intrinsic value and give them cash now so Berkshire can earn more cash in the future. Many dividend growth investors look to the Berkshire equity portfolio with reverence, stocks like Coca-Cola (KO) have been longstanding holdings of Berkshire and are earning mouth-watering yields on cost. But this was not the initial reason for the investment, the reason Berkshire allocated so much capital to Coke is because it's simply a wonderful business with an immense economic moat. These characteristics have allowed Coke to both grow its intrinsic value and grow its dividend over time. Make no mistake, Buffett loves dividends. But he is far from a dividend growth investor.

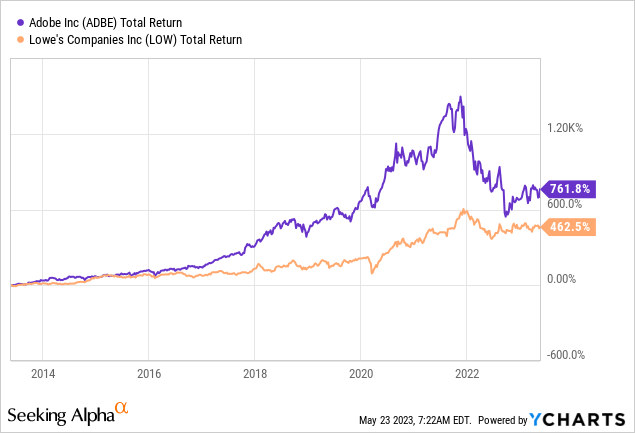

The best strategy for any long-term investor is that which maximizes capital appreciation. A business like Adobe (ADBE) has an aggressive share buyback program but pays no dividends. This strategy allows management to retain capital for rigorous re-investment in the business and has proven to generate solid returns over time:

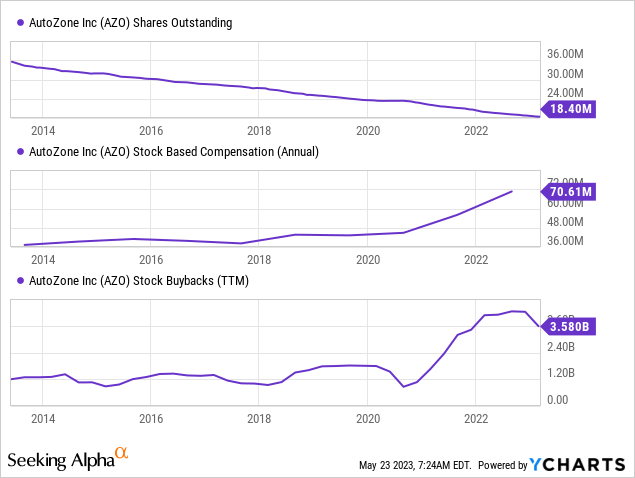

Share buybacks also take capital away from potentially better opportunities, but are shareholder friendly because they avoid dilution commonly caused by stock-incentive programs. In most cases, stock incentive programs are a net benefit for shareholders as they ensure both management and employees are well-motivated and mutually invested in the long-term success of the company. In some cases, like Autozone, share buybacks have outpaced stock-incentive programs and have led to growth in equity ownership for long-term holders.

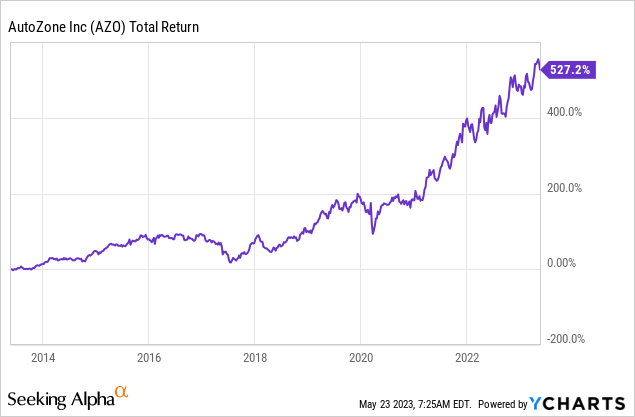

Coupled with healthy price returns, Autozone has produced immense long-term value appreciation for owners and has richly rewarded shareholders with not only competitive total return but also an increase in ownership share over time.

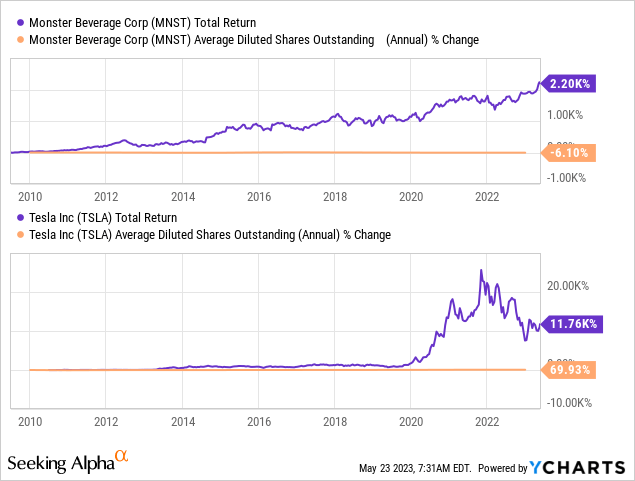

Some companies take it even further, take Monster (MNST) or Tesla (TSLA) for example, who have limited share buyback programs and mouth-watering long-term price returns.

In these cases, management has opted for heavy re-investment in the business to grow market share and earnings and to achieve its business strategy.

In other words, if you find a business you believe could be a long-term compounder, investing heavily in that business is likely a better option than a dividend growth stock with a lower likelihood of compounding over time. If you invested $1,000 in a compounder at an average return of 10% annually you'd end with $2,357.95 after 10 years. Similarly, you could invest $1,000 at a 3% yield growing 10% per year with a 7% price return, and end with $2,450.38 (when considering a 15% tax on dividends). But wait a minute, didn't I just disprove my argument? There are two additional considerations: 1) this considers dividend reinvestment, which allows the principal to compound along with dividend yield. For any investors that aren't reinvesting dividends, this number would be much lower. 2) This assumes an ambitious average dividend growth rate of 10% which is probably not a realistic target for a portfolio. If we tweaked this growth rate to 5%, we'd end with a figure of $2,286.50. Additionally, assuming only 10% growth may be conservative, as many of the above examples have achieved significantly more than 10% growth per annum over time.

The Business Risk of a Dividend Growth Model

The foremost risk from the perspective of the business is how a dividend growth policy influences current prices. Investors price in future expectable distributions and growth, so any change to that strategy for the worse can and likely will erode the stock price. This hurts total return and future expected yield on cost. Worse yet, this could cause management to continue an irresponsible or otherwise unsustainable dividend policy which will erode long-term returns over time.

For the shareholder, there is a triple tax incidence: the tax the business pays, the capital gains tax upon selling, and the dividend income tax for each distribution. An investor in a non-dividend paying business will only face two of these. This adds to the frictional costs of a dividend growth portfolio and increases the likelihood of sub-par long-term results.

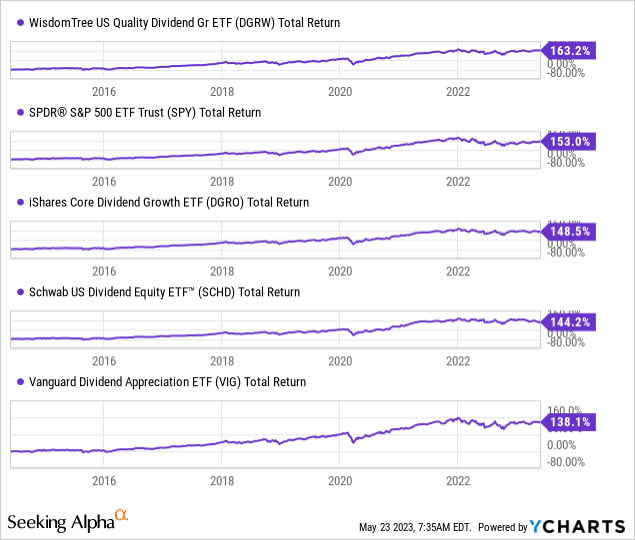

Let's take a look at some popular dividend and dividend growth focused ETFs and whether they beat the market:

The market has outperformed all but DGRW over the past 10 years in terms of total returns, but that doesn't guarantee outperformance in the future.

Conclusion

Overall, a dividend growth strategy is a solid pick for long-term investors but may not necessarily maximize capital appreciation. It's an easy way to get compound interest working for you but increases some frictional costs and may erode returns over a value or growth investing strategy. A better alternative to this strategy for long-term capital appreciation and value creation is Warren Buffet's style of value investing. If you look for really solid business fundamentals and competitive advantages, it's likely that those businesses will continue winning and creating value for shareholders over the long term. High dividend yields may be a fringe benefit of that if the management team feels that is a good use of capital, but if there are better uses for capital than dividends a regimented dividend policy could be problematic. Investors should look further past just a dividend yield and expectable growth rate when making investment decisions.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW, ADBE, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.