Frontier Communications: Recent Sell-Off Could Be A Buying Opportunity

Summary

- Management announced that CapEx could rise $200-$400 million above previous guidance on increasing costs for their fiber buildout.

- FYBR should see EBITDA begin to grow significantly in the second half of 2023 and into 2024.

- CapEx spending will remain elevated as FYBR completes their 10 million passing fiber build but could fall by roughly half in future years, which should generate significant FCF.

Frontier continues their aggressive Fiber rollout. nano/E+ via Getty Images

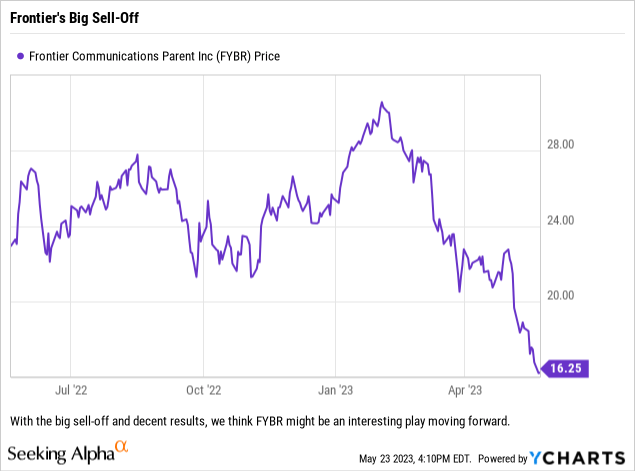

It has been a rough ride for shareholders of Frontier Communications Parent, Inc. (NASDAQ:FYBR) since early February when the stock traded above $30/share. The company had been building momentum with their fiber rollout/expansion as the new management team was delivering on various guidance and plans. The happy story began to run into headwinds as the market corrected and investors began to fret as some inflationary pressures on the company's fiber build adjusted CapEx guidance. With investors now seeming to have moved the goal line, and demanding that the management team show them results based off of the new data, the stock has fallen into the $16/share range. We previously covered FYBR in Dec 2022.

We went through the conference call and the company's filings and came away with the following thoughts:

Fiber Rollout

So far, so good. Frontier continues to deliver on their fiber buildout, adding 339,000 new fiber locations in Q1, which brings their total fiber passings to 5.5 million. The 330k passings in Q1 were below both Q3 and Q4 of 2022 but keeps Frontier on track to hit their guidance for 1.3 million new locations for 2023.

The one issue that the market was unforgiving about, and analysts had a few questions about during the Q&A on the conference call, centered around increasing costs on the build and the impact to cost per location going forward. Management believes that the total cost per location on the total buildout will be about $1,000 per location. However, it appears that the cost this year will result in a cost per location "in the $1,000 to $1,100 range," according to Scott Beasley, Frontier's Chief Financial Officer. The company believes that they can keep the total cost of the build around $1,000 by mixing in more lower cost locations as well as focusing on muti-dwelling units.

While we understand the worry from the market, especially considering that to date the cost per location has been about $830, we think that focusing on the bigger picture is key here. Management was always going to first go after the low hanging fruit and focus on their most fertile territories for rolling out fiber. Geographic areas with little to no competition with low build costs were high on the priority list, and as they work their way through the build priority there are going to be periods of time where costs are higher - which could be due to inflation or just due to that particular market, its density, spacing and type of build.

The key takeaway is that CapEx for 2023 is going to be front loaded as the company spends heavily in the first half before seeing spending slow in the second half of the year.

Execution On Improving the Business

Frontier still has execution risk, but it appears management has delivered on their promise to return to growth mode in 2023. For the first time in five years, the company saw EBITDA grow year-over-year. The fiber build is driving this growth, and Frontier is now a fiber company - with the majority of its revenue and EBITDA now generated from that segment.

The company's shift to fiber continues to lower its overall ARPC, especially as Frontier abandons the video business and instead relies on its partnership with Alphabet's (GOOGL) YouTube TV. We suspect that this is a small part of what is driving down call center activity (outside of what management mentioned on the conference call), which when combined with the exit from the low margin video business highlights part of how Frontier is driving margin expansion.

The company is also implementing new practices which they discussed late last year that they hoped would drive fiber ARPU higher. Those decisions did in fact help move fiber segment new customer ARPU higher in Q1, as Frontier focused on selling speed to customers and upselling those customers at the initial point of sale. Frontier also began their plan to monetize value-add services (which previously had been free) while also slowing promotional activity and getting rid of price locks and discounts. Altogether, this resulted in "new customer ARPU increasing into the $65 to $70 range," according to Nick Joffrey, Frontier's CEO.

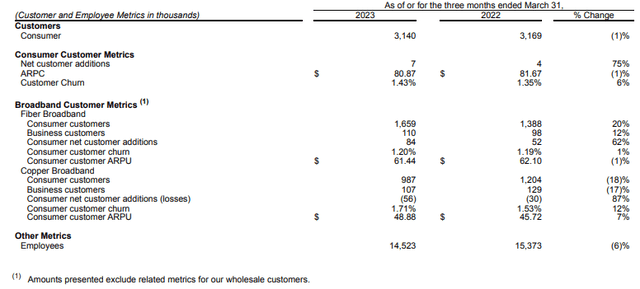

While Consumer Customer ARPU declined in the quarter, management indicated that this should increase significantly as contracts reprice over the next year. (Frontier 10-Q Filing)

While Consumer Customer ARPU for fiber broadband was $61.44 in Q1 2023 (and down year-over-year), management is indicating that we should see this metric begin to increase as price locks and other promotional activity rolls off from their earlier builds. If we look to something in the middle of the $65 to $70 range for ARPU moving forward (which is where management indicated new customer ARPU is at now), say $67.50, then Frontier could see a 10% increase in revenues from the fiber segment which would mostly flow down to earnings (as it would be high margin revenue).

Results Should Be Reaching An Inflection Point

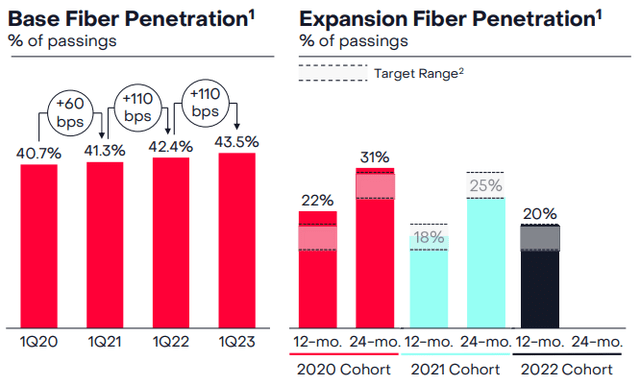

It appears that Frontier may have some tailwinds to help offset the headwinds of higher build costs. As the company's expansions age, they add more customers, building up to the 40-45% penetration level Frontier is targeting. The company's base fiber footprint , which has 3.2 million locations, is up to 43.5% penetration. Below you can see Frontier's performance among their base fiber network and various cohorts over 12 and 24-month periods:

Frontier has had success among their base fiber footprint and their various cohorts from their current fiber build. (Frontier Q1 2023 Investor Presentation)

With the steady penetration of the base fiber footprint since 2020, it looks like management might be able to deliver on the 45% penetration goal. The new fiber builds also look promising, especially with the 2022 cohort coming in at 20% after 12 months - which is not that far behind the 2020 cohort which was a strong year for fiber and broadband as a whole due to COVID changing consumer needs and demands.

All of this leads us to this quote from Frontier's Chairman, John Stratton, during the conference call which summarizes the opportunity for Frontier in a very simple and eye opening way:

As we build our fiber we've shown with a high degree of consistency, that we can achieve penetration rates of 15% to 20% after 12 months, and 25% to 30% after 24 months.

While revenue has grown significantly alongside this penetration growth, it's been largely offset by our expected one-time acquisition costs. So as a result, in the trailing 12 months, this 2 million home cohort has only contributed about $10 million in EBITDA. In the next 24 months, however, we expect this same 2 million home cohort to release substantially more EBITDA, an estimated $230 million.

And when the same cohort achieves our 45% penetration goal at full maturity, it will generate EBITDA in the range of $680 million. This powerful release of EBITDA is what drives very attractive returns in the mid to high teens.

Final Thoughts

This is an interesting story which we think deserves attention. While Frontier's debt increased due to a debt issuance in March, the leverage ratio increasing from 3.4x at FY2022 year-end to 3.7x in the latest quarter is nothing to worry about as Frontier has to borrow the money before the increased EBITDA registers. The company has about 85% of its debt at fixed interest rates, with an average weighted cost of debt at 6.9% and no maturities until 2027, so they are somewhat insulated from rates rising any further. An argument could also be made that the company might have the opportunity to lower their borrowing costs by securing their debt via an ABS (asset-backed security) offering and/or showing strong growth in cash from operations and EBITDA.

With Frontier now looking at adding 1.3 million passings per year moving forward - at least until they reach 10 million - we think that this could be a nice play. In the first 12 months, those 1.3 million passings should generate about 260,000 new fiber customers with another 65,000 over the following year. This should generate enough revenue to help drive EBITDA higher and help the company keep their leverage ratios in check - although we suspect that this particular measurement will ebb and flow as Frontier manages their liquidity and balance sheet needs (think debt offerings).

If Frontier can continue to deliver on their cost-cutting initiatives, keep their leverage ratio below 4x and attract customers to their fiber offering at the same pace as the last three years, then we think that the most recent sell-off may be overdone. The CapEx for the fiber build muddies the water here, so looking at cash from operations and adjusted EBITDA might be the best measurements on progress. With what we have seen so far, we are adding Frontier to our 'Buy List' for accounts that seek capital gains. If the economy does not hit a hard recession, this name could trade back up into the $25/share range.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FYBR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No positions currently for client or personal portfolios. We may initiate purchases in the next few days based on reinvesting income or putting new funds to work.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.