As Gold Loses Grip On $2000, Further Losses Await

Summary

- After threatening to break above $2,000 earlier this month, gold has seen a downside reversal, with the focus now shifting to $1,800.

- Gold's fair value continues to decline amid rising real bond yields and falling industrial metals prices, leaving the metal extremely overvalued.

- Interest rate markets are pricing in aggressive cuts, but with stocks having reversed their recent losses and headline CPI remaining far above target, rate risks are weighted to the upside.

- Any further rise in US yields would further undermine gold's fair value, raising the risk of a crash down to $1,600.

Eoneren

Gold prices have once again lost their grip on the $2,000 level, with the reversal from the May 5 peak erasing two months of gains for the metal. As I argued earlier this month in 'Gold Hits New All Time Highs, Don't Expect Them To Last', the rally in gold prices is not backed by the fundamentals. Since then, the metal has seen a downside reversal, putting the short-term focus on the February lows around $1,800. Below here would open up a move down to range lows just above $1,600. While this may seem unlikely, the metal's fair value continues to decline due to rising real bond yields and falling industrial metals prices, suggesting downside risks are rising.

Rising Real Yields And Falling Industrial Metals Prices Continue To Undermine Gold's Fair Value

Gold has finally begun to succumb to the intensifying pressure of falling inflation expectations and rising interest rate expectations, which has seen 10-year inflation-linked Treasury yields back towards multi-year highs. While gold bulls have sought to dismiss this rise in real yields due arguments such as central bank gold buying and instability in the US regional banking system, there is no escaping the importance of real bond yields as they represent the opportunity cost of holding the zero-interest bearing metal.

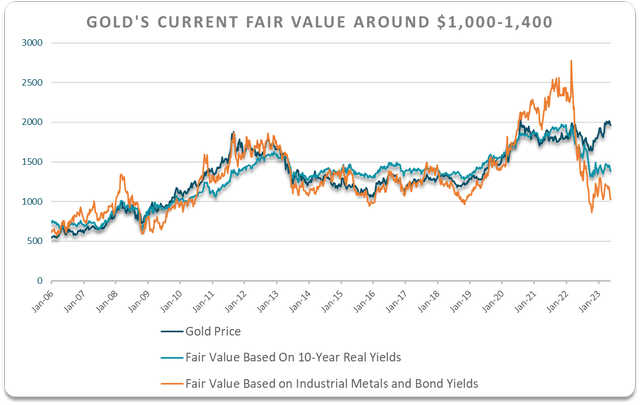

Depending on the time period, the particular real interest rate, and whether we use actual or inflation-adjusted gold prices, the correlation between real yields and gold prices has been exceptionally strong. In recent articles I have looked at the correlation between 10-year inflation-linked bond yields and the inflation-adjusted gold price. The reason being that rising consumer prices gradually raise the fair value of nominal gold prices. Since 2006 the r-squared between the inflation-adjusted gold price and 10-year US inflation-linked bond yields has been 0.66, and this figure was as high as 0.75% in 2021 before the surge in real yields. Based on this correlation, the fair value of gold currently is now around $1,400.

Bloomberg, Author's calculations

An even greater degree of gold overvaluation is seen when comparing nominal bond yields with the ratio of gold over industrial metals prices. The r-squared between these two variables has been 0.82 over the past two decades, and the current fair value gold price based on this correlation is around $1,000. If we combine the two fair value indicators this gives us a fair value for gold of around $1,200, and the degree of overvaluation is over four standard deviations from its mean.

If The Fed Keeps Rate Elevated, Look Out Below

I should note that gold's fair value can move rapidly, and I expect it to move higher over the coming years due to three factors; positive inflation, falling bond yields, and rising industrial commodity prices. However, based on current real yields and industrial commodity prices, gold is extremely overvalued.

Note also that the real 10-year bond yields used to calculate gold's fair value already factor in aggressive interest rate cuts. Interest rate markets are pricing in 173bps in rate cuts by end-2024, but with stocks having reversed their recent losses and headline CPI remaining far above target, rate risks are heavily weighted to the upside. Any bearish steepening in the US yield curve would further undermine gold's fair value, raising the risk of a crash down to $1,600.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of XAUUSD:CUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.