GLU: A High-Risk Strategy That May Be Uncomfortable For Some Yield Seekers

Summary

- The utility sector has long been a favorite of conservative investors due to its overall stability and high yields.

- The market mania has driven down yields, but Gabelli Global Utility & Income Trust is still able to provide its investors with a positive real yield.

- The fund's performance vs. iShares Global Utilities ETF has been mixed, which may be partly due to its very high leverage.

- The distribution may not be sustainable, as the fund's assets declined last year, but it still brought in outside money.

- The Gabelli Global Utility & Income Trust is trading at a very attractive discount to net asset value, which helps offset some of the concerns.

- This idea was discussed in more depth with members of my private investing community, Energy Profits in Dividends. Learn More »

SimonSkafar

For many years now, one of the most popular investments among investors seeking both safety and income has been utility stocks. This makes a great deal of sense as these companies tend to enjoy remarkably stable cash flows regardless of the conditions in the broader economy. After all, utilities provide products that consumers typically consider to be necessities for modern life so they usually prioritize paying their utility bills ahead of making discretionary expenses.

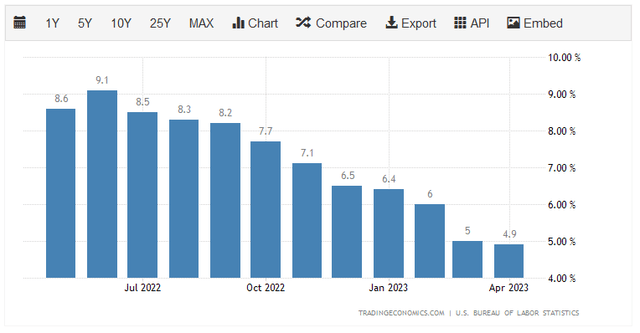

Unfortunately, there are a few problems with utilities today. Perhaps the most important one is that the incredible strength that we continue to see in the market today has suppressed the yields of many utilities. As of the time of writing, the U.S. Utilities Index (IDU) only yields 2.56%, which is actually a negative real yield given current inflation rates:

As is usually the case, foreign utilities are able to give somewhat better yields due to the fact that the international markets have not experienced a bubble of anywhere near the magnitude of the American one over the past fifteen years. As of the time of writing, the iShares Global Utilities ETF (JXI) currently yields 3.14%. That is better than American utilities, but it still represents a negative real yield.

Another problem facing utility investors is that it is incredibly difficult to put together a diversified portfolio of these assets without having access to a considerable amount of capital. This is not something that is exclusively limited to utilities though, as investors in any sector face this problem.

Fortunately, there is an easy way to solve both of these problems and gain diversified exposure to the sector while still earning a very respectable real yield. This is to purchase shares of a closed-end fund, or CEF, that invests in the utility sector. These funds are unfortunately not very well-followed by the financial media so it can be difficult to obtain information about them. This is a shame because these funds have a number of advantages over open-ended or exchange-traded funds. In particular, a closed-end fund can employ certain strategies that allow them to boost its yields well beyond that of any of the underlying assets or the market as a whole.

In this article, we will discuss the Gabelli Global Utility & Income Trust (NYSE:GLU), which specializes in investing in utilities from around the world. This fund currently yields an attractive 8.91%, which is much higher than either of the index funds and is clearly sufficient to provide us with a positive real yield. I have discussed this fund before, but several months have passed since that time, so obviously a great many things have changed. This article will therefore focus specifically on these changes as well as provide investors with an updated analysis of the fund's financial condition.

About The Fund

According to the fund's webpage, the Gabelli Global Utility & Income Trust has the stated objective of providing its investors with a high level of after-tax total return. That is not particularly surprising considering that this is an equity fund. In fact, the webpage specifically states that it is an equity fund:

The Gabelli Global Utility & Income Trust is a non-diversified, closed-end management investment company whose investment objective is to seek a consistent level of after-tax total return for its investors with an emphasis on tax-advantaged dividend income. Under normal market conditions, the fund invests at least 80% of its assets in equity securities and income-producing securities (such as governments) of domestic and foreign companies involved in the utilities industry and other industries that are expected to pay dividends periodically.

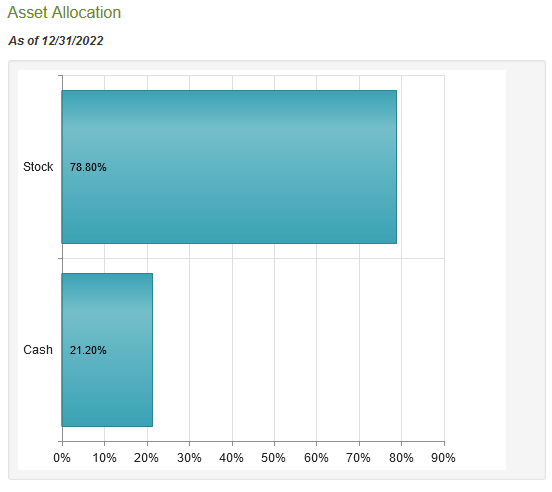

We can see that the fund directly states that it invests at least 80% of its assets in equity securities. Notably, it does not specifically exclude that fixed-income securities will also comprise a significant amount of the portfolio since those can be considered "income-producing securities." However, the portfolio's actual composition right now consists solely of common stock and cash:

CEF Connect

This is somewhat surprising as the fund does not have 80% of its portfolio invested as described above, although it is fairly close. Then again, it is possible that current market conditions do not exactly match the fund's definition as normal. After all, the Federal Reserve and other central banks around the world have never raised interest rates as aggressively as we have seen over the past year. Nor were interest rates in most of the Western world kept at 0% for more than a decade prior to the rate-hiking cycle. As I have mentioned a few times in the past, the 2010s were a "free money" era in which all financial risk was essentially removed and saving punished so everyone was simply putting money into anything that had any chance of producing a profit. This shows up in the very high market valuations that we saw (and continue to see in some sectors), low yields in traditional income sectors like utilities and high valuations being assigned to digital assets and companies that are dependent on issuing stock or debt just to pay their bills. While some of the excesses of this era diminished last year as money stopped being freely available to everyone, the economy does remain oversupplied with cash so the fund may be trying to protect itself or be prepared for opportunities that will emerge in the event of another market collapse.

It is certainly possible that we will see a near-term market collapse. As various analysts have mentioned, the resolution of the debt ceiling stand-off in the United States will likely be a downside catalyst here. Once the debt ceiling is increased, the Treasury is expected to increase its general account to $550 billion by the end of June. That is nearly a $500 billion increase from today's level of $57 billion. This would require a significant amount of new Treasury securities issuance, which would remove a massive amount of liquidity from the market as investors sell stocks to raise the money to purchase these equities. While this would likely only be a short-term event, it would almost certainly push stocks down for at least a month or two. The Gabelli Global Utility & Income Trust could be able to take advantage of such a decline with its large cash balance.

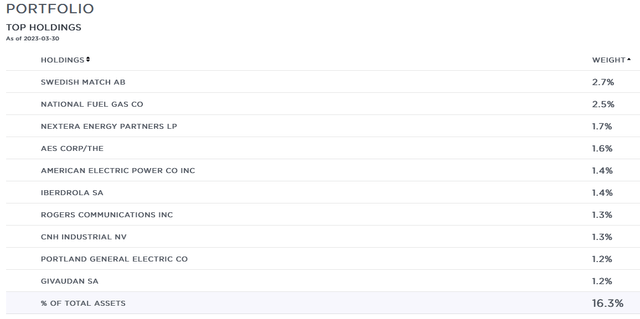

As my regular readers are no doubt well aware, I have spent a considerable amount of time and effort discussing various utilities on Seeking Alpha over the past few years. Admittedly, my articles have been largely limited to American utilities, but the largest positions in the fund will probably still be familiar to most of you. Here they are:

I have discussed several of these stocks, including NextEra Energy Partners (NEP), The AES Corporation (AES), American Electric Power (AEP), and Portland General Electric (POR). However, there are several companies here that I have not discussed. For the most part, this would be the foreign companies on the list, which comprise a surprisingly large number of the fund's holdings. This is not really surprising though, considering that many foreign stocks have higher yields than American ones and this fund is focused on producing an income for investors.

The non-American stocks on the fund's list are still mostly utilities or similar companies. This is important because utilities have many of the same characteristics no matter where they are located in the world. The most important of these characteristics is that they have remarkably stable cash flows regardless of the conditions in the broader economy. This is because most people consider utility services to be critical for modern life. After all, how many people in modern society in any nation do not have electric service to their homes and businesses? Rogers Communications (RCI) is similar since most people with Internet and phone service to their homes could not imagine life without it. These are all things that people take for granted and will be greatly missed if they do not have them. As such, most people will prioritize paying their utility bills ahead of just about anything else during times when money gets tight. This makes utilities generally very recession-resistant, which is important for any risk-averse investor. After all, the United States is showing signs of potentially falling into a recession in the near future but that is not the case with every country. However, as investors in this fund, we will not really need to worry about that because few of these companies will actually be affected by a recession.

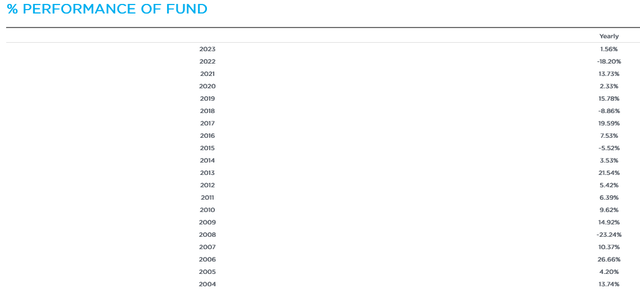

The largest positions in the Gabelli Global Utility & Income Trust are generally the same as the last time that we looked at this fund, although some of the weightings have changed. That could easily be caused by one stock outperforming another in the market though and is not necessarily indicative of the fund actively attempting to change its portfolio. As such, we might assume that this fund has a very low turnover. That is certainly the case, as the fund only had a 6.00% annual turnover last year. This is the lowest turnover that I have ever seen for any closed-end fund. It is in fact pretty close to what some index funds would have. The reason that this is important is that it costs money to trade stocks or other assets, which are billed directly to the shareholders of the fund. This creates a drag on the fund's performance and makes management's job more difficult because the fund's management needs to generate sufficient returns to overcome these extra costs as well as have enough left over to provide a satisfactory return to the shareholders. This is something that very few management teams accomplish on a consistent basis, which is the biggest reason why most actively-managed funds underperform their benchmark indices. For its part, the Gabelli Global Utility & Income Trust has delivered mixed performance over the years:

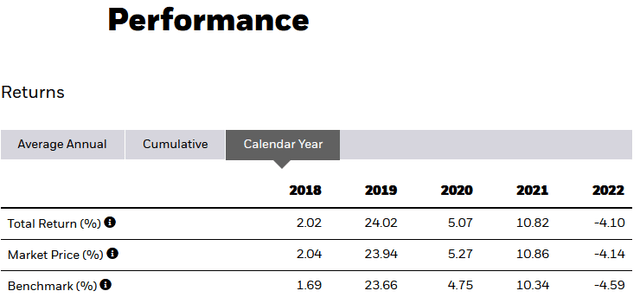

There are some very strong years here, but also a few disappointing ones. Unfortunately, we do not have a perfect index to compare to the fund, and the fund manager does not provide a benchmark index for this fund. The global utility index outperformed the Gabelli fund in 2022 but greatly lagged it in 2021:

The global utility index generally outperforms the Gabelli Global Utilities and Income Fund:

| Calendar Year | GLU Performance | JXI Performance |

| 2022 | -18.20% | -4.10% |

| 2021 | 13.73% | 10.82% |

| 2020 | 2.33% | 5.07% |

| 2019 | 15.78% | 24.02% |

| 2018 | -8.86% | 2.02% |

Thus, it overall appears that the global utility index is generally a more conservative pick. The Gabelli fund is more aggressive and has the ability to deliver strong outperformance in raging bull markets, as it did in 2021. However, there was also a very strong bull market in 2019 and the Gabelli fund underperformed the index by quite a lot. It is important to keep in mind that this is not a perfect comparison as the Gabelli Global Utilities & Income Trust contains companies such as Swedish Match (OTC:SWMAY) that are not utilities and have a much higher yield than the index, so it is intended for a different sort of investor. I will admit that I am not particularly impressed by the performance of the closed-end fund, though.

Leverage

As I stated in the introduction to this article, closed-end funds such as the Gabelli Global Utility & Income Trust have the ability to employ certain strategies that have the effect of boosting their yields well above anything else in the market and even above the yields of their underlying assets. One of the methods through which this is accomplished is the use of leverage. In short, the fund is borrowing money and using these borrowed funds to purchase stocks and other income-producing assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage because that would expose us to too much risk. I do not usually like to see a fund's leverage exceed a third as a percentage of its assets for this reason. Unfortunately, the Gabelli Global Utility & Income Trust is currently above this level as its levered assets comprise 39.62% of the portfolio as of the time of writing. This is quite a bit higher than I really like to see, and it implies that this fund is running a fairly high-risk, high-reward strategy. This could somewhat reduce the fund's appeal among more conservative investors. It is also one reason for the volatility of the fund's returns that we saw earlier.

Distribution Analysis

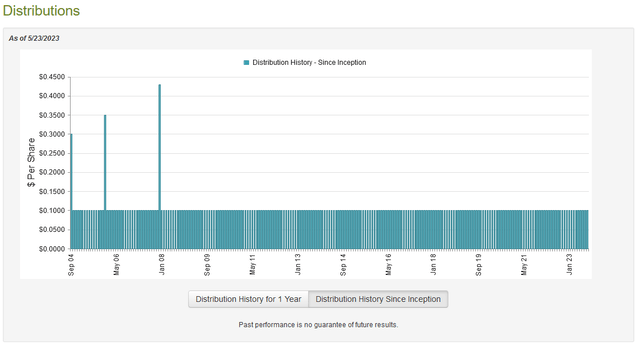

One of the biggest reasons why investors purchase shares of utility companies is because these stocks tend to have higher yields than many other things in the market. This comes from the fact that utilities are generally monopolies with specific service territories and limited growth potential. Thus, the market does not assign them high growth multiples nor do their earnings grow at a rapid rate that is conducive to capital gains. In order to provide the investors with an acceptable total return, utilities have usually opted to pay out a high percentage of their cash flows to common shareholders in the form of a dividend. The Gabelli Global Utility & Income Trust purchases stocks in these companies and other income-producing assets that have similar characteristics, such as telecommunications companies or tobacco companies. It then applies a layer of leverage to boost its effective portfolio yield beyond that possessed by any of the stocks. Thus, we can assume that the fund itself would have a very high dividend yield. This is indeed the case as the Gabelli Global Utility & Income Trust pays out a monthly distribution of $0.10 per share ($1.20 per share annually), which gives it an 8.91% yield at the current share price. The fund has been remarkably consistent with its distribution, as it has paid out the same amount for many years now:

This is one of the longest histories of stability of any closed-end fund and it certainly reflects well on the fund's stated strategy of investing in companies that enjoy remarkable financial stability over time. The fund's track record will also undoubtedly appeal to any investor that is seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. However, it is still important that we investigate the sustainability of the fund's distribution as it seems rather strange that this fund has managed to accomplish a task that many of its peers have failed to accomplish.

Fortunately, we do have a relatively recent document that we can consult for this purpose. The fund's most recent financial report corresponds to the full-year period that ended on December 31, 2022. As such, it will not include any information about the fund's performance so far this year, but it will provide us with a great deal of information about how well the fund navigated the extremely challenging market conditions of 2022. During the full-year period, the Gabelli Global Utility & Income Trust received $3,628,953 in dividends (net of foreign withholding taxes) and $431,297 in interest from the assets in its portfolio. This gives the fund a total investment income of $4,060,250 over the period. The fund paid its expenses out of this amount, which left it with $2,723,892 available for the shareholders.

This was, unfortunately, nowhere close to enough to cover the $6,807,576 that the fund paid out in distributions during the period. At first glance, this is likely to be concerning as the fund's net investment income was clearly not enough to cover the distributions.

However, the fund does have other means through which it can obtain the money that it needs to cover the distribution payment. For example, it might be able to earn sufficient capital gains that can be paid out to the investors. The fund, unfortunately, failed at this task in 2022, which is not particularly surprising. To its credit, the fund did have net realized gains of $2,865,647 but this was more than offset by $23,637,499 net unrealized losses. The fund also paid out $2,461,586 to the preferred stockholders, offsetting nearly all of the net realized gains. Overall, its assets declined by $18,100,641 after accounting for all inflows and outflows during the period. The decline would have been much greater, but the fund issued $9,463,248 in new shares. That will make it even harder for the fund to sustain the distribution at the current level, as it will increase the total payment but the fund still has fewer assets upon which it can earn a return. There could be reasons to believe that it will be forced to cut the distribution in the near future.

Valuation

It is always critical that we do not overpay for any assets in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the Gabelli Global Utility & Income Trust, the usual way to value it is by looking at the fund's net asset value. The net asset value of a fund is the total current market value of the fund's assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain them at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund's assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of May 23, 2023 (the most recent date for which data is available as of the time of writing), the Gabelli Global Utility & Income Trust had a net asset value of $15.56 per share but the shares traded for $13.37 each. This gives the fund's shares a 14.07% discount to net asset value at the current price. This is quite a bit better than the 10.59% discount that the shares have had on average over the past month. Thus, the price appears to be acceptable right now and the market could be pricing in a potential distribution cut, which is nice.

Conclusion

In conclusion, the Gabelli Utility & Income Trust is one of the few closed-end funds that provide exposure to global utilities, which could prove appealing today. After all, utilities tend to enjoy remarkably stable cash flows regardless of conditions in the broader economy, and economic conditions are somewhat uncertain right now. Unfortunately, the fund appears to be running a rather aggressive strategy that could reduce its appeal among more conservative investors and appears to be overdistributing. Fortunately, the market looks to be pricing in a distribution cut, so Gabelli Global Utility & Income Trust might still be worth considering.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was originally published to Energy Profits in Dividends on the morning of May 24, 2023. Subscribers have had since that time to act upon it.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.