Ford: High Pessimism Creates A Fantastic Buying Opportunity

Summary

- Ford buyers returned over the past few weeks to help support strong dip buying sentiments. Buyers are not ready to give up yet.

- Ford's Capital Markets Day event demonstrated its conviction to lead the EV transformation. In addition, Ford's EV segment has strong support from its legacy segment.

- F's valuation is not aggressive, suggesting investors are still pessimistic about its transformation. Momentum buyers are likely still waiting on the sidelines for more clarity.

- Investors with high conviction over Ford's EV transformation should see the risk/reward attractive at the current levels.

- We're currently running a sale for our private investing group, Ultimate Growth Investing, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Vera Tikhonova

In my previous update on Ford Motor Company (NYSE:F), I urged investors to try "avoiding catching the falling knives" in F stock. However, dip buyers refused to give up, likely seeing the potential in Ford's transformation plans.

Ford held its Capital Markets Day this week, as CEO Jim Farley & his team assured that the company is ahead of its electrification plans. In addition, the company provided helpful milestones for investors to assess, seeing a huge potential for earnings accretion through 2026.

Investors new to Ford should not rule out the criticality of its internal combustion engine or ICE segment (Ford Blue), which posted a segment-adjusted EBIT margin of 10.4% at its Q1 earnings release in early May.

It's essential to help fund the company's transition into EVs, as Ford focuses on higher-margin lineups while cutting down structural costs. However, Ford Blue's execution risks shouldn't be understated, as management reminded investors that "net pricing on ICE vehicles is expected to decrease." In addition, the company added cyclical headwinds normalizing average transaction prices, and the "growth of EV adoption" could add more pressure on Ford Blue.

As such, I believe management was astute in highlighting several efficiency gains as the company restructured its legacy segment. The company reminded investors that Ford Blue would focus on "what it does best: trucks, large SUVs, and commercial vans."

The company believes that such a focus will help it mitigate the highly competitive segments that could attract more intense price competition moving ahead. Farley highlighted that Ford sees "less price competition in these segments compared to the two-row crossover market." As such, it could avoid debilitating discounting that could complicate the economics of its transformation plans.

In addition, the company is also focused on reducing the structural costs in its legacy segment. Farley stressed that the company aims to "eliminate costs at the core of [Ford's] industrial system." With that in mind, Ford is confident it could lead to a low-double-digit adjusted EBIT margin for Ford Blue by 2026.

In addition, Ford expects its Ford Pro commercial business to provide critical support for its profitability through 2026. Ford Pro delivered an adjusted EBIT margin of 10.3% in Q1. Management expects Ford Pro to post an FY26 adjusted EBIT margin in the mid-teens.

Notably, Ford sees significant potential in Ford Pro as a "$50 billion revenue business." In addition, management regards the segment as a "secret weapon due to its intersection of hardware, software, and services."

As such, it's expected to provide additional support for the growth and success of Ford Model e (the company's EV segment). While it's expected to deliver an adjusted EBIT margin of 8% by 2026 (the lowest of all three segments), it's the company's future. Based on the company's expectations of a $3B segment loss for 2023, Ford sees significant potential for Model e in margins accretion, supporting the company's target of a total adjusted EBIT margin of 10% by 2026.

However, Model e is also the segment that could make or break the company's profitability, given the structural decline in ICE vehicles over time. As such, it also attracted interesting questions from analysts at the recent company event, as analysts assessed the viability of Ford's optimistic outlook.

It's important to note that Ford's FY26 outlook for its EV segment is driven by the volume modeling of achieving an annualized exit run rate of between 1.2B to 1.3B. It's a highly aggressive assumption over the next three years, which Farley is confident about its competitiveness by "offering differentiated features and software."

I think it's still too early to assess whether the transition to Model e will succeed as the auto industry dynamics continue to evolve. Hence, it's critical to reflect significant execution risks in Ford's transformation and consider buying aggressively only when F is assessed to be significantly undervalued.

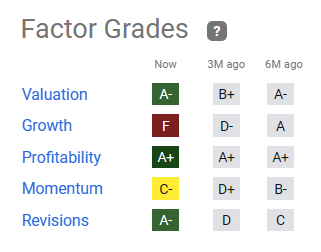

F quant factor ratings (Seeking Alpha)

Seeking Alpha Quant updated rating shows that F's valuation has improved to an "A-" grade. Therefore, I assessed that investors considering adding more at the current levels should have a reasonable margin of safety, as the market remains skeptical about Ford's transformation plans.

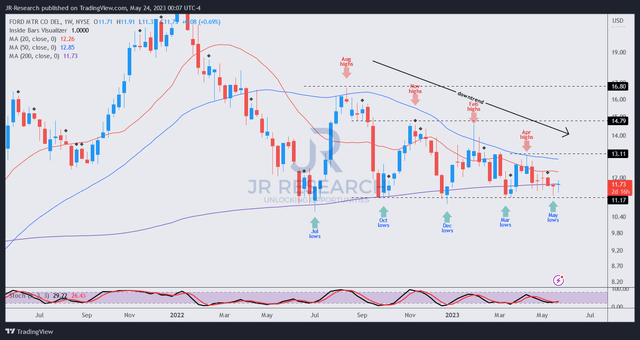

F price chart (weekly) (TradingView)

I cautioned investors in my previous update that F is mired in a medium-term downtrend that it needs to break away from to attract momentum investors back.

Despite that, dip-buying sentiments remained robust over the past few weeks, suggesting dip buyers are still confident about bolstering F's pullback at the $11 level.

Hence, the risk/reward profile remains constructive at the current levels for holders to add more positions. However, it's still crucial for F buyers to demonstrate stronger conviction to help it break out of its downtrend bias. High-conviction investors should view the current levels as attractive while the market remains pessimistic.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for Technology, Software, and the Internet.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore and currently holds the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.