Accenture: No Upside Potential With Low Dividend Yield

Summary

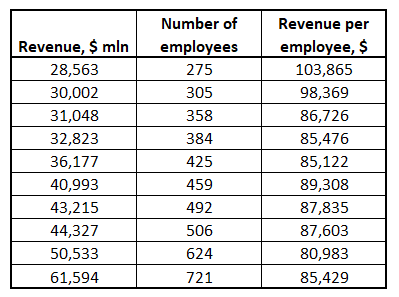

- Accenture has been demonstrating solid financial performance over the long term but on a per-employee basis, efficiency was not as good if we dig down to the details.

- Currently, the company is navigating a challenging environment and remaining on the revenue growth path.

- My valuation analysis suggests the stock is fairly valued with almost no upside potential.

- Given the numerous risks of consulting firms, I believe that the risks outweigh the potential benefits here.

Justin Sullivan

Investment thesis

Accenture plc (NYSE:ACN) is one of the leading global consulting firms which delivered solid financial performance over the last decade from a high-level perspective. On the other hand, revenue per employee declined over the last decade, which for me, indicates that it becomes much harder to fuel further growth. The company's business is also cyclical, which is not good from potential investors' point of view in the current harsh environment. Moreover, my valuation analysis suggests almost no room for the stock price's upside in the near term.

Company information

Accenture is a Dublin-based global management consulting, technology services, and outsourcing company. The two main lines of business are consulting and outsourcing.

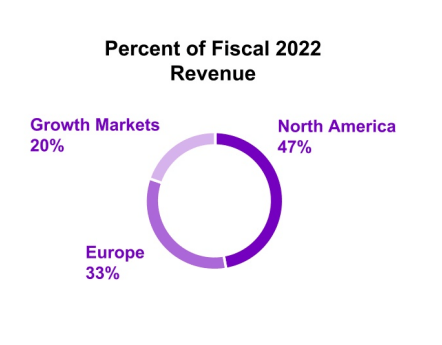

The company's fiscal year ends on August 31st of each calendar year. The company's reporting segments are represented by geographic areas, with North America comprising almost half of the company's sales.

Accenture's latest 10-K report

Financials

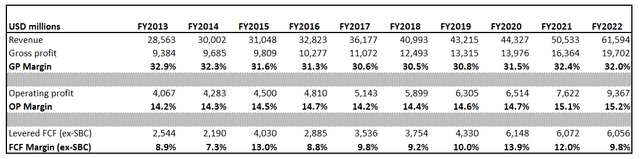

Accenture delivered solid financial performance over the last decade with both gross and operating margins being very stable. Free cash flow [FCF] margin with stock-based compensation [SBC] deducted has been relatively volatile though, but generally expanding.

"Why did not margins expand given the revenue doubling over the decade?" might be a very fair question. The reason is quite simple if we dig a little deeper. Despite steady growth over the last decade, on the other hand, I would like to underline that the revenue per employee metric declined significantly over the decade. That might indicate that the company lacked efficiency in managing growth.

Compiled by the author based on Seeking Alpha

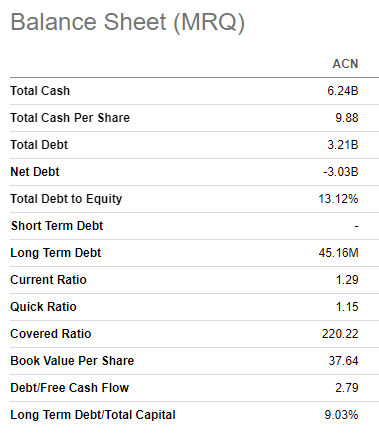

The company pays out dividends to shareholders, though a forward dividend yield of 1.5% does not look attractive, especially in the current high rates and high inflation environment. Apart from dividends, Accenture returns money to shareholders via share repurchases. Over the last decade, the company returned to shareholders more than $28 billion as a stock buyback. This would have been impossible if the company's balance sheet was not strong. The company is in a confident net cash position with strong liquidity ratios and almost no debt compared to total capital.

Seeking Alpha

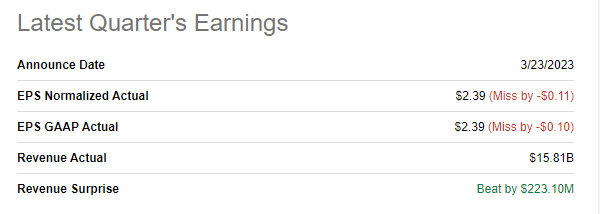

The company missed consensus earnings estimates last quarter, the results were announced on March 23. Despite the current demanding macro environment, the company was able to deliver an increase in revenue both YoY and sequentially.

Seeking Alpha

In local currency, revenue grew by 9% and 5% in the U.S. dollars. All geographic markets demonstrated growth on a local currency basis with growth markets outpacing North America and Europe.

The management is quite optimistic regarding near future prospects. For fiscal 3Q23, Accenture guided for revenue of $16.1-$16.7 billion, which would be up 3%-7% annually in local currency. Management has narrowed its FY23 revenue growth forecast to 8%-10% in local currency from a prior 8%-11%. The current environment is tough and it is a good sign that the company remains on a modest growth trajectory. Though, the company's major markets are North America and Europe where most developed countries nowadays face a high probability of entering into recession.

Valuation

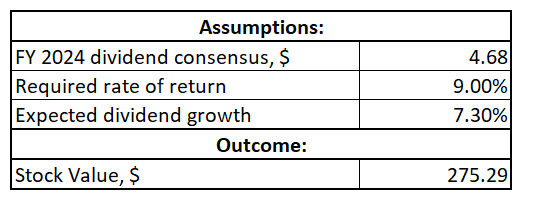

Accenture pays shareholders' dividends so I can do both dividend discount model [DDM] and discounted cash flow [DCF] approaches for valuation. As a discount rate, I will use WACC provided by valueinvesting.com and round it up to 9%.

I have dividend consensus estimates, and for DDM, I use FY 2024 forecast at $4.68 per share. Dividend growth 3-year CAGR seems to be reasonable to use in my opinion, which is at 7.3%, according to Seeking Alpha Quant dividend growth metrics.

Author's calculations

Based on the above assumptions, the DDM formula returns me approximately $275 as a stock fair value, which is about 5% lower than the current share price indicating a slight overvaluation.

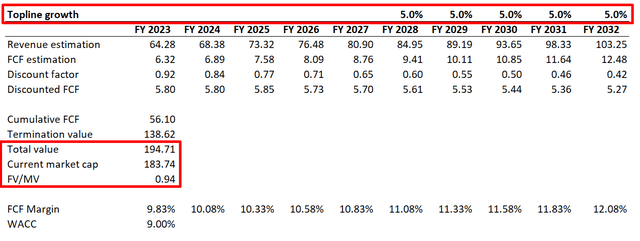

Now, let me cross-check my DDM calculations with the help of the DCF approach. For revenue growth over the next decade, I mix consensus estimates for years up to FY2027 and my estimation of 5% revenue CAGR for years beyond FY 2027. For FCF margin, I use the latest available full-year FCF ex-SBC margin, which is 9.83%, and expect it to expand by 25 basis points yearly.

Incorporating all assumptions into the DCF template gives me a fair value of the business at about $195 billion, which is about 5% higher than the current market cap. Contrary to DDM, the DCF approach suggests the stock is slightly undervalued.

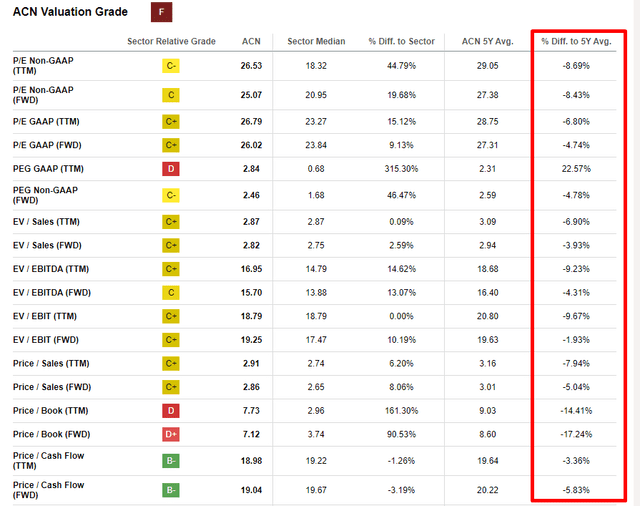

Let me also look at the multiples to get additional evidence. According to Seeking Alpha Quant valuation grades, Accenture has the lowest possible "F" grade. But it is due to a significant premium compared to the sector median. But here I would argue that Accenture is a uniquely profitable company in its niche, so I consider premium fair. Therefore, I compare ACN's current valuation ratios to 5-year averages, which would be more appropriate.

As you can see in the rightmost column of the above table, current multiples are mostly lower than 5-year averages, which indicates undervaluation. On the other hand, discrepancies are mostly single digits. I consider these discrepancies insignificant.

Overall, I believe the current stock price is within the fair value range, closer to the upper edge. I think there is little upside potential from current levels in the near term.

Risks to consider

Apart from apparent cyclicality, as a consulting firm, Accenture faces numerous risks. In the consulting business, employees are the main assets. Therefore, it is crucial to manage each employee's efficiency and utilization. The management needs to be strong in forecasting personnel needs to maximize shareholder value. As we saw in the "Financials" section above, revenue per employee declined notably over the last decade. I consider dropping the topline per employee metric as a risk and a red flag for potential investors.

Another risk inherent to a consulting firm such as Accenture is that it is the business of vague deliverables. It may lead to disputes and even lawsuits with clients like there were between Accenture and Hertz. Such litigations are usually immaterial in terms of unexpected costs, but they might be harmful to the reputation, which is crucial in the consulting business.

Another risk Accenture faces as a consulting firm is relatively low barriers to entry. The company's competitors are strong and experienced like Cognizant (CTSH) and IBM (IBM) in consulting. For the second line of service, outsourcing, the company faces fierce competition from India-based firms like Infosys (INFY).

Bottom line

Overall, I give ACN stock a neutral rating. The stock is currently fairly valued with almost no upside potential, and the dividend yield does not look attractive in the current high-interest rates environment. Investors should also beware of the declining revenue per employee metric, which is crucial given the nature of Accenture's business.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.