Medical Properties Trust Got A Base Hit

Summary

- Medical Properties Trust, Inc. tenant Prospect Medical Holdings Inc. appears to have successfully reorganized.

- Partial lease payments will resume in September.

- The planned sale of some Prospect assets will be completed later in the fiscal year.

- Medical Properties Trust management guidance continues to be solid.

- Management appears to be well on their way toward resolving a lot of market-perceived issues.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Ninoon

(Note: This article is in the newsletter on May 24, 2023.)

Medical Properties Trust, Inc. (NYSE:MPW) has reported solid progress with their list of challenges in the current fiscal year. This is a management that has consistently given fairly reliable guidance for as long as I have followed them. I have long stated that managements that "hit a lot of singles and doubles" have the best chance for an investment homerun.

This management appears to be well on their way to resolving a lot of market-perceived issues. As long as the progress continues, then there will be a time when management can get back to the business of building a still larger more valuable company. That is when an investment homerun becomes a very realistic goal.

The latest news was that Prospect Medical completed roughly $375 million of new financings. The asset-based line was paid off and replaced with the new financing.

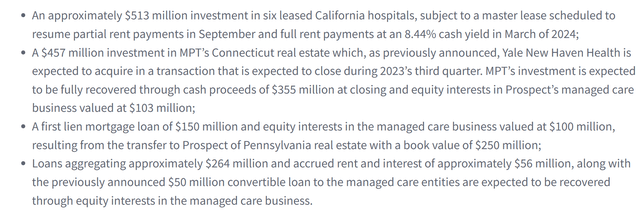

In addition:

Medical Properties Trust Prospect Medical Holdings New Loan Structure And Equity Interests (Medical Properties Trust May 23, 2023, Press Release)

The resumption of partial rent payments in September will increase the distribution coverage that has been a short target of late. That distribution coverage will receive another coverage boost when full payments resume in fiscal year 2024.

Now it is true that some of the claims have become equity in the business of managing hospitals. But that is to be expected when a situation like this arises. Should Prospect management succeed in building the business as planned, then those equity holdings could become fairly valuable.

Probably the big deal is that all the horror stories floating around about the situation have pretty much been debunked. Instead of a worst-case scenario (or much worse than that), there is a very reasonable solution that demonstrates yet again that management chose properties wisely and reasonably valued the properties (and business) before getting involved.

There have long been stories about management overpaying or not having an interest of sufficient value through the lease despite the results like the current situation that really demonstrate otherwise. As these results continue to be achieved, the bear case for insufficient interest keeps coming undone.

Given all the misinformation that competes with accurate information, investors should probably wait for the second quarter 10-Q to come out before making any conclusions about the outcome of this situation. However, it does appear that MPW management can now put the Prospect issues in the "resolved" column so that management can now tackle more issues.

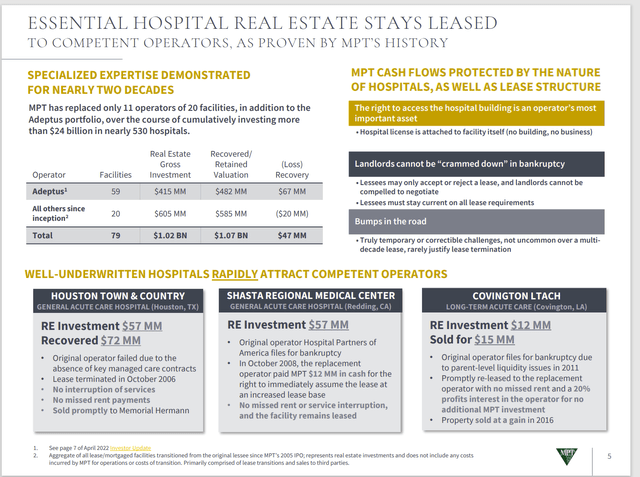

Medical Properties Trust History Of Operators Filing Bankruptcy (Medical Properties Trust August 2022, Investor Presentation)

The Prospect resolution seems to fit well with the other cases cited by management above. Medical Properties Trust appears to have an outcome similar to what is noted above. In this case, Prospect was not replaced, although some of the hospitals were sold to aid in the refinancing process.

Overall, Medical Properties Trust clearly did not suffer a major loss, nor was the company in any danger at any time in the process. This is in sharp contrast to all the fears evident when it was announced that Prospect was seeking refinancing. That announcement led to a common stock price slide. Clearly, that reaction was overdone.

The bears still think they have a chance, as Steward still has to refinance and has an advisor to help it get that accomplished. However, so far, that situation actually looks pretty normal. Plus, the hospital industry is doing much better than it was back in fiscal year 2020. Lenders tend to care a lot about "now." Therefore, Steward is likely to get the refinancing it seeks.

I have probably followed at least a dozen companies to bankruptcy. Not a single one was ever pushed into bankruptcy by a secured lender. The reason is that most secured lenders hope that they get the assets back during a time of inflation because then the lender can recover the inflation effects far better "going forward."

It is far harder to predict inflation and get it accepted into the contract when interest rates are low, and everyone is predicting low rates well into the future. It can be done, and some managements do actually put in the lease good inflation coverage. However, generally when a property comes back during an inflationary period, it usually re-leases for a greater amount than was the case before a bankruptcy. Because of this factor, bankruptcy is rarely a threat to a company like this one that holds leases and collects rent.

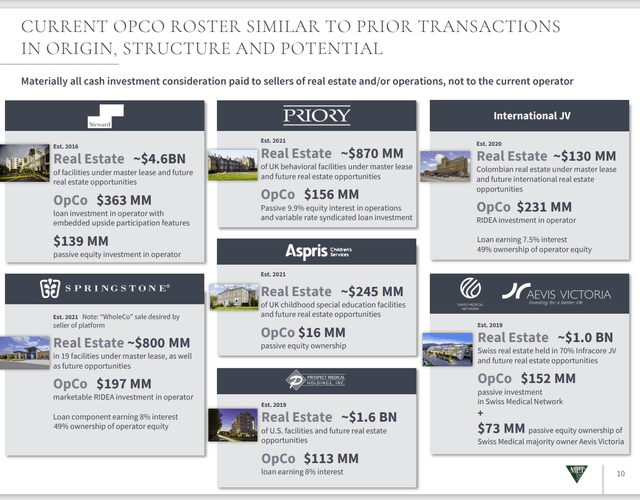

Medical Properties Trust Investment Position Summary (Medical Properties Trust August 2022, Investor Update)

Notice that the equity interests are relatively small compared to the whole business. Management long ago noted that an equity loss would be a relatively small loss if it happened. On another slide, it has been noted that, so far, the equity investments are profitable.

Probably the biggest deal so far has been a shift in attention from the profits made in the past to whether or not the money for the equity investment went directly to the entity issuing the equity. Management states elsewhere in the presentation that is rarely the case. This most likely refers to equity taken as part of the overall deal that results in a new lease.

In the current case, Prospect was basically reorganizing itself outside of bankruptcy. It is not that unusual for some of the loans to convert to equity in the post reorganized company. Even in the case of Prospect, the equity investment is relatively low.

Key Ideas

Throughout the whole short attack, Medical Properties Trust, Inc. management has given some pretty solid guidance. The latest evidence of that is how the company fared in the Prospect situation. Management got the company through the whole Prospect adventure in relatively good shape.

If there are losses to be booked, then those losses will be booked in the second quarter of the fiscal year. Cash flow effects (which can vary from losses reported considerably) have yet to be fully accounted for.

Any business will from time to time report some losses. It is part of the business. The key here is not to have company-destroying losses. Management appears well on the way to achieving that goal.

It does appear that management did participate in critical assets for which there will always be a market. As long as that continues, then investors have nothing to fear. The big risk is that management made a fatal error or (worse yet) stopped doing that due diligence that has made the company so successful. So far, there is no evidence of anything close to that.

Instead, it would appear that management understands its business very well and has the shareholders well-covered. The hospital industry itself is well on the road to recovery from fiscal year 2020. As the challenges of that year fade into the past, there will be less reason for the shorts to pay attention to the stock.

At that point, Medical Properties Trust, Inc. stock is likely to stage quite a recovery. In the meantime, MPW stock is a strong buy consideration because an investor is paid generously to wait through the high dividend yield. That high dividend does indicate increased risk in Medical Properties Trust, Inc. stock. But the Prospect settlement will soon be decreasing at least some of that elevated risk. At some point, MPW stock will be re-rated by the market for a greater level of safety that appears to have prevailed throughout the short attack.

As a side note, banks generally charge a fee for nonconformance and at a certain point raise the interest rate. Bank financing is rarely the issue that some stories have made it out to be. Banks love to make money, so if something is "out of whack" they charge a fee and occasionally more interest and then the whole process keeps going. I have yet to see a bank push a company the size of Medical Properties Trust, Inc. into bankruptcy or even threaten to not renew a bank line.

I analyze oil and gas companies, related companies, and Medical Properties Trust in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.