Luminar: Rapid Growth Ahead

Summary

- Luminar Technologies, Inc. reported a big Q1 2023 beat, with revenues hitting a crucial milestone.

- The Lidar sensor company continues to guide to 100%+ growth in the years ahead after hitting 112% during Q1.

- Luminar Technologies stock remains cheap while trading below 1x the forward order book, considering the massive opportunity ahead.

- Looking for a portfolio of ideas like this one? Members of Out Fox The Street get exclusive access to our subscriber-only portfolios. Learn More »

JHVEPhoto

Despite all of the great news, Luminar Technologies, Inc. (NASDAQ:LAZR) continues to trade near all-time lows around $6. The Lidar sensor company is quickly headed towards production ramps, with multiple vehicles and sales growth set to top 100% for several years ahead, yet the stock won't rally. My investment thesis remains ultra Bullish on the stock, with investors now able to buy alongside insiders.

Source: Finviz

Rapid Luminar Growth Is Here

For Q1 2023, Luminar reported revenues of $14.5 million for 112% growth. A key aspect of the $2.6 million revenue beat for the quarter is that the Lidar sensor company finally reported a material step up in quarterly sales.

A big problem for the sector is that a handful of companies came public via SPACs over the last couple of years, but most of the companies reported quarterly revenues in the $1 million or less range. Even worse, Velodyne Lidar, now owned by Ouster, Inc. (OUST), reported large revenues, but the revenues were declining. The end result was a sector not projecting the future very well to Wall Street despite all of the promises for massive growth.

Luminar has altered this view with its Q1 revenue approaching $15 million while guidance for Q2 is $15 to $17 million. The 2023 revenue target was kept at at least 100% revenue growth leading to a target in excess of $80 million.

The importance here is that the targets suggest Luminar Technologies, Inc. must average $24 million in revenues per quarter in the 2H of the year. A leader in the Lidar sensor sector will start reporting quarterly revenues no longer at the peanuts level, likely bringing more attention from investors.

Luminar has several prime reasons to be very confident in a large revenue ramp that could easily be far in excess of the 100% growth now targeted. A prime example was this statement on the Q1'23 earnings call by CEO Russell:

...so for context of the now more than 20 production vehicle models Luminar is designed into, the majority are also slated for the China market.

While the company constantly announces high level customer engagements, Luminar actually placed the vehicle models with Luminar designed into the car at 20. One of the prime deals kicking off implementation of Lidar in a production vehicle is the AB Volvo (publ) (OTCPK:VOLVF) EX90 vehicle including the Iris sensor as an additional feature of ADAS. Though the vehicle production was delayed, the CEO highlighted the strong initial orders for the vehicle as follows:

And one of the recent interesting bits of news is that the Volvo CEO, Jim Rowan has just said on the recent earnings call that preorders for the Luminar X90 had surpassed even the company's boldest and most ambitious internal projections in terms of what the sales were. So they sold out for that initial run that they'll do and then, obviously, you're going to be scaling that up exponentially.

At the Investor Day back in February, Luminar highlighted a projection for the forward looking order book to reach $4.4 billion, up from $3.4 billion at the end of 2022. As noted, some of these deals heading towards production massively changes the equation and ramps up the confidence these future orders turn into reality.

As mentioned in our prior research, the company announcing another production partner was a good indication these deals are legitimate. The TPK deal apparently includes a $20 million investment with an initial plan for producing up to 600K sensors. Considering Luminar just opened a production facility in Mexico, the company expects massive demand growth in the year ahead in order to justify a new production facility, not to mention TPK wouldn't invest cash into the business without confirmation of the rapid growth ahead.

Strong Cash Position

A big key to the public markets is a company having the cash in order to reach a cash flow positive position. A lot of the SPACs failed to raise enough cash from the going public transaction, but Luminar isn't in this position.

During Q1'23, Luminar burned $76 million in cash and ended the quarter with a cash balance of $414 million. The company forecasts cutting the quarterly cash burn in half by year end and ending the year with a cash balance in excess of $300 million.

Once the company gets to 2024, analysts forecast sales surging in the 200% range to top $200 million. The cash burn concern should quickly disappear once sales ramp and these production deals start. Remember, Luminar already has deals with Volvo, Mercedes-Benz Group AG (OTCPK:MBGAF), and Polestar Automotive Holding UK PLC (PSNY) now covering 20 vehicle models already.

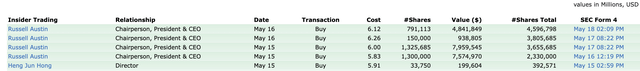

The CEO is apparently so confident in these deals reaching production, he just bought nearly 3.6 million shares. Mr. Russell spent over $20 million on the stock without much media attention and the shares were bought following the Volvo vehicle push out until early 2024.

One reason for the confidence appears the apparent case that Luminar has already landed a deal with Nissan Motor Co., Ltd. (OTCPK:NSANY). Per the CFO at the J.P. Morgan Global Technology conference earlier this week, Tom Fennimore was clear that Nissan plans to utilize the Luminar Lidar in future vehicles, but the amount isn't included in the forward order book due to the lack of a formal agreement with financial targets outlined.

Takeaway

The key investor takeaway is that Luminar Technologies, Inc. stock remains too attractive here at $6 with a market cap of only $2.5 billion. The Lidar sensor company already has a massive and forward order book and the amount should only grow in the years ahead.

Luminar Technologies, Inc. stock doesn't appear cheap at 9x 2024 sales targets, but Luminar will ultimately trade at higher multiples as revenues surge the next few years.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAZR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.