Gartner: I Like The Business, But Not At This Price

Summary

- The company is in a very interesting sector that will be in demand for a long time.

- Everchanging technologies in the world will drive demand for their services if the company manages to keep up to date.

- I can see long-term sustained double-digit growth, with really solid financials to support these assumptions.

- However, it is slightly too expensive for me right now, and I will be patient.

courtneyk/E+ via Getty Images

Investment Thesis

After a very strong first quarter of the year, I wanted to take a look at Gartner’s (NYSE:IT) long-term prospects to see if the company is a good buy for a long-term investor. I argue that the company is very resilient in many different economic outcomes due to its very strong research segment, however, if I was to invest in the company right now, I wouldn’t get a very favorable risk/reward profile, and so I will give it a hold rating until the share price sees a pullback, which is very possible. The upcoming economic downturn sometime in the next year or so might present a better entry point for me.

Briefly on the Company and Q1 Results

Gartner is a research and advisory company that provides information and tools for leaders in IT, HR, finance, legal and compliance, sales, marketing, and many others. It reports three segments in its financials, the main one being by far, the Research segment, followed by Consulting, and a strong comeback of Conferences, which may overtake consulting in the next year.

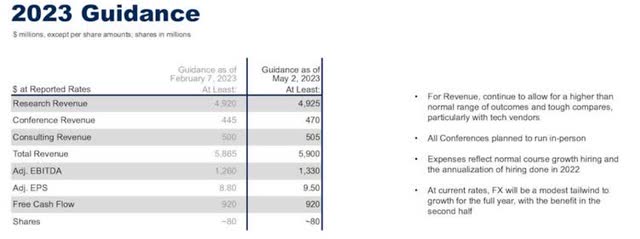

The company beat analysts' estimates comfortably and even raised its '23 outlook in the process. It was slightly surprising to see a drop after the announcement, however, in the last 3 weeks or so the company has been performing quite well and is now above the price it was before reporting quarterly results.

Non-GAAP EPS beat by 78 cents, delivering $2.88 a share. Revenues saw an impressive low double-digit growth of 11.6% y-o-y, delivering $1.41B. There was a slight margin contraction due to the company's aggressive hiring in the last half of the year, which may persist slightly into the next couple of quarters because these new hires will not be performing at their best, but once they do, margins should come back to their usual levels.

Q1 23 Results (Gartner Presentation Slides)

The guidance wasn’t changed too much; however, it is still revised upwards.

Revised Guidance (Presentation Slides)

Outlook Beyond 2023

Research

In my opinion, companies like Gartner will always be in demand for their expertise. The business and technology environments are constantly changing. With the emergence of AI these days which is a big buzzword right now, there will be much more demand for Gartner’s services in research to find what is best practice in the everchanging environment that involves advanced tools and technologies to improve efficiency and streamline business operations. I believe that Gartner is positioned very well in this regard, seeing that they are constantly hiring new talent that will develop as technology develops and will be able to service many executives and their employees to perform at their best.

As the management said in their latest quarter:

“Our business is fueled by our highly talented associates. We have carefully aligned our hiring with recent demand and our long-term opportunity. We are well positioned to drive long-term, sustained double-digit growth.”

I tend to agree with their statement. I don't think the company will ever see lower than double-digit growth in the future since technology and other advancements in the workplace will continue to evolve and if Gartner can keep up with the times, it will be able to capture a lot of that service demand worldwide and take a good chunk of the market share.

Even with high inflation still a problem, it does not seem to affect the company's demand for their services. In Q4 ’22, the management said that they saw no client pushback on their increase in prices, by saying: “We've had, I'd say, essentially zero pushback from our clients on it. And if you look at the cost of Gartner for an individual user or even a contract for the company, it's a small ticket item. And whether it increases by 3% or 7% isn't a swing factor. The swing factor is the value we provide.” Clients are likely not fazed by increases in prices because they probably believe Gartner is providing much better value in terms of efficiencies in operations by streamlining every facet of their business, and that is worth the price.

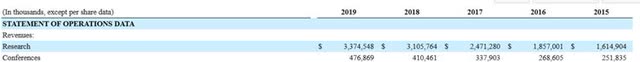

Conferences

The conferences saw over 500% y-o-y increase in revenue for the first quarter of ’23, which is very impressive. I believe that this is just the beginning for this revenue segment as more and more countries begin to ease restrictions of the pandemic. If it wasn’t for the pandemic scare in ’20, I would have expected a steady increase in this revenue as it was visible before COVID. In '19, conference revenues topped out at $476m, while at the end of FY22 revenues have reached $389m, so there is still a way to go, and I don’t see this segment slowing down any time soon.

Conference Revenue growth pre-pandemic (2019 10-K )

I wouldn't be surprised if conference revenues doubled in the next 7 years. In ’19, Gartner held 72 destination conferences, while in ’22, 16 virtual and 25 in-person conferences. If it matches ‘19’s numbers, it will see a nice bump in revenues in my view.

Financials

All of the graphs below will be yearly snapshots of the company up to FY22 because this shows the big picture and the trend of the company’s performance. I will include any relevant numbers from the latest quarter for extra color.

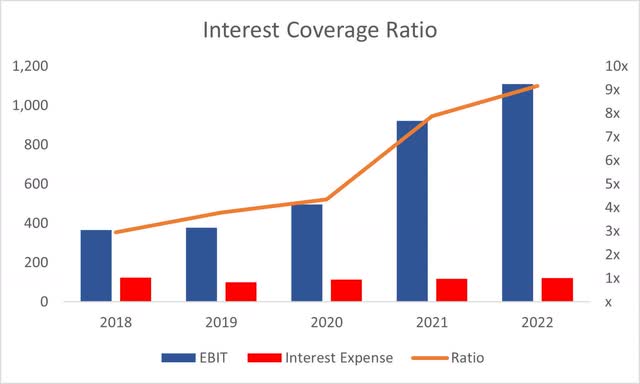

In Q1 '23, the company had $893m in cash and $2.4B in long-term debt, which is the same as it was at the end of FY22. This amount of debt is not a problem at all for Gartner. Annual interest expense is around $121m, which is easily covered by EBIT, as the interest coverage ratio is around 9x. That means the company can cover interest expenses 9 times over. That is a very healthy position to be in.

Coverage Ratio (Own Calculations)

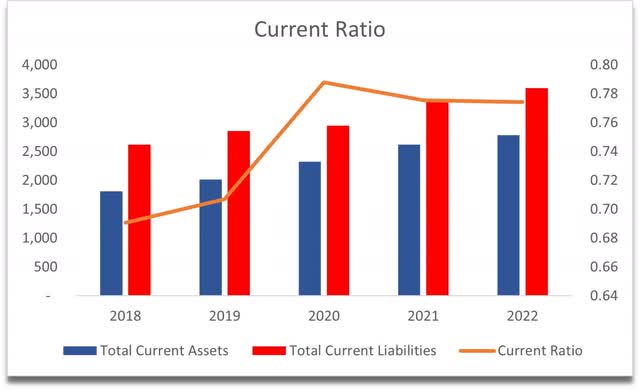

Continuing on liquidity, Gartner’s current ratio could be much better. I would like it to be well above 1.0, however, the company has been operating at a level around .7 This to me would be a red flag, however, due to the company's subscription-based business model, the company has to report unearned income as a deferred revenue under current liabilities of which it had $2.4B at the end of FY22. Since the company’s subscriptions are usually annual, I don’t see the current ratio being a problem in the long run.

Current Ratio (Own Calculations)

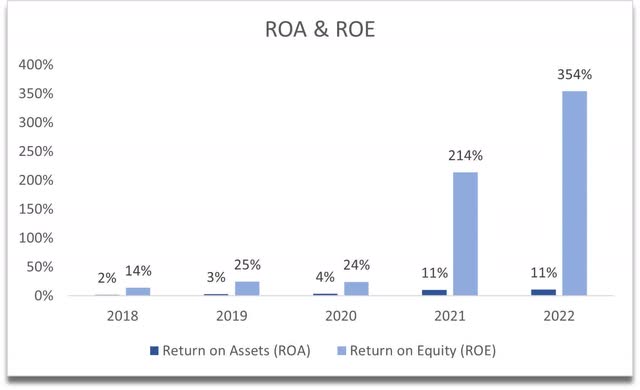

In terms of efficiency and profitability, ROA and ROE are very good. ROE has likely been inflated due to the company’s share repurchases and debt. This may look good on paper, however, artificially inflating EPS and ROE while buying back expensive stock is not the best use of the company’s capital. And I do think the share price right now is quite steep.

ROA and ROE (Own Calculations)

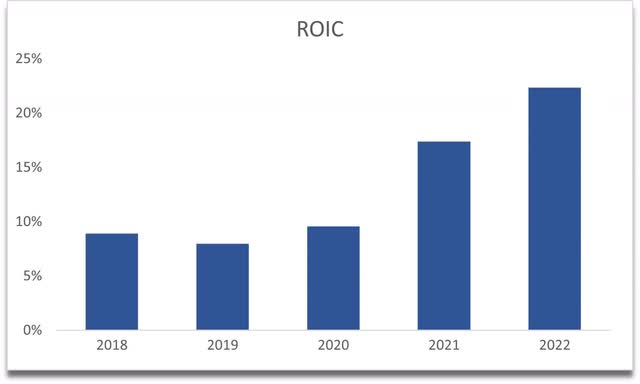

I do like the fact that the return on invested capital is on an uptrend and is well above what I considered to be a good return, which is 10%. The company’s ROIC was at 22% as of FY22. This means that Gartner is very well positioned in the sector it is operating in, has a competitive advantage, and has a very strong moat.

Return on invested capital (Own Calculations)

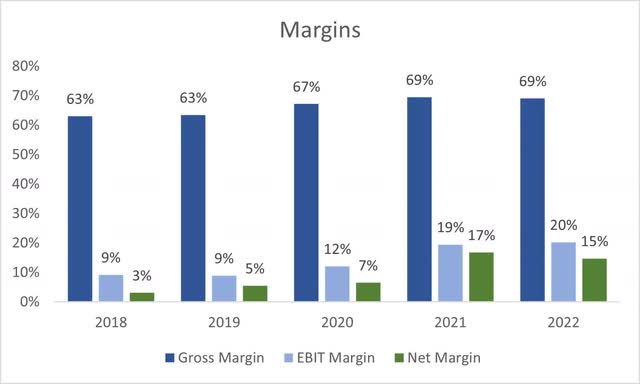

Margins have been on the rise in the last 5 years up to FY22, however, as I mentioned earlier in the article, margins have seen a slight drop because of the aggressive hiring of staff who have not reached their full potential.

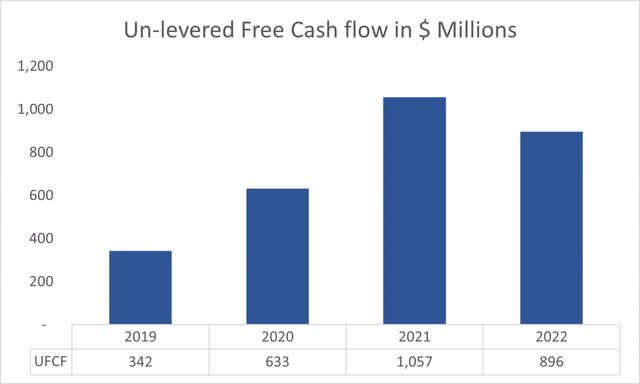

The company has been generating very solid unlevered free cash flow, with a slight dip at the end of FY22, however, it is still very solid.

Overall, the financials of the company look very strong, and I don’t see any issues sticking out that would prevent the company from performing well during the supposed economic downturn in the near future.

Valuation

I like to be conservative when it comes to evaluating a company. Conservative usually means reasonable to me. What I believe is reasonable growth for a company in the long run. That means that most of the time my calculations end up being below what the company is trading at and I'm ok with that because I want to get a better risk/reward profile, which in the long run will turn into better returns.

For the base case, I grew revenues by 13.3% per year on average, which is in line with the management's “long-term, sustained double-digit growth”. I would usually be more conservative, but I do believe that it is very achievable for a company like Gartner to grow at these levels.

For the optimistic case, I went with 17.1% average yearly growth for the next decade, which is very optimistic in my opinion, but I think still within reason. In the conservative case, I went with 9.7% growth. To be honest, looking at these numbers written down like that, they seem very high, however, I’ll stick with them.

In terms of margins, I assumed that the company is going to be able to achieve better profitability and efficiency over the next decade. In the base case I have operating, and gross margins improve over time by 200 basis points, or 2%. On the conservative case, these improve by around 1% over the next decade, while on the optimistic case, these improve by 275bps. The company has improved gross margins and operating margins by around 600bps in the last 5 years, so I think my assumptions are on the conservative side still.

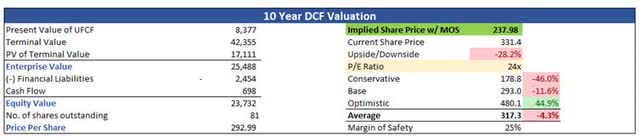

On top of that, I will add a 25% margin of safety to the intrinsic value calculation. With all of that said, I would be willing to pay $237.98 a share for that sort of growth and improvements in profitability, which means that the intrinsic value is around 28% below what the company is trading currently. The company would still be trading at around 24x earnings if it was at $238 a share, which is still high, however, I believe that is a good risk/reward ratio for me.

Intrinsic Valuation (Own Calculations)

Closing Comments

I will not recommend selling the company as it is a very solid business with really good long-term prospects. It is just slightly too expensive for me right now and I will be waiting patiently for it to come back down closer to my intrinsic value calculation. I’d like the risk/reward profile to improve, which I believe it will in the next year or so, once some of that volatility kicks in during the supposed economic headwinds or if the company can improve its FCF and EPS dramatically to where the P/E ratio comes back down organically without the stock every coming down.

Nevertheless, I have a price alert set at around $250 a share which is very close to my buying price, and I will reassess when the time comes to see if it is still an attractive business to invest in in the long run, which I think it will be.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.