Palo Alto Networks Rises On Q3 Results: GAAP Margins To Expand

Summary

- Cybersecurity operator Palo Alto Networks was rising after solid earnings results.

- The company delivered strong revenue and billings results and continued to drive margin expansion.

- Palo Alto Networks is poised to end the year with GAAP profitability.

- PANW stock has not participated in the recent tech sector rally and has some catch-up to do.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

TU IS

Palo Alto Networks (NASDAQ:PANW) turned in a quarter which showed resilient growth rates in spite of the tough macro environment. PANW beat or came at the high end of both revenue and billings guidance with growth rates that most tech companies would die for. PANW benefits from not just being in the mission-critical cybersecurity sector but also from its deep product portfolio, which both helps in winning new customers as well as in sustaining growth through cross-selling with existing ones. PANW has delivered surprisingly aggressive margin expansion to go alongside the resilient revenue growth and appears set to close out this year with GAAP profitability. From a fundamentals perspective, PANW stock is firing on all cylinders, though one must wonder how much of the optimism is priced into the stock already.

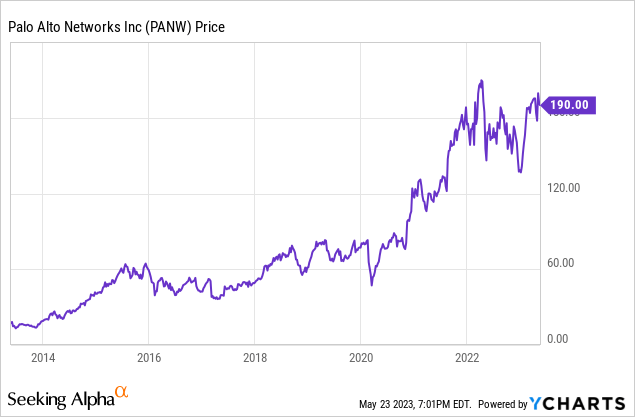

PANW Stock Price

PANW stock rose slightly after reporting earnings and the stock is one of the few in the tech sector which trades close to all-time highs. Besides having for the most part avoided the excess valuations in the tech bubble, PANW has not seen material deceleration in revenue growth rates and has shown cost discipline, earning the respect of Wall Street.

I last covered PANW stock in February where I rated the stock a buy on account of the resilient fundamentals. The stock is roughly flat since then, but given the aggressive rally elsewhere in the tech sector, I can see the stock playing "catch up" as it is proving itself to be a reliable growth machine for growth investors.

PANW Stock Key Metrics

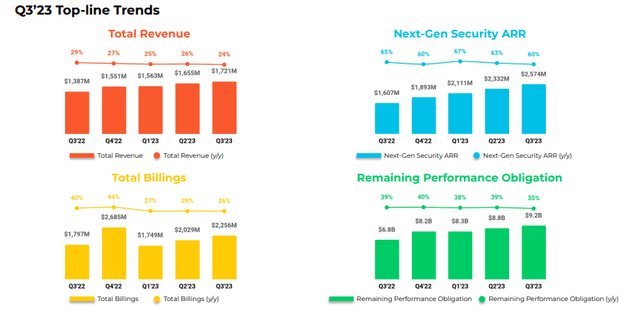

In this most recent quarter, PANW delivered 24% revenue growth to $1.72 billion and 26% billings growth to $2.26 billion, both coming at the high end of management guidance. The robust billings growth adds confidence that PANW should be able to sustain strong top-line growth in the near term as well.

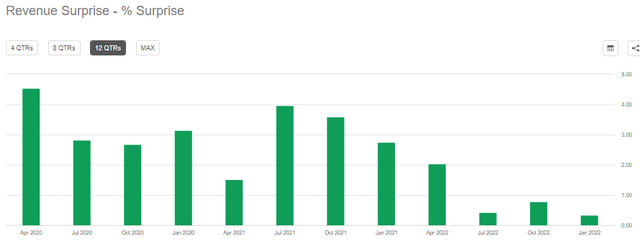

PANW has not delivered big beats to consensus for many quarters, but that should be excused due to the tough macro environment.

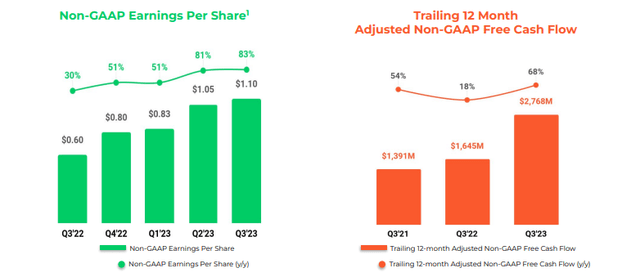

PANW also delivered strong profit growth, with non-GAAP earnings per share growing by 83% YOY.

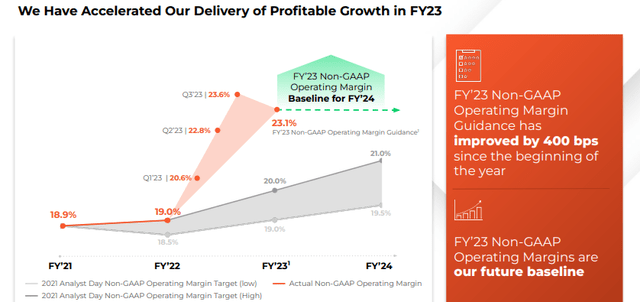

PANW has delivered 4 consecutive quarters with GAAP profitability and expects to remain GAAP profitable moving forward. The company has already materially exceeded the 21% non-GAAP operating margin for FY'24 given at its 2021 Analyst Day. At this point, Wall Street is likely pricing in the company's ability to further expand margins, perhaps to 25% and beyond.

PANW ended the quarter with $6.7 billion of cash and investments versus $3.7 billion of debt, reflecting both the company's profitable cash generation as well as the prepaid benefits of the software business model.

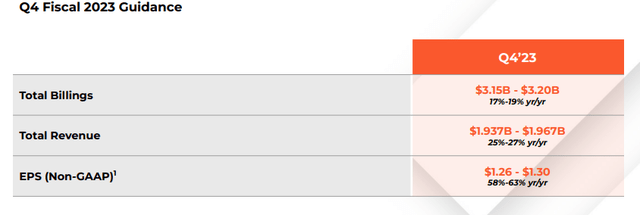

Looking ahead, management has guided for the fourth quarter to see revenue growth of 27% YOY but billings growth to decelerate to 19% at the high end.

That reflects some beat to their prior full-year guidance, but much of that beat seems to have been from this most recent quarter. Some investors may be concerned by the deceleration in billings growth, but again, the macro environment remains difficult for all companies. PANW did, however, lift its non-GAAP operating margin guidance to up to 23.25%, up from 22%. Like many other tech companies, PANW has offset decelerating top-line growth with strong margin expansion.

Is PANW Stock A Buy, Sell, or Hold?

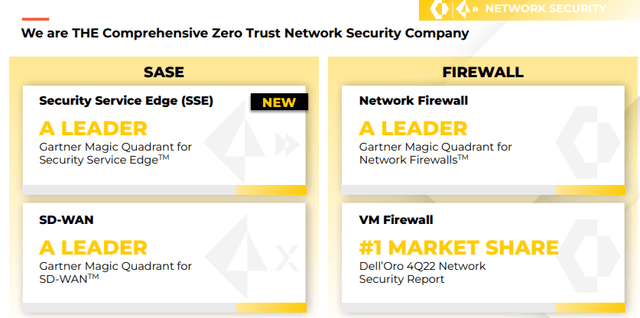

PANW is a profitable investment proposition in the cybersecurity sector. PANW is most well-known for its firewall products, but over the years it has assembled a portfolio with a wide product offering.

Management has credited their resilient growth rates as being in large part due to that product offering, as many customers may be looking for a one-stop shop for their cybersecurity needs. While one can make the argument that PANW might not have the very best product from a technical perspective, the tough macro environment may be pushing customers to seek more convenient and potentially cheaper implementations. PANW may be able to keep on to these share gains even as we move beyond the tough macro as customers might not see any immediate need to switch to potentially superior alternatives.

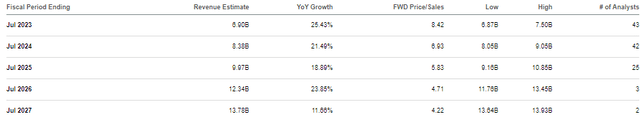

As of recent prices, PANW was trading at around 8.4x sales, a reasonable though not necessarily dirt cheap valuation given consensus estimates for 20% forward growth.

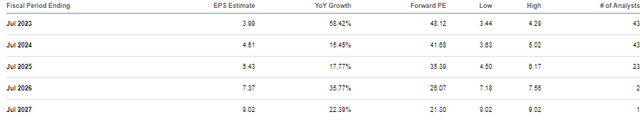

Management's guidance for $4.29 in non-GAAP EPS is well ahead of consensus estimates, and I expect consensus estimates for earnings to move sharply higher in the weeks to follow.

I am increasing my long term net margin assumption from 25% to 28%. Based on 20% growth and a 1.5x price to earnings growth ratio ('PEG ratio'), I could see fair value hovering at around 8.4x sales, right around where the stock is trading. That bodes well for long term investors, as the stock might deliver returns in-line with its above-market growth rate.

What are the key risks? Valuation is an obvious risk, as PANW carries the typical "cybersecurity premium" and trades richly relative to many tech peers. It is possible that PANW sees revenue growth decelerate meaningfully, similar to what has happened to many tech peers. If that were to happen, then Wall Street may question whether the current valuation premium is appropriate. I can see PANW trading down at least 25% just to trade in-line with peers on a growth-adjusted basis. Another risk is that of disruption. As discussed earlier, PANW appears to be benefiting from having a complete product portfolio in the current macro environment. However, there might come a time in which companies seek to alter their cybersecurity protection to reflect the very best in industry, at which point I cannot say that PANW is immune to such risks. PANW's net cash balance sheet and GAAP profitability should add some valuation protection, but there can be a big drop in valuation if investors begin to view this business as one being disrupted over the long term. Due to the strong tailwinds in the near term and cybersecurity tailwinds over the long term, I reiterate my buy rating for PANW stock as I anticipate solid near term returns as the stock plays catch-up with the rest of the tech sector.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PANW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.