If You Believe In Lithium Battery Growth, Albemarle Is A Must Own

Summary

- Albemarle has declined roughly 10% from my last bullish article in 2022, despite its continuing push to increase production and processing capabilities.

- Assuming lithium prices turn higher again in the next economic cycle, following a global recession in the second half of 2023, now may be a smart time to buy shares.

- I peg prices under $200 per share as Strong Buy territory for long-term holders searching for high rates of durable compounding on your money.

PhonlamaiPhoto

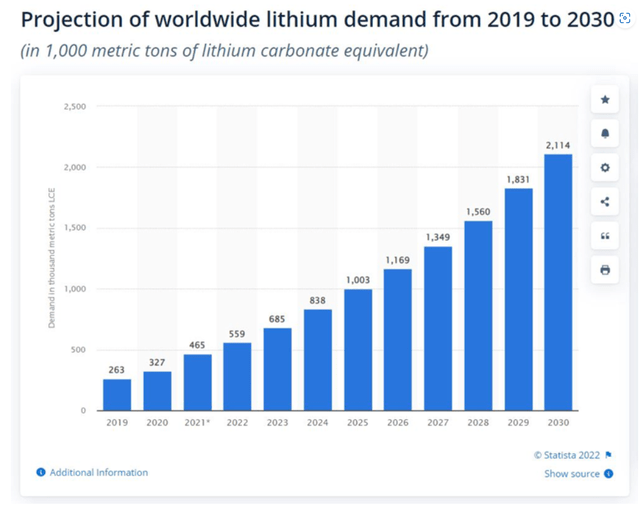

As the crossover in total costs to operate an electric vehicle [EV] vs. traditional gasoline-powered autos continue to push consumers in the green energy direction, demand for lithium-based batteries should rise dramatically over the next 10 years. And, real shortages in lithium supplies (including specialty processing for each OEM manufacturer) are projected to be the new normal for years. The industry growth-curve forecast for total lithium demand globally into 2030 is quite extraordinary, with nearly 300% more supplies needed annually in seven short years.

World Economic Forum Article, July 2022 - Statista Graph

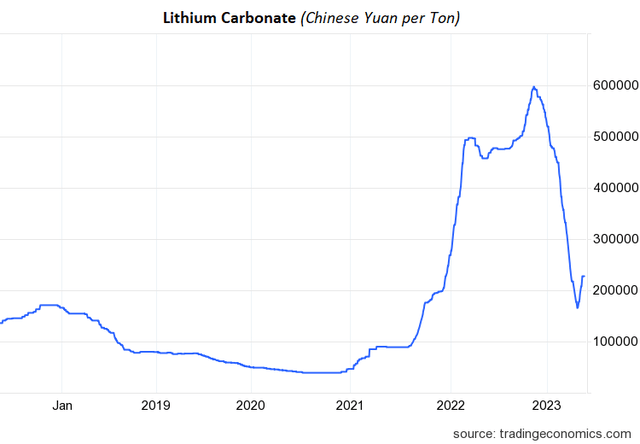

Last year's spike in prices to over 60,000 Chinese Yuan per ton from under 10,000 CY/T in 2021 may be just a hint of what is approaching for shortage pricing when EV demand accelerates in the next macroeconomic upcycle for autos.

TradingEconomics.com - Lithium Carbonate Prices in China, Since 2017

What is the best risk-adjusted way to participate as an investor? My answer is easy and straightforward - Albemarle (NYSE:ALB) - the only large, diversified, blue-chip miner and processor based in America.

I discussed the bullish self-funded growth plan from leading lithium producer Albemarle in my October article here. Since then, the share quote has swung wildly, sitting 10% lower currently vs. my article post, as lithium prices have corrected in a material way with a slowing global economy. However, my long-term view of the company's exposure and setup to future shortages of lithium have not changed. In fact, the sub-$200 stock quote ($171 bottom) witnessed in April-May may prove the low price point in this name (absent a stock market crash in the U.S.).

World's Top Diversified Lithium Asset Setup

Across the board in terms of assets, both mining production and processing, diversification and location across the planet, with a leading financial foundation, Albemarle is far and away the best lithium play, in my view.

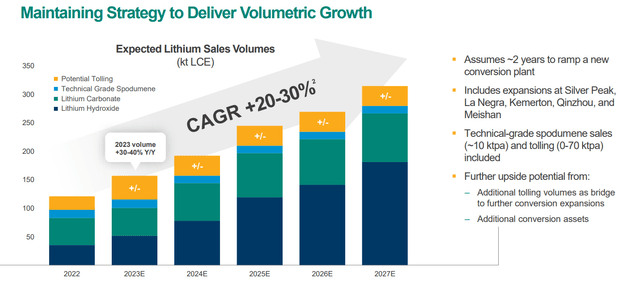

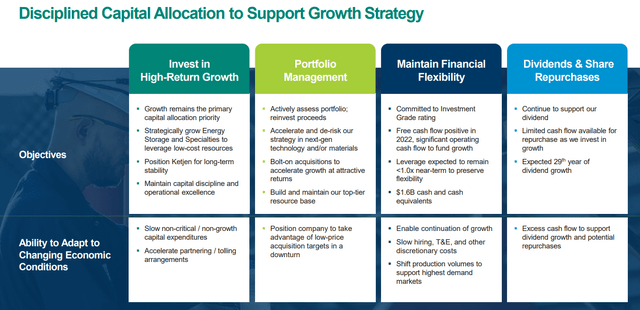

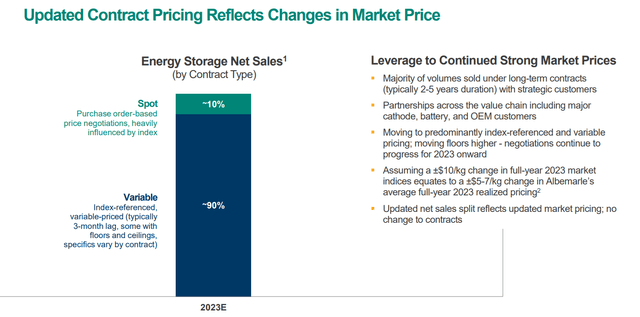

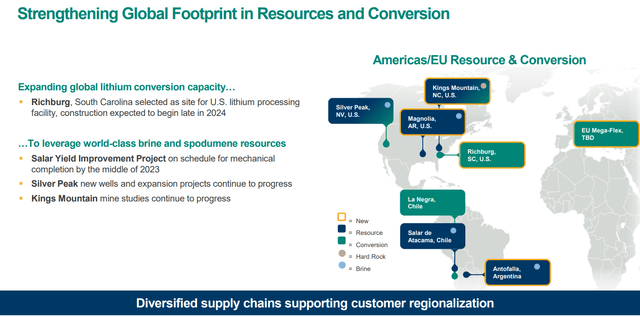

Below are slides from the company's early May Earnings Presentation for the Q1 2023 period ended in March. The highlights are: (1) a projected increase in production volumes approaching +200% by 2027 vs. last year, mostly financed with incredible cash flows coming in the door today; (2) conservative financials, with plenty of cash and little debt in early 2023; (3) flexible and variable long-term price contracts with customers to capture future lithium price gains; and (4), an unparalleled list of assets all over the world.

Albemarle - Q1 2023 Earnings Presentation Albemarle - Q1 2023 Earnings Presentation Albemarle - Q1 2023 Earnings Presentation Albemarle - Q1 2023 Earnings Presentation Albemarle - Q1 2023 Earnings Presentation Albemarle - Q1 2023 Earnings Presentation

Low Valuation Argument

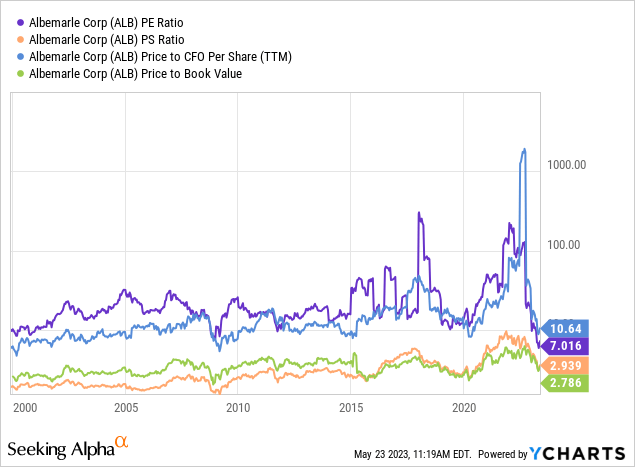

With the near certainty of tight supplies to match the major escalation in EV battery demand for many years, I am quite fascinated the stock quote has really gone nowhere since late 2021 (trading lower today than December 2021). The good news for investors is the valuation on both trailing and future results is now super-cheap. Below I have graphed the basic financial ratio setup, which is at a 10-year low, and approaching the least expensive since the Great Recession bottom in 2009. Of course, the lithium spike in price in 2022 is largely responsible for the undervaluation picture on "trailing" stats.

YCharts - Albemarle, Price to Earnings, Sales, Cash Flow, Book Value, Since 2000

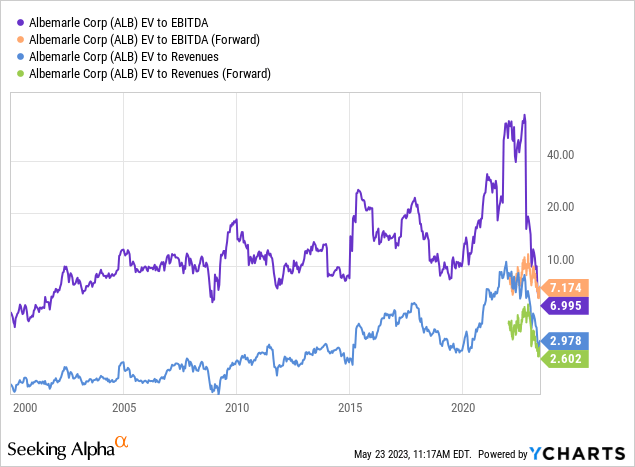

However, when we account for Albemarle's stellar balance sheet with $1.6 billion in cash and $3 billion in working capital, on top of only $3.5 billion in debt, the enterprise valuation for the whole business on "future" projected results in 2023-24 is equally in underpriced territory. On enterprise value vs. cash EBITDA or revenues, Albemarle is again approaching the cheapest setup since 2012, if not 2009.

YCharts - Albemarle, Enterprise Value to EBITDA & Revenues, Since 2000

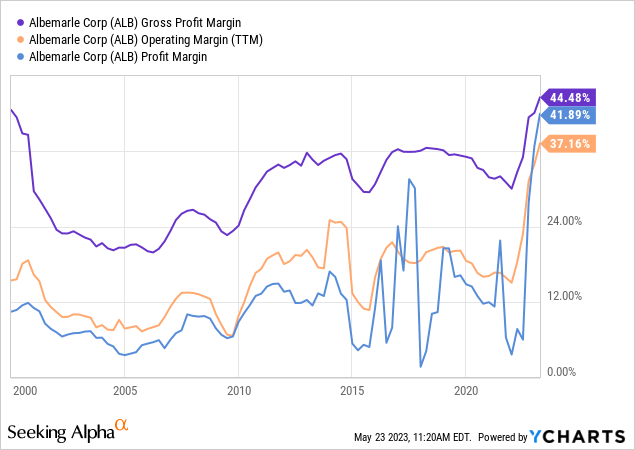

In early 2023, profit margins are now in record territory for the company, a direct result of the lithium shortage and shrewd, conservative management decisions over a number of years.

YCharts - Albemarle, Trailing Profit Margin Performance, Since 2000

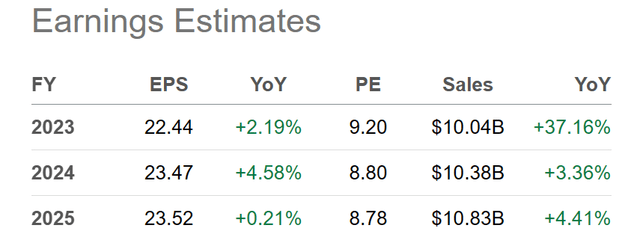

Amazingly, Wall Street estimates are now trending "under" company guidance expectations. To me the below table of consensus Wall Street analyst projections is likely a "worst-case scenario," assuming the lithium price of May will not rise materially into 2024-25. I strongly disagree, and believe another surge, perhaps past last year's pricing remains a distinct possibility. And, with skyrocketing growth in production, EPS of $30 to $40 are reasonable projections by 2025-27, in my view.

Seeking Alpha Table - Albemarle, Analyst Estimates for 2023-25, Made on May 22nd, 2023

Final Thoughts

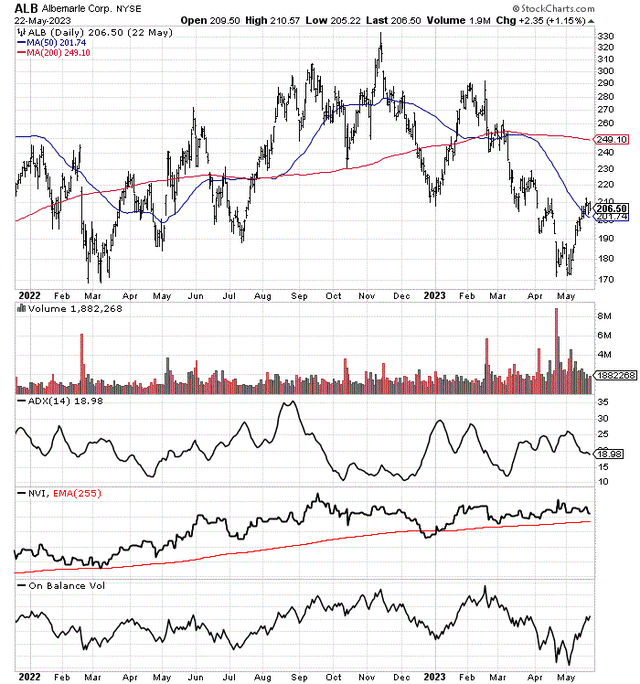

The technical chart pattern is very neutral currently for momentum. Given the exaggerated price swings in lithium and Albemarle, you would expect some sort of clear signal on the next direction for price. Unfortunately, the next 10% of price change could be either up or down, based on the technical formation. However, I am rating a quote under $200 as Strong Buy territory, from the valuation setup and long-term lithium shortage story. Under $225 per share represents a Buy for starter positions, with a view to add on weakness.

StockCharts.com - Albemarle, 18 Months of Price & Volume Changes

What are the main risks on investment? Right now, the biggest downside would come from a deep and protracted recession globally. Stunted demand for EVs vs. present expectations could allow for new lithium supplies to be developed and mined, hitting the marketplace before demand completely outstrips inventories. Under this bearish scenario, lithium prices may remain flat or even decline into 2024.

Yet, I doubt the long-term bullish shortage situation can be avoided in the end. Sure, a one or two-year reprieve from severe shortage could occur, but green-energy EV acceptance and ramping purchase trends by consumers are still in their infancy.

Another risk is the overseas jurisdiction kind. Chile in late April announced a nationalization plan requiring a government ownership percentage on all new projects. Albemarle's contract to operate at Salar de Atacama lasts until 2043.

Albemarle's manager, Ignacio Mehech, met with state development agency Corfo, and repeated Chilean President Boric's statement about respecting current contracts as an "unequivocal sign to the market that lets us maximize our commitment in Chile."

My view is the Chile news event and selloff presented a great opportunity to buy shares, while related confusion may still be holding the quote in check during May.

I am projecting a double to triple in the share price for Albemarle over the next 3-5 years, good for total returns of +15% to +35% compounded annually. Where else can you find a leader in its industry, with deep value today, and a high-growth future dead ahead? Outside of a few smaller technology names, I cannot find many. Albemarle has a unique combination of safety, value, and growth investment characteristics, not easily found elsewhere. If you believe in the EV revolution and lithium batteries are the way forward for OEM manufacturers, Albemarle should be part of your portfolio. It is one of my top growth-at-a-reasonable-price [GARP] selections for new money today.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in the securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.