Protagonist Therapeutics: All Quiet Heading Into An Important H2 2023

Summary

- Protagonist continues to quietly progress its pipeline, relying mainly on the polycythemia vera story to drive its business efforts.

- An ongoing phase 3 study will be the critical readout, but that doesn't mean that you need to wait for it.

- Other good news has given big boosts to Protagonist outside of PV.

Dr_Microbe

Investment Thesis

Protagonist (NASDAQ:PTGX) offers a lot of potential to the biotech investor, with a lot of risk mitigated. As I have argued before, the bad news that jeopardized the company's lead product has not translated into destruction of their pipeline. Protagonist has gained a lot of the hype back that it had a few years ago, but there is room to grow. Of course, there are major risks, like failure of its other pipeline candidates, a negative data readout, or the resurfacing of cancer risk with their therapy.

Introduction

Protagonist Therapeutics has been on a wild ride over the past 3 years, rising to highs of $50 per share on the back of groundbreaking development in their therapy rusfertide (formerly PTG-300), which showed remarkable control of phlebotomy in patients with polycythemia vera.

Of course, since then there was a cancer scare with rusfertide, taking a lot of wind out of their sails and stopping drug development for months. Then there was the failure of another one of their pipeline agents failed to help patients with ulcerative colitis. Most of 2022 was spent in the sub-$10 range for the company with no significant developments for rusfertide or other agents.

Moreover, if you comb the list of ASCO abstracts for this year's meeting, you'll see that the company is a no-show. So there's no big news coming any time soon, as far as anyone outside of the company can tell. And yet the price today sits north of $25, giving PTGX a valuation of almost $1.5 billion.

Is now a good time to take another look at this company?

Rusfertide: What Do We Know About This Drug So Far?

The near-term future of PTGX rests entirely on the shoulders of the rusfertide project, which as of late last year is now the subject of a randomized, phase 3 trial, comparing rusfertide versus placebo to reduce phlebotomy burden in patients with polycythemia vera.

And just what is polycythemia vera? It is a form of blood cancer originating in the bone marrow that leads the body to make enormous numbers of blood cells, including red blood cell and platelets. You might not think that having "too much blood" would be particularly bad, but it can lead to crippling symptoms, as well as painful swelling of the spleen. Patients spend years battling to keep the blood cell levels under control to try and manage symptoms and the risk of heart problems brought on by the disease.

The main treatment for polycythemia vera is phlebotomy: literally just removing blood to help reduce the cell burden in patients. While this is effective, you can imagine what kind of burden this can place on patients, who may end up having to "donate" blood several times a year to manage their symptoms.

Chemotherapy with hydroxyurea or an interferon is another option for patients who don't do well with phlebotomy, or who have a high risk of heart complications.

This is where PTGX's drug comes in, offering a disruptive mechanism of stopping polycythemia vera through mimicking the body's natural hepcidin system, which controls the amount of iron that gets to blood cells. By mimicking this system, researchers have shown that rusfertide can all but wipe out the need for phlebotomy, whether or not the patient is receiving another drug.

Most recently, we've heard that the phase 2 portion of the REVIVE study met its primary endpoint; 12 weeks of rusfertide versus placebo showed response rates of 69.2% vs 18.5%. 24 out of 26 patients receiving rusfertide had no further need for phlebotomy during the course of the study, indicating a strong likelihood that rusfertide is having a major effect in PV.

Now, we await further updates, but I expect we will see another significant formal publication or presentation of these data in 2023. It's possible that these data are enough for the company to move forward with getting the drug approved on a provisional basis, to be contingent on positive findings from the aforementioned phase 3 trial that is now ongoing (and is estimated to be completed February 2024).

Commentary on the Rest of the Pipeline

PTGX has a number of other promising drug candidates in the pipeline, and I wouldn't want to downplay these too much. In fact, one of the major catalysts in 2023 has been positive findings in psoriasis for their investigational IL-23 inhibitor.

For the biotech investor, this is both an intriguing, potentially de-risking of the company's portfolio (not having to rest on a single drug's success) and muddying the waters. As an investor principally focused on cancer research, the IL-23 story does not strongly drive my investment thesis, and it's simply not as far along as the rusfertide story. Hopefully it will be another driver of forward momentum for the company as we see more from rusfertide, but it is not the most exciting part about PTGX.

Financial Assessment of PTGX

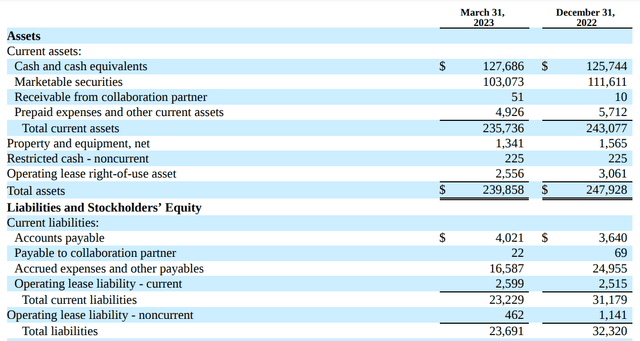

The Q1 filing from May 2023 offers the most up-to-date look at the financial state of PTGX that we have. Here is a summary of the assets and liabilities:

As you can see here, the company maintains approximately $230 million in cash and liquid assets. And it's worth noting that this would not take into the account the extra $100 million raised through a sale of stock back in April. This would bring the balance sheet up to roughly $330 million more or less on hand.

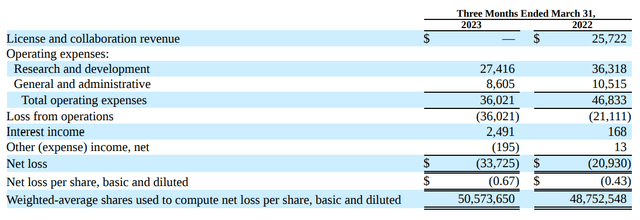

How does this stack up against their cash flow?

PTGX recognized no licensing revenue in Q1 2023, contributing to an overall loss of $33.7 million in the quarter, which is up over 50% from this time in 2022.

There is a silver lining, though, in terms of costs. Expenses were actually lower in Q1 2023 compared with the same time in 2022. So they have tightened their belts, but I don't expect that to continue. Running phase 3 trials is massively expensive, and putting a drug through regulatory review requires a huge amount of resources.

However, if you do a cash runway analysis, and assuming somewhat modest cost increases of, say, 10% quarter over quarter, PTGX would be dealing with this runway:

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | |

| Net loss ($M) | 33.7 | 37.1 | 40.8 | 44.9 | 49.3 | 54.3 | 59.7 | 65.7 | 72.2 |

| Cash on hand ($M) | 330 | 292.9 | 252.2 | 207.3 | 158.0 | 103.7 | 44.0 | -21.7 | -93.9 |

Based on these assumptions, the company has the room to run until the second half of 2024, at which point they will have needed to resolve cash issues. Therefore, I don't think it's unreasonable to see another cash raise in, say, the first half of 2024.

Key Risk Factors for PTGX

PTGX has a lot of promise with rusfertide, but it's worth analyzing the risk factors that may work against the company in the coming year. These include:

- Relatively short cash runway: Assuming 10% quarterly growth of costs, PTGX simply doesn't have that long before they're going back to the well for more money. Anybody buying in today is probably going to face some dilution as the company finds itself needing to raise funds before they have a product to market, even in the best of scenarios.

- Competition: I've been very surprised that PTGX has been able to operate in the polycythemia vera space without any competition for years and years, with not a whiff of a competitor coming down the pike. This is no longer the case, as we're now seeing different approaches to target hepcidin reach the clinic. If this is a successful approach, PTGX won't be the only kid on the block for that long, which poses a long-term risk.

- Failed trials: No matter how promising something looks in early-phase trials, you should always be prepared for the confirmatory phase 3 to fail. It's why we run the confirmatory phase 3 trial in the first place. There are many high-profile examples in recent years of promising drugs that seem like shoo-ins failing at this stage, even after the drug was approved! Nothing I've seen would make rusfertide immune to this, no matter how great those phase 2 results look. I'm very optimistic, but I don't think my jaw would hit the floor if the results are not confirmed.

- Phlebotomy control might not save lives: Not to downplay the impact that symptoms have on patients with PV, but if these early findings can't demonstrate a clear signal that patients are having a major change in their overall outcomes, the FDA might not be so generous with the approval. This could mean the difference between a 2023 submission/2024 approval and having to wait until 2025 to see a drug to market. Drugs that clearly are impacting patient survival tend to be prioritized, and as great as rusfertide has seemed, I'm not sure it rises quite to the level of immune checkpoint inhibitors. Still, rusfertide does have breakthrough therapy designation, which opens the door for accelerated approval.

Conclusions - Should You Invest in PTGX?

PTGX has capitalized on a lot of the progress they've made in drug development already. $1.5 billion valuation is a really big figure for a company that's not bringing in a dime through sales. However, if PTGX continues to meet catalysts I expect, there's no reason that we can't be looking at a company worth $3 to $5 billion heading into 2024 in my opinion. This is the reason I continue to hold and will consider adding should there be any dips.

What would cause me to sell? Further gains allow me to pare down my exposure to the company, so I would take some of the gains off the table. Barring that, a failed efficacy readout would strongly undermine my confidence in the rusfertide project, and I would sell most of my shares in that event.

What would cause me to buy more? PTGX has been the subject of various dips that ultimately proved to be non-items. The "risk of cancer" with rusfertide never made sense as a story, and further analysis bore that out and ultimately showed those dips to be buying opportunities. There's no way to know for sure, but if negative news comes out that is not related to rusfertide efficacy, I would be looking for a good point to consider buying more. With all the caveats of trying to time the market, of course.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PTGX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.