Burberry: Strong Results, Rating Upgrade To Buy

Summary

- Burberry's latest results reflect that it is strategically on the right track and the demand revival in China has helped.

- Notably, the company's operating margin has risen to 20%+ levels, and it expects it to stay there. An improvement in EPS also makes its P/E competitive with peers.

- While there are risks from a possible US recession, and its price has risen a fair bit in the past year, I am still upgrading it to a medium-term buy.

- Looking for more investing ideas like this one? Get them exclusively at Green Growth Giants. Learn More »

Thinglass/iStock Editorial via Getty Images

The British luxury fashion label, Burberry Group plc (OTCPK:BBRYF) (OTCPK:BURBY) best known for its signature check and trench coats has come a long way in the past year. Its price is up by 43%, which is driven by improvements in its fundamentals. In fact, the company's latest numbers suggest more upside to it, despite macroeconomic risks.

When I last wrote about Burberry in November 2022, it was already clear that a positive change was already underway. While its margins and revenue growth lagged those of its peers, the return of growth to China and the appointment of its new creative head Daniel Lee, showed promise.

The China factor

Since then, the company has released its full year results, which indeed show that its potential positives have played out nicely. Let's first consider the China factor. Asia Pacific [APAC] accounts for 43% of Burberry's revenues. Considering that China is the biggest luxury market in the world after the US, indicates the extent of influence it has on the company's APAC revenues. And indeed, the return of demand from the market after the relaxation of COVID-19 restrictions is obvious.

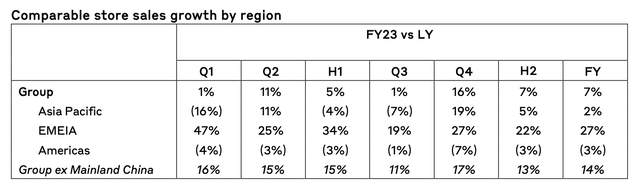

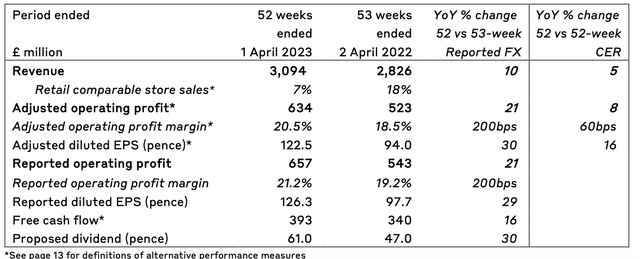

In FY23, ending April 1 2023, the company saw a 7% year-on-year [YoY] increase in same store sales, with the biggest increase in Q4 FY23 of 16%. It is no coincidence that it is exactly during this quarter that APAC growth picked up to 19%, the fastest in the year. While sales to Mainland China showed a healthy improvement to 13% during the quarter, recovery in the country had spillover effects for the region as well, with a huge 50% jump in South APAC sales in Q4 because of the return of Chinese tourists. The company's retail growth was also helped significantly by strong EMEIA performance and despite a weakening in sales to the Americas (see table below).

Improved H2 performance

Next, consider growth by product. Burberry's leather products sales grew by 12% in FY23, outstripping that of its outerwear, which grew by 7%. Lee's appointment to the position of the creative head was particularly significant for leather products since he was seen as responsible for earlier revitalising the Kering (OTCPK:PPRUY) owned Bottega Veneta, best known for its leather accessories.

Even as such, the company has seen good growth in revenue in FY23 of 10% compared to last year's 7.3% increase against FY20, the last pre-pandemic year. Focusing on H2 FY23, the period for which Lee has been around, the company saw a faster 7% growth in same store sales, compared to 5% in H1 FY23. The second half of the year was also helped by the pickup in APAC sales, though.

Better operating margins

Another positive in Burberry's latest report is the jump in its operating margin to 21.2%, finally breaching the 20% mark, from 19.2% in FY22 and lower figures in preceding years. Besides the growth in revenues, the company has seen an impressive decline in operating expenses growth to 5% from over 20% in FY22. While the company doesn't explicitly mention inflation as a factor in expense reduction, inferring from the sparse mention of the term in its FY23 update compared to FY22 does indicate that it is less of a challenge now.

Going forward, we can expect the company's operating margins to remain strong. In its guidance, Burberry expects its adjusted operating margin to come in around 20%. For context, it was at 20.5% in the past year, a little less than the reported margin. It is still lower than that for the likes of LVMH (OTCPK:LVMUY), Richemont (OTCPK:CFRUY) and Kering, though. This indicates that Burberry still does not have the kind of pricing power that its peers have, but with a come-off in inflation in recent months, I am somewhat less concerned about this aspect than I was last year. This is for the simple reason that a company with lesser pricing power is more likely to see a further shrinking in margins if cost inflation continues to accelerate.

Competitive market valuation

Good performance at the operating level has also spilled onto the company's net earnings, with reported diluted EPS having shown strong growth of 29% to 126.3 pence.

Its trailing twelve months price-to-earnings (P/E) ratio is now at 18.3x is not low, and definitely higher than that for the consumer discretionary sector at 15.2x. It does, however, continue to lag behind some luxury peers like LVMH and Richemont, which have far higher P/E ratios at 31.5x and 37x, but then they also have better financials.

Interestingly though, since my last check on it, the gap between the P/E ratios has widened significantly. Consider the example of LVMUY. While there was earlier a difference of 8.8 percentage points between its P/E and that of Burberry, it has now risen to 13 percentage points. There's no doubt that it is a far better performing peer, but for investors looking to get into the luxury sector, Burberry can look more appealing now at a lower P/E, even with lower growth. That said, it is still at par with Gucci owner Kering.

The downsides

It's not all roses for Burberry, however. There are also downsides and risks to consider. The company's growth at constant exchange rates is still low at 5%. I would be less worried about this if its Americas market were not slowing down. But it is. And while the US has averted a recession so far, if forecasts are to be believed it is quite likely on the cards. While the Americas have a relatively smaller share than other geographies like APAC and EMEIA, in itself it is not small at 24% of retail sales, which accounts for most of the company's sales.

Burberry has also recently flagged that the UK is at a competitive disadvantage after it scrapped VAT tax breaks for visitors. This is evident in faster sales growth in European cities like Paris and Milan compared to London in 2023. As a British luxury brand, it hopes bigger sales when tourists visit the UK instead. This may or may not affect the company's sales in total, but the fact that it has brought it up, suggests that this is a situation worth watching.

What next?

Concerns about right now aside, I think Burberry is on a good track. It expects to reach a revenue of GBP 4 billion in the medium term. If the undefined medium term translates into the next three years, that is an almost 9% growth up to FY26. It also intends to increase productivity, which can show up in its margins as well. Improvements in performance are already visible for the company.

Its P/E leaves me on the fence about it short-term future of its price, especially with some macroeconomic risks on the horizon. It is true that China's demand can sustain Burberry going forward, but I wouldn't ignore the Americas market because it still has an appreciable share in revenues.

On balance, though, I like how Burberry is reinvigorating itself and the improvements can show up in its financials over time. It is a medium-term Buy for me, an upgrade in rating from Hold.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BURBY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.