10 A-Rated Dividend Aristocrats For The Ultimate High-Yield SWAN Portfolio

Summary

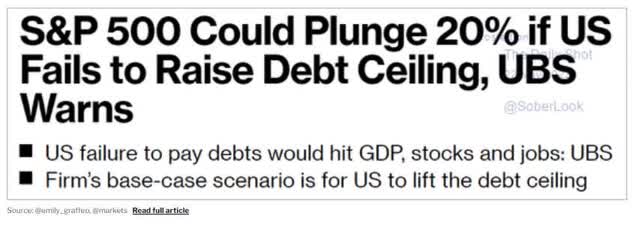

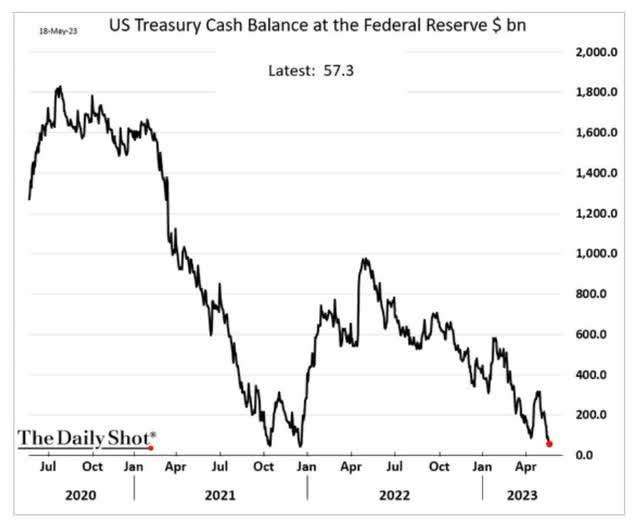

- The debt ceiling crisis is coming down to the wire. We're possibly already out of time to prevent default and just don't know it.

- UBS estimates a short default could create a 20% bear market and a one-month default could lead to a 44% crash.

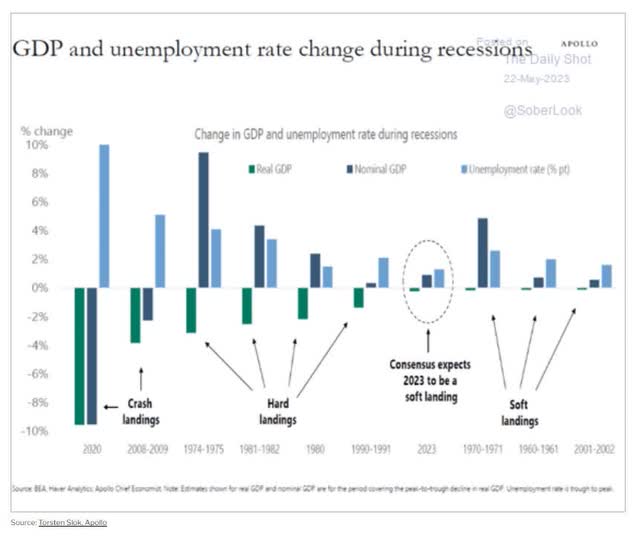

- Even without a debt default, we're likely facing a 1.5% to 4% GDP recession later this year that the market is not at all prepared for.

- These 10 A-rated dividend aristocrats have the strongest balance sheets of any aristocrat, an A+ stable rating with 0.52% 30-year bankruptcy risk. They have a 40-year dividend growth streak and risk management in the top 25% of all global companies.

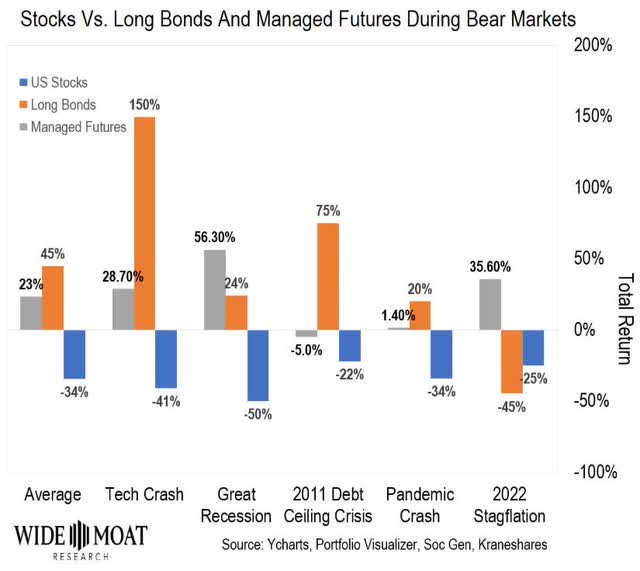

- Combined with two hedging ETFs, they create a 4% yielding Ultra Sleep-Well-At-Night, or SWAN, aristocrat portfolio that historically delivers market-like returns but with 75% smaller peak declines in bear markets. The average bear market decline is 8%, falling just 18% in the Great Recession.

- Looking for a portfolio of ideas like this one? Members of The Dividend Kings get exclusive access to our subscriber-only portfolios. Learn More »

peshkov

This article was published on Dividend Kings on Monday, May 22nd.

---------------------------------------------------------------------------------------

In my last article, we saw how the debt ceiling negotiations were possibly a long way from finding a deal.

The newest information is that the Republican demand for spending cuts has potentially changed from 2% cuts for 2024 to 8% by Saturday.

- Or so Bloomberg and Reuters are reporting.

- it's backroom negotiations and hard to pin down who is offering what.

That's the difference between $130 billion in 2024 spending cuts and $500 billion.

Democrats are offering flat spending growth.

No headway has been made on the other key sticking points.

- defense vs. non-defense spending

- work requirements for Medicaid and food stamps

- energy project regulatory approval.

It seems the only thing both sides were able to agree on is clawing back $30 billion in COVID funds that haven't been used.

UBS just put out a note estimating that a one-week default, which they estimate is a 25% probability, would send stocks down 20%.

In that case — one of four outlined by the bank — the country could shed at least 265,000 jobs and take a 0.3 percentage point hit to gross domestic product. The S&P 500 would stay suppressed before slightly rebounding to end 2023 near 3,700...

The worst-case scenario outlined by UBS would be marked by a prolonged, one-month delay in all US payments. That would lower GDP by an additional 0.8 percentage points, add 700,000 job losses and cause a 30% “immediate” drop in stocks — though they stressed — this scenario is “very unlikely.” - Bloomberg.

Moody's estimates a 2-month default sends the stock market down 33% from here, while UBS estimates a one-month default results in a 30% decline on top of a 20% decline.

- a 44% decline from here.

The Joint Economic Committee estimates a 3-month default results in a 45% stock market decline from here.

Bloomberg Economics doesn't have a market forecast for a three or four-month default but does estimate that GDP would contract by 8%.

That would be the 3rd worst economic collapse of the last 100 years behind the Pandemic's 9% recession and the Great Depression's 25%.

- in the 1800s, the U.S. averaged a 22% GDP depression every three years

- the "Great Depression" wasn't "great" because of its severity, just its duration.

In part one of this series, we ranked all 133 dividend aristocrats by credit rating.

But what if you want to build the ultimate fortress SWAN (sleep-well-at-night) portfolio for these uncertain times?

Buying aristocrats purely based on credit rating isn't the best way to create a fortress Ultra SWAN portfolio that can withstand even a worst-case debt ceiling economic crash.

How To Find The Best A-Rated Dividend Aristocrats For These Troubled Times...In 2 Minutes

Let me show you how to screen the Dividend Kings Zen Research Terminal, which runs off the DK 500 Master List, to find the best A-rated aristocrats for this recession.

- whether it's a mild recession or an 8% GDP collapse.

The Dividend Kings 500 Master List includes some of the world's best companies, including:

- Every dividend champion (25+ year dividend growth streaks, including foreign aristocrats)

- Every dividend aristocrat

- Every dividend king (50+ year dividend growth streaks)

- Every Ultra SWAN (as close to perfect quality companies as exist)

- The 20% highest quality REITs, according to iREIT

- 40 of the world's best-growth blue chips.

The key with any screen is to remember that whatever metric you're targeting is never enough on its own.

Valuation always matters, and even some A-rated aristocrats like IBM are speculative due to their turnarounds.

| Step | Screening Criteria | Companies Remaining | % Of Master List |

| 1 | Dividend Champions List | 133 | 26.60% |

| 2 | Reasonable Buy or better (nothing overvalued) | 80 | 16.00% |

| 3 | Non-Speculative (No Turnaround Stocks, investment grade) | 67 | 13.40% |

| 4 | A-Rated Or Better | 26 | 5.20% |

| 5 | Sort By 30-Year Bankruptcy Risk | 0.00% | |

| 6 | Select the 10 Lowest Bankruptcy Risk Companies | 0.00% | |

| 7 | Use "build your watchlist" to get just those ten aristocrats | 11 | 2.20% |

| Total Time | 2 Minute |

This screen eliminates overvalued aristocrats, as well as speculative ones. There are 26 remaining A-rated aristocrats.

We want the ten highest credit ratings from those.

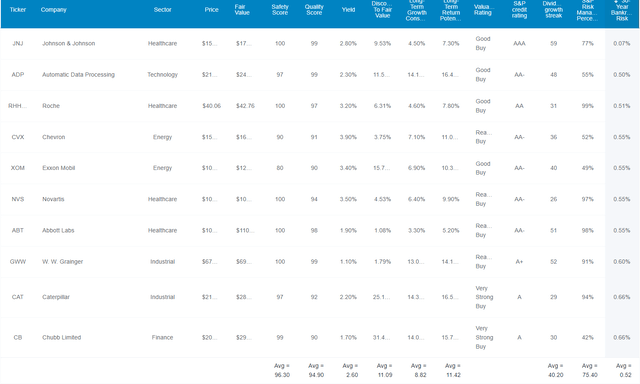

10 A-Rated Dividend Aristocrats For The Ultimate Fortress Portfolio

I've linked to articles about each company for further research.

Here they are in order of strongest credit rating and lowest 30-year bankruptcy risk.

- Johnson & Johnson (JNJ)

- Automatic Data Processing (ADP)

- Roche (OTCQX:RHHBY)

- Chevron (CVX)

- Exxon (XOM)

- Novartis (NVS)

- Abbott Labs (ABT)

- W.W. Grainger (GWW)

- Caterpillar (CAT)

- Chubb (CB).

Tax Implications

Chubb is a Swiss Company, BUT U.S. investors have zero tax withholdings IF your broker files the appropriate paperwork with the Swiss government.

- IRS Forms W-8 or W-9.

Roche is a Swiss Company with a 15% dividend tax withholding for U.S. investors IF your broker field the appropriate paperwork.

Otherwise, a 35% tax withholding.

Novartis is also Swiss—the same tax implications as Roche.

The U.S. tax credit eliminates the remaining tax withholding if you own it in taxable accounts.

Fundamental Summary

- quality: 94% low risk 13/13 Ultra SWAN aristocrat

- yield 2.6%

- safety: 96% very safe (1.2% severe recession cut risk)

- dividend growth streak: 40 years

- S&P long-term risk management: 75th percentile = good, low risk

- credit rating: A+ stable (0.52% 30-year bankruptcy risk)

- discount to fair value: 11% (potentially good buy)

- growth: 8.8% consensus

- total return potential: 11.4% vs. 10.2% S&P 500

- 5-year consensus return potential: 11.4% + 2.4% valuation boost = 13.8% = 91% total return potential = 2X S&P 500 consensus.

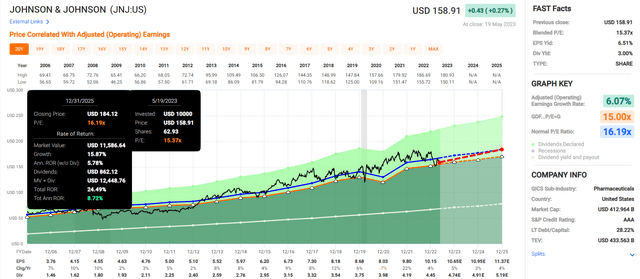

FAST Graphs

Johnson & Johnson 2025 Consensus Total Return Potential

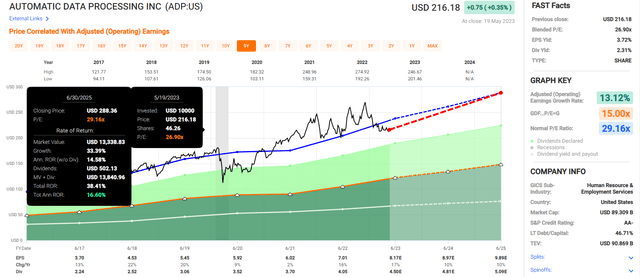

Automatic Data Processing 2025 Consensus Total Return Potential

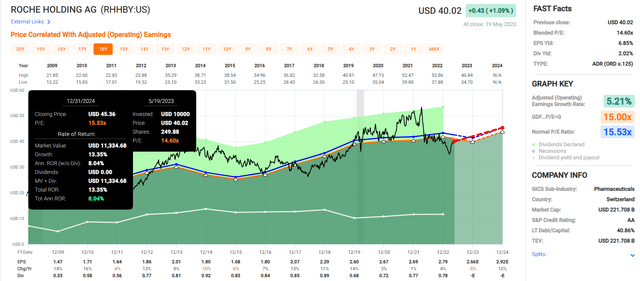

Roche 2025 Consensus Total Return Potential

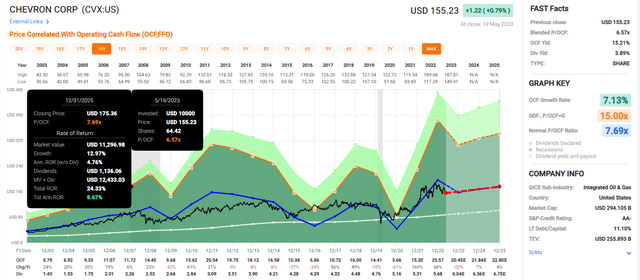

Chevron 2025 Consensus Total Return Potential

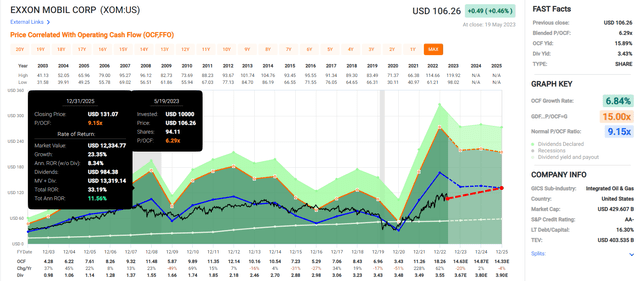

Exxon 2025 Consensus Total Return Potential

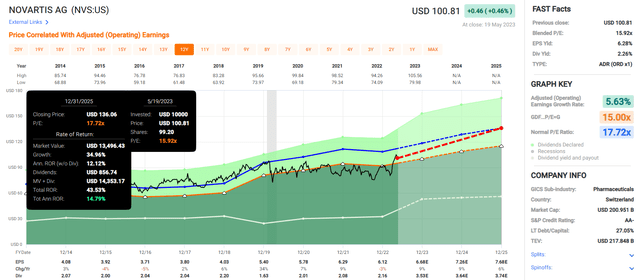

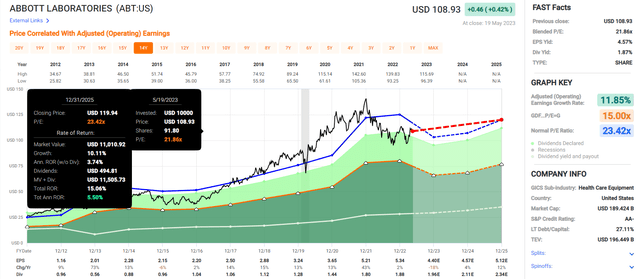

Novartis 2025 Consensus Total Return Potential

Abbott 2025 Consensus Total Return Potential

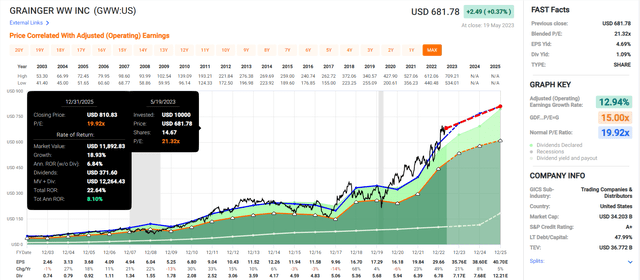

W.W. Grainger 2025 Consensus Total Return Potential

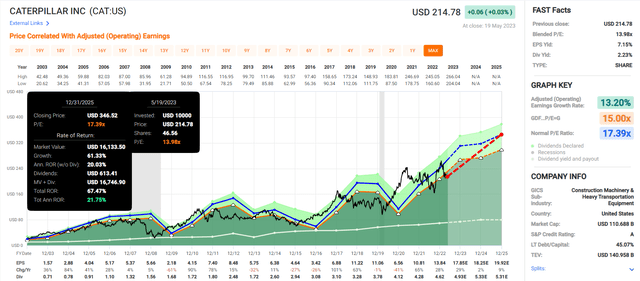

Caterpillar 2025 Consensus Total Return Potential

Chubb 2025 Consensus Total Return Potential

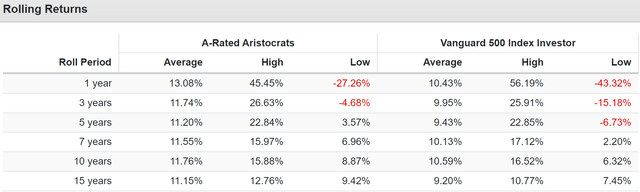

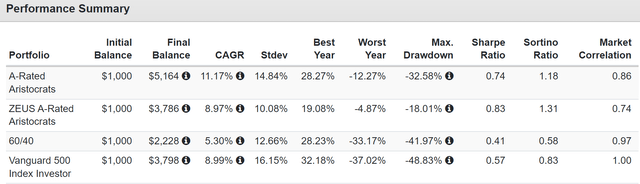

Historical Total Returns Since 2003

(Source: Portfolio Visualizer Premium)

Historical returns of 12.6% are similar to the 11.4% analysts expect in the future, with lower volatility than the S&P and a 34% small speaker decline during the Great Recession.

(Source: Portfolio Visualizer Premium)

Consistent market outperformance across every time frame.

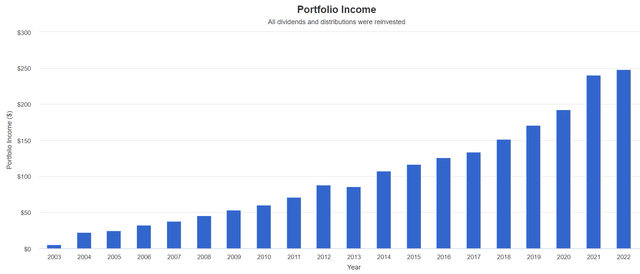

13.6% Annual Income Growth For 20 Years

(Source: Portfolio Visualizer Premium)

How To Create A ZEUS A-Rated Aristocrat Portfolio

Do you know why Warren Buffett never worries about 30%, 40%, or even 50% market crashes? Because Berkshire Hathaway Inc. (BRK.A) generates $25 billion per year in free cash flow and he's sitting on $130 billion in cash.

Buffett owns the world's best companies... and always has money to buy more in bear markets.

You probably don't own insurance companies, and thus might think that you need cash set aside for bear market blue-chip buying.

Actually, you need non-correlated blue-chip assets that zig when the market zags.

Consider the DK ZEUS strategy: Zen Extraordinary Ultra Sleep-Well-At-Night

Consider adding a 16.67% allocation to long-duration bonds like Vanguard Extended Duration Treasury Index Fund ETF Shares (EDV).

And a 16.67% allocation to managed futures like KFA Mount Lucas Index Strategy ETF (KMLM).

Take a look at what this balanced Zen Extraordinary Ultra Sleep Well At Night or ZEUS Wide Moat aristocrat portfolio does.

- 16.66% EDV

- 16.66% KMLM

- 6.66% each of the 10 A-rated aristocrats.

ZEUS A-Rated Aristocrat Vs. 60/40

| Metric | 60/40 | ZEUS A-Rated Aristocrat Portfolio | X Better Than 60/40 |

| Yield | 2.1% | 3.9% | 1.86 |

| Growth Consensus | 5.1% | 5.9% | 1.16 |

| LT Consensus Total Return Potential | 7.2% | 9.8% | 1.36 |

| Risk-Adjusted Expected Return | 5.0% | 6.9% | 1.36 |

| Safe Withdrawal Rate (Risk And Inflation-Adjusted Expected Returns) | 2.8% | 4.6% | 1.66 |

| Conservative Time To Double (Years) | 26.0 | 15.7 | 1.66 |

(Source: DK Research Terminal, FactSet.)

ZEUS A-Rated Aristocrat Vs. 60/40

| Metric | S&P | ZEUS A-Rated Aristocrat Portfolio | X Better Than S&P 500 |

| Yield | 1.7% | 3.9% | 2.29 |

| Growth Consensus | 8.5% | 5.9% | 0.69 |

| LT Consensus Total Return Potential | 10.2% | 9.8% | 0.96 |

| Risk-Adjusted Expected Return | 7.1% | 6.9% | 0.96 |

| Safe Withdrawal Rate (Risk And Inflation-Adjusted Expected Returns) | 4.9% | 4.6% | 0.94 |

| Conservative Time To Double (Years) | 14.8 | 15.7 | 0.94 |

(Source: DK Research Terminal, FactSet.)

How would you like yields more than twice that of the market, much higher than a 60/40, with market-like returns that runs circles around 60/40?

All in an A-rated wide-moat aristocrat package that's also defensive and relatively recession-resistant?

How about being able to rebalance into stocks, effectively minting free money to buy blue-chip bargains in a bear market?

And how about a portfolio this attractive with volatility so low it's like rolling over the market's biggest potholes in a Rolls Royce?

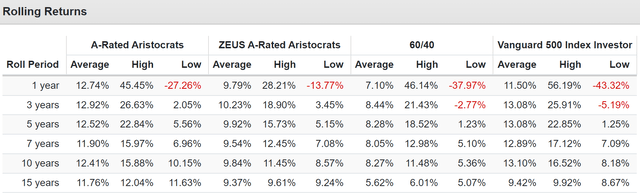

Historical Total Returns Since December 2007 (Start Of The Great Recession)

(Source: Portfolio Visualizer Premium)

Matching the market across two economic cycles but with 40% lower annual volatility and a peak decline of just 18%.

(Source: Portfolio Visualizer Premium)

In a market that was all tech all the time for a decade, this portfolio that is 15% energy (during the worst decade for energy in history) managed to keep up with the market with identical 15-year rolling returns.

(Source: Portfolio Visualizer Premium)

Except for a few months in 2014, there hasn't been a five-year period in which ZEUS A-rated aristocrats underperformed the 60/40.

It's fundamentally superior, and fundamentals drive 97% of returns over time.

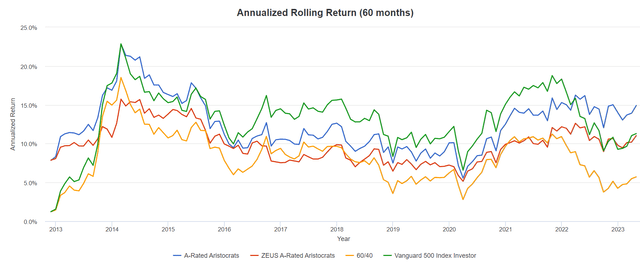

Peak Bear Market Declines

| Bear Market | 10 A-Rated Aristocrats | ZEUS A-Rated Aristocrats | 60/40 | S&P |

| 2022 Stagflation | -11% | -9% | -21% | -28% |

| Pandemic Crash | -20% | -8% | -13% | -34% |

| 2018 Recession Scare | -9% | -7% | -9% | -21% |

| 2011 Debt Ceiling Crisis | -10% | 0% | -16% | -22% |

| Great Recession | -33% | -18% | -44% | -58% |

| Tech Crash | NA | NA | -22% | -50% |

| Average | -17% | -8% | -21% | -34% |

| Median | -11% | -8% | -19% | -31% |

Great yield, good returns, and 60% smaller peak declines than a 60/40 in bear markets and 75% smaller declines than the S&P.

40% lower annual volatility in any given year, but when it matters most, and the market loses its mind in terror, ZEUS A-rated aristocrat really steps up and becomes the king of Ultra SWAN portfolios.

Bottom Line: 10 A-Rated Dividend Aristocrats For The Ultimate High-Yield Fortress Portfolio

Things could get very scary in the next few days and weeks.

If the Treasury's X-date algorithm is off by a little bit, we could potentially default this week, with just one or two days warning, according to the Treasury Department.

I always thought this would go right down to the wire," Zandi said in a phone interview. "If the rhetoric is dark next week, markets will start to react. We'll see a lot more red on the screen and dark red by the end of the week." Zandi warned that if there is still no deal after Memorial Day weekend, markets could face a 2011-style moment where major indexes lose 3% to 5% in a single day." That would light a fire under lawmakers," he said." - CNN.

And even if we avoid a debt ceiling disaster, we're still left with a likely recession in 2023 that Bank of America thinks will be 3X worse than most economists expect.

- 16% decline in earnings, according to Bank of America

- 20% decline, according to Morgan Stanley.

Do you know what is currently priced into stocks?

- +2% EPS growth in 2023

- +12% growth in 2024.

That's an earnings gap almost as wide at the negotiating positions of the White House and Congressional Republicans.

But do you know who isn't going to lose a wink of sleep over even the worst-case debt default doomsday scenario? Investors who buy:

- Johnson & Johnson

- Automatic Data Processing

- Roche

- Chevron

- Exxon

- Novartis

- Abbott Labs

- W.W. Grainger

- Caterpillar

- Chubb.

These are the 10 strongest balance sheets you can safely buy among the aristocrats today.

Fundamental Summary

- quality: 94% low risk 13/13 Ultra SWAN aristocrat

- yield 2.6%

- safety: 96% very safe (1.2% severe recession cut risk)

- dividend growth streak: 40 years

- S&P long-term risk management: 75th percentile = good, low risk

- credit rating: A+ stable (0.52% 30-year bankruptcy risk)

- discount to fair value: 11% (potentially good buy)

- growth: 8.8% consensus

- total return potential: 11.4% vs. 10.2% S&P 500

- 5-year consensus return potential: 11.4% + 2.4% valuation boost = 13.8% = 91% total return potential = 2X S&P 500 consensus.

Companies with fortress balance sheets, battle-tested management, wide moats, and who have been raising their dividends every year since 1983.

- through five recessions

- seven bear markets

- two economic crises

- eight financial crises

- inflation as high as 9.1%

- interest rates as high as 10%.

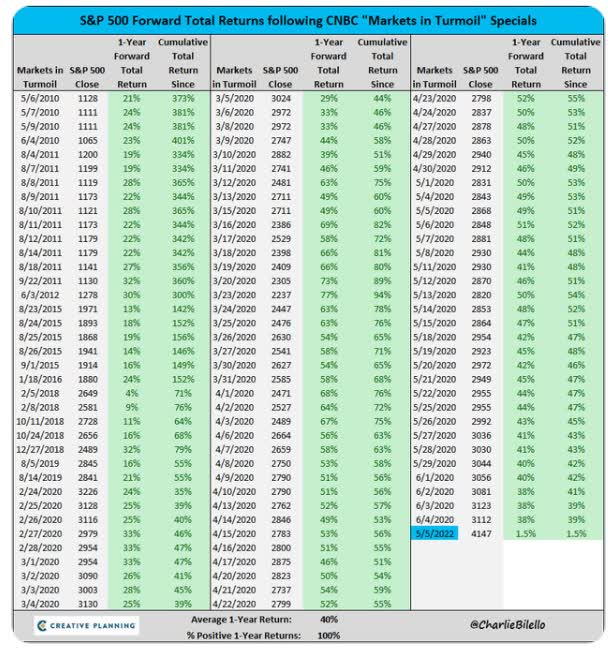

Bring on the terror, the market panic, and "markets in turmoil" specials on CNBC!

Charlie Bilello

Anyone owning these A-rated aristocrats within a ZEUS high-yield aristocrat portfolio doesn't just laugh at bear markets; they are euphoric at the thought of one!

The more markets crash, the more your hedges go up in value, letting you print free "dry powder" for your Buffett "elephant gun."

Moody's thinks stocks might fall 33%. Excellent.

UBS thinks stocks might fall 44%. Fantastic.

The JEC thinks stocks might crash by 45%. From their lips to God's ears!

When you know how to build world-beater blue-chip portfolios like these, bear markets don't become something to fear but to look forward to and embrace like a lover.

Every market crisis is an opportunity to boost long-term income, and these 10 A-rated aristocrats and two hedging ETFs are exactly how you can do it.

So sleep well, friends; the world's best companies have your back, even if the U.S. government doesn't. ;)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my family's $2.5 million hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own all of these aristocrats via ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.