BrainsWay Q1 2023 Results: A Step In The Right Direction

Summary

- BrainsWay has had a difficult 12 months, as a tough macro environment has overly impacted its customer base, which skews towards smaller companies.

- A return to growth and a renewed focus on profitability should begin moving BrainsWay towards breakeven in the second half of the year.

- BrainsWay's large net cash position and low market capitalization creates the opportunity for strong returns, but cash may need to be distributed to shareholders for this to occur.

da-kuk/E+ via Getty Images

BrainsWay (NASDAQ:BWAY) has had a difficult 12 months on the back of sluggish sales and rising costs. While much of this is likely due to the macro environment, BrainsWay has also likely been facing more aggressive competition. The business appears to have stabilized over the past 2 quarters though, and a renewed focus on profitability could soon make the stock appear inexpensive. I am slightly less optimistic about BrainsWay's prospects than I have been in the past as insurance coverage for OCD is yet to really shift the company's financials and competitors are demonstrating an ability to follow in BrainsWay's footsteps.

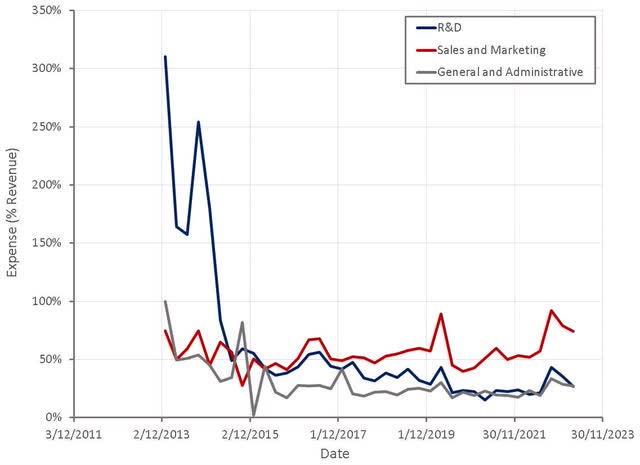

BrainsWay is trying to reduce its operating expenses by reprioritizing the allocation of R&D resources and reducing its focus on digital marketing. While there aren't currently any details on what future R&D efforts will look like, it is probably reasonable to expect BrainsWay to target a smaller number of indications with strong commercial prospects. BrainsWay also recently launched an investigator-initiated study program, which aims to support Deep TMS research through data collaboration and equipment loan initiatives. This would appear to be an effort to outsource some of the R&D burden of proving the efficacy of TMS. There also appears to be a shift in sales and marketing efforts towards more impactful sales initiatives, like direct sales to larger organizations.

BrainsWay is still collecting data from the soft launch of its smoking cessation product, but multicenter trial results have reportedly been good. The importance of this initiative is currently unclear, but if smoking cessation proves to be cost effective, leading to reimbursement, it should be supportive of growth and further differentiate BrainsWay.

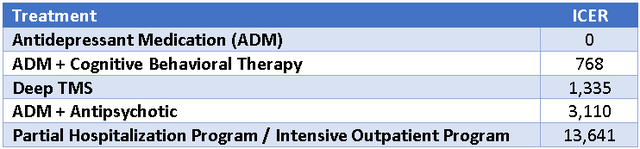

Treatment cost and the subsequent ability to obtain reimbursement is critical to more widespread adoption of TMS generally. TMS is relatively expensive and data on the durability of treatment effectiveness is somewhat limited, but BrainsWay continues to demonstrate it is a potentially viable option for treatment resistant patients.

Table 1: OCD Treatment Incremental Cost Effectiveness Ratios (source: Created by author using data from BrainsWay)

On the technology side, BrainsWay is also planning on launching a multi-channel system in 2023. There will initially be a limited product roll out which will be used to collect data for use in obtaining FDA clearance. A multi-channel system could enable a variety of unique stimulation protocols and obviate the need for a range of helmets to treat different conditions.

The first quarter of 2023 was far more constructive for BrainsWay, with a record number of units shipped, although this strength wasn’t fully reflected in revenue. Revenue was impacted by the inability to recognize around 0.9 million USD in lease revenue due to the financial condition of one BrainsWay customer. This situation is expected to impact BrainsWay’s recurring revenue throughout 2023. Management has stated that the company’s pipeline continues to grow, leading towards optimism for the remainder of 2023.

While the broader economy hasn't been overly impacted by the dramatic tightening of monetary policy over the past year, there are parts of the economy that have been significantly affected. It appears likely that at least some of BrainsWay's recent struggle is due to customers finding themselves in a weak financial position.

Figure 1: BrainsWay Revenue (source: Created by author using data from BrainsWay and The Federal Reserve)

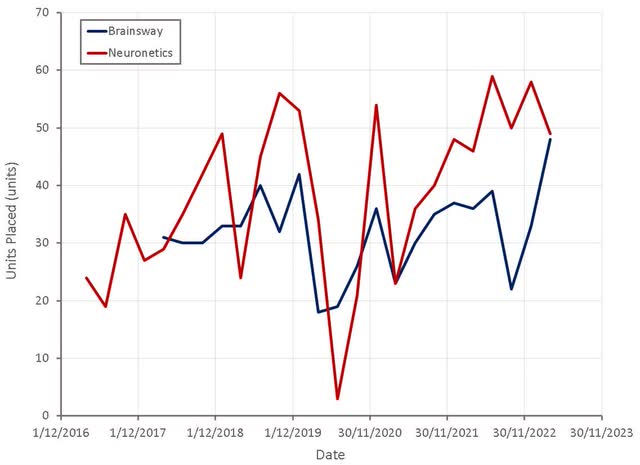

The number of new Deep TMS systems shipped in the first quarter increased to 48, bringing BrainsWay’s total installed base to 932, an 18% increase YoY. Adoption of BrainsWay’s OCD helmet also continues to increase, with 453 helmets now having been shipped. These are both reasonably positive results which support the belief that the underlying business remains healthy.

Figure 2: BrainsWay Units Placed (source: Created by author using data from company reports)

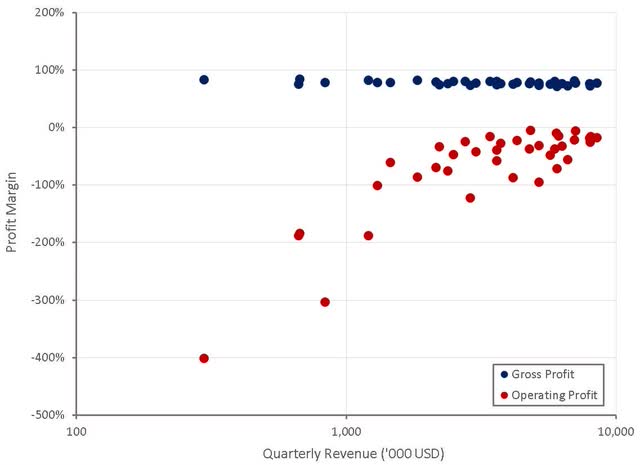

While BrainsWay still needs to demonstrate that recent revenue growth can be sustained, the primary concern for the company at this point is improving the efficiency of operating expenditures. The company recently instituted a number of cost optimization initiatives which are expected to begin yielding benefits in the second quarter.

Management is targeting operating income breakeven in the fourth quarter of 2023. This may appear to be an optimistic target based on BrainsWay’s current margins, but it should be achievable, provided that growth remains robust. The first quarter of 2023 included approximately 0.5 million USD of one-time severance cost and 0.9 million USD of revenue was missed due to the weak financial position of a customer. Management currently expect full year 2023 operating expenses to decrease moderately relative to 2022. This means that revenue in the fourth quarter probably needs to be around 7.5-8 million USD to achieve breakeven.

Figure 3: BrainsWay Profit Margins (source: Created by author using data from BrainsWay)

The big question for BrainsWay is whether it can begin realizing economies of scale with its sales and marketing efforts. The burden of sales and marketing expenses has remained relatively constant over the company’s history at a level that makes achieving decent margins difficult. This may have been reasonable 10 years ago when BrainsWay was trying to establish its market presence, but it is now a situation that needs to be resolved.

Figure 4: BrainsWay Operating Expenses (source: Created by author using data from BrainsWay)

As of March 31 2023, BrainsWay had cash, cash equivalents, and short-term deposits on its balance sheet amounting to 44.3 million USD, in comparison to its current market capitalization of roughly 26 million USD. This means that cash burn is not an immediate concern, as BrainsWay probably has at least a 4 year runway at its current burn rate. It also potentially sets the stock up for strong returns if the company can begin to consistently achieve profitability. Given the market's current indifference to small cap stocks, BrainsWay may need to begin to return capital to shareholders in the form of buybacks or dividends before the stock responds though.

While BrainsWay presents significant upside opportunity, there are questions around BrainsWay’s business. For example, there is growing acceptance of alternative MDD treatments, like ketamine. BrainsWay also seems to be struggling to capture sufficient value from the systems it is shipping to customers, with revenue growth trailing unit growth by a wide margin. It is also not clear that BrainsWay has a viable sales and marketing model figured out. The burden of sales and marketing expenses is high, and a heavy focus on digital marketing in 2021 does not appear to have been effective. The competitive advantage provided by an ongoing focus on R&D is also questionable. BrainsWay is blazing the trail on proving the effectiveness of TMS across a range of indications, but competitors are riding its coat tails while investing significantly less.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BWAY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.