Mobileye Global: A Speed Bump, Nothing More

Summary

- Mobileye Global stock has stabilized after a downward revision in full-year revenues and profitability.

- Market sentiment is becoming more forgiving, allowing for a long-term view on investing.

- Mobileye's growth prospects are tied to the auto market, and a potential resumption of growth in 2024 offers upside potential.

- I do much more than just articles at Deep Value Returns: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

metamorworks

Investment Thesis

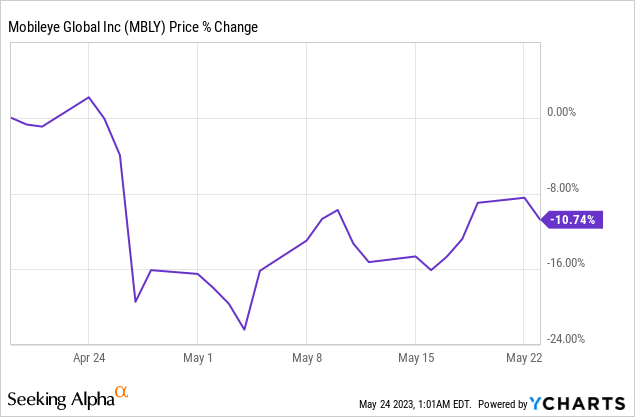

Mobileye Global Inc. (NASDAQ:MBLY) is an autonomous driving solutions company. Mobileye Global downwards-revised its full-year revenues and profitability guidance, and MBLY stock got hit.

However, recently, the stock price appears to have stabilized. While MBLY stock isn't particularly cheap, at around 41x forward cash flow from operations, investors that are able to wait until 2024 could be positively surprised.

In short, Mobileye argues that in 2024, the business will benefit from improved operating leverage, which will translate into higher cash flows than in 2023.

Why Mobileye Global? Why Now?

Mobileye Global is a provider of advanced driver-assistance systems (''ADAS'') and autonomous driving technologies.

When Mobileye Global first reported its updated guidance for 2023, the stock sold off by around 20%. But lately, Mobileye's share price has made a slight comeback. Why?

Not because of any fundamental market-changing news relating to Mobileye. Rather, I believe that the market is starting to become more forgiving. I believe that investors are returning to the stock market and are more willing to take a long-term view of investing.

To put it more concretely, in the past 2 years, investors had been selling first and asking questions later. But I believe that today, this stance is no longer as acutely taking hold. In short, I believe that the bear market has already come to an end.

While I'm far from calling this the start of a new bull market, my key argument is that now is the time to reconsider getting into the market and figuring out that it pays to have a slightly more patient long-term horizon.

Mobileye Global Growth Is A 2024 Story

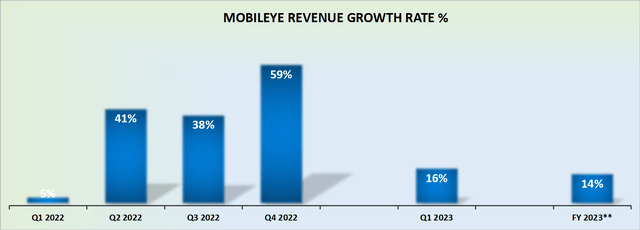

Nobody likes to see their company lower its revenue expectations for the year. Previously, Mobileye Global had been expecting to grow its revenues in 2023 by around 21% y/y.

Now, on the back of lackluster progress in China's auto market, Mobileye's revenue growth rates this year point to around 14% CAGR.

For a business that is perceived to be a high-growth cutting-edge technology business, these growth rates fail to impress.

That being said, I believe it's worthwhile keeping in mind that Mobileye's growth prospects are directly tied to the auto market. And, if indeed the auto market could resume its steady growth in 2024, this leaves investors today primed for upside potential in the next twelve months.

Financial Position Remains Very Strong

Next, let's get to the bull case of this investment thesis.

Mobileye holds $1.2 billion of cash and no debt. Furthermore, since Mobileye is clearly free cash flow positive, this provides Mobileye with enough resources to continue to invest in its underlying business and strengthen its growth prospects.

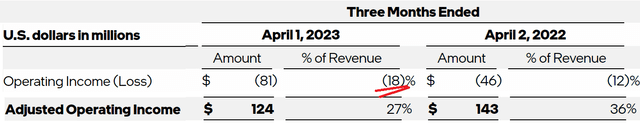

However, there are pesky considerations that make the overall profitability profile underwhelming right now.

Case in point, what we see above is that Q1 2023 saw both its GAAP operating loss and non-GAAP adjusted operating income turned south compared with the same period a year ago.

However, Mobileye continues to remind investors that, in 2024, the business could see substantial operating leverage.

We continue to believe that OpEx growth will come down closer to historical levels of 20% growth in 2024. That should enable us to begin generating substantial operating leverage if the core business continues to grow and our advanced products become a more meaningful portion of revenue.

The problem for investors is two-fold. We are halfway through 2023 and thinking about 2024, which feels like a long time away.

Secondly, and equally pertinent, if we roughly assume that this year, Mobileye Global reports approximately $800 million in cash flows from operations, this leaves the stock priced at 41x forward its cash flows from operations.

While this is clearly a lot cheaper than it was a few weeks ago, the fact remains, this is not the cheapest multiple going amongst tech companies.

The Bottom Line

Mobileye Global Inc.'s valuation has been cut lower, but the overall story remains intact. Even if progress is slightly slower now.

Again, I won't make the argument that recent Mobileye Global Inc. results are all that stellar. Rather, I make the contention that for this investment to work out positively, investors will have to be patient.

Fundamentally, I believe that it makes sense to stick with the leading companies in a sector. The companies that are able to outgrow their broad industry and take market share, even in a downturn. Don't give up on Mobileye Global Inc.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.