QYLD Has Been Rebounding While Generating Double-Digit Yields

Summary

- QYLD has rebounded 17.13% from its 52-week lows, and in 2023 QYLD has appreciated by 10.78%.

- Since its inception, QYLD has delivered 112 consecutive monthly distributions to its shareholders and established a long-term record of generating income.

- If you're looking for capital appreciation QYLD isn't a great choice, but as part of an overall income strategy it can become a strong addition to an income portfolio.

Sakorn Sukkasemsakorn

We're approaching June, and the markets have been rebounding nicely in 2023. The S&P 500 has appreciated by 9.63%, while the Nasdaq is up 11.15%. Investing isn't easy, and sometimes it takes nerves of steel to withstand a downturn, especially in a bear market. Some people dislike the Global X Nasdaq 100 Covered Call ETF (NASDAQ:QYLD), while others look at it as a passive way to generate income. Over the past year, shares of QYLD had declined as low as $15 as the Nasdaq fell deep into bear market territory. Since the lows, QYLD has appreciated 17.13%, and in 2023, shares of QYLD have appreciated by 10.78%. Over the years, I have seen many bear cases, but no matter what was articulated, QYLD continued to write covered calls and distribute income monthly to its shareholders. I wouldn't allocate capital toward QYLD for capital appreciation, as this is strictly an income play for me. No matter what has occurred from the pandemic, economic uncertainty, inflation, or political turmoil, QYLD has delivered 112 consecutive monthly distributions, and its income generation hasn't been impacted. QYLD continues to rebound and generate monthly income for its shareholders, and as the markets rebound, QYLD should continue to follow.

Investing in QYLD as an income play has been lucrative over the years, despite the chart

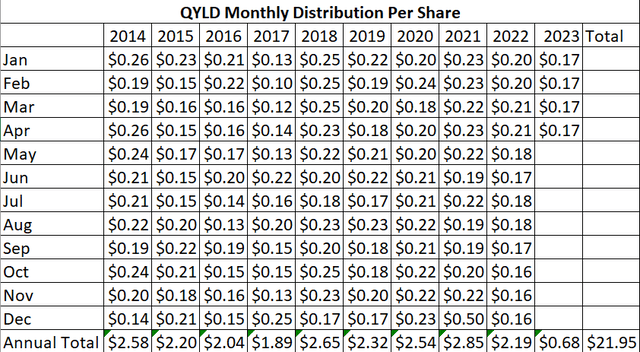

When investing for income, I have a different mindset than when I am looking for capital appreciation. Unless my investment thesis has changed, the price fluctuations don't bother me. As long as I own the underlying asset and its generating income, whether I am up or down on the original investment becomes insignificant. QYLD debuted at $25 and closed at $25.04 on its first day of trading. Since January of 2014, QYLD has delivered 112 months of continuous distributions, and generated $21.95 per share of income for shareholders. I have taken every distribution from the Global X site and put them in an annual grid below.

Since its inception, QYLD has produced 87.79% of its initial share price in distributed income from its monthly distributions. Based on the current share price of $17.57, shares of QYLD have declined by -29.72%. This may be a problem for individuals who are used to investing for capital appreciation, but from the perspective of income, it doesn't bother me. If I invest in a business that generates a monthly return, I am not focused on what the valuation of the business is day in and day out. I am focused on the stream of income it's going to generate for me. I look at QYLD from the same lens. Each share that was purchased and held since inception has generated $21.95 of income and is currently worth $17.57. While shares lost -29.72%, the net investment is positive by 58.07%. Between the $17.57 share value and the $21.95 in distributed income, you would be ahead of the game by $14.52 per share.

The trade-off between just buying the Invesco QQQ Trust ETF (QQQ) and QYLD, is a matter of preference to some degree. Since QYLD tracks the Nasdaq 100, some commenters have said that you're better off purchasing QQQ and just selling a share here and there to generate income. While this will work for a while, there is a fundamental flaw in this methodology. QQQ doesn't generate much of a dividend, as each share produces $2.17, which is a yield of 0.65%. If you purchased 100 shares and needed to sell 1 share per month for income each year, you would deplete your share base by 12 shares. The annual dividend on 100 shares would only generate $217 prior to selling the first share, which isn't enough income to repurchase 1 share annually. Eventually, you will deplete the share base if you need to generate income from the QQQ investment, regardless if shares are appreciating in value.

Purchasing 100 shares of QQQ would cost $33,651, and if you were to purchase QYLD instead, you would get 1,915 shares. Based on the TTM distribution of $2.05, the 1,915 shares of QYLD would generate $3,926.27 of income. This would correlate to $327.19 per month, which is around the same price as 1 share of QQQ. While some feel buying QQQ and selling a share to generate income is a better way to go, it doesn't make sense over the long haul. In less than 9 years, your investment would be gone, drawing down at a rate of 1 share per month, while your share base of 1,915 shares of QYLD would remain unchanged.

Why QYLD has been able to generate ample amounts of income despite economic and market cycles

What some have considered QYLD's weakness or fundamental flaw, has actually been its strength. Writing covered calls to generate income isn't a gimmick. It's a real strategy that works. I have been writing covered calls on my dividend holdings to generate additional income and supersize the overall yield for years. Regardless of the economic cycle, or market dynamics, the options market is alive and well. The difference is that premiums can fluctuate, and there isn't the same continuity each month as a quarterly dividend.

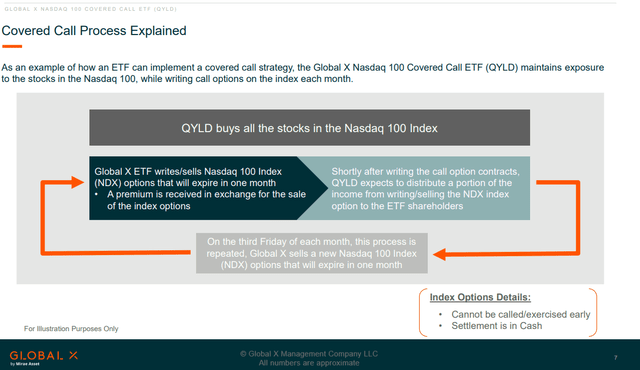

QYLD owns the underlying assets as it invests in the companies that make up the Nasdaq 100 then writes covered calls against those positions. Writing covered calls on its assets limits the upside potential if the market is appreciating as a trade-off to pay large amounts of income to its investors monthly. If the market rallies, the upside in QYLD is capped to an extent. Each month QYLD will write or sell one-month call options on the Nasdaq 100 index, which are covered since QYLD holds the securities underlying the options written. Each option written will generally have an exercise price at or above the prevailing market price of the Nasdaq 100 index from when it was written, creating immediate income for QYLD.

Covered calls aren't a gimmick, and while they have become more popular over the past several years, I am still surprised that some people place a negative stigma on them. When selling a covered call, you're writing a contract where someone buys the right to purchase your shares from you at a specific price on a specific date. If the price never reaches the agreed-upon price, the options expire worthless, and you keep the shares and the income you were paid. It's as simple as that. This becomes an obligation between you and someone else. QYLD amplifies this process and does the work for its shareholders. This is how QYLD is able to generate monthly income like clockwork.

Conclusion

QYLD has been rebounding with the market and continues to generate large amounts of income. I don't have a crystal ball, but QYLD has established a track record over 112 months of distributing income without having to sell a single share. QYLD isn't right for everyone, and I can't stress this enough if you're looking for capital appreciation, QYLD isn't going to meet your needs. If you're looking for income, QYLD is very interesting because it isn't dependent on dividend income from its investments to generate distributable income. I think QYLD can be a good component of any diversified dividend portfolio and deliver a continuous stream of monthly income and generate ongoing yields that are well above average.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QYLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.