BXMX: Buy-Write CEF Outperforming JEPI, 7% Yield

Summary

- BXMX is an equity buy-write closed-end fund.

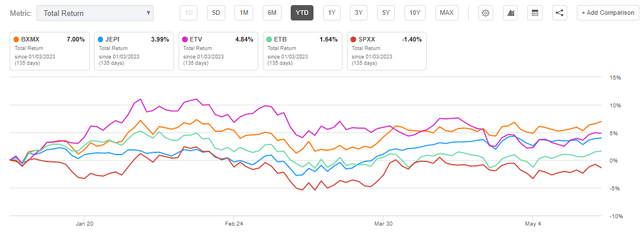

- The CEF has a 7% dividend yield and has managed to outperform most buy-write funds this year, including the vaunted JP Morgan JEPI fund.

- BXMX's structural features have helped its performance, including a high options overlay and a tight call option strike versus spot prices.

- Given the range-bound markets in the past months, we would have expected more buy-write CEFs to outperform, but in fact, some vehicles have negative YTD performances.

- Structural features in buy-write CEFs are critical in ensuring viability and profitability in today's environment.

Olivier Le Moal

Thesis

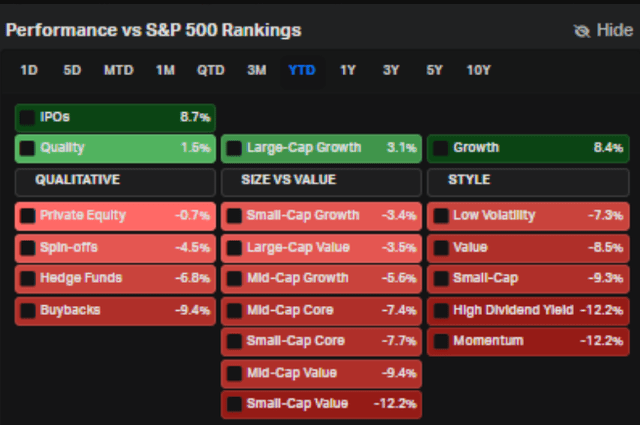

The S&P 500 is now up 10% for the year, although it has been very range bound in the past month. On paper this would be an ideal set-up for an equity buy-write fund, with a smooth increasing equity price action, while volatility is decreasing. In reality, the most followed names in the equity buy write space have had a terrible year, with the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX) actually negative year to date.

One of the new outperformers in the space is Nuveen S&P 500 Buy-Write Income Fund (NYSE:BXMX), and we are going to have a closer look at the fund and the drivers for its outperformance. We have covered this name before for investors here.

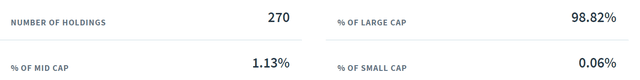

The vehicle has taken a very aggressive stance this year, writing calls on 99% of its portfolio, and furthermore it utilizes very high delta strikes which are only 2% off from spot levels. The closer the strike level to the current spot price, the higher the premium obtained for the written options. These are both structural features that have helped BXMX do well in 2023. Another component of its outperformance has been its composition - the fund holds only 270 names, mostly large caps and mega caps, in a year that has seen the FAANG cohort crush all other sectors in the market (the (FNGS) ETF which focuses on this cohort is up more than 50% in 2023 for example). On the other hand, the equal weighted S&P 500 index in the form of the Invesco S&P 500 Equal Weight ETF (RSP) is up just 1.23% for the year:

BXMX has therefore been helped by both its focus on large capitalization stocks, as well as its aggressive option overlay which incorporates a high delta.

Performance

The fund is the only one with a positive performance very close to that one exhibited by the S&P 500:

YTD Total Return (Seeking Alpha)

We are looking at a number of well-known CEFs in this space, namely the Eaton Vance Tax-Managed Buy-Write Opportunity Fund (ETV), Eaton Vance Tax-Managed Buy-Write Income Fund (ETB) and the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX). They all exhibit very poor performances so far this year, with SPXX actually being negative!

The S&P 500 is now up more than 10% for the year and volatility has come down tremendously with the market range bound. On paper, this should be an ideal time for buy-write funds to monetize their written call options and outperform the index.

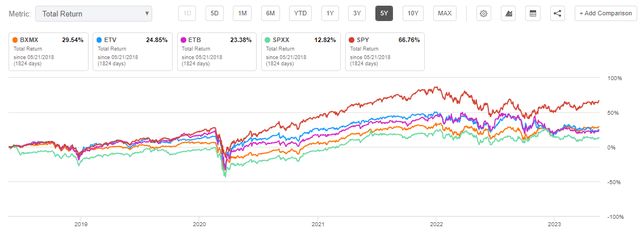

Longer term, BXMX is the winner as well:

To be frank, we are surprised BXMX outperforms ETV long term, since ETV in our book is the golden standard in the space, and furthermore it has a slight technology tilt.

Holdings

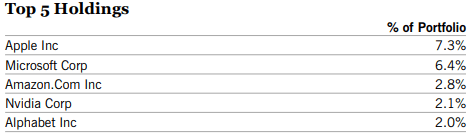

The fund tries to replicate the S&P 500 through its holdings, hence the top names are the FAANG cohort:

Top Holdings (Fun)

The fund does not hold each and every names in the S&P 500, but focuses on the large caps:

This has been beneficial for its performance in 2023, with large caps significantly outperforming the rest of the market this year.

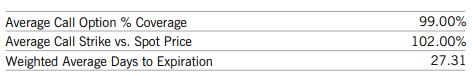

What is more interesting though is the option overlay details:

Option Overlay (Fund Fact Sheet)

The fund overlays calls on virtually the entire portfolio (99% coverage), and it does it with a very high delta (102% average call strike versus spot). The closer a written call is to the spot price the higher the delta (or sensitivity to underlying equity moves). That translates into a higher premium and a higher realized premium if the market does not push through the call level.

This is almost as aggressive as a fund can get with their option overlay - almost 100% coverage with a very high delta for the options. To note the fund writes options on the S&P 500 index rather than individual names, so there is a slight basis between its holdings and the S&P 500 holdings.

Conclusion

BXMX is an equity buy-write fund. The vehicle aims to replicate and outperform the S&P 500 via a written call strategy. The CEF holds only 270 names versus the index, and is focused on large cap stocks. This structural feature has helped the CEF this year, with mega caps outperforming the rest of the market. Furthermore BXMX takes a very aggressive stance in its option overlay, with over 99% of the portfolio covered by calls with a tight strike (102% average call strike versus spot prices). These two features have helped BXMX beat most of the buy-write funds out there this year, even the vaunted (JEPI) vehicle. Option overlay funds work in a range bound or gently up-trending market. We think there will be another leg down in this cycle, so long term BXMX shareholders can Hold, while new money should wait for a sell-off as a good entry point.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.