How To Drink Coke Like Buffett

Summary

- Everyone is looking for the "best" investment.

- A look at one of the greatest investments of all time.

- Some lessons we can learn.

- High Dividend Opportunities members get exclusive access to our real-world portfolio. See all our investments here »

Kerkez/iStock via Getty Images

Co-authored with Beyond Saving.

Warren Buffett has a well-deserved reputation as one of the best investors living today. He is one of my idols, and you've seen me talk about his investment principles. They are the basis of my own investing principles.

To be clear, I don't copy Buffett's investments, nor do I exactly mimic his style. Every investor needs to tailor their investment strategy to their unique needs. When looking at the "greats," our main goal should be to understand the fundamental principles. Like an artist studying Da Vinci, the goal isn't to learn to mimic but to learn the building blocks we can adapt and use in the creation of our own portfolios.

Today, I want to discuss one of Warren Buffett's most famous investments and the lessons we can draw from it.

When talking about the famous investments that Buffett has made over the decades, one that comes to mind is The Coca-Cola Company (KO). It's a Dividend Aristocrat that Buffett bought from 1988-1989 following the "Black Monday" stock market crash. He bought a few more shares through 1994 and has since held the position, neither buying nor selling a share.

Was KO a great investment? Is "The Oracle of Omaha" really a genius for picking KO out of the group?

Today, I want to look at this investment and discuss why it was great. It might not be for the reasons you think.

Lesson #1: You don't need to "crush" the market

Investors are always looking for ways to "beat" the market. I hear it all the time, endless obsessing about how much they are ahead or behind the market over some particular time frame.

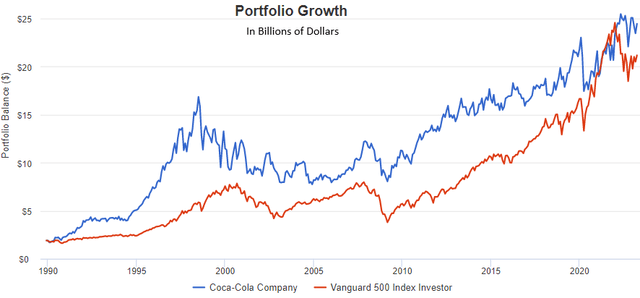

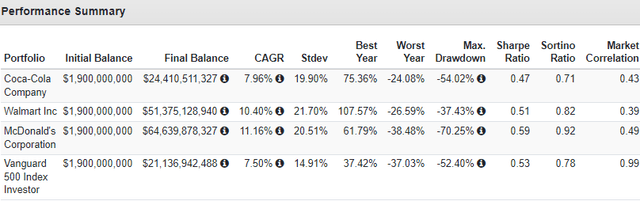

From the end of 1989, when Berkshire Hathaway's (BRK.A, BRK.B) position was valued at approximately $1.9 billion, to today, KO has enjoyed a CAGR of 7.96%, compared to the Vanguard 500 Index Investor at 7.50%.

We can use Portfolio Visualizer to model BRK's position in KO since 1989. This isn't going to be exact, but it should be very close. Source.

At the end of the day, BRK has about $3 billion in extra value from owning KO, as opposed to an index fund. If you include the impact of reinvesting dividends, that outperformance is a bit wider, but Buffett didn't reinvest his dividends. He took them out and did other things with them.

KO's outperformance is modest at best for one of the "greatest investments" that almost everyone is aware of. On a year-to-year basis, KO outperformed the market in 15 of the 32 years Buffett has held it. That's right, in over 50% of the years, KO was a "loser."

Lesson #2: You Don't Need To Own "The Best"

Another common theme I hear from aspiring investors is a desire to find "the next Amazon." From time to time, some investments have meteoric rises. Investors are often swayed by these "lottery ticket" types of investments.

KO wasn't a "lottery ticket" investment. It was a well-established company trading at an attractive price of about 15x earnings and paying a moderate dividend. It wasn't even the best investment at the time.

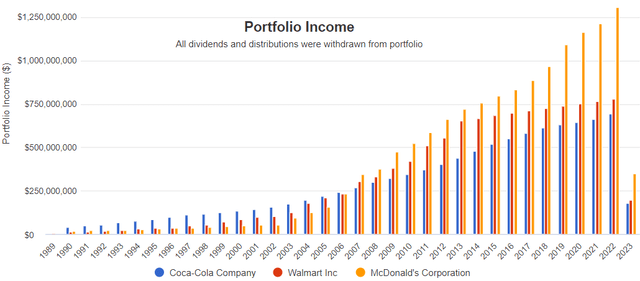

Too bad Buffett picked up a habit of drinking Cherry Coke. If he had fallen in love with Big Macs from McDonald's Corporation (MCD) or been a fan of shopping at Walmart Inc. (WMT), he would be a lot wealthier. Source.

Both investments would have enjoyed roughly twice the return and would be paying higher dividends today.

However you cut it, KO was a good investment, but it was nowhere near the best if you had a time machine and could go back and invest a couple of billion in 1989.

Lesson #3: Prices Will Swing

I am frequently asked why this ticker or that ticker is up or down X%. Many investors assume that if an investment is down, something is "wrong." As someone who writes publicly about the stocks I invest in, I am frequently criticized, with demands to admit that I was "wrong" when a holding I discussed is down 30% or more. (Some start at about 10% down.)

In his 2023 letter to shareholders, Buffett wrote:

"One advantage of our publicly-traded segment is that – episodically – it becomes easy to buy pieces of wonderful businesses at wonderful prices. It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. “Efficient” markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect."

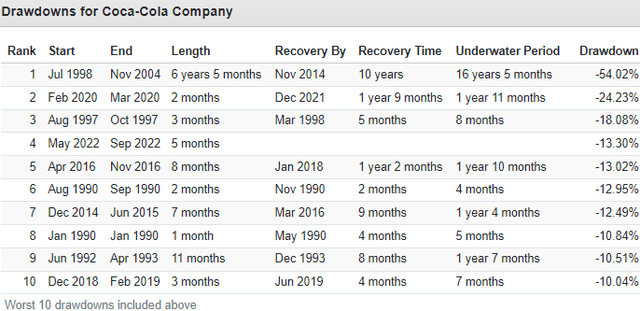

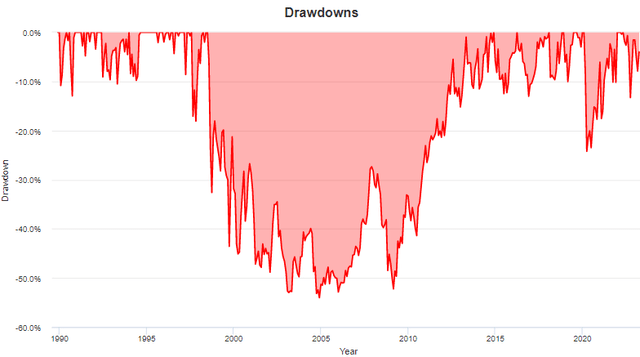

Here is a look at the largest "drawdowns" that KO has experienced since Buffett bought it. The "length" is the time it took to go from the peak price to the lowest price, and the "recovery time" is the amount of time it took to get back to the peak price after the bottom was reached.

Note that over 32 years, KO has seen ten drawdowns exceeding 10%. It is currently in one right now. The longest spanned from July 1998 to November 2014. For over 16 years, KO was trading below its peak.

During this massive drawdown, the price fell 54% from its peak and spanned two recessions. The GFC set in just when it felt like recovery from the Dot-Com bust. Source.

Buffett's position in KO was worth around $16 billion in July 1998. For the next 16 years, it spent most of the time trading around $8-$10 billion. Did Buffett panic and sell? No. Was he worried that there was "something wrong" with KO? No. He ignored the noise and was patient, confident that he owned a great company with good management and a dividend that would continue growing.

The Most Important Lesson

Warren Buffett's investing success isn't the result of some exceptional aptitude for identifying "the next big thing." When he bought Coca-Cola, it was a well-known and well-established brand. It already had market dominance, mass distribution, and a household name.

Over the decades, KO has beaten the market, but it was far from "the best" option for Buffett to buy at the time. With the advantage of hindsight, numerous stocks have materially outperformed KO over Buffett's entire investment and certainly over shorter periods.

KO has been a great investment for BRK, primarily thanks to patience. Over the decades, KO has paid BRK billions in dividends. Dividends were then used to invest in other companies and build the BRK empire. Buffett didn't panic and sell when KO's share price oscillated. He just went about his life, understanding that the price didn't matter because he had no intention of selling.

"The world is full of foolish gamblers, and they will not do as well as the patient investor." – Charlie Munger.

Our Income Method

The Income Method is "inspired by" Buffett; it isn't meant to copy him. We aren't billionaires, we aren't in the same position he was in 1989, and we have different priorities. Yet, we can still learn lessons from his style.

- Focus on the fundamentals

Our goal isn't to buy speculative investments that might make money in the future. We are buying companies that are making money right now. So much money that they are paying above-average dividends. Our main priority is to pick companies that will continue providing high dividends indefinitely.

- Be prepared to invest "forever"

We don't buy stocks to sell them by a certain date. We buy companies that we would be comfortable holding indefinitely. However, if the market is willing to pay us a price too high or something changes that makes the investment unattractive, we will sell.

- Be mindful of your goals

One thing that sets Buffett apart from other fund managers is his goals. In his 2023 letter, Buffett describes himself not as a "stock picker" but as a "business picker." He wants to own all of, or a portion of, a business forever. This is very different from many on Wall Street who live quarter to quarter, obsessively comparing themselves to the indexes.

Similarly, you likely have different goals. Most of you are not trying to be "professional" investors. You already had a career and managed to build up a chunk of capital. Now you want that capital to provide you with a financial means to live the rest of your life. At HDO, we focus on higher-yielding investments because a 3% yield is wonderful when you invest billions; it isn't so wonderful if you invest less.

- Diversify to protect yourself

A major difference between the Income Method and Buffett's style is that we stress diversification. I typically recommend position sizes of 3% or less. The reason is that, for Buffett, if KO stopped paying a dividend tomorrow, he would lose several billion in value and $700+ million in annual dividends. His lifestyle wouldn't be impacted at all. He would still be one of the richest people in the world.

When thinking about diversification, consider the impact that a disaster with that investment would have on you. I use 3% or less because, for the average investor, that risk would not have a material impact on your portfolio or income.

For some, larger losses can easily be absorbed; 3% is too stressful for others. If you are overly obsessed with the price movements of any particular stock, or a dividend cut/elimination would cause you to be stressed and possibly impact your ability to manage your finances, then you are over-allocated whether that allocation is 1% or 10% of your portfolio.

No investment is worth obsessing and gnashing your teeth over every time it goes up or down 10%. What percentage of loss can you shrug off, learn a lesson and move on without too much stress? That is the maximum percentage your allocations should be. Buffett's is much higher than mine. Yours might be higher or lower.

This is a question I can't answer for you. People often ask me if it is "ok" to increase their allocation to a certain percentage. Take time to really think about it and do an honest assessment of how much you can risk on one investment, both from a practical financial standpoint and a psychological one.

Conclusion

On Seeking Alpha, there is often a lot of debate about investing styles, often with different proponents arguing about which is "better" than the others. The reality is there is no single right answer. The "right" answer is the investment style that works best for you. No investment strategy will outperform at all times over all investment periods.

You need an investment strategy that will:

- Help you achieve your goals. The Income Method was created to achieve the goal of having a high current income and sustainable income growth.

- Keep risk within acceptable parameters. Nobody can predict the future, so your strategy should account for the strong likelihood that many of your investments won't meet your expectations. Buffett describes his portfolio as "a few" businesses that have been extraordinary and "a large group" that are marginal, along with others that have outright failed.

- Be easily executed by you today and in the future. The best strategy in the world isn't useful if you cannot execute it. Do you have the time, knowledge, and resources to follow your investment strategy today? Will you have the time and resources to follow it in the future? One huge strength of the Income Method is that you can execute it without a significant time commitment. You don't need to watch the market bob up and down daily.

- Fits your temperament. The most common mistake I see investors make is having a good strategy but failing to stick to it because they start second-guessing themselves. As a result, they end up having no strategy, just buying and selling based on their emotions, which is a guaranteed way to underperform and achieve none of your goals.

The Income Method is the best strategy for me. It is inspired by Buffett, and I strive to achieve the level of patience he has displayed over the decades. Yet, I don't follow him blindly because my goals are different. The Income Method is a strategy that has been successful for me, and I believe it is easily adapted to the goals of most retirees.

Was Warren Buffett's investment in Coca-Cola the greatest investment of all time? It only modestly "beat the market," yet it was a key investment that propelled Buffett's success over the decades and is a great example of his level of patience over his peers. Any investor with $1 billion could have put it in another company like Walmart or McDonald's and held for 40 years, and they would have beat Buffett. But nobody did because if they did, we would know their name as we know Buffett's.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years of experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. I am the lead analyst at High Dividend Opportunities, the #1 service on Seeking Alpha for 6 years running.

Our unique Income Method fuels our portfolio and generates yields of +9% alongside steady capital gains. We have generated 16% average annual returns for our 7,500+ members, so they see their portfolios grow even while living off of their income! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. Our motto is: No one needs to invest alone!

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and of course, on Seeking Alpha. Follow me on this page to get alerts whenever I publish new articles.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side, each of whom invest in our own recommendations, you can count on the best advice. (We wouldn't follow it ourselves if we didn't truly believe it!)

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space including dividend stocks, CEFs, baby bonds, preferreds, REITs, and more! To learn more about “High Dividend Opportunities” and see if you qualify for a free trial, please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.