Vontier: Why Earnings Could Bounce Back By 2024

Summary

- Despite the expected weakness, Vontier's robust quarterly results have showcased the strength of its core business.

- VNT stock has reported a surprising increase in revenues on a YoY basis.

- Although the current year will still be challenging due to the EMV headwinds, the company appears well-positioned to grow revenues and earnings from 2024.

jutawat Rawichot/iStock via Getty Images

Businesses have their ups and downs - that's just how it goes. The real test, however, lies in how well a company can handle the tough times. Take Vontier Corporation (NYSE:VNT), for example. It's really showing its strength and proving its business model is solid, even when the market gets tricky. Sure, its earnings might take a hit this year, but its recent quarterly results show that things won't be as bad as feared. More importantly, looking ahead, there's a good chance it could bounce back and start growing again by 2024.

About Vontier

Here's a bit about the company in question: Vontier is an industrial technology firm that specializes in delivering solutions such as technical equipment, components, and software to the mobility industry. Its offerings encompass a range of products, from fueling equipment and environmental sensors to vehicle tracking and fleet management systems, as well as car wash solutions and vehicle repair tools. With operations across 25 countries, Vontier still relies heavily on the United States, which contributes more than 70% to its total sales. Notably, the company's customer base is diversified, with no single customer representing more than 10% of its annual sales.

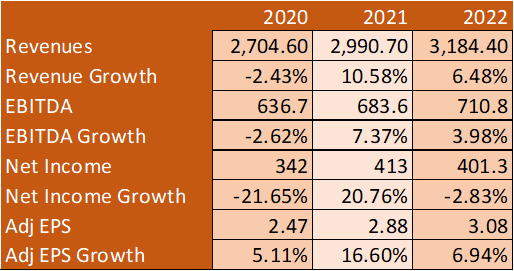

Vontier has been on a growth trajectory, both in terms of revenues and earnings, with the exception of the pandemic year. However, the current year was poised to be a challenging one, posing a serious test for the robustness of the company's core business. This predicament arose due to a surge in demand Vontier experienced over the past couple of years from fueling stations transitioning to the U.S. Eurocard, Mastercard (MA), Visa (V) (EMV) payment standard. The anticipated end of this adoption cycle was expected to trigger a decline in demand.

Author

Such a downturn would inevitably affect Vontier's Environmental & Fueling Solutions segment, the company's heavyweight in terms of sales and profit, and place its performance in a post-EMV world under scrutiny. It would also bring to the spotlight the resilience of Vontier's other business segments, evaluating their capacity to step up if required. Reflecting on the company's recent quarterly results, I believe that Vontier has met these challenges head-on. Despite facing hurdles, the results have demonstrated the underlying strength of the business, which is encouraging.

Earnings Analysis

A couple of weeks ago, Vontier unveiled its quarterly results, defying expectations of a decline and instead reporting a 3.8% year-over-year increase in revenues to $776.4 million. This rise was propelled by a core sales growth of 3.9%. Discounting the effects of EMV, the baseline core sales growth registered an impressive surge of 10.6%. The company posted an adjusted EPS of $0.68 per share, a marginal dip from $0.70 per share during the same quarter last year. Additionally, Vontier closed the period with free cash flows of $78 million, marking a notable rise from last year's $40 million.

Yes, there was a 2.2% contraction in core sales in the Environmental and Fueling Solutions segment, which was widely expected due to the drop in EMV demand, but it also experienced a robust 10% plus increase in baseline core sales growth. Furthermore, the company's two other smaller segments, Mobility Technologies and Repair Solutions, both logged double-digit growth in core sales at 12% and 10.5% respectively.

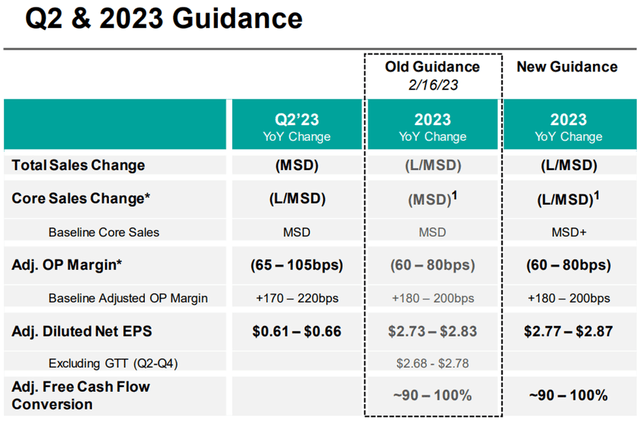

Another positive development is that Vontier has revised its guidance for core sales and adjusted EPS, showing an optimistic outlook. While the company still anticipates a downtrend in core sales for 2023, it doesn't foresee the decline to be as sharp as initially predicted. This suggests that the management team's confidence in the company's prospects is robust. The likelihood of Vontier posting a modest decrease in revenues and earnings is quite high. However, by 2024, when the effects of the EMV transition have subsided, the company should be poised to resume a normal pace of growth in both revenues and earnings.

Future Outlook Amidst Expected Challenges

Peering into the future, I'm of the belief that Vontier is well-positioned to maintain an upward trajectory in sales and earnings, on an adjusted basis, once we've factored out the EMV effect. It's essential to recall that the anticipated reduction in EMV demand was projected to impact the company's sales by $300 million in 2023. By my estimates, the bulk of this effect (roughly $180 million) was expected to surface in the second half of the year, a sentiment echoed by the management during the conference call. This implies that the EMV impact will persist as a drag on the company's performance throughout the year.

Despite these challenges, the revenue beat witnessed in the first quarter, in my view, highlights Vontier's sustained demand and underscores the resilience of its core business. All segments have delivered solid results. Notably, even after reporting better-than-expected revenues (primarily driven by the resolution of supply chain issues), the company still closed the quarter with a favorable book-to-bill ratio of 1. This suggests that Vontier continues to bask in a healthy demand environment from various end markets, an encouraging sign amidst the current challenging macroeconomic landscape. This is inclusive of the company's largest Environmental & Fueling Solutions segment, which is witnessing good dispenser demand due to new site openings and upgrade activities. This likely spurred the double-digit rise in sales and I foresee this trend extending into the future.

The company's ongoing introduction of new products and services is another highlight, proving that Vontier isn't slowing down. This includes the recently launched iNFX microservices software platform, geared towards enhancing services for convenience store retail clients striving to optimize their operations and improve customer service. As an established frontrunner in the convenience retail market (where non-fuel retail sales have been consistently growing at a CAGR of around 5% for two decades), Vontier is seeing an uptick in demand for its automation and digitization offerings. A recent victory in customer acquisition for the company will see the deployment of iNFX at the client's sites located all across the US.

There's also Vontier's knack for generating healthy free cash flows to keep in mind. This cash generation capability can enable Vontier to repay debt and distribute excess cash to shareholders through share buybacks. This should have a positive impact on its shares.

In the first quarter, the company allocated $18 million towards share buybacks and $65 million for debt reduction, though it should be noted that $50 million of the debt reduction was facilitated by an asset sale (GTT). Given that the second quarter is typically a seasonally low period for cash flows, we might witness a dip in free cash flows in the upcoming quarterly report. However, I anticipate things to stabilize from the third quarter onwards. As such, it's likely the company will persist in directing cash towards buybacks and debt reduction. As it stands, the company's debt has dropped from $2.58 billion at the end of last year to $2.51 billion at the conclusion of the current quarter.

Takeaway & Risks

Vontier shares have experienced a strong rally this year, rising by almost 50% on a year-to-date basis. To me, this underscores market confidence in the robustness of the company's business, which should presumably facilitate growth in revenues and earnings from 2024 onwards.

However, from a valuation perspective, the stock appears to be fully priced. The company's shares are trading at 10.3x forward earnings estimates, aligning closely with its five-year average of 10.04x, as per data from Seeking Alpha. While shares are trading at a discount compared to the sector median of 20.9x, this discount could be justified by Vontier's high debt levels.

This leads us to a critical discussion about the risks confronting Vontier. It's important for prospective shareholders to bear in mind that the company shoulders a higher-than-average level of debt. As specified previously, Vontier carries $2.58 billion of debt, corresponding to an elevated debt-to-equity ratio of nearly 400%. While this debt level does not immediately raise alarms and appears to be manageable, there are nuances to consider. The company's near-term debt maturities consist of $335 million due in 2024, $600 million in 2025, and $500 million in 2026, with no impending debt for 2023.

Given that Vontier has generated more than $200 million in free cash flows on a ttm basis and possesses $958 million of liquidity (comprising $208 million in cash reserves and $750 million available under the revolving credit facility), these obligations seem to be under control. Nevertheless, the significant debt load still exerts a burden on the company. It pressures earnings and cash flows due to interest payments, and necessitates allocation of financial resources for repayment. Thus, despite appearing manageable on the surface, this debt is a substantial factor shareholders must take into account.

If the company's financial plans falter - for instance, if it fails to generate adequate levels of free cash flows due to an unexpected downturn in market conditions - this could position Vontier in a precarious situation. Therefore, the company's debt situation, while currently manageable, remains a critical point of consideration for shareholders and potential investors.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.