BJ's Wholesale Club: Explaining The Post-Earnings Selloff And Why It Might Be A Value Trap

Summary

- BJ's Wholesale Club reported mixed Q1-23 results, with $0.85 EPS coming in line, and revenues of $4.7B missing by $90M.

- The company opened 2 locations in the quarter and is on track to deliver its 11 openings target for the year. Comparable sales excluding gas amounted to 5.7%, above guidance.

- Gross margins improved by 1 percentage point to 18.6%, however, management expects margins to decline in the following quarters.

- The main reason for the selloff is hiding in a comment made by management on the earnings call, stating next quarter EPS should be up only slightly, while the consensus expects $1.06.

- Despite the relatively attractive valuation after the selloff, I rate the stock a Hold over competition and growth concerns, with a price target of $69.9 per share.

jetcityimage/iStock Editorial via Getty Images

BJ's Wholesale Club (NYSE:BJ) reported mixed Q1-23 results, with $0.85 EPS coming in line, and revenues of $4.7B missing by $90M. The stock is currently down 8.5%, mainly due to a comment made by management on the earnings call, stating next quarter EPS should be up only slightly, while the consensus expects $1.06.

Despite being significantly undervalued compared to its peers, BJ's isn't attractive in my opinion, as the company's growth prospects are questionable, primarily due to the fierce competition and unproven track record.

I rate the stock a Hold with a price target of $69.9 per share, reflecting 9.0% upside at the time of writing.

Company Overview

BJ's Wholesale Club is a warehouse club operator with 237 clubs and 167 gas stations across 18 states. In addition to shopping in clubs, BJ offers an E-commerce website and mobile app, through which it provides buy-online-pickup-in-club ("BOPIC") service, curbside delivery, same-day home delivery or traditional ship-to-home service, as well as through the DoorDash (DASH) and Instacart (ICART) marketplaces where members receive preferential pricing by linking their membership.

BJ's is concentrated primarily on the east coast, with more than three times the number of clubs compared to the next largest warehouse club competitor in the area.

Club Members & Membership Fees Income

The company offers its 6.8M members four tiers of memberships, with varying annual fees and benefits:

BJ's Wholesale Club March 2023 Investor Day Presentation

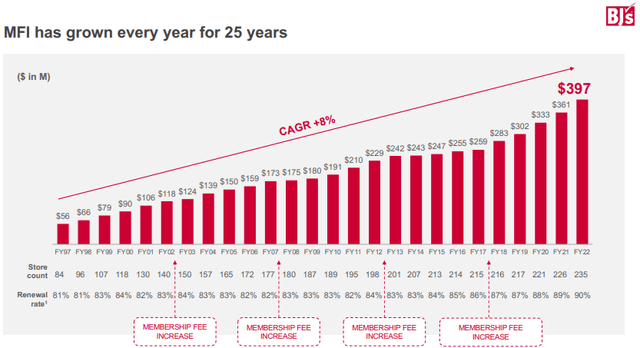

Membership fee income (MFI) increased consecutively for the last 25 years, at an 8.0% CAGR. In 2022, MFI amounted to $397M. As we can see, the company typically raises its fees once every five years, which means we're closing in on another raise in the near term. Moreover, renewal rates are at an all-time high, reaching 90% in 2022, and reflecting the growing popularity of wholesale clubs.

BJ's Wholesale Club March 2023 Investor Day Presentation

Stores & Competitive Position

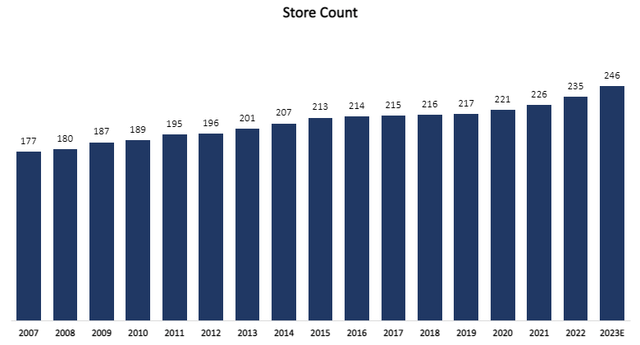

BJ's is a relatively small player in the wholesale club market, with 237 warehouses in the U.S. as of March 2023, compared to Costco's (COST) 584 and Walmart's (WMT) Sam's Club 600.

Created and calculated by the author using data from BJ's Wholesale Club financial reports (10-K)

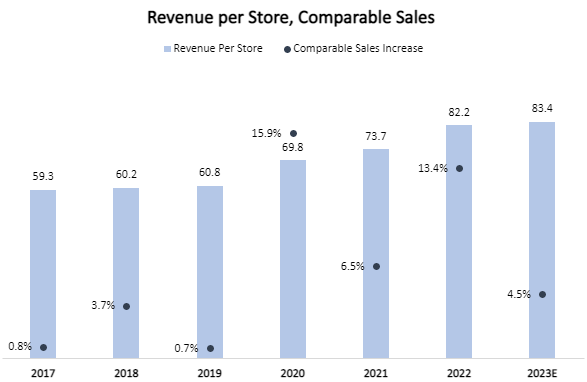

Not only is it smaller in terms of locations, BJ's warehouses in general are relatively smaller in terms of size and sales per location compared to Costco and Sam's Club. While Costco generates more than $250M in annual sales per warehouse, BJ's is at around $83M.

Created and calculated by the author using data from BJ's Wholesale Club financial reports (10-K)

As we can see, revenue per location has been growing steadily, along with consecutive increases in comparable sales. However, BJ's is still very far from reaching Costco levels, and it isn't feasible, with the much smaller size of its stores in terms of square meters.

BJ's Wholesale Club March 2023 Investor Day Presentation

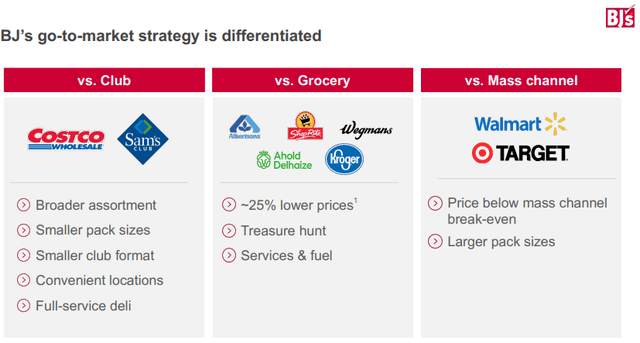

BJ's differentiates itself as a mid-sized club compared to three main types of competitors - other clubs, grocery retailers, and mass channels. Looking at clubs, BJ's supposedly offers more convenient locations and smaller pack sizes. Looking at grocery retailers, BJ's offers lower prices and additional services like gas and optics, and looking at large retailers like Walmart and Target (TGT), BJ's offers larger pack sizes and better prices.

Overall, as I will discuss under risks, I believe there isn't real, significant differentiation here. The competitive landscape is very challenging and no company has a real advantage. They all sell essentially the same products (with the exception of some private label options), and then it comes down to convenience and price. Consumers with stricter budgets might go the distance for a cheaper option, and vice versa. But, the truth is, if there's a BJ's, a Costco, and a Sam's Club nearby, there isn't a clear advantage to any of them in my opinion.

The Wholesale Club Business Model

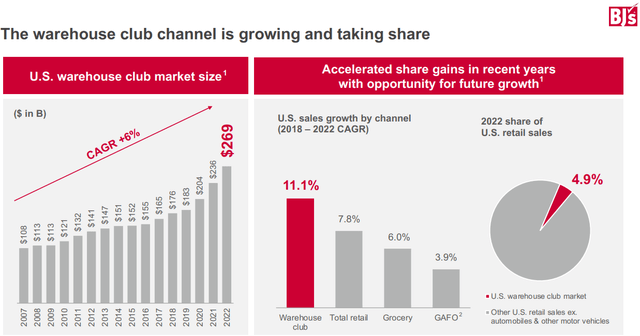

Pioneered in 1982 by John Geisse, who founded "The Wholesale Club" which merged into Walmart's Sam's Club, the wholesale club business model is becoming more and more popular, especially at times of deteriorating economic conditions.

BJ's Wholesale Club March 2023 Investor Day Presentation

In short, a wholesale club conjoins a large number of paying members who pay an annual fee to enjoy the club's benefits, which are typically cashback rewards, and cheaper delivery. The club then aggregates the buying power of all its members in negotiations with major suppliers and offers limited services, as well as a limited number of SKUs (stock-keeping units).

The combination of lower COGS and a leaner operation enables the club to sell goods to its members for a significantly lower price compared to the average, which then incentivizes more members to join and the flywheel continues. Actually, the majority of the club's profits is generated from the member fees, and many of the goods a club sells have zero or negative markup (the club sells it for the same price it was bought for or lower).

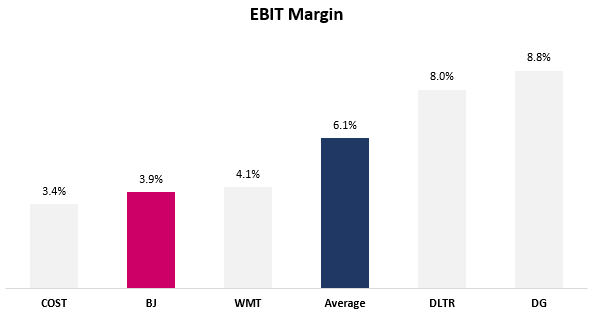

Thus, we see pure wholesalers operate with extremely low operating margins, as their turnover is very steady. For example, Costco's EBIT margin for the last 12 months amount to 3.4%, and BJ's is not much higher at 3.9%. Actually, unlike other industries, lower margins could be a sign of strength when looking at wholesalers, as long as it's stable and predictable.

Growth Prospects

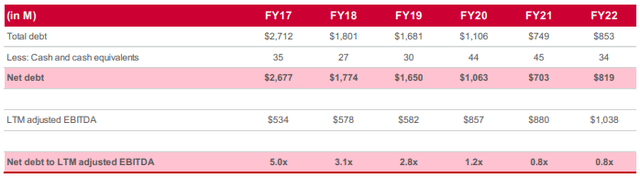

BJ's didn't have a major growth strategy during the last decade, as it dealt with higher leverage than its peers, with relatively high net debt / Adj. EBITDA.

BJ's Wholesale Club March 2023 Investor Day Presentation

We can see that right around 2021, the company reached reasonable leverage levels, and with the election of Bob Eddy as CEO, BJ's was ready to accelerate store openings and provide investors with a clear long-term growth strategy.

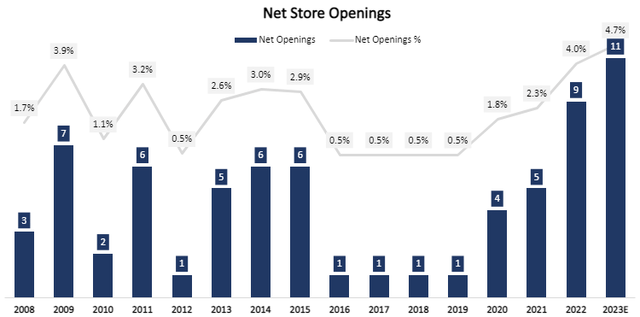

Created and calculated by the author using data from BJ's Wholesale Club financial reports (10-K)

Revenue Growth

BJ's management expects mid-single-digits revenue growth for the foreseeable future, driven by stable comparable sales growth, combined with 10 new openings per year, a stable gas business, and mid-single-digits MFI growth.

BJ's Wholesale Club March 2023 Investor Day Presentation

Historically, as we saw above, comparable sales had years of close to zero growth, and ever since 2008, never did the company open more than 9 locations in a single year. So, we should take these targets with caution. Moreover, it's important to remember there are already large operators in the U.S. It's not like 40 years ago when Walmart and Costco began. Attractive locations aren't that easy to find and those that are available are driving interest from many competitors. Thus, I believe BJ's expansion targets are very ambitious. So far, it seems they are on track.

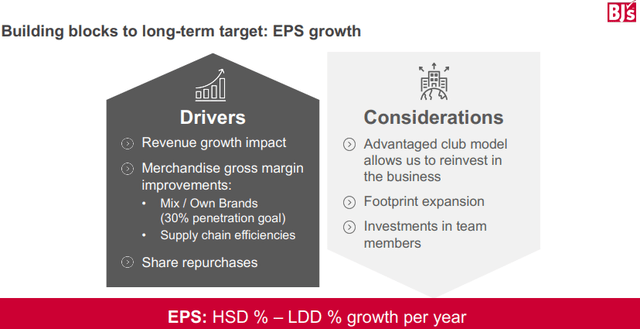

EPS Growth

As Peter Lynch says, the stock eventually follows the earnings. Revenue growth is nice, but earnings growth is incomparably more important.

BJ's Wholesale Club March 2023 Investor Day Presentation

On that front, management targets high-single-digits to low-double-digits EPS growth, driven by revenue growth, margin expansion, and share repurchases. Specifically on the margin expansion front, the group relies on supply chain efficiencies (as it exploits the same distribution channels for additional clubs) and Own Brands penetration, with a 30% target (currently at 24%).

Competitors & Multiples

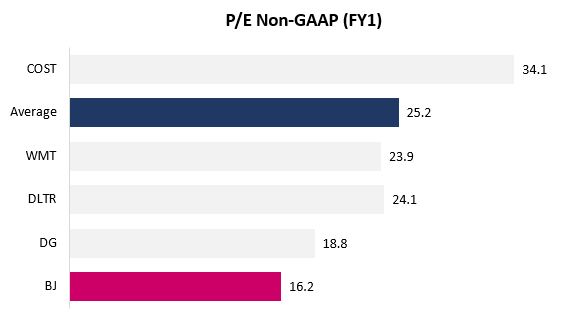

BJ's is clearly discounted compared to its peers, as it trades at a significantly lower P/E multiple compared to the peers' average.

Created by the author using data from Seeking Alpha; Data as of May 23, 2023

While it seems like an opportunity, I believe the market views BJ's as the lowest quality among its peers, due to lackluster comparable sales growth in the past, and its inability to outgrow even materially larger competitors like Costco and Walmart.

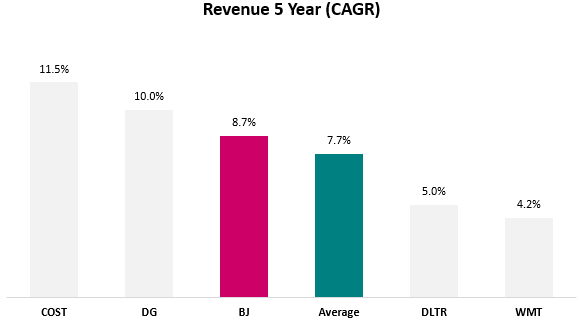

Created by the author using data from Seeking Alpha; Data as of May 23, 2023

As we can see, for the past 5 years, Costco outgrew BJ's despite starting at a much higher baseline (in 2019, Costco generated 10X the sales of BJ's).

Created by the author using data from Seeking Alpha; Data as of May 23, 2023

Looking at EBIT margins, it becomes clear that BJ's is playing in the field of giants. The company's business model requires operating at low margins. As such, scale is a key factor. And in terms of scale, Walmart and Costco are at a whole other level, generating revenues of $611B and $235B, respectively, in 2022.

Overall, I find BJ's positioning to be concerning. It competes with behemoths and doesn't provide real differentiation to the market. Thus, I believe it will be extremely hard for the company to generate profitable growth at the same pace as its peers, despite the law of large numbers working against them.

Valuation

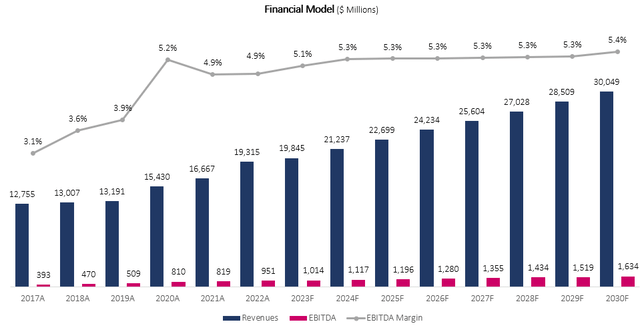

I used a discounted cash flow methodology to evaluate BJ's fair value. I assume the company will grow revenues at a CAGR of 6.1% between 2023-2030, based on $400M incremental revenues each year according to the 10 store openings per year target, and 5.0% comparable sales growth.

I project EBITDA margins to increase incrementally up to 5.5% in 2030, due to improvements in gross margins with increased penetration of Own Brands and economies of scale which will result in a decrease of G&A as % of sales, as well as a decrease of opening costs as % of sales.

Created and calculated by the author based on BJ's Wholesale Club financial reports and the author's projections

Taking a WACC of 9.0% and adding BJ's net debt position, I estimate the company's fair value at $9.4B or $69.9 per share.

Risks

BJ's is operating in the consumer staple category. It mostly sells essential products, with approximately 85% of its revenues derived from groceries and gas. Moreover, the company is one of the cheapest options among its peers. Thus, I see no material risk regarding demand here, and I believe the company's results should be very steady and stable.

The major concern I have with BJ's is competition. In general, I try to avoid investing in companies that have no significant competitive advantage, and I believe BJ's falls in that category. In my view, in the wholesale market (and adjacent markets like mass channels and grocery retailers), the only real competitive advantage is geographic presence. In essence, everybody copies the business model of the other, and everybody sells essentially the same products. Some lean on cheaper pricing, and some lean on better customer experience, but the real importance is geographic position. As a club customer, your first choice will generally be the nearest location, unless there's a material price difference. As a U.S.-only operator, the expansion opportunities are limited with competitors like Costco and Walmart having vast operations throughout the country. And, geographic expansion is the focal point of BJ's growth strategy.

According to management, every new location makes around $40M in sales in its first year. Currently, BJ's annual sales are around $20B. On a 10-location-per-year pace, we understand that new locations should drive approximately 2% sales growth each year. If the company fails to meet its expansion targets, revenue growth might not meet management's targets.

Another cause for concern is the company's comparable sales growth, which historically hasn't been impressive. While management targets 4%-5% (excluding gasoline prices) for the foreseeable future, the company achieved that range only twice between 2017-2022. Now there's a caveat here, which is pulled-forward demand during Covid-19. In 2020, no-gas comparable sales grew by 21.4%, making it tough to achieve targets in the trailing years. When we smooth out comparable sales, we see a CAGR of 4.7% between 2017-2022, right in the middle of management's targets.

Lastly, I want to address the limited track record of cash returns to shareholders. BJ's doesn't pay a dividend, and its share repurchase program is underwhelming, as the current number of outstanding shares is still 52% higher than what it was in 2015. This is a clear representation of the importance of scale, as the company uses the majority of its cash flows to finance store openings and improvements, not leaving much for the shareholders in the near term. Being a 'stalwart', I view the low returns to shareholders as another unattractive aspect of the company.

Conclusion

BJ's Wholesale Club operates a steady business, with sticky recurring demand. Competition in its industry is fierce, with no real differentiation between companies. Despite being relatively smaller, BJ's isn't outgrowing its larger peers by a significant margin, due to the importance of scale and large resources in the industry. Moreover, as it operates only in the U.S., there are limited opportunities to expand. For all these reasons, I don't find the stock attractive despite its undervaluation compared to the peers' average, and despite the massive post-earnings selloff. Thus, I rate BJ's a Hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.