Added Microsoft To Our New 2024 Model Portfolio (Technical Analysis, Upgrade)

Summary

- This is a technical analysis article. We have added Microsoft Corporation stock to our new, one year, 2024 Model Portfolio because it has our proprietary, fundamental and technical SID Buy Signal.

- Seeking Alpha Quant ratings show that Microsoft Corporation gets good grades for Profitability, Revisions and Momentum, but poor grades for Valuation and Growth.

- Microsoft is outperforming the market and will remain in the portfolio as long as this continues. The market is giving it an AI growth premium. We are upgrading to Strong Buy.

- It has a low beta and will do better than the Index in a down market. We expect this bear market to retest the bottom by October.

- Management beat Google to the punch on AI, and that tells me how sharp management is at Microsoft. We expect Google to catch up quickly.

- This idea was discussed in more depth with members of my private investing community, Daily Index Beaters. Learn More »

jewhyte

Microsoft Corporation (NASDAQ:MSFT) has our proprietary Stocks In Demand, SID Buy Signal, so we have added it to our new, one year, 2024 Model Portfolio. We had a Buy Signal in our previous MSFT article and we now are upgrading to a Strong Buy Signal. As long as it continues to outperform the Index, it will stay in the portfolio. MSFT has a low beta, so we expect it to go down less than the S&P 500 Index (SP500) when this bear market goes down to retest the bottom.

Our SID Buy Signal uses both fundamentals and technical indicators. We use the MSFT chart below to see the technical Buy signals. We like to use SA Quant ratings and articles to do our fundamental due diligence. We see the good SA ratings for Profitability, Momentum and Revisions. We have a problem with the weak scores for Valuation and Growth.

The recent surge in artificial intelligence, or AI, may solve some of the growth challenges. It was very surprising that MSFT was able to beat Alphabet Inc. (GOOG, GOOGL) aka Google by incorporating AI into its existing platform. That tells me how good the management is at MSFT. Unfortunately for MSFT, the guys at GOOGL are smart enough to catch up very quickly. GOOGL has already reorganized its AI departments to do just that. Most companies will be using AI to improve their products.

PEG is the metric that combines both Growth and Valuation. As you might expect, the low growth and high P/E give us a PEG that is overvalued because the PEG is above 2. Growth needs to move up, or price needs to move down, to bring this PEG down to more acceptable levels. Right now, the market is giving MSFT an AI premium in price. It expects growth to improve and for analysts to upgrade.

Because MSFT is overvalued, we know that it will go down when the recession comes and the market goes down. Most overvalued stocks will drop when the market drops. However, even if MSFT drops with the market, it may drop less than the market and continue to outperform the Index. In that case, it would stay in our Model Portfolio, even if our SID Buy Signal drops to a Hold Signal.

Right now, the analysts' consensus 12-month target is about $331. Price continues to move up reaching for that target. As soon as it hits that target, we expect to see a pullback in price to retest support. The growth of AI in MSFT may force analysts to raise that target.

We will have to watch that movement. Right now, 44 of 53 analysts on Wall Street have a Buy rating on MSFT, so you can see that it is quite possible they will raise their targets. We are not that sanguine, but it is an indication that they might move the target higher. Also Seeking Alpha has a good rating for Revisions.

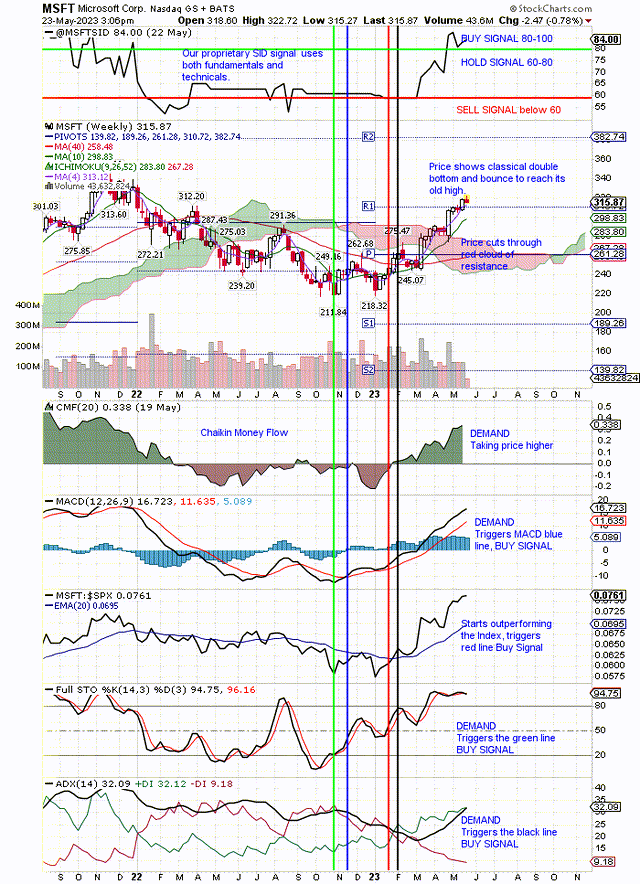

Here is the weekly chart for MSFT showing our Buy Signals, Notice the vertical line; technical Buy Signals occur well ahead of our SID Buy Signal. Valuation problems with MSFT cause our SID Buy Signal to lag the purely technical buy signals. The advantage of our lagging SID signal is that it provides a great degree of confidence in higher prices.

Our lagging SID Buy Signal provides confidence to upgrade to Strong Buy (StockCharts.com)

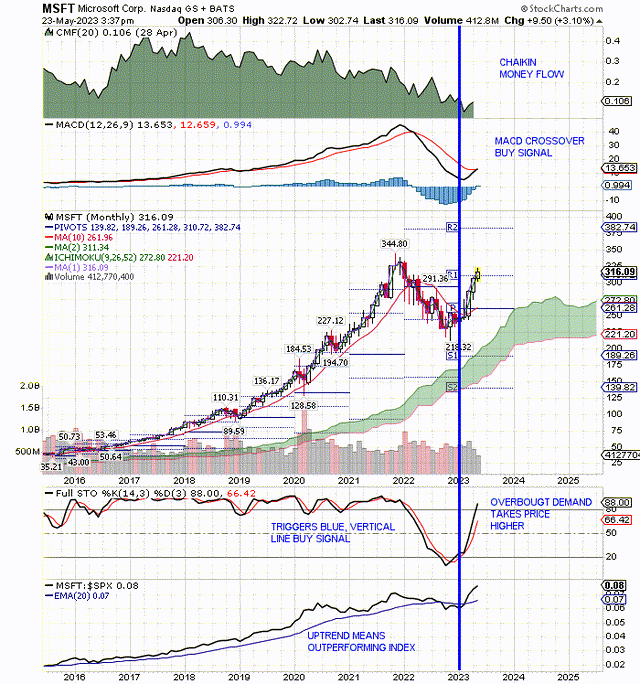

Here is the monthly chart, and it shows MSFT targeting its old high with our technical, vertical, blue line, Buy Signal.

Use our free, 30 day training program to become a succesful trader or investor. Join us on Zoom to discuss your questions.

This article was written by

Tom’s book "Successful Stock Signals for Traders and Portfolio Managers" is available on StockCharts.com and Amazon. The StocksInDemand.com system is designed to make money using a combined fundamental and technical grade for each stock. Tom received his MBA in Accounting from St. John's University, where he taught courses on the stock market. He marketed fundamental research, technical research and quantitative research to professional portfolio managers during his Wall St. career.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.