PXE: Energy ETF In All The Right Places For Next Bull Run

Summary

- PXE focuses on a limited number of stocks in the energy exploration and production (E&P) industry.

- PXE’s tightly constructed, high-yield E&P portfolio should outperform more popular energy index ETFs in the coming years.

- It is at a rare buying point that has only been seen two other times in the last 5 years.

- I rate PXE as a Buy, based on a 12-24 month outlook.

peshkov

Invesco Dynamic Energy Exploration & Production ETF (NYSEARCA:PXE) is poised to outperform larger, more diverse energy ETFs. One of the key advantages and differentiators of this ETF compared to other energy ETFs is its quant-based strategy for selecting stocks. The ETF also constructs its holdings in a way where it does not have too much downstream (manufacturing and marketing) exposure. Unlike most other energy indexes, this ETF holds a strong mix of small, mid, and large-cap stocks and isn't skewed to the top.

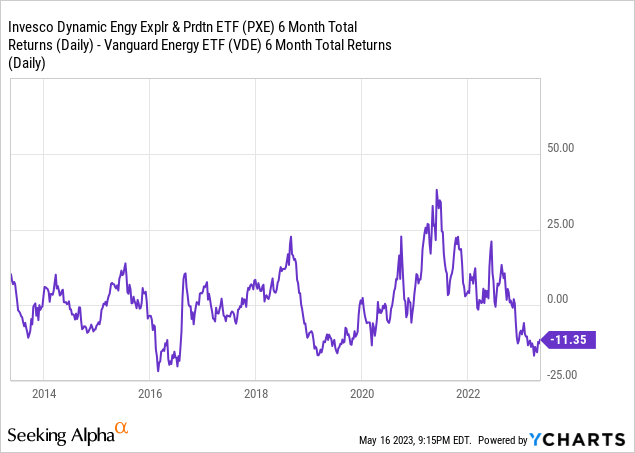

In the past two and a half years, PXE has outperformed one of the most notable energy index ETFs (VDE) about two-thirds of the time. However, based on the last three years of performance, it currently dipped and is now underperforming by about 11%, which I see as akin to a stock selling at a discount to its own history. It has also beaten VDE by over 20% 4 times, with one instance almost reaching 40%. Along with this impressive return history, VDE also has an attractive 12-Month Distribution Rate of a little over 4%.

As we head into the summer of 2023, many economists predict a rise in oil prices. If this happens, this is where PXE would outperform most energy indexes. PXE holds a high concentration of upstream oil companies. Upstream companies are the most affected by changes in oil prices. This means that this ETF's companies would profit more from the rise in oil prices than the downstream companies that are highly concentrated in other energy indexes.

Strategy

PXE aims to track the Dynamic Energy Exploration & Production Intellidex Index by utilizing a full replication technique, meaning its holdings are identical to the actual index. It invests in both small, mid, and large-cap stocks across the energy exploration and production sector. With approximately $152 million in AUM, this is much smaller than popular energy sector ETFs like Vanguard Energy ETF and Energy Select Sector SPDR® ETF (XLE), and makes PXE a "hidden gem" in this crowded part of the ETF space.

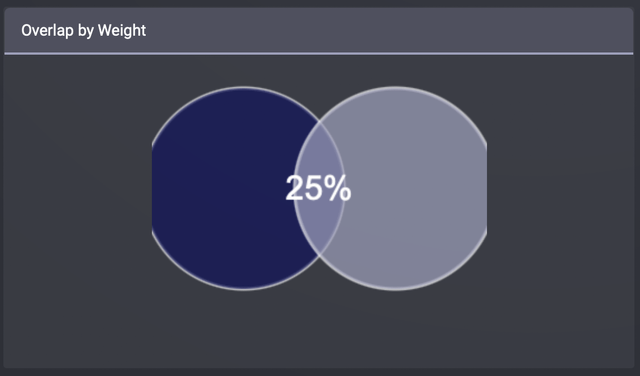

PXE holds 32 energy exploration and production stocks weighted by a quant-based strategy. This strategy takes many factors into account, including price momentum, earnings momentum, quality, management action, and value. Having a unique, non-market-cap-weighted strategy means that its holdings are very different from most other energy index funds. For example, PXE has only a 25% overlap with VDE.

PXE and VDE Overlap (ETFRC.com)

PXE's top 10 holdings account for about 47% of the AUM. The fund and index are rebalanced and reconstituted quarterly.

Strengths

The greatest strength of PXE lies in its holdings. The biggest difference between PXE and a typical market-cap weighted energy index is that PXE does not hold Exxon Mobil (XOM) or Chevron (CVX). These two stocks usually comprise around 40% of the market-cap weighted energy index. In PXE, the top 10 holdings only account for about 47% of the slate, making PXE much more diversified. Excluding these two companies leaves room for more small and mid-cap companies to be held. Having these stocks in PXE doesn't just mean more growth potential, but also gives the ETF a higher beta. Having a higher beta means that when we enter a bullish period, the ETF may have a higher upswing relative to the overall market.

Another aspect of PXE that makes it stand out is its concentration of midstream companies. This is mostly due to the absence of XOM and CVX in its holdings. Although these companies are vertically integrated, they dominate the downstream sector. Not having these two massive companies in its portfolio allows smaller midstream and upstream companies to have a place in the ETF and make up a meaningful percentage of its holdings. Midstream companies make their money through transportation and refining. The price of these services tends to be fixed in long-term contracts, meaning the price of oil does not directly have a big impact on their profits. So whatever happens to oil, these companies will continue to bring in revenue. If oil rises in the second half of 2023 PXE is also in a great position for outperformance because of its upstream holdings.

Weaknesses

So many different factors play into the price of oil. Although there is a general consensus that oil will rise in the second half of 2023, there is a chance some unforeseen factors will come into play and oil prices fall. This ETF will be affected more than most other energy ETFs. As mentioned before, this ETF has a higher concentration of upstream oil companies. These companies often have fixed costs for exploration and extraction. If the price of oil gets too low, it can severely cut into their profit margin. With so many factors playing into the price of oil, there will likely be many up-and-down swings. But if prices fall and stay low, it will severely hurt the price of PXE.

Opportunities

PXE is at a rare buying level that has only been seen two other times in the last 5 years. When PXE's performance is compared to a traditional energy index, in this case, VDE, it doesn't often fall below 15-20% under VDE. PXE is currently tailing VDE by 11.35%, suggesting that it may have bottomed. This is a rare buying opportunity and I think that it could really pay off.

Along with technical analysis showing that this is a great entry price, looking at forecasts of oil prices makes it even better. Many economists and notable firms are predicting oil prices will rise in the second half of 2023, with Goldman forecasting a price of $95 by the end of 2023. Even much more conservative oil price forecasts, such as EIA's (U.S. Energy Information Administration), show a rise in oil later this year from its current price. This rise in oil prices would not just benefit the entire energy sector, but specifically PXE because of its high concentration of upstream companies.

Threats

If the US economy enters a recession, it is likely that most stocks will lose value. However, there is added risk to the energy sector. A recession would lower the price of oil, cutting into energy companies' profits and affecting the upstream companies greatly.

Additionally, one of the most enticing qualities of this ETF (and pretty much every energy ETF) is its well-above-average dividend yield. The reason energy stocks are able to have such high dividend yields is that energy companies, specifically oil companies, have very stable incomes. If oil prices fall and stay low, the companies held by PXE will also likely have to lower their dividend yield.

Conclusions

ETF Quality Opinion

PXE becomes more and more attractive as oil prices remain low. The longer they stay around $70 per barrel, the more bullish I become. PXE offers a well-diversified energy ETF, which is hard to find, and a strong performance history.

ETF Investment Opinion

With PXE's high concentration of upstream companies, it is in a position to outperform most Energy ETFs assuming oil prices rise in the coming 12-24 months. This, combined with its holdings of midstream companies providing stable income regardless of oil price volatility, makes PXE a Buy for me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.