ANGL And Fallen Angels: Recent Developments

Summary

- ANGL invests in recently downgraded high-yield corporate bonds.

- The fund has outperformed since inception, and by a very hefty margin.

- A look as to how rising interest rates and worsening economic fundamentals impact the fund, its investment thesis, and its investors.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

Andres Victorero

Author's note: This article was released to CEF/ETF Income Laboratory members on April 30th, but numbers have been updated.

I've covered the VanEck Vectors Fallen Angel High Yield Bond ETF (NASDAQ:ANGL) and the iShares Fallen Angels USD Bond ETF (FALN), both of which invest in fallen angels, several times in the past. In past articles, I've focused on their fundamentals and benefits, including their long track-record of outperformance. In this one, I'll be focusing on recent developments for fallen angels, in the context of sharply rising interest rates.

Fallen angels have seen higher interest rates these past few months, a product of Federal Reserve rate hikes. On the other hand, fallen angels have seen lower spreads relative to broader high-yield corporate bond benchmarks, probably due to declining credit quality in the latter. Fallen angel performance has been about average in the recent past, due to a lack of catalysts for outperformance.

In general terms, fallen angels remain strong investment opportunities, due to their long track-record of outperformance. Nevertheless, fallen angel fundamentals have weakened in the recent past, and these do not currently present compelling entry points for new investors. Waiting for a more opportune time to invest seems ideal, in my opinion at least.

I'll be focusing on ANGL for this article, but everything here should apply to FALN as well.

ANGL - Quick Overview

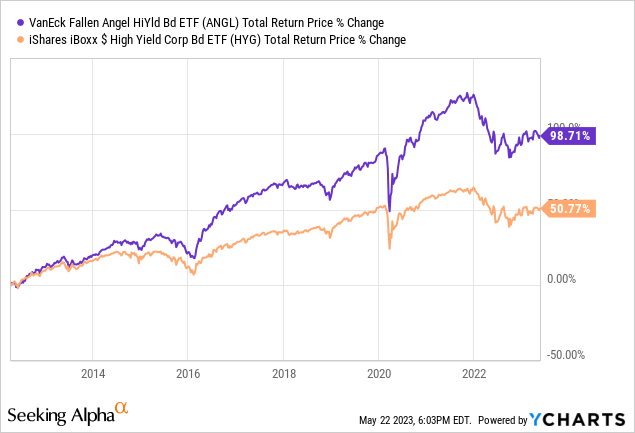

ANGL invests in fallen angels, or corporate bonds recently downgraded from investment grade to non-investment grade. Fallen angels generally exhibit forced selling, as many institutional investors are prohibited from investing in non-investment grade bonds, and so must necessarily sell their fallen angel investments. Due to forced selling, fallen angel tends to sport attractive prices and yields, which lead to long-term outperformance. This has been the case since inception, as expected.

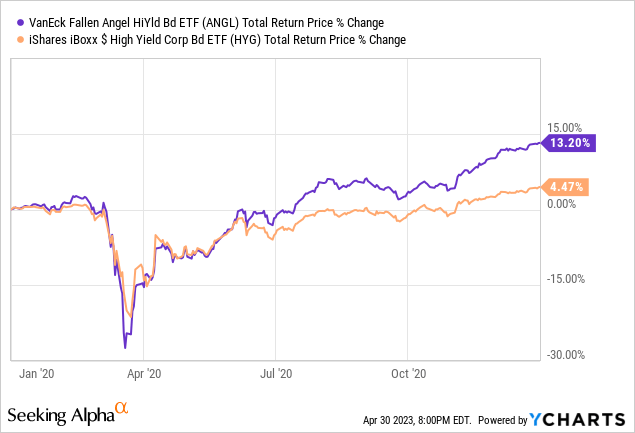

Fallen angels tend to perform particularly well in the months after their downgrade, as prices settle and recover. Downgrades occur when economic or industry conditions worsen. Due to this, fallen angel funds tend to perform particularly well in the months after a downturn or recession occurs, from an influx of new bonds, and their attendant recoveries. As an example, ANGL outperformed its benchmark in 2020 after May, once the market had bottomed, and the recovery had started. There was no outperformance when asset prices were dropping, nor at the very start of the recovery.

Data by YCharts

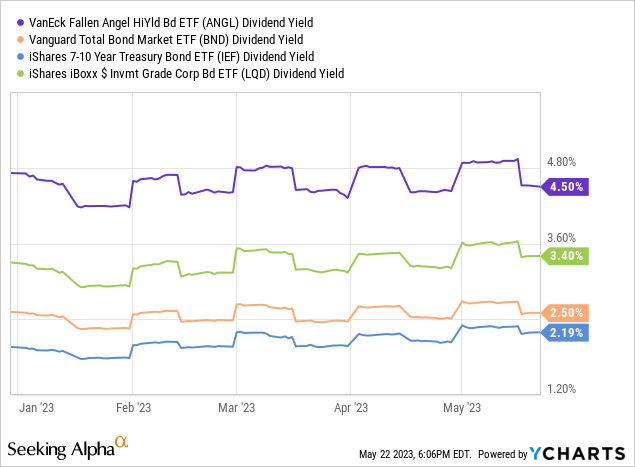

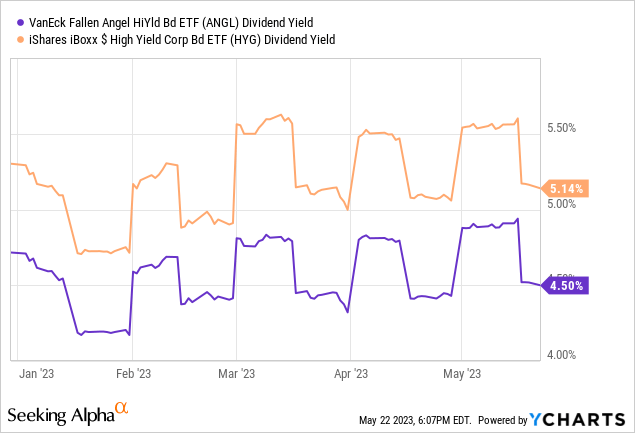

Fallen angels are non-investment grade bonds, and so carry higher yields than average, and then more or less all investment-grade bond funds. This is the case for ANGL, as expected.

Fallen angels tend to be of higher credit quality than most high-yield corporate bonds, and so sport lower yields too. This is the case for ANGL too.

ANGL invests in fallen angels, recently downgraded corporate bonds with a long-term track-record of outperformance. With this in mind, let's have a look at some recent developments for the fund.

ANGL - Recent Developments

Strong Dividend Growth

Federal Reserve interest rate hikes have led to higher interest rates on most bonds and fixed-income securities, resulting in higher income and dividends for most bond funds. ANGL invests in bonds, and so has benefited from these trends. Dividends have grown 8.6% these past twelve months, with heavy volatility.

The fund will likely see strong dividend growth moving forward, due to recent Federal Reserve hikes, and as the fund seems to be generating quite a bit more in income than it distributes to shareholders. ANGL currently sports an SEC yield, a standardized measure of short-term generation of income, of 6.8%, quite a bit higher than its current 4.8% yield. Dividends will likely grow until yields reach 6.8% in the coming years, at least assuming no significant changes in interest rates in the coming months.

Lower Spreads

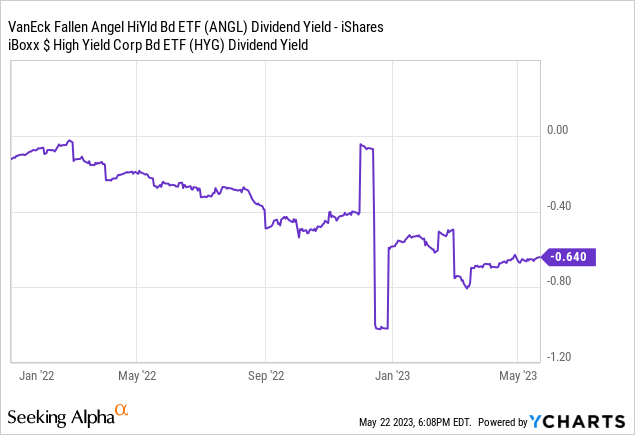

ANGL's dividends have seen strong growth since early 2022, but the same is true for most bond funds. Benchmark high-yield corporate bond funds have seen particularly strong growth, from a combination of higher Fed rates and wider credit spreads. Combined with higher demand / popularity for fallen angels, and a relative dearth of downgrades, and ANGL's yield is looking quite weak relative to that of its benchmark. Spreads have narrowed since early 2022, and are at their lowest in decades.

ANGL's comparatively weak yield puts the fund at something of a disadvantage vis a vis its peers. ANGL's yield is good, its peer's yields are great.

From what I've seen, ANGL's lower spread was caused by declining credit quality in high-yield corporate bond benchmarks, due to weakening economic fundamentals. As bond yields are dependent on many factors I'm not 100% confident that this explains the entire situation, but it does seem like an important factor.

Fewer Issuances

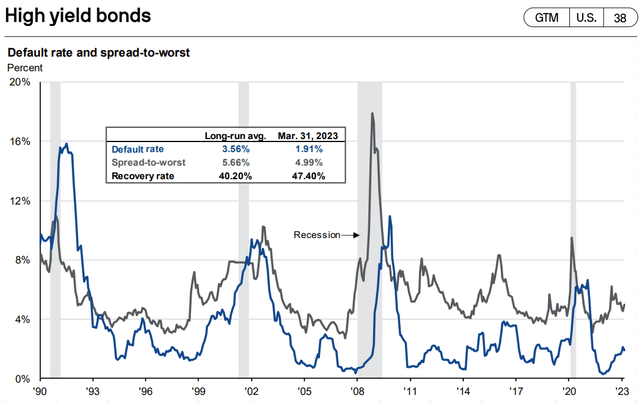

Economic conditions have significantly improved since the onset of the coronavirus pandemic, with strong economic growth, low unemployment, and decreasing default rates. Conditions have somewhat worsened YTD, but these remain reasonably strong, with default rates hovering around 2.0%.

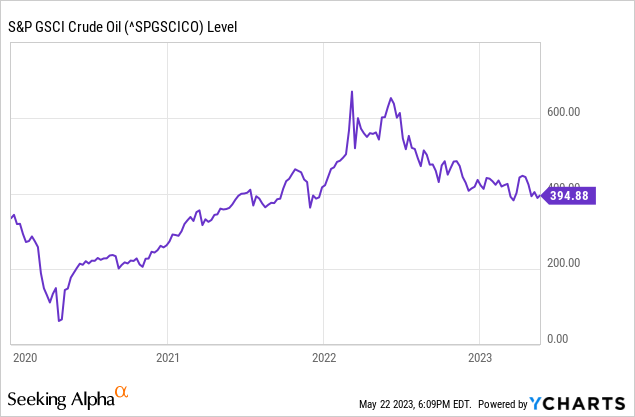

Conditions in the energy industry, particularly large in the high-yield corporate bond space, have evolved in a similar manner. Oil prices have risen from their 2020 lows, but have declined since around mid-2022.

Improved economic and industry conditions have led to fewer bond downgrades, reducing the number of fallen angels. Due to this, ANGL's holdings have declined these past few years, by around 1.0% per month. As conditions have worsened these past few months, I believe that fallen angel numbers will increase from here on out, although this is obviously far from certain.

Average Performance

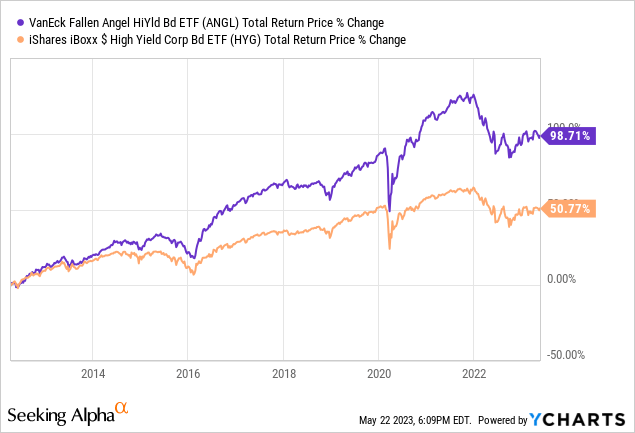

ANGL's long-term performance track-record is outstanding, with the fund almost doubling the performance of its benchmark since inception.

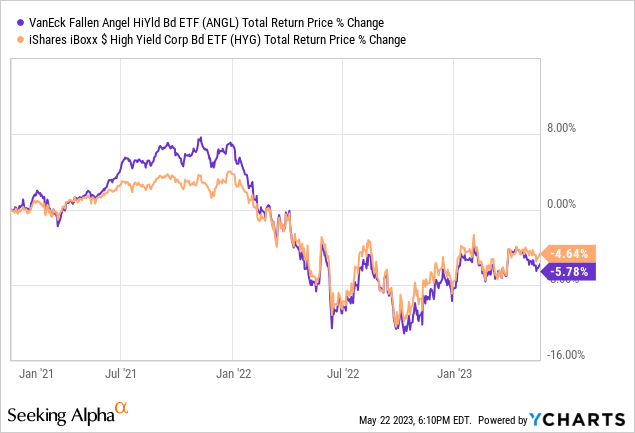

ANGL's most recent performance is about average, with the fund slightly underperforming its benchmark since early 2021.

ANGL's lack of outperformance was, I believe, caused by the lack of new fallen angels. As previously mentioned, these securities tend to perform particularly well a few months after their downgrade. As there have been few downgrades, there has been few fallen angels performing particularly well, hence ANGL's average performance.

As ANGL has higher credit quality than HYG, matching HYG's performance qualifies as good performance for ANGL. Nevertheless, the objective of ANGL funds is to outperform, and it has failed to do so in the recent past.

ANGL - Tying it All Together

Recent developments have somewhat undercut ANGL's advantages and investment thesis.

The fund yields quite a bit less than HYG, a significant, direct negative for shareholders.

The fund is seeing fewer additions to its portfolio, which pressures its performance.

The fund's performance itself has worsened, although it remains adequate.

In general terms, I think that ANGL's strong, proven investment strategy and outstanding long-term performance track-record continue to make the fund a buy. On the other hand, it does not look like a particularly compelling time to invest in the fund, due to its comparatively weak yield, worsening performance, and lower fallen angel issuance.

ANGL - Conclusions

ANGL's investment thesis remains reasonably good but somewhat weaker than in the past. Although the fund remains a reasonable investment opportunity, waiting for a more opportune time to invest seems best.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.