Sendas Distribuidora S.A.: Checkout This Brazilian Grocery Chain

Summary

- ASAI is generating strong growth during an accelerated expansion phase.

- The company may benefit from a resilient Brazilian economy and solid consumer spending trends.

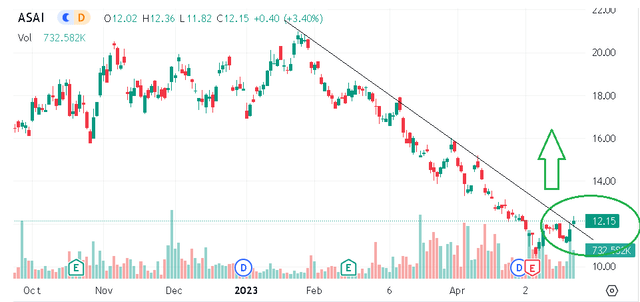

- ASAI looks interesting following the recent selloff.

- Looking for more investing ideas like this one? Get them exclusively at Conviction Dossier. Learn More »

Portra/E+ via Getty Images

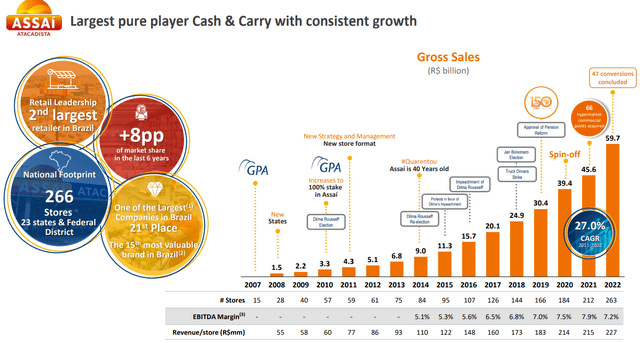

Sendas Distribuidora S.A. (NYSE:ASAI) is a major grocery store chain and food wholesaler through the "Assai Atacadista" brand, recognized as Brazil's second-largest retailer. The company has benefited from an emerging middle class and urbanization in the country supporting its ongoing national expansion effort.

Indeed, 2022 was a record year for Assai, opening 60 new stores which fueled an impressive 37% revenue increase. At the same time, the stock has been more volatile in recent months amid some mixed financial trends and macro uncertainties.

We like ASAI at the current level, eyeing value following the selloff considering some encouraging economic trends in the region. We see ASAI as well-positioned to rebound higher and a good option to gain exposure to Brazilian retail.

ASAI Financials Recap

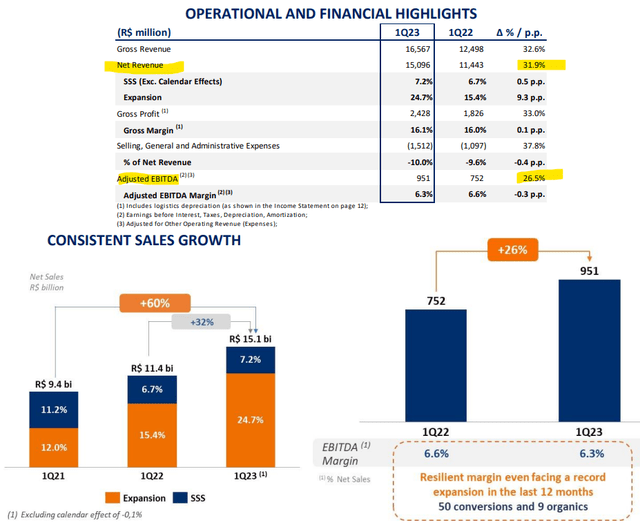

ASAI reported its Q1 results on May 5 with the headline net revenue of BRL 15.1 billion (approximately $3.0 billion), up 32% compared to the period last year. We mentioned the impact new stores are making, contributing a 25% increase at the top line, although same-store sales are also solid, climbing 7.2% y/y during Q1.

The gross margin ticked higher by 10 basis points to 16.1%, reflecting a growing product assortment and higher pricing initiatives, helping to balance what has been inflationary cost pressures. Even amid the aggressive expansion investments being made, adjusted EBITDA of BRL 951 million (or ~$190 million), was up 26% year-over-year.

source: company IR

Management projected optimism during the earnings conference call, suggesting the new stores are performing well, and represent an earnings runway as locations typically trend toward optimal operating efficiency over time.

With 27 sites currently under construction amid organic new locations or conversion renovations, the expectation is for that spending pace to moderate in 2024, which should result in higher profitability. Compared to the current net debt to EBITDA ratio of 2.8x, the company sees that ratio normalizing toward 2x as the Capex cycle normalizes by the end of this year.

source: company IR

Why ASAI May Rally In 2023

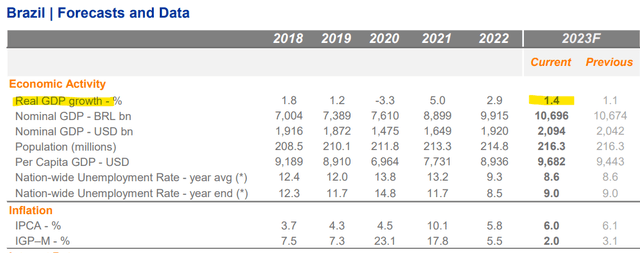

Given the size and scale of Sendas Distribuidora, the macro picture out of Brazil including the trends in consumer spending, will play a key role in driving the company's operating performance. We believe that a path for economic growth in the region to evolve stronger than expected could be positive toward earnings as a catalyst for shares to rally higher.

Favorably, the data we're looking at suggests the Brazilian economy has been resilient with its labor market and retail sales surprisingly stronger in recent months. A rebound in consumer sentiment could likely translate into stronger growth for ASAI.

According to Itau Economics Research, declining inflation has been encouraging at the start of the year and could provide the Central Bank some flexibility to cut the monetary policy rate into 2024 as support for stronger conditions. Notably, the research team has upwardly revised its 2023 GDP growth estimate to 1.4% from a previous 1.1% estimate.

source: Itau Research

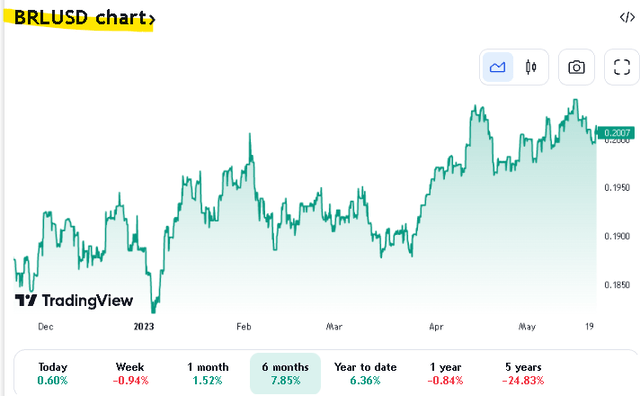

The setup here is in contrast to the U.S. and developed economies in Europe where concerns of weaker growth or a deepening recession have clouded the outlook. That contrast is part of the allure in Brazil right now where the same factors including a weaker U.S. Dollar have contributed to a strengthening BRL currency, appreciating 8% against USD over the past six months. Further gains here should be positive for Brazilian ADR stocks, including ASAI.

source: TradingView

In the meantime, ASAI will continue to execute its growth strategy and efforts at realizing financial efficiencies. The latest update notes the company has 28 stores currently under construction, which include conversions from the "hypermarkets" business by adding square footage to those locations alongside the brand refresh. Management explains that renovated stores are driving higher margins by adding transaction volumes.

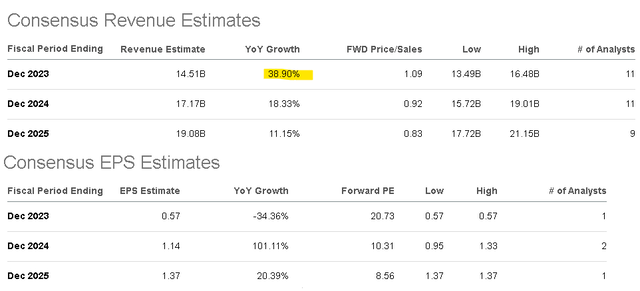

The current consensus is for revenues to climb by 39% this year as a combination of the expansion effort and same-store sales momentum. The understanding is that the newest stores, including the locations opened in 2022, are still in the early stages of maturation.

This means that they should have a greater impact on earnings through firming store-level economics over a two to three-year period. That's reflected in the outlook for 2023 where EPS is forecast to double, as Assai benefits from a moderation of its investment spending requirements.

In terms of valuation, we believe ASAI's implied 1-year forward P/E of 10x based on next year's EPS estimate is particularly attractive for a high-growth emerging market leader that maintains strong fundamentals.

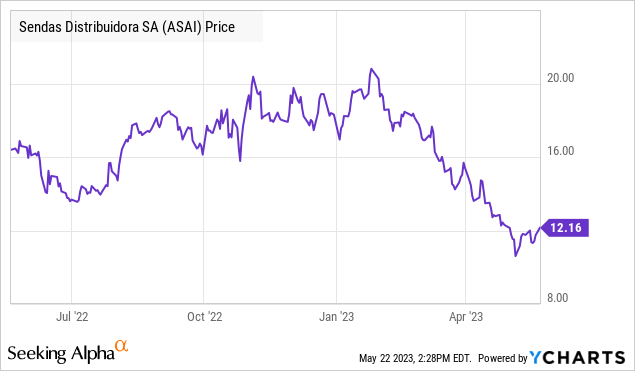

Seeking Alpha

ASAI Stock Price Forecast

We rate ASAI as a buy with a year-ahead price target of $17.00, representing a 15x multiple on the current consensus EPS for 2024. Notably, the stock traded at this level as recently as early March and we sense that shares are simply undervalued here at $12.00.

The way we see it playing out is that a string of solid quarterly reports, while the Brazilian economy stays on a firm footing, should work to support sentiment in the stock for shares to reprice higher. Overall, we view ASAI as a good stock for capturing consumption trends in a major emerging market.

The main risk to consider would be in the scenario of a deterioration of the macro picture with weaker-than-expected conditions in Brazil forcing a reassessment of ASAI's growth outlook. With Brazil, the political climate is also a consideration. Our take is that any type of turmoil would be reflected in the FX trends. Monitoring points for ASAI for the rest of the year include the EBITDA margin and same-store sales trends.

Seeking Alpha

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASAI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.