Seadrill: Buy On Inexpensive Valuation While Waiting For Earnings Power To Unfold

Summary

- Leading offshore driller reports improved first quarter results with strong Adjusted EBITDA margins but somewhat limited cash generation.

- Contracting activity during the quarter was weak. Following the completion of the Aquadrill acquisition in early April, the combined company's backlog stands at $2.6 billion.

- The company is looking for near-term capital structure improvements in order to establish a sustainable shareholder returns policy.

- Outlook for the remainder of the year points to constructive margin expectations and meaningful free cash flow generation.

- While it will take another couple of years for Seadrill's full earnings and cash generation potential to unfold, investors should consider taking advantage of the company's inexpensive valuation by scaling into the shares on pullbacks.

nikkytok/iStock via Getty Images

Note: Seadrill Limited (NYSE:SDRL) has been covered by me previously, so investors should view this as an update to my earlier articles on the company.

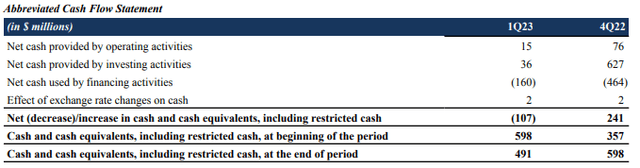

On Tuesday, leading offshore driller Seadrill Limited or "Seadrill" reported sequentially improved first quarter results with strong Adjusted EBITDA margin:

Company Press Release

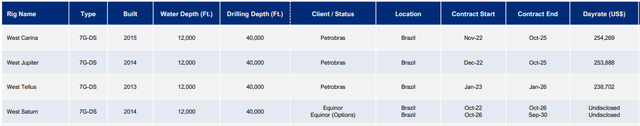

The company attributed the remarkable improvement to "higher operating days overall across the fleet, including notably with respect to our four drillships operating offshore Brazil, and the West Neptune working at a higher dayrate with LLOG."

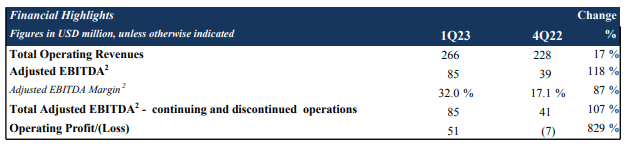

That said, cash generated from operating activities actually decreased substantially from Q4 levels as the company settled liabilities primarily associated with the mobilization of rigs to Brazil.

In addition, Seadrill had to settle accounts payable and accrued expenses following the recent return of the harsh environment semi-submersible rig West Hercules to its owner SFL Corporation Ltd. or "SFL" (SFL).

Please note that SFL has filed a lawsuit against Seadrill in Norway as disclosed in a recent regulatory filing:

On March 5, 2023, we were served with a claim from SFL Hercules Ltd. (“SFL”), filed in the Oslo District Court in Norway, relating to our redelivery of the rig West Hercules to SFL in December 2022. In its petition, SFL claims that the rig was not redelivered in the condition required under our contract with SFL and seeks damages in the amount of approximately NOK 300 million (approximately $28 million).

During the quarter, the company received $44 million in cash for the previously announced sale of its 35% stake in Paratus Energy Services Limited or "PES":

On September 30, 2022, Seadrill entered into share purchase agreements under which it would sell its entire 35% shareholding in PES and certain other interests. PES is the entity through which investments in the SeaMex Group, Seabras Sapura, and Archer Ltd are held. The sale closed on February 24, 2023 for total consideration of $44 million. As the total consideration received approximated the book value disposed, a minor gain has been recognized in the income statement. In connection with the disposal, on March 14, 2023, we provided each of PES and SeaMex Holdings with a termination notice regarding (i) the Paratus MSA and (ii) the SeaMex MSA, respectively. The Paratus MSA will terminate effective July 12, 2023; and the SeaMex MSA will terminate effective September 10, 2023. We do not believe these terminations will have a material effect on the financial condition of the Company.

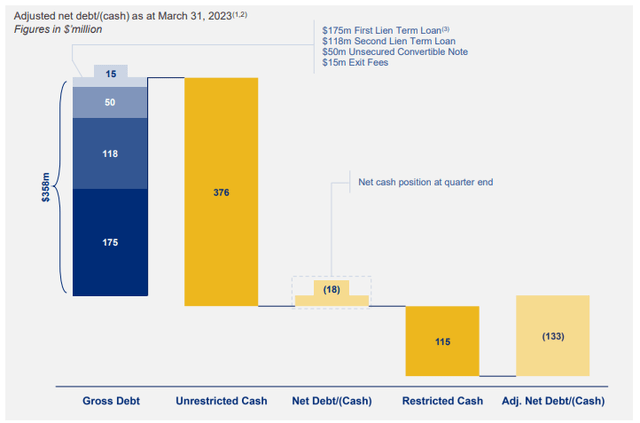

After using an aggregate $161 million in cash to reduce outstanding debt under its expensive second lien debt facility, Seadrill ended Q1 with $376 million in unrestricted cash and $115 million in restricted cash.

In addition, the company has access to a currently undrawn $125 million revolving credit facility.

With Seadrill's remaining debt obligations amounting to $358 million, the company's net cash position calculated to $133 million at quarter-end:

On the conference call, management disclosed efforts to improve the company's capital structure in the near-term in order to establish a sustainable shareholder returns policy.

Perhaps the most disappointing disclosure in the company's Q1 report was the absence of material contracting activity which resulted in meaningful backlog consumption:

Order Backlog as of March 31, 2023 was approximately $2.2 billion. During the quarter ended March 31, 2023, Seadrill added $39 million of Order Backlog, while consuming $257 million. The addition related to the West Neptune drillship securing a three-month extension with LLOG in the U.S. Gulf of Mexico. The extension will commence in direct continuation of the existing term and is expected to continue until Q3 2024.

Furthermore, during Q1 2023, Order Backlog was adjusted upwards by a further $101 million, primarily in respect of certain well variations, partially offset by the effect of the terminations to the PES and SeaMex master service agreements.

Please note that the recent acquisition of Aquadrill LLC or "Aquadrill" which closed in early April added approximately $470 million in backlog. As a result, the combined company now owns thirteen modern ultra-deepwater floaters:

Seadrill's backlog as of May 23 amounted to $2.6 billion but a good chunk relates to a number of low-margin legacy contracts for drillships working offshore Brazil:

Following the acquisition of Aquadrill, Seadrill also provided full-year expectations for the combined company:

Quite frankly, with large parts of Seadrill's fleet still working on legacy contracts at painfully low rates and no meaningful near-term synergies anticipated from the Aquadrill acquisition, I wasn't expecting the company to project Adjusted EBITDA margins north of 30% for 2023.

On the conference call, management pointed to up to $1 billion in incremental Adjusted EBITDA potential assuming the company's fleet being deployed at prevailing market rates.

Even when accounting for up to $250 million in capital expenditures as well as $50 million for estimated interest payments and cash taxes, Seadrill should be able to generate approximately $150 million in free cash flow this year.

From a valuation perspective, the company remains inexpensive at below 5x EV/EBITDA based on my estimates for next year.

Bottom Line

While Seadrill delivered sequentially improved quarterly results with decent Adjusted EBITDA margins, cash generation was nothing to write home about.

Following the completion of the Aquadrill acquisition last month, the combined company provided its initial outlook for 2023 with Adjusted EBITDA margins projected to remain north of 30% and expectations for meaningful free cash flow generation.

While it will take another couple of years for Seadrill's full earnings and cash generation potential to unfold, investors should consider taking advantage of the company's inexpensive valuation by scaling into the shares on pullbacks.

At this point, I remain positive on the entire industry, including leading U.S. exchange-listed players Valaris (VAL), Noble Corp. (NE), Diamond Offshore Drilling (DO), Transocean (RIG), specialty services provider Helix Energy Solutions (HLX), and offshore drilling support providers like Tidewater (TDW) and SEACOR Marine Holdings (SMHI).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.