Trinity Capital: So-So First Quarter

Summary

- TRIN's latest quarter had some positives but also some negatives that offset the corresponding positives to create a sort of so-so quarter.

- NII per share and NAV per share declined, both quarter-over-quarter and year-over-year.

- Without some improvement, the regular distribution raises could be in jeopardy, or the economy slipping into recession could leave them lacking coverage.

- This idea was discussed in more depth with members of my private investing community, Cash Builder Opportunities. Learn More »

MicroStockHub/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on May 8th, 2023.

There always seems to be a desire to look at holdings in our own portfolios and try to come up with an optimistic view. However, sometimes a first glance at a quarter doesn't always give us the best insight. We look at the important highlights and come away with a rosy feeling. Then perhaps later, we return to a quarterly report, look through the material, and find some things to be less than enthusiastic about.

That was really my process with Trinity Capital's (NASDAQ:TRIN) results for the first quarter of 2023. At first, reading through the highlights and giving it a quick read, I felt all was fine. Then I started to look at it a bit deeper, and I realized that, at best, it was a so-so quarter. It seemed that for every decent news from the quarter, there was a corresponding negative.

While I'm certainly going to continue to hold my position, it wasn't a bad quarter by any means! Before getting too enthusiastic about buying more, I think I'd want to get it a bit cheaper than here, given the current environment and the latest quarter. For those that may not already hold a position and wouldn't mind potentially averaging lower later, it's not a bad choice in the venture capital business development space. One should just note that venture-focused BDCs, in general, are generally riskier.

A Look At TII and NII Highlights

The highlights are going to be the first thing that you see on an earnings report. These are all the things that make you feel good about your investments. It's the accomplishments of the BDC/management/company for each respective quarter. Naturally, these are going to be positive. So, after looking at several highlights, I wanted to call out a couple.

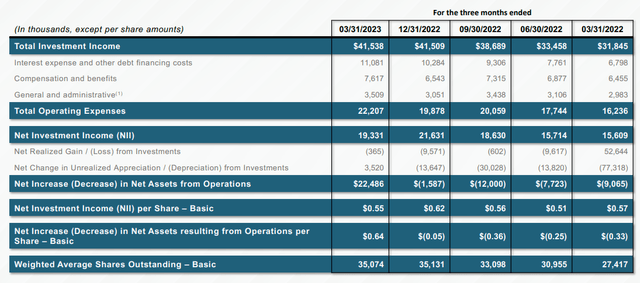

Total investment income of $41.5 million, an increase of 30.5% year-over-year

Excellent! Total income or TII is rising. 30.5% per year is quite terrific at that. The basic underlying expectation is that higher interest rates bode well for BDCs. TRIN is invested with around 70% of its portfolio in floating-rate debt, while 70.2% of its borrowings are fixed-rate. Therefore, naturally, as rates rise, they should be able to earn more income.

Unfortunately, the total operating expenses increased at an even faster clip. Expenses increased at a nearly 37% pace.

That being said, TII, on its own, doesn't really mean much for investors in the end. Instead, that's where the net investment income or NII, comes in handy. This is left over for the shareholders after the BDC receives the interest/dividend payments and the expenses are charged.

Net investment income ("NII") of $19.3 million, or $0.55 per basic share, an increase of 23.7% year-over-year

In this case, the NII for the fund shows that it was up around 23.7% year-over-year. That's fantastic! So what's the bad news? Well, that 23.7% YoY increase refers to the $19.3 million over the $15.609 million in Q1 2022. The actual NII per share showed a decline of 3.51% from the $0.57 it was a year ago

This happened because not only did the operating expenses balloon faster than the TII of the portfolio, but because of a large jump in new outstanding shares. Shares being sold at a premium to NAV is accretive; however, there was also a significant amount due to stock awards. This isn't the only time stock awards will be a negative for this BDC in the first quarter.

TRIN Stats of Previous 5 Quarters (Trinity Capital)

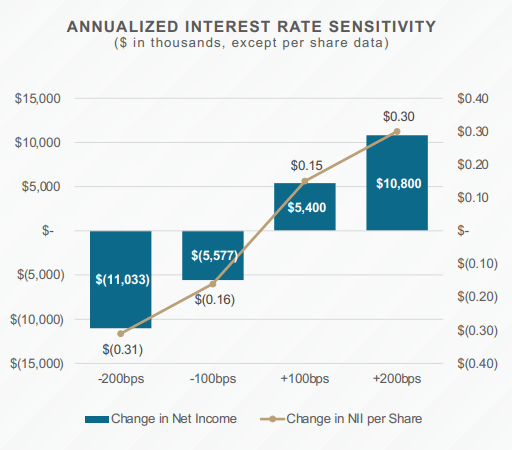

In the end, the $0.55 is still above the last $0.47 distribution paid to shareholders. However, seeing a decline means that they might not be benefiting from interest rates in the way they project. The below shows what they project in terms of interest rate changes.

TRIN Theoretical Interest Rate Impacts (Trinity Capital)

A year ago today, rates went from around 0 to 5%, so naturally, one should have expected a benefit. Perhaps they didn't anticipate their expenses rising so dramatically through the year. Additionally, this could be a projection going forward. If that is the case, then we may never see the benefit because it is largely expected - at least at this point - that the Fed will not be increasing another 1%. In fact, the market anticipates potential cuts within a year or two.

If the Fed cuts, it's likely to be because there is a recession to drive down inflation. That could cause further pressure on TRIN with non-accruals as companies can't cope with the slowdown.

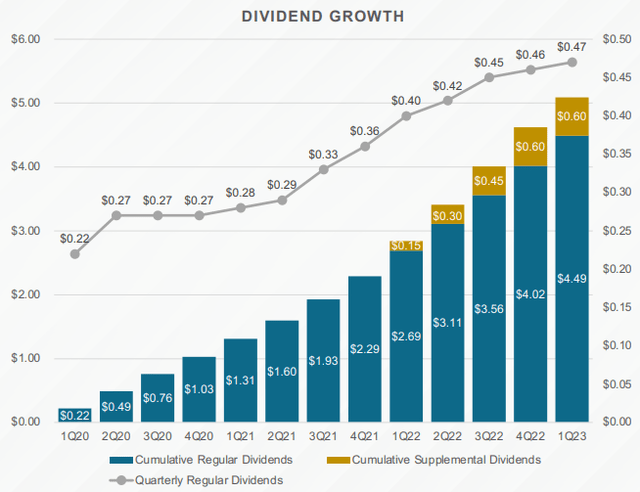

So, unless this improves, we could be seeing peak earnings from TRIN, and that could mean a stop to the quarterly increases we've been receiving. In an even worse-case scenario, there could be potential for cuts if things get too ugly during a recession.

TRIN Dividend Growth (Trinity Capital)

They noted their spillover income and the idea that there could be specials this year.

I would also like to remind our shareholders that we had spillover income of approximately $1.64 per share at year-end that we'll continue to reinvest. Management is diligently evaluating our liquidity position in this market and regularly discusses the various uses of our capital with our Board, including the possibility of special dividends in 2023. However, our Board has not made any affirmative decisions on the special dividend at this time.

I, too, believed that there could be specials this year previously. That being said, any specials paid will reduce the NAV unless it is being earned in the current year. Therefore, it might not be the best to provide a special if it isn't being earned. Special dividends are great... when they can be earned and times are better.

Also worth noting is that no other BDC raises every quarter; at some point, it levels out when their portfolios mature. TRIN experienced a burst of growth as they could implement leverage into the BDC over the prior years and the success of investments through 2021. The upward trajectory becomes limited at some point, especially when you are already sporting a 14%+ distribution yield.

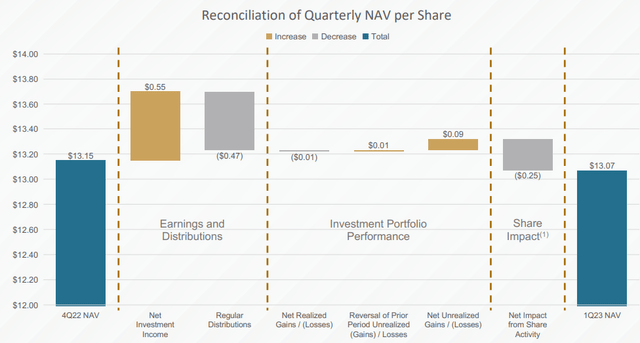

Net Asset Value Hit

Returning to the stock-based rewards in the latest quarter, one of the other pieces they noted that seemed positive at first was a net increase in net assets. This was the third highlight right below the TII and NII figures.

Net increase in net assets resulting from operations of $22.5 million, or $0.64 per basic share

In the above quarterly income statement we shared, you'll also note they listed a "net increase (decrease) in net assets resulting from operations per share - basic." That showed the same $0.64 increase but didn't list the NAV per share in that table. That sounds pretty good at first.

However, that doesn't actually factor in the distribution or stock awards. The NAV actually went from $13.15 to $13.07.

TRIN NAV Bridge (Trinity Capital)

That highlight also doesn't appear in the prior quarterly report, as they just simply provide the NAV per share and note that it decreased from the prior quarter.

To be fair, it was simply due to the share impact of the stock awards and the distribution. Take away the stock award, and the NAV would have grown, too. That is something they noted in the earnings call too. It was also mentioned that this was really the big quarter for the hit due to the stock award, and later in October, there will be another one but smaller.

This is a plan that we've had in place early -- for the last few years. And we look at it twice a year relative to grants and the larger portion of that is this quarter and the hit is this quarter. And it was good to see now increase meaningfully with a little adjustment for that. We're well into that plan. There are more shares available under it. So I think you'll see it again to a smaller degree in the October timeframe and then another probably more next time this first quarter of next year.

We know the current environment is tough. Tightening credit and higher costs of that credit are going to be pressuring the economy - which is exactly what the Fed wants. However, at some point, the Fed will likely have to cut rates.

Core Scientific

As most know, who follow TRIN anyway, Core Scientific (OTCPK:CORZQ) is their big non-accrual name. Fortunately, there were no new loans to hit the non-accrual list in the latest quarter. But... non-accruals for the quarter actually ticked higher.

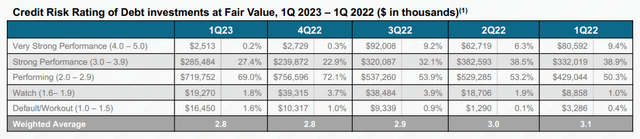

TRIN Credit Risk Rating (Trinity Capital)

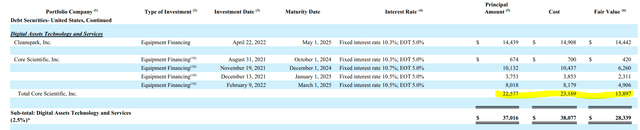

The reason for this was that they bumped up the fair value of the Core equipment. The latest fair value at quarter end was nearly $13.9 million, up from the $8.24 million they listed previously, or what amounted to an increase of roughly $5.66 million.

Core Scientific Valuation (Trinity Capital)

In Q1, the number of loans on nonaccrual remained unchanged with the same forward debt investments that have a cumulative investment cost and fair value of approximately $49 million and $24 million, respectively. For reference, this represents 4.5% and 2.3% as a percentage of the company's total debt portfolio at cost and fair value, respectively. The $6 million increase in fair value on the nonaccrual assets is related to our fair value market adjustment to our investment in Core Scientific. The company is benefiting from improved underlying market conditions.

That would have helped limit the NAV per share decrease for the quarter, as they listed that net unrealized appreciation was $3.52 million. Therefore, if it hadn't been for that increase in the fair value of something that's already in bankruptcy and producing no income, they would have unrealized depreciation.

Now, I'm not saying it isn't warranted. After all, they're the portfolio managers dealing with these venture capital investments daily. They certainly know the ins and outs much more than I would. The price of Bitcoin also increased, so it seems fair enough. However, my hesitation would be that the increase in valuation isn't necessarily the most promising when it's based on such a volatile area of their portfolio. At least, it isn't the type of higher quality fair value changes I'd like to see.

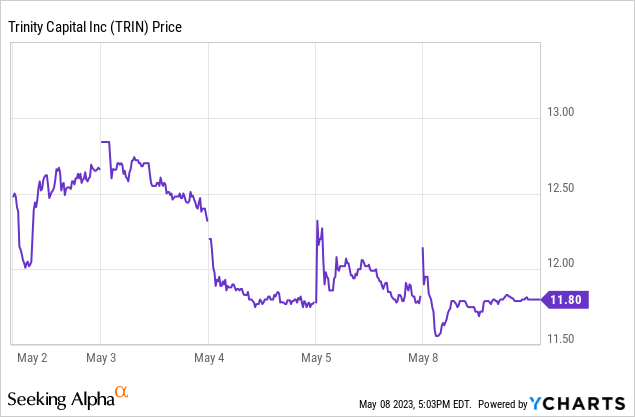

Market Reaction Agrees It Was A So-So Quarter

When I originally read through the earnings report for TRIN, I thought everything seemed fairly good. However, I took off the rose-tinted glasses and read a bit deeper. When doing so, I found out what the rest of the market must have noticed since shares didn't do much of anything. Though to be fair, the market has been incredibly volatile with bank failures, too, so doing nothing can be a benefit these days. They announced results after the close of trading on May 4 and saw two flat days of trading following that.

Ycharts

That being said, it wasn't an awful quarter, either. There are some positives to take away, as NAV would have risen if it wouldn't have been for the stock awards. Stock awards can also compensate and retain key talent; in that sense, it isn't all negative.

Similarly, NII would have been better if they could have kept expenses lower. Increasing leverage and increasing borrowing costs during this period saw the largest increase, which should have gone to the benefit of income generation. However, it was the compensation and benefits, along with the general and administrative expenses, that also rose during this period.

Leaving Off On A Couple Of Positive Notes

The positives of the BDC are that they now have the i40 joint venture ramping up after it started out in December 2022. It contributed to around $0.453 million in fee income. They also have their RIA business that launched too. They expect both of these to contribute to income generation and help them flexibly manage the portfolio.

I think you saw we were able to reduce that debt-to-equity ratio slightly as a result of not just the ATM, but also offloading some of those investments to the JV. You'll see that continue. Our off-balance sheet activity is really going to give us the ability, not just to generate new income via the JV and funds under the RIA, but also give us the ability to really kind of manage that debt-to-equity ratio and not just reduce the debt-to-equity ratio but generate above accretive returns as well simultaneously. So yes, I think our intention there is to make sure we stay within the guidance we've given and then use our off-balance sheet activity to continue to drive it down.

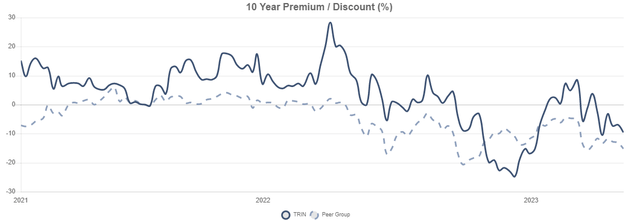

An additional positive is that despite the NAV dropping, the discount to NAV that it currently is trading at is fairly attractive too. At a nearly 9.5% discount, this is toward the lower end of its historical range.

TRIN Discount/Premium History (CEFData)

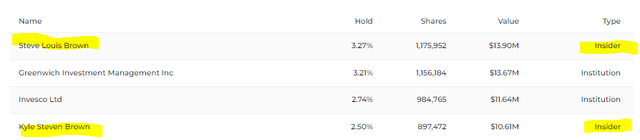

There is also some serious insider ownership here — both the CEO and the CIO.

TRIN Insider Ownership (Wallstreetzen)

This hasn't come from stock awards alone either; they've generally been fairly consistent buyers as well. As an internally managed BDC, that can be important. If they fail with TRIN, they not only lose out on their investments but their jobs.

Finally, they also did repurchase some of their shares during the quarter as part of the earlier announced $25 million buyback program. It wasn't anything massive, but every little bit can help when shares are repurchased at a discount to NAV.

Conclusion

Overall, I'm already holding a fairly sizeable position, given the risks of a venture-focused BDC. So personally, I think I'd look at adding under $10. During times of panic selling or when the market capitulates, that wouldn't be that hard to hit, either.

Another way to do that would be looking to sell puts at a $10 strike price. After collecting the premium, your breakeven is then pushed below $10. At the same time, if you aren't assigned, you get to collect the premium and are free to write more puts. As someone who is already happy with their position currently but wants to add lower potentially, this is a fairly compelling option.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor's income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.

This article was written by

Cash Builder Opportunities provides high-quality and reliable dividend growth ideas to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor's income even further.

-----

Who are we?

Nick Ackerman is the lead author for Cash Builder Opportunities. Nick is an avid student of the markets and has been investing in his own accounts for over 12 years. He is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. His specific focus is on closed-end funds, dividend growth stocks and option writing as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long-term financial goals.

Stanford Chemist is a scientific researcher by training who has taken up a strong and passionate interest in investing. His members appreciate the analytical and agenda-free insight and analysis that he brings to investments. He has developed his own metrics and tools for understanding closed-end funds and exchange-traded funds and how to profit from them and will seek to apply the same logical principles to Cash Builder Opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TRIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

May short TRIN puts in the next 72 hours.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.